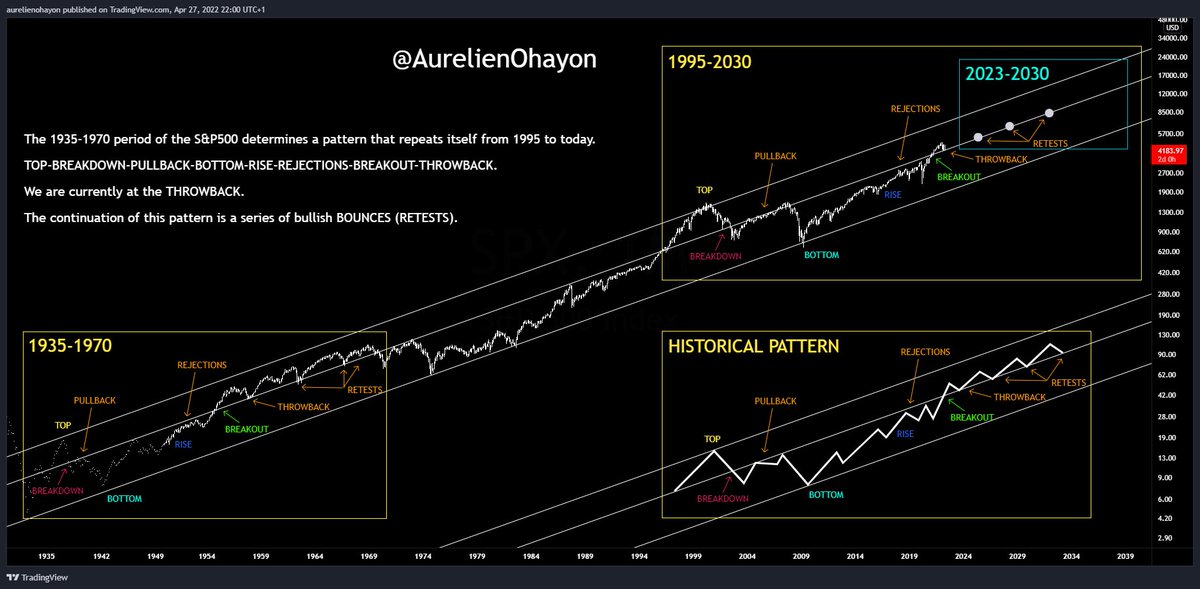

2/ THE 1935-1970 PERIOD OF THE #SP500 DETERMINES A PATTERN THAT REPEATS ITSELF FROM 1995 TO TODAY.

TOP-BREAKDOWN-PULLBACK-BOTTOM-RISE-REJECTIONS-BREAKOUT-THROWBACK.

WE ARE CURRENTLY AT THE THROWBACK.

THE CONTINUATION OF THIS PATTERN IS A SERIES OF BULLISH BOUNCES (RETESTS).

TOP-BREAKDOWN-PULLBACK-BOTTOM-RISE-REJECTIONS-BREAKOUT-THROWBACK.

WE ARE CURRENTLY AT THE THROWBACK.

THE CONTINUATION OF THIS PATTERN IS A SERIES OF BULLISH BOUNCES (RETESTS).

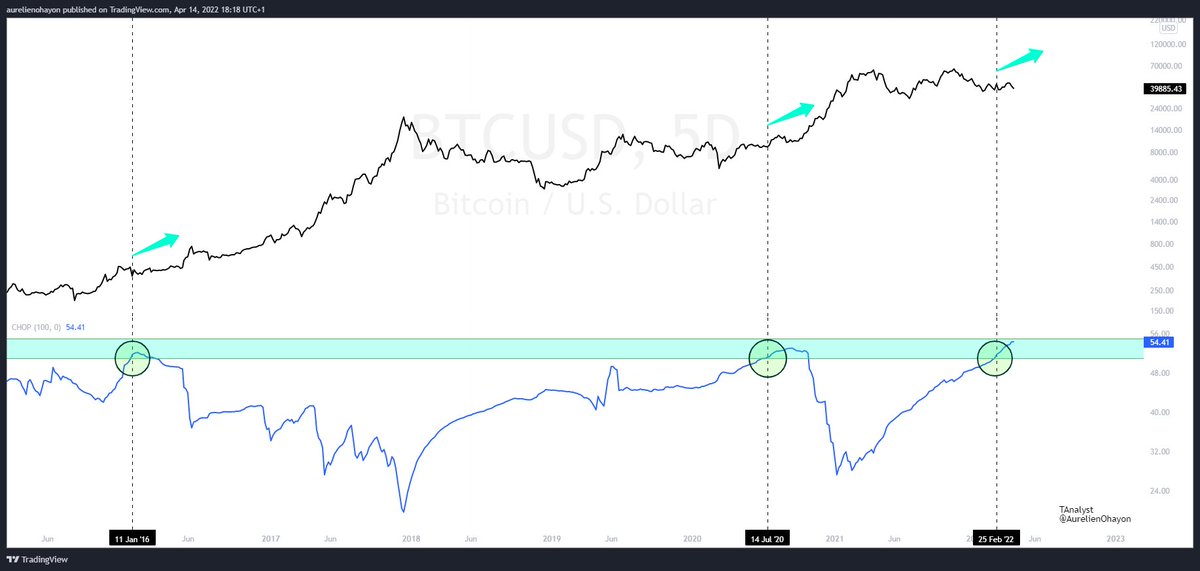

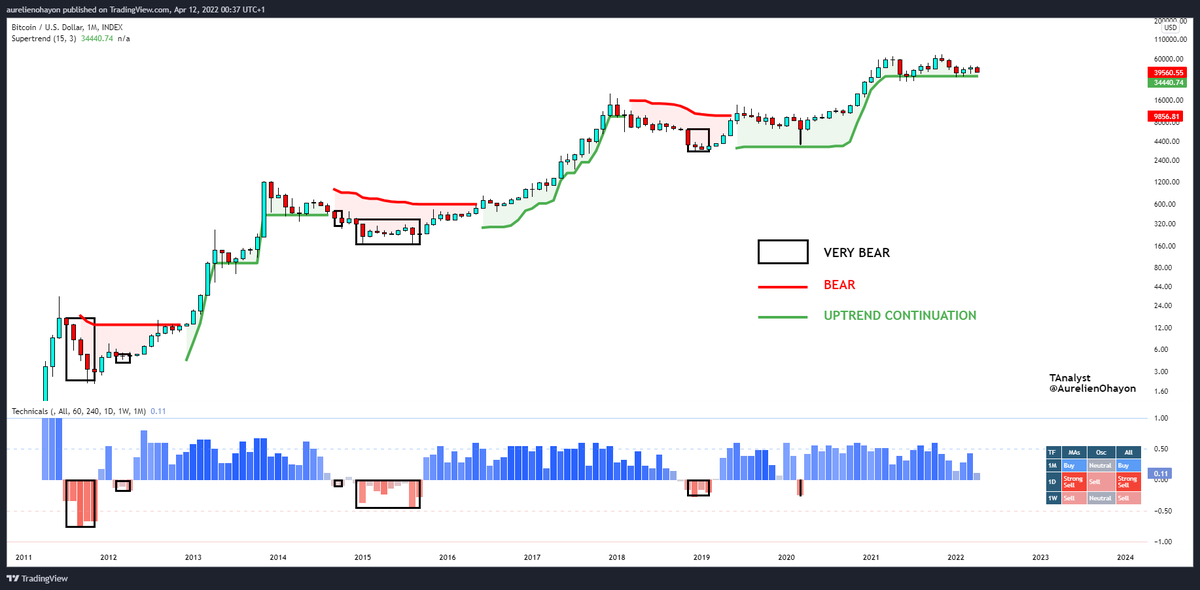

3/ MANY OF THE #SP500 INDICATORS HELP DETERMINE HISTORICAL #BTC BOTTOMS. (SEE FOLLOWING ANALYSIS)

NOW AS THE PREVIOUS ANALYSIS SHOWS, #SPX WILL PROBABLY BE BULLISH IN THE NEXT MONTHS.

BITCOIN WILL THEREFORE FOLLOW THIS MOMENTUM AND WILL ALSO BE BULLISH.

NOW AS THE PREVIOUS ANALYSIS SHOWS, #SPX WILL PROBABLY BE BULLISH IN THE NEXT MONTHS.

BITCOIN WILL THEREFORE FOLLOW THIS MOMENTUM AND WILL ALSO BE BULLISH.

https://twitter.com/AurelienOhayon/status/1516892774263664641?s=20&t=AP5Onl9TP49kEJLLFlSWyw

4/ ZOOM IN 👇

https://twitter.com/AurelienOhayon/status/1519447217907675142?s=20&t=o1HcnPhV4onJ-Stp7Isbuw

5/ COMPLETE VIEW 👇

https://twitter.com/AurelienOhayon/status/1519463171785957378?s=20&t=o1HcnPhV4onJ-Stp7Isbuw

• • •

Missing some Tweet in this thread? You can try to

force a refresh