Djed was the Quintessence of ''stability'' in ancient Egypt

The symbolic backbone of the god Osiris, the god of Afterlife & Ressurection

And Stability is what Djed is bringing to the #Cardano ecosystem

Here’s a deepdive on the tech behind Djed, stable coin on #Cardano🧵👇

The symbolic backbone of the god Osiris, the god of Afterlife & Ressurection

And Stability is what Djed is bringing to the #Cardano ecosystem

Here’s a deepdive on the tech behind Djed, stable coin on #Cardano🧵👇

So what is a stable coin?

A stable coin is a price-stable digital asset

that behaves like a fiat currency

but maintains the mobility and utility of a cryptocurrency

It offers a way to bridge the gap between fiat currencies like the U.S dollar and cryptocurrencies

A stable coin is a price-stable digital asset

that behaves like a fiat currency

but maintains the mobility and utility of a cryptocurrency

It offers a way to bridge the gap between fiat currencies like the U.S dollar and cryptocurrencies

Stable coins are important for crypto markets

Because price stability is built into the assets themselves

It opens up many opportunities for DeFi and value transfer without the risk of price fluctuations

They achieve this price stability is through the underlying collateral

Because price stability is built into the assets themselves

It opens up many opportunities for DeFi and value transfer without the risk of price fluctuations

They achieve this price stability is through the underlying collateral

Based on the underlying collateral structures

They are broadly divided into 2 classes

1. Centralized asset-backed stable coins (based on the U.S. dollar)

eg: USDT, USDC

2. Decentralized algorithmic stable coins: eg DAI, SigmaUSD, etc

They are broadly divided into 2 classes

1. Centralized asset-backed stable coins (based on the U.S. dollar)

eg: USDT, USDC

2. Decentralized algorithmic stable coins: eg DAI, SigmaUSD, etc

Centralized asset-backed stablecoins came under criticism and scrutiny by authorities for the lack of transparency

USDT is a well-known example

Due to the centralization and lack of transparency

these stablecoins cant be seen as a reliable solution

decrypt.co/88250/tether-a…

USDT is a well-known example

Due to the centralization and lack of transparency

these stablecoins cant be seen as a reliable solution

decrypt.co/88250/tether-a…

On the other hand

Building a reliable algorithmic stable coin is an immense challenge

Yesterday we saw UST in free fall

The algorithmic stable coin, which had the biggest market cap was in free fall and lost its peg to the dollar

Building a reliable algorithmic stable coin is an immense challenge

Yesterday we saw UST in free fall

The algorithmic stable coin, which had the biggest market cap was in free fall and lost its peg to the dollar

This is where we realize

that methodic approach, based on research & rigorous testing is the only way to build reliable systems

That aspire to serve Billions of people

& #Cardano is pioneering this technique in the world of crypto

Now it's building a stable coin👇

that methodic approach, based on research & rigorous testing is the only way to build reliable systems

That aspire to serve Billions of people

& #Cardano is pioneering this technique in the world of crypto

Now it's building a stable coin👇

Djed is the 1st stablecoin protocol for which

Stability claims are precisely & mathematically stated, proven & formally verified

Djed's governing algorithm behaves like an autonomous Bank

that buys and sells stablecoins for a price in a range that is pegged to a target price

Stability claims are precisely & mathematically stated, proven & formally verified

Djed's governing algorithm behaves like an autonomous Bank

that buys and sells stablecoins for a price in a range that is pegged to a target price

Let's dig deeper into the ''stability properties'' of Djed

The stability properties of Djed are based on ''provable Theorems''

which are mathematically tested & verified using formal techniques

Let's try to understand the essence of these complex mathematical theorems👇

The stability properties of Djed are based on ''provable Theorems''

which are mathematically tested & verified using formal techniques

Let's try to understand the essence of these complex mathematical theorems👇

The stability properties of Djed are based on 8 ''provable Theorems''

• Peg upper and lower bound maintenance

• Peg robustness during market crashes

• No insolvency

• No bank runs

• Monotonically increasing equity per reserve coin

• No reserve draining

• Bounded dilution

• Peg upper and lower bound maintenance

• Peg robustness during market crashes

• No insolvency

• No bank runs

• Monotonically increasing equity per reserve coin

• No reserve draining

• Bounded dilution

Theorem 1 & 2: Peg upper & lower bound maintenance

This theorem states that

the price will not go above or beyond the set price

eg: the price of Djed will never go above 1.01 dollars and never go below 99.9 cents 👇

This theorem states that

the price will not go above or beyond the set price

eg: the price of Djed will never go above 1.01 dollars and never go below 99.9 cents 👇

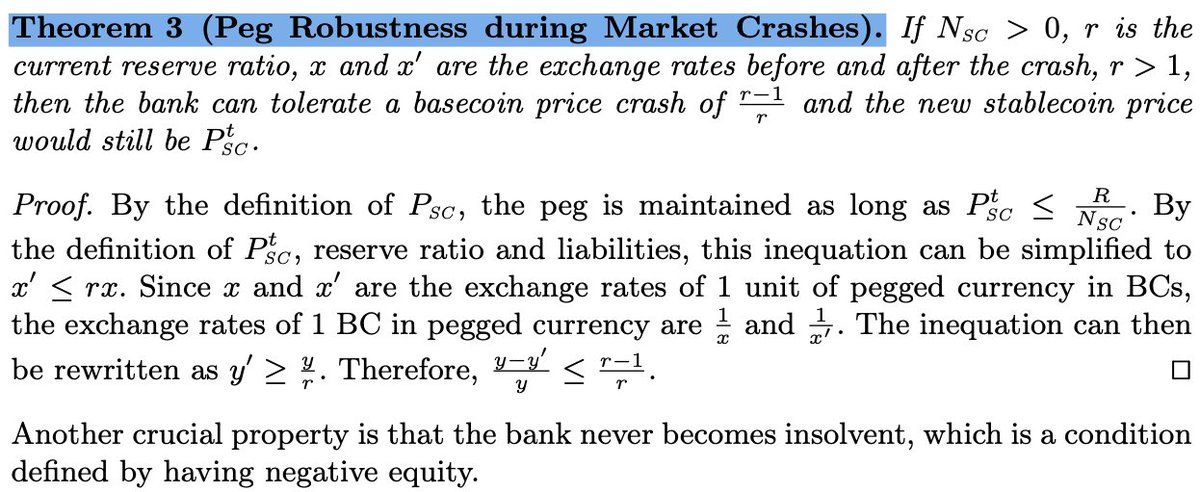

Theorem 3: Peg robustness during market crashes

It states that

up to a set limit, depending on the reserve ratio, the peg is maintained

even when Price of the base coin crashes

eg: if the reserve ratio is 1:3, Djed can withstand a market crash of 66%

without losing the peg👇

It states that

up to a set limit, depending on the reserve ratio, the peg is maintained

even when Price of the base coin crashes

eg: if the reserve ratio is 1:3, Djed can withstand a market crash of 66%

without losing the peg👇

Theorem 4: No insolvency

This theorem states that

the equity of the smart contract governing Djed can never go bankrupt or negative

meaning

if you hold the stable coin, you will be always able to get your money back

given the peg is still maintained 👇

This theorem states that

the equity of the smart contract governing Djed can never go bankrupt or negative

meaning

if you hold the stable coin, you will be always able to get your money back

given the peg is still maintained 👇

Theorem 5: No bank runs

this basically means

in the case of a market crash

there is no incentive for users to race to redeem their stablecoins

The smart contract treats all users fairly and equally and paid accordingly 👇

this basically means

in the case of a market crash

there is no incentive for users to race to redeem their stablecoins

The smart contract treats all users fairly and equally and paid accordingly 👇

Theorem 6: Monotonically increasing equity per reserve coin

this basically means

provided that the exchange rate remains constant

the equity or the value returned to the holders of the reserve coin always increases

and reserve coin holders are guaranteed to profit from this👇

this basically means

provided that the exchange rate remains constant

the equity or the value returned to the holders of the reserve coin always increases

and reserve coin holders are guaranteed to profit from this👇

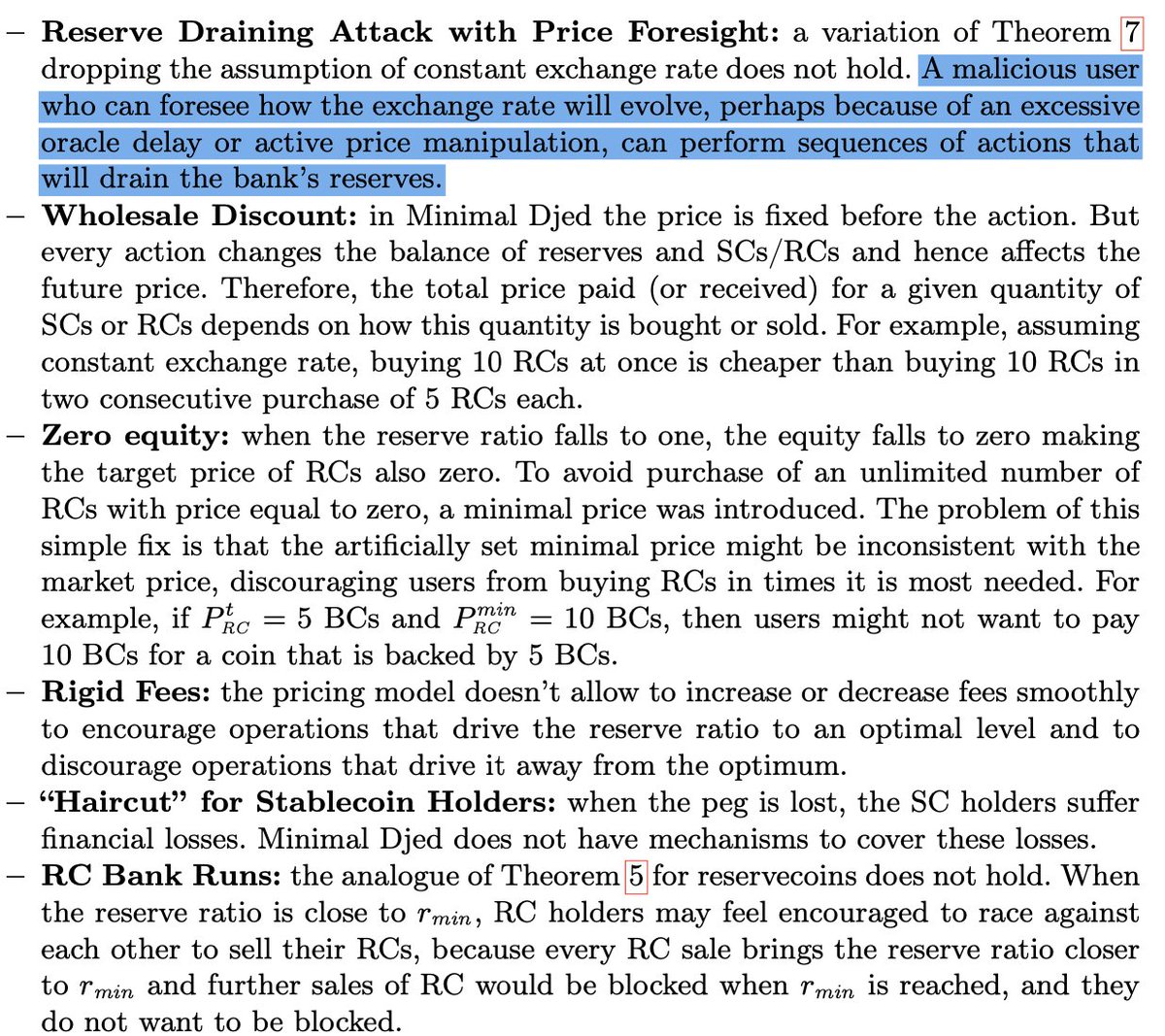

Theorem 7: No reserve draining

this theorem states that

provided that the exchange rate remains constant

it is impossible for a malicious user to execute a sequence of actions that would steal reserves from the bank / smart contract 👇

this theorem states that

provided that the exchange rate remains constant

it is impossible for a malicious user to execute a sequence of actions that would steal reserves from the bank / smart contract 👇

Theorem 8: Bounded dilution

this basically means that

there is a ''limit'' to how many reserve coin holders and their profit can be diluted

due to the issuance of more reserve coins

and this incentives users to hold reserve coins 👇

this basically means that

there is a ''limit'' to how many reserve coin holders and their profit can be diluted

due to the issuance of more reserve coins

and this incentives users to hold reserve coins 👇

The Theorems were checked for their mathematical correctness with automated tools

Researchers used 2 formal verifications methods

• Model checking: a fully automated technique

&

• Interactive theorem prover- Isabell

where you have to interact with it to prove the correctness

Researchers used 2 formal verifications methods

• Model checking: a fully automated technique

&

• Interactive theorem prover- Isabell

where you have to interact with it to prove the correctness

The Djed research paper envisions two versions of Djed

• minimal Djed: simple uncomplicated design

&

• extended Djed

minimal Djed is currently implemented on #Ergo as sigmaUSD

This version could be vulnerable to attacks like the Reserve draining attack

• minimal Djed: simple uncomplicated design

&

• extended Djed

minimal Djed is currently implemented on #Ergo as sigmaUSD

This version could be vulnerable to attacks like the Reserve draining attack

The sigmaUSD was subject to a reserve drain attack

by an anonymous user who owned a large amount of ERG

The attack was ultimately unsuccessful & the attacker is estimated to have lost $ 100,000

Extended Djed envisions to overcome these shortcomings with dynamic fees mechanism

by an anonymous user who owned a large amount of ERG

The attack was ultimately unsuccessful & the attacker is estimated to have lost $ 100,000

Extended Djed envisions to overcome these shortcomings with dynamic fees mechanism

Now that we have an idea about the formally verified ''stability properties'' of Djed

let's look at how Djed's advanced algorithm works

Djed has a Base coin, which is $Ada

and a reserve coin, which is $Shen

let's look at how Djed's advanced algorithm works

Djed has a Base coin, which is $Ada

and a reserve coin, which is $Shen

The cryptocurrency that will be backing Djed is $Ada

In order to mint the Djed

the user will need to interact with the smart contract by sending Ada to its address

after that contract will send Djed back to the user

In order to mint the Djed

the user will need to interact with the smart contract by sending Ada to its address

after that contract will send Djed back to the user

So let's assume Ada is worth $2 and Djed is worth $1

so in order to mint one Djed

the user needs to send 0.5 Ada to the smart contract

this process can be repeated

and users can send more and more $Ada to the contract and get more Djed

so in order to mint one Djed

the user needs to send 0.5 Ada to the smart contract

this process can be repeated

and users can send more and more $Ada to the contract and get more Djed

if the user wants to sell one Djed

user should send it back to the contract

which will then burn the Djed and sends back the amount of Ada that is equivalent to $1

As the price of $Ada can fluctuate

there may not be enough $Ada in the contract to give back to the Djed holders

user should send it back to the contract

which will then burn the Djed and sends back the amount of Ada that is equivalent to $1

As the price of $Ada can fluctuate

there may not be enough $Ada in the contract to give back to the Djed holders

Here is where $Shen comes into the picture

It is the reserve coin in charge of providing extra reserves for the pool

it's an ancient Egyptian symbol representing infinity & durability

unlike the Djed stablecoin

$Shen is not pegged to a specific asset & its price can fluctuate

It is the reserve coin in charge of providing extra reserves for the pool

it's an ancient Egyptian symbol representing infinity & durability

unlike the Djed stablecoin

$Shen is not pegged to a specific asset & its price can fluctuate

So what is the incentive for users to mint & hold $Shen?

There are fees associated with minting and burning $Djed & $Shen

which will be collected and sent to an $Ada pool

•$Shen holders will get a share of these fees

•&positive price appreciation from the growing $Ada pool

There are fees associated with minting and burning $Djed & $Shen

which will be collected and sent to an $Ada pool

•$Shen holders will get a share of these fees

•&positive price appreciation from the growing $Ada pool

according to @shahafbg , CEO of COTI

Djed’s collateral ratio is in the range of 400%-800%

Djed can be over collateralized (up to 8x)

this considerably decreases the risk of $Djed being unpegged

This means that for every 1 $Djed minted, there are 4-8 $Shen in the reserve pool

Djed’s collateral ratio is in the range of 400%-800%

Djed can be over collateralized (up to 8x)

this considerably decreases the risk of $Djed being unpegged

This means that for every 1 $Djed minted, there are 4-8 $Shen in the reserve pool

And If the ratio falls below 400%

users will not be able to mint $Djed

and $Shen holders won’t be able to burn their $Shen

So in the event of a market crash, there is a security for the peg of $Djed

that ensures its stability of $Djed

users will not be able to mint $Djed

and $Shen holders won’t be able to burn their $Shen

So in the event of a market crash, there is a security for the peg of $Djed

that ensures its stability of $Djed

$Djed is awaiting its first implementation on @COTInetwork

After months of development months of development

the public Testnet version of Djed was released last week

medium.com/cotinetwork/dj…

After months of development months of development

the public Testnet version of Djed was released last week

medium.com/cotinetwork/dj…

TL;DR -

• Djed is the first formally verified algorithmic stablecoin protocol

• Its stability claims have been precisely and mathematically stated, proven, and formally verified

• Djed is currently on the testnet version @COTInetwork & awaiting mainnet implementation

• Djed is the first formally verified algorithmic stablecoin protocol

• Its stability claims have been precisely and mathematically stated, proven, and formally verified

• Djed is currently on the testnet version @COTInetwork & awaiting mainnet implementation

If you found this thread valuable:

1. Toss me a follow for more threads on technical deep dives and Defi→ @Soorajksaju2

2. Here’s another thread on the L2 solution ''Orbis project'' bringing zk-Rollup on #Cardano that you might enjoy:

1. Toss me a follow for more threads on technical deep dives and Defi→ @Soorajksaju2

2. Here’s another thread on the L2 solution ''Orbis project'' bringing zk-Rollup on #Cardano that you might enjoy:

https://twitter.com/Soorajksaju2/status/1518208661084160008?s=20&t=sYZLs5mZr6x7qgAlXS209Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh