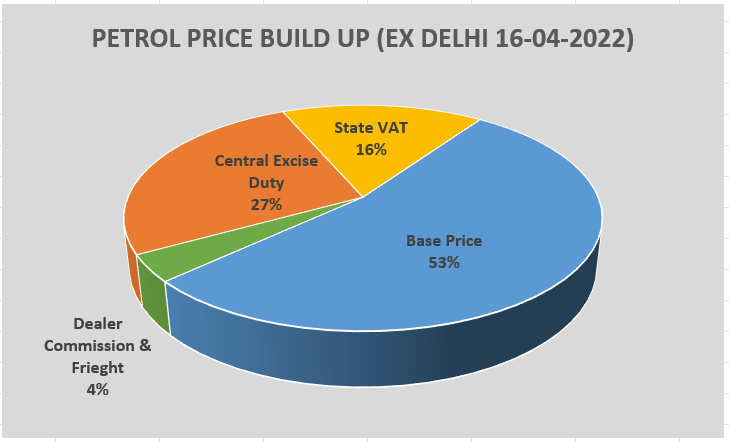

Let me decode the petrol price build up again for you.

This pie chart is preapred from the price build-up given by IOC dated 16-04-2022, ex-Delhi.

The tax on petrol is 43% of the total price of petrol, ie, we pay 80% as tax on the base price of petrol.

#thread #fueltax

This pie chart is preapred from the price build-up given by IOC dated 16-04-2022, ex-Delhi.

The tax on petrol is 43% of the total price of petrol, ie, we pay 80% as tax on the base price of petrol.

#thread #fueltax

The source is here, IOC price build-up for ex-Delhi

Base Price - Rs. 56.32/lit

Freight & Dealer Commission - Rs. 0.20+3.86/lit

Central Excise Duty - Rs. 27.90/lit

State VAT - Rs. 17.13/lit

Base Price - Rs. 56.32/lit

Freight & Dealer Commission - Rs. 0.20+3.86/lit

Central Excise Duty - Rs. 27.90/lit

State VAT - Rs. 17.13/lit

How the Central Government increased the Excise duty on Petrol, this chart will explain it.

While NDA took over in 2014, the tax was Rs.9.48 (wef 14/09/22), it was continuously increased to Rs.32.98 (on 6.06.2020.

On 4.11.2021, the central excise is reduced to Rs.27.90

While NDA took over in 2014, the tax was Rs.9.48 (wef 14/09/22), it was continuously increased to Rs.32.98 (on 6.06.2020.

On 4.11.2021, the central excise is reduced to Rs.27.90

Also, understand that only Basic Excise Duty is to be shared with States under the divisible pool.

Rest are either Cess/Surcharge at the discretion of Union.

BED shared is now mere 5% of the total excise duty from 67% of what it was in 2012.

Real co-operative federalism ;)

Rest are either Cess/Surcharge at the discretion of Union.

BED shared is now mere 5% of the total excise duty from 67% of what it was in 2012.

Real co-operative federalism ;)

As Central Government gets 58% of BED, how the excise duty of Rs.27.90 collected is shared between Union & States.

Yes, when Union increased the excise duty, it systematically reduced the States' share too and grabbed 98% of it to their kitty.

A silent coup!

Yes, when Union increased the excise duty, it systematically reduced the States' share too and grabbed 98% of it to their kitty.

A silent coup!

Now see the tax structure, while Union Excise is a specific tax, that is fixed amount per liter of petrol.

States charge their tax as either Sales Tax/VAT, where it is a percentage tax.

After GST regime, only Petrol & Alcohol are only available at State's disposal to tweak

States charge their tax as either Sales Tax/VAT, where it is a percentage tax.

After GST regime, only Petrol & Alcohol are only available at State's disposal to tweak

Since it is a VAT/Sales Tax, States' taxation is a percentage of base price, central excise, freight and dealer commission.

So when Union reduce excise, State's automatically take a cut, while base price increases States benefit immensely.

So when Union reduce excise, State's automatically take a cut, while base price increases States benefit immensely.

The following table gives you a glimpse of percentage tax charged by all States/UT in India.

States/UT like Assam, Bihar, Chandigarh, Haryana, Himachal Pradesh, Jharkhand, Meghalaya, Nagaland, Uttar Pradesh, Uttarakhand & West Bengal charge higher of either specific tax or VAT.

States/UT like Assam, Bihar, Chandigarh, Haryana, Himachal Pradesh, Jharkhand, Meghalaya, Nagaland, Uttar Pradesh, Uttarakhand & West Bengal charge higher of either specific tax or VAT.

The above tax regime of ceiling VAT with a specific tax adopted by some States is a welcome step in the right direction to ameliorate the pain due to the exorbitant VAT component when the fuel prices hit the roof.

Please recollect that Union Excise Duty changed from ad valorem (percentage tax) regime to specific tax regime in 2008 as per the recommendation of Rangarajan Committee.

IMHO, States should shift to a specific tax regime, which insulate from volatility of markets.

IMHO, States should shift to a specific tax regime, which insulate from volatility of markets.

Sometimes, economical with truth helps👇

Kerala charges 30.08% Sales Tax + Rs.1/lit addl sales tax + 1% cess.

What about Madhya Pradesh?

They also charge 29% VAT + Rs 2.5/lit VAT + 1% cess.

Kerala charges 30.08% Sales Tax + Rs.1/lit addl sales tax + 1% cess.

What about Madhya Pradesh?

They also charge 29% VAT + Rs 2.5/lit VAT + 1% cess.

It is preferred, as a matter of transparency, all oil companies shall publish the price build up of petrol & diesel at least for every State capital.

Now they publish this data only for Delhi.

This will help people to have a meaningful comparison.

Now they publish this data only for Delhi.

This will help people to have a meaningful comparison.

Typo...read as

Rs. 9.48 (wef 14/09/12) it is 2012 not 2022

Rs. 9.48 (wef 14/09/12) it is 2012 not 2022

PS: My interest on fuel tax was triggered during the fag end of UPA-2 regime, when there was huge cry about fuel prices.

So I meticulously fill my Excel sheet & read all policy papers by Petroleum Ministry and Gazettes to understand the nuances.

So I meticulously fill my Excel sheet & read all policy papers by Petroleum Ministry and Gazettes to understand the nuances.

• • •

Missing some Tweet in this thread? You can try to

force a refresh