Globus spirits - Business Analysis

A great play on ethanol theme?

Sometimes I drink water to surprise liver, But can Globus spirits surprise with its performance?

A thread🧵

1)

#globussprits #unitedspirits #diageo #radicokhaitan #investing #stocks #nse

A great play on ethanol theme?

Sometimes I drink water to surprise liver, But can Globus spirits surprise with its performance?

A thread🧵

1)

#globussprits #unitedspirits #diageo #radicokhaitan #investing #stocks #nse

2) Story/ theme

- Contract Manufacturing

- Ethanol blending

- Premiumization of spirits

- Contract Manufacturing

- Ethanol blending

- Premiumization of spirits

3) About Company

It is engaged in manufacturing of IMIL, IMFL, bulk alcohol, hand sanitizer & franchise alcohol blotting

It's a unique 360° business model with forward & backward Integration

It is engaged in manufacturing of IMIL, IMFL, bulk alcohol, hand sanitizer & franchise alcohol blotting

It's a unique 360° business model with forward & backward Integration

4) Business segments

i) manufacturing segment - bulk spirits, franchise blotting, by products

ii) consumer segments - value, value plus & premium brands

i) manufacturing segment - bulk spirits, franchise blotting, by products

ii) consumer segments - value, value plus & premium brands

5)

i) manufacturing segment

Bulk alcohol-Largest ENA player with 195 mn litres capacity with presence in rajasthan,haryana,WB

Franchise blotting 20yrs of strong relationship with Diageo,United spirits & ABD

By products-used for animal feed supplements & CO2 for carbonation

i) manufacturing segment

Bulk alcohol-Largest ENA player with 195 mn litres capacity with presence in rajasthan,haryana,WB

Franchise blotting 20yrs of strong relationship with Diageo,United spirits & ABD

By products-used for animal feed supplements & CO2 for carbonation

6

ii) consumer segments

It is one of the largest IMIL player

It has brands in mass to premium segments

Value & Value plus brands-Globus green ,county club,royal estate,black lace

Premium brands -Governor reserved , Oakton,Terai( Indian dry gin)

Gin is fastest growing segment

ii) consumer segments

It is one of the largest IMIL player

It has brands in mass to premium segments

Value & Value plus brands-Globus green ,county club,royal estate,black lace

Premium brands -Governor reserved , Oakton,Terai( Indian dry gin)

Gin is fastest growing segment

7) Revenue realisation in consumer segment

avg realisation in value & value plus rs 461/ case

Price increase of Rs 19/case in value & Rs 39/case in value plus wef april 1st 2022

So Q1FY23 will be good quater

avg realisation in value & value plus rs 461/ case

Price increase of Rs 19/case in value & Rs 39/case in value plus wef april 1st 2022

So Q1FY23 will be good quater

8 Realisation in Manufacturing

Capacity utilisation at 90% (expect more capex to come)

Avg realisation up 8% you & 11%qoq

Sales have increased due to new capex live at WB

Capacity utilisation at 90% (expect more capex to come)

Avg realisation up 8% you & 11%qoq

Sales have increased due to new capex live at WB

9) FY22 Highlights

Rev 2344crs up 50%

EBITDA 335crs up 28%

EBITDA margin 21.2%

PAT 187crs up 30%

All plants operating at optimum capacity

New capex live at WB

Dividend of 3rs/share

Finance cost at just 3.9% 🔥🔥

Rev 2344crs up 50%

EBITDA 335crs up 28%

EBITDA margin 21.2%

PAT 187crs up 30%

All plants operating at optimum capacity

New capex live at WB

Dividend of 3rs/share

Finance cost at just 3.9% 🔥🔥

10) Q4FY22 highlights

- gross margin at 42%

- Ethanol price increased by 1.37%

- New capex live at WB

- RM pressure,fuel cost up 37% , packaging cost up 40%

- Price up in RJ

- mitigation of broken rice helps increase incremental cost realisation of 3rs/L ethanol

-eff tax 19%

- gross margin at 42%

- Ethanol price increased by 1.37%

- New capex live at WB

- RM pressure,fuel cost up 37% , packaging cost up 40%

- Price up in RJ

- mitigation of broken rice helps increase incremental cost realisation of 3rs/L ethanol

-eff tax 19%

11) capex update

New plant at jharkhand

New ethanol plant at UP & odisha

10yrs of long term ethanol contract

New plant at jharkhand

New ethanol plant at UP & odisha

10yrs of long term ethanol contract

13) Globus spirits vs peers

It's trading at mouth watering valuations vs peers

Cheapest and the best spirits & ethanol company with best financials and valuation

It's trading at mouth watering valuations vs peers

Cheapest and the best spirits & ethanol company with best financials and valuation

14) Key risks

- Govt control over prices

- C. Governance issue from promotors long back

- Bihar plant is prone to floods

- capacity utilisation is at peak so more capex will be announced and financial will not be great

- Govt control over prices

- C. Governance issue from promotors long back

- Bihar plant is prone to floods

- capacity utilisation is at peak so more capex will be announced and financial will not be great

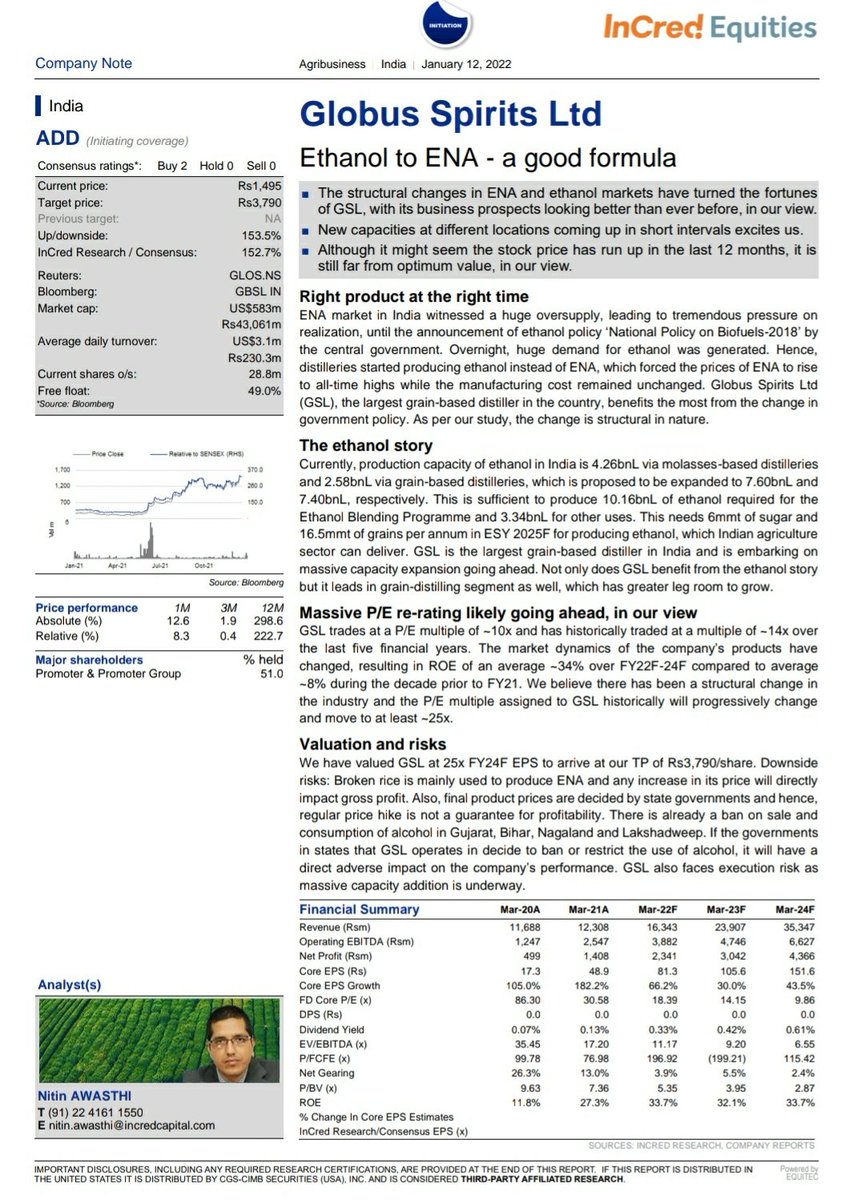

15) brokerage coverage

- Edelweiss 1400

- icici 1750

- incred 3750

I'm on same side of incred with personal target of 4000rs with timeline of 2yrs

For research reports dm

D- invested ,not recommendation

If u found it useful do like share & retweet & consider following me

- Edelweiss 1400

- icici 1750

- incred 3750

I'm on same side of incred with personal target of 4000rs with timeline of 2yrs

For research reports dm

D- invested ,not recommendation

If u found it useful do like share & retweet & consider following me

• • •

Missing some Tweet in this thread? You can try to

force a refresh