Hi

Interesting astro & markets charts ahead - unique #Datavisualization with #Tableau

$SPX 2005-current

Colors show Pluto through Terms

Note 2008 - Pluto in Term Mars (red) rallied at 1st, but then most of meltdown Pluto in red

Now 2021-22 & change into red Mars near the top

Interesting astro & markets charts ahead - unique #Datavisualization with #Tableau

$SPX 2005-current

Colors show Pluto through Terms

Note 2008 - Pluto in Term Mars (red) rallied at 1st, but then most of meltdown Pluto in red

Now 2021-22 & change into red Mars near the top

Volatility idea was not hindsight as I pointed out negative historical data in Dec-2021

https://twitter.com/MarsiliosMM/status/1471237209856479233

If you are new to this account, what are the "terms"?

Very ancient divisions of the zodiac not in regular use today by 99%+ of astrologers

Yet I find the data & market reactions compelling again and again

Very ancient divisions of the zodiac not in regular use today by 99%+ of astrologers

Yet I find the data & market reactions compelling again and again

Now a totally different idea

Saturn marking hard aspects (0' 90' 180') with Uranus within 10' in colors

Saturn-Uranus square of 2020-21 was given doomsday status by most finastros

And yet, looks like part of major top! Same in 2000. This aspect doesn't go down all the time.

Saturn marking hard aspects (0' 90' 180') with Uranus within 10' in colors

Saturn-Uranus square of 2020-21 was given doomsday status by most finastros

And yet, looks like part of major top! Same in 2000. This aspect doesn't go down all the time.

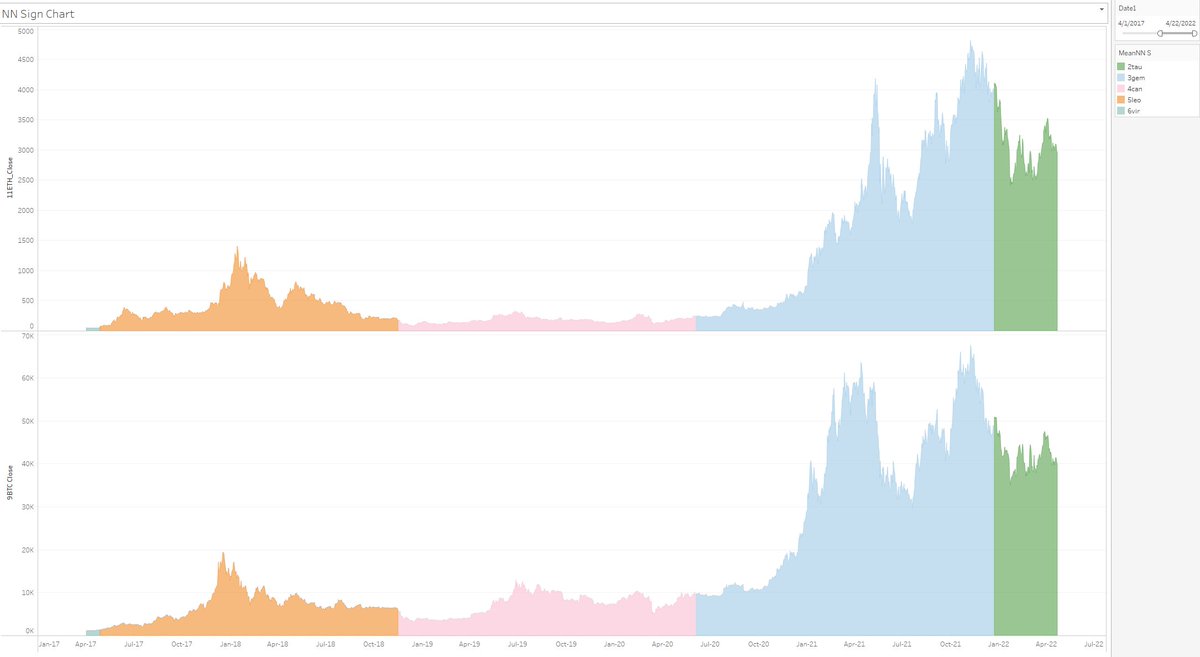

Now again, a totally different idea

Jupiter together in the same zodiac sign as Saturn shown in gold

SPX 1995-current

Jupiter together in the same zodiac sign as Saturn shown in gold

SPX 1995-current

If you are new you might be asking - wait, the last time Jupiter was together with Saturn was 2000? And that formed massive multi-year top in markets?

And then again 2020-21? And no other times between?

Yes, that's exactly it.

Also not hindsight...

And then again 2020-21? And no other times between?

Yes, that's exactly it.

Also not hindsight...

https://twitter.com/MarsiliosMM/status/1477698452033138691

Lastly the Venus motion cycle

Slowdown under 1' per day in gold

Apparent retrograde (Rx) motion in red

Many major market turns on Venus motion

SPX 2018-current

Most recently, major top during the start of the Rx

Slowdown under 1' per day in gold

Apparent retrograde (Rx) motion in red

Many major market turns on Venus motion

SPX 2018-current

Most recently, major top during the start of the Rx

Has this happened before?

Here's 2007-2010

2007 Rx included major tops during the slow periods but Rx was a correction

"The low" in 2009 was on the Rx like +1 day

Here's 2007-2010

2007 Rx included major tops during the slow periods but Rx was a correction

"The low" in 2009 was on the Rx like +1 day

Which of these was really it? Am I grasping at astro straws just looking for bizarre correlations? That would be the skeptic view.

The astro view is that all of these make sense, & they all conspired together to form a particularly notable market top.

The astro view is that all of these make sense, & they all conspired together to form a particularly notable market top.

Venus Rx periods especially can form highs or lows & sometimes both within the same slow & Rx period - but in context of these other major events involving Pluto term, Saturn-Uranus aspect, & Jupiter together with Saturn, it formed a key top as last of retail buying on indexes

"What does all this mean? Just tell me what to do. And what about cryptos?"

OK.

On 21 & 22-April I was tweeting bear warnings (will retweet below) as $DJI and $SPX broke under yearly pivots (YP) for the 3rd time, along with another $ETH YP rejection

OK.

On 21 & 22-April I was tweeting bear warnings (will retweet below) as $DJI and $SPX broke under yearly pivots (YP) for the 3rd time, along with another $ETH YP rejection

https://twitter.com/MarsiliosMM/status/1517229145922572288

Now when scanning major indexes & 3 simple things:

Yearly Pivot status, above / below

Weekly 50MA status, above / below

Weekly 50MA slope, up / down

How many are ALL bearish?

Ummm...

SPX DJI NDX RUT NYA ARKK

DAX, Nikkei, Hang Seng, Shanghai Comp, Bovespa

Nearly every crypto

Yearly Pivot status, above / below

Weekly 50MA status, above / below

Weekly 50MA slope, up / down

How many are ALL bearish?

Ummm...

SPX DJI NDX RUT NYA ARKK

DAX, Nikkei, Hang Seng, Shanghai Comp, Bovespa

Nearly every crypto

Exceptions are interesting -

What asset classes, sectors, or individual names are standing firm and not yet technically bearish?

India - Sensex and Nifty, but in $USD terms ETFs like INDA are also bearish

Sectors - XLP, XLE, XLV XLB XLRE XLU all not terrible yet

What asset classes, sectors, or individual names are standing firm and not yet technically bearish?

India - Sensex and Nifty, but in $USD terms ETFs like INDA are also bearish

Sectors - XLP, XLE, XLV XLB XLRE XLU all not terrible yet

LUNA still the 1 holdout that I'm aware of - something must be going on for this coin to be so strong in such carnage

And then various commodities - not going to list them all here

Basically:

Bull market - participate, use leverage

Bear market - don't lose $, swing trade

And then various commodities - not going to list them all here

Basically:

Bull market - participate, use leverage

Bear market - don't lose $, swing trade

When enough indexes on major levels, especially yearly support levels, we see various divergences, sentiment extremely bearish, and astro timing suggests it, then maybe a real deal low

Until then, protect and see the damage is real

Until then, protect and see the damage is real

(thread almost over)

While eclipse low (29-30 April) definitely possible timing wise there are some issues for major index & crypto low

1 - Not really enough on yearly levels yet

2 - SPX valuation, which is what institutions are deciding everything on right now

While eclipse low (29-30 April) definitely possible timing wise there are some issues for major index & crypto low

1 - Not really enough on yearly levels yet

2 - SPX valuation, which is what institutions are deciding everything on right now

Covid bubble SPX forward P/E above 20 (multiples of 5 in red), then hugged 22.5X gray dots

Problem is 18X, orange, testing now, formerly considered high - brief flings above near yellow 19X were sold quite hard

And with massive overshoot for so long to 22.5, might we see 15X?

Problem is 18X, orange, testing now, formerly considered high - brief flings above near yellow 19X were sold quite hard

And with massive overshoot for so long to 22.5, might we see 15X?

With astro charts really cannot be ruled out

Or maybe indexes will hold here for major eclipse season low

Still on forecasting break so you'll have to decide

But a more bearish scenario than SPX 4010 (YS1) is definitely possible

Still should be good for bounce though

end

Or maybe indexes will hold here for major eclipse season low

Still on forecasting break so you'll have to decide

But a more bearish scenario than SPX 4010 (YS1) is definitely possible

Still should be good for bounce though

end

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh