✨A thread on joining lending/borrowing protocol on @BastionProtocol

1/18

For example, #NEAR has an LTV of 60%, $USDC 85%, $USDT 80%, $ETH 70%. Other assets are also the same but they will have a different LTV (Loan-to-value).

#BMEanalytics $NEAR $BSTN #auroraisnear #DeFi $USN

1/18

For example, #NEAR has an LTV of 60%, $USDC 85%, $USDT 80%, $ETH 70%. Other assets are also the same but they will have a different LTV (Loan-to-value).

#BMEanalytics $NEAR $BSTN #auroraisnear #DeFi $USN

2/18

Keep in mind that LTV is not the profit that you can earn but it is the percentage that you can borrow based on the assets that you have deposited in the Lending platform.

#BMEanalytics $NEAR $BSTN @auroraisnear #DeFi $USN @BastionProtocol

Keep in mind that LTV is not the profit that you can earn but it is the percentage that you can borrow based on the assets that you have deposited in the Lending platform.

#BMEanalytics $NEAR $BSTN @auroraisnear #DeFi $USN @BastionProtocol

3/18

First, you need to buy $NEAR on any exchanges and withdraw them into your #NEAR Wallet. Since #Aurora EVM uses $ETH as transaction fees so connect your wallet to @finance_ref and swap a few Near to ETH.

#BMEanalytics $BSTN @auroraisnear #DeFi $USN @BastionProtocol

First, you need to buy $NEAR on any exchanges and withdraw them into your #NEAR Wallet. Since #Aurora EVM uses $ETH as transaction fees so connect your wallet to @finance_ref and swap a few Near to ETH.

#BMEanalytics $BSTN @auroraisnear #DeFi $USN @BastionProtocol

4/18

After that, use Rainbow Bridge to transfer $ETH and $NEAR from your #NEAR Wallet to #AuroraNetwork. Make sure that you added Aurora Mainnet Network to your Metamask wallet 🧐.

#BMEanalytics $BSTN @auroraisnear #DeFi $USN @BastionProtocol

After that, use Rainbow Bridge to transfer $ETH and $NEAR from your #NEAR Wallet to #AuroraNetwork. Make sure that you added Aurora Mainnet Network to your Metamask wallet 🧐.

#BMEanalytics $BSTN @auroraisnear #DeFi $USN @BastionProtocol

5/18

Access Bastion Mainhub and choose the #NEAR pool, deposit $NEAR into the pool and borrow Near from the deposited amount. Continuing the step to earn the profit from the interest, both Lending and Borrowing are risk-free and profitable.

#BMEanalytics #DeFi @BastionProtocol

Access Bastion Mainhub and choose the #NEAR pool, deposit $NEAR into the pool and borrow Near from the deposited amount. Continuing the step to earn the profit from the interest, both Lending and Borrowing are risk-free and profitable.

#BMEanalytics #DeFi @BastionProtocol

6/18

Note:

- Collateral: give access to “Use as Collateral” feature to be able to borrow amount of money/assets that were deposited into Lending.

- LTV: The percentage of assets you can borrow back from your deposited ones.

#BMEanalytics $BSTN #DeFi $USN @BastionProtocol #NEAR

Note:

- Collateral: give access to “Use as Collateral” feature to be able to borrow amount of money/assets that were deposited into Lending.

- LTV: The percentage of assets you can borrow back from your deposited ones.

#BMEanalytics $BSTN #DeFi $USN @BastionProtocol #NEAR

7/18

➡️Example: You deposit 100 $NEAR then the amount of Near that you can borrow is calculated by:

💎A = %Collateral x % LTV x Deposit Amount = 0.8 x 0.6 x 100 = 48 $NEAR (Assume the LTV is 80%)

#BMEanalytics $BSTN @auroraisnear #DeFi $USN @BastionProtocol

➡️Example: You deposit 100 $NEAR then the amount of Near that you can borrow is calculated by:

💎A = %Collateral x % LTV x Deposit Amount = 0.8 x 0.6 x 100 = 48 $NEAR (Assume the LTV is 80%)

#BMEanalytics $BSTN @auroraisnear #DeFi $USN @BastionProtocol

8/18

After this step, use 48 $NEAR that you borrowed and redo all the steps to maximize the amount of $NEAR deposited in the pool.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

After this step, use 48 $NEAR that you borrowed and redo all the steps to maximize the amount of $NEAR deposited in the pool.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

9/18

The current APY stats of the #NEAR pool are 1.59% for Supply APY and -7.67% for Borrow APY. That means that you will receive 1.59% of your 100 Near and 7.67% of the borrowed 48 $NEAR. Continue the calculation of the next round.

#BMEanalytics $BSTN #auroraisnear #DeFi #FTX

The current APY stats of the #NEAR pool are 1.59% for Supply APY and -7.67% for Borrow APY. That means that you will receive 1.59% of your 100 Near and 7.67% of the borrowed 48 $NEAR. Continue the calculation of the next round.

#BMEanalytics $BSTN #auroraisnear #DeFi #FTX

9.1/18

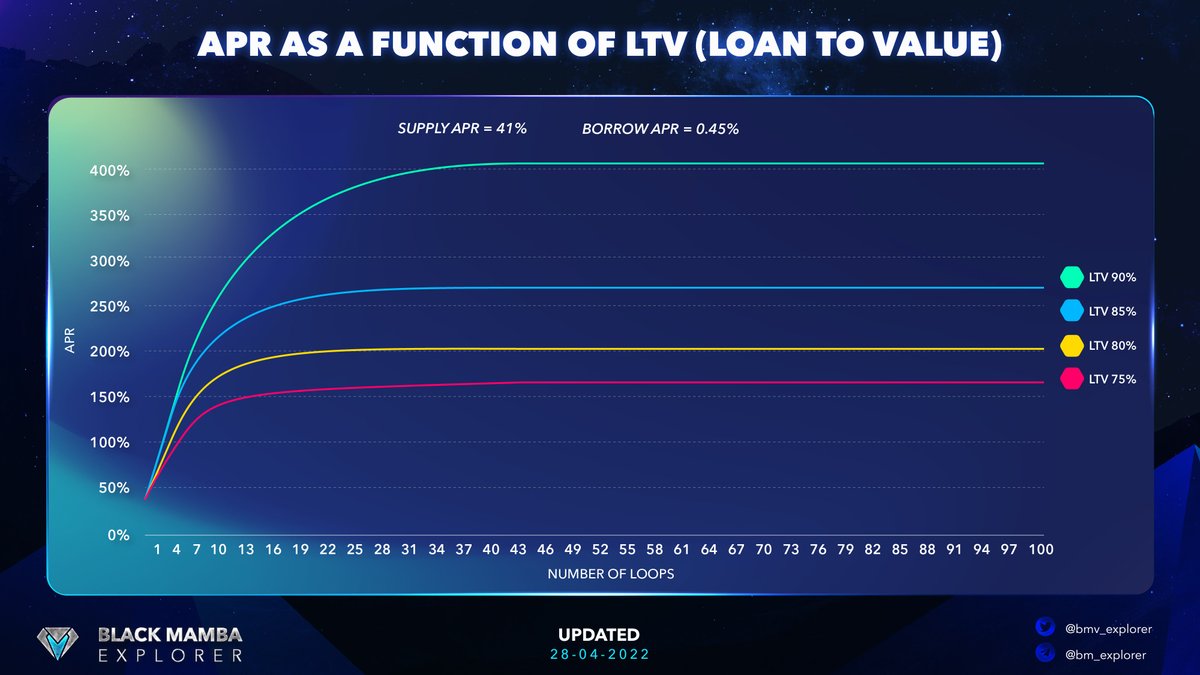

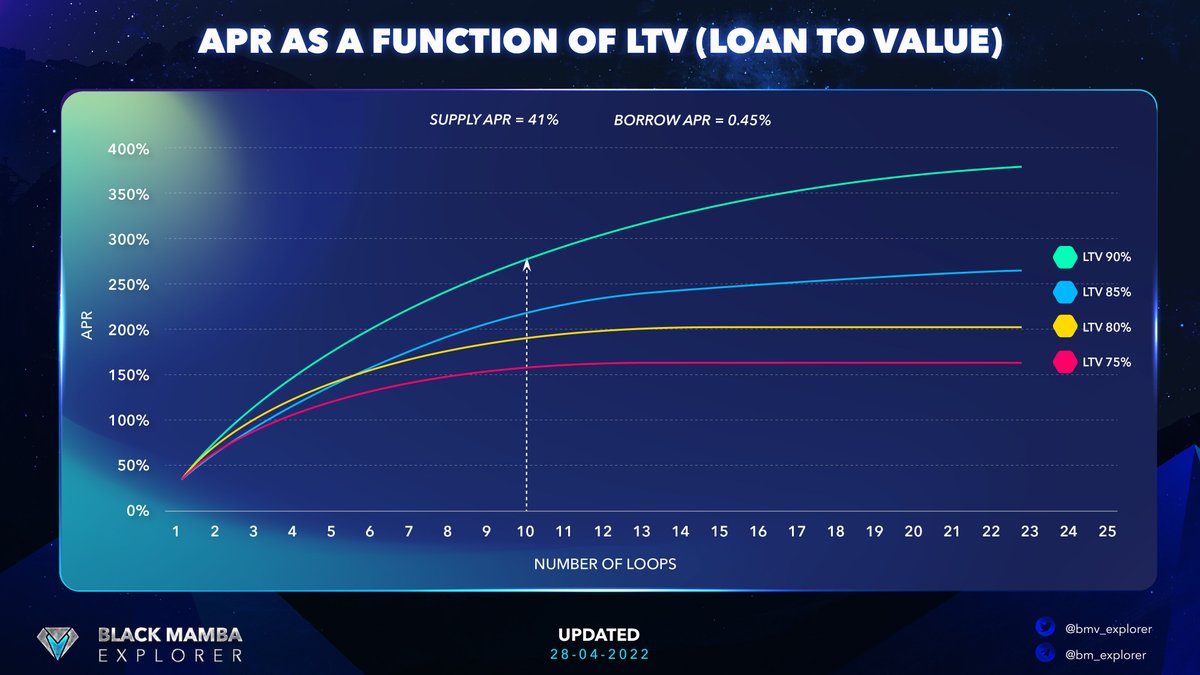

See this chart below for an overview of the APR💰💰

#BMEanalytics $BSTN #auroraisnear #DeFi #NEAR

See this chart below for an overview of the APR💰💰

#BMEanalytics $BSTN #auroraisnear #DeFi #NEAR

10/18

The interest from project will be payback by their token (BSTN), but the asset you use to repay the lending interest is $NEAR. The borrow APY is negative, not only you don't need to repay the interest but also get to earn $BSTN.

#BMEanalytics #DeFi @BastionProtocol $NEAR

The interest from project will be payback by their token (BSTN), but the asset you use to repay the lending interest is $NEAR. The borrow APY is negative, not only you don't need to repay the interest but also get to earn $BSTN.

#BMEanalytics #DeFi @BastionProtocol $NEAR

11/18

However, when the APY is no longer negative you would need to keep an eye on the price of $BSTN and $NEAR 🥸.

#BMEanalytics @auroraisnear #DeFi #NEAR @BastionProtocol

However, when the APY is no longer negative you would need to keep an eye on the price of $BSTN and $NEAR 🥸.

#BMEanalytics @auroraisnear #DeFi #NEAR @BastionProtocol

12/18

If BSTN’s price plummeted, you wouldn't have enough money to repay the interest even though Lending #APY is higher (but this scenario is not likely to occur). The Lending APY is higher than the Borrowing APY then you are profitable.

#BMEanalytics $BSTN @BastionProtocol

If BSTN’s price plummeted, you wouldn't have enough money to repay the interest even though Lending #APY is higher (but this scenario is not likely to occur). The Lending APY is higher than the Borrowing APY then you are profitable.

#BMEanalytics $BSTN @BastionProtocol

13/18

If you want to withdraw the profit then click Repay to pay for the interest (a negative interest means you are receiving profit). Next, simply withdraw #NEAR to your wallet. Remember to save a few $NEAR to use as transaction fees.

#BMEanalytics #DeFi @BastionProtocol

If you want to withdraw the profit then click Repay to pay for the interest (a negative interest means you are receiving profit). Next, simply withdraw #NEAR to your wallet. Remember to save a few $NEAR to use as transaction fees.

#BMEanalytics #DeFi @BastionProtocol

13.1/18

Risk: Participating in #DeFi always has inherent risks such as Bridge hacking, and flash loans so DYOR and this is not financial advice👌.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

Risk: Participating in #DeFi always has inherent risks such as Bridge hacking, and flash loans so DYOR and this is not financial advice👌.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

14/18

Backers:

Bastion has received a lot of investment from well-known VCs such as Three Arrows Capital or @paraficapital 💯.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

Backers:

Bastion has received a lot of investment from well-known VCs such as Three Arrows Capital or @paraficapital 💯.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

15/18

Besides, Bastion also gets support from experts and advisors from #SushiSwap or #Terraform Labs.

#BMEanalytics $BSTN #DeFi #NEAR #Crypto

Besides, Bastion also gets support from experts and advisors from #SushiSwap or #Terraform Labs.

#BMEanalytics $BSTN #DeFi #NEAR #Crypto

16/18

Bastion recently received a $2M #DeFi Rewards grant from Proximity Labs.

#BMEanalytics $BSTN #auroraisnear #NEAR #Definews #Crypto

Bastion recently received a $2M #DeFi Rewards grant from Proximity Labs.

#BMEanalytics $BSTN #auroraisnear #NEAR #Definews #Crypto

17/18

💎Bastion tokenomics:

🍹Total supply: 5,000,000,000 $BSTN

🍹Liquidity Mining: 30%

🍹Treasury: 30%

🍹Team and Advisors: 25% (2-year linear vest, with 6-month cliff)

🍹Investors: 15% (2-year linear vest, with 9-month cliff)

#BMEanalytics #auroraisnear #DeFi #NEAR #Crypto

💎Bastion tokenomics:

🍹Total supply: 5,000,000,000 $BSTN

🍹Liquidity Mining: 30%

🍹Treasury: 30%

🍹Team and Advisors: 25% (2-year linear vest, with 6-month cliff)

🍹Investors: 15% (2-year linear vest, with 9-month cliff)

#BMEanalytics #auroraisnear #DeFi #NEAR #Crypto

18/18

Thank you @jakesully96 for your contribution🤝.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

Thank you @jakesully96 for your contribution🤝.

#BMEanalytics $BSTN @auroraisnear #DeFi #NEAR @BastionProtocol

• • •

Missing some Tweet in this thread? You can try to

force a refresh