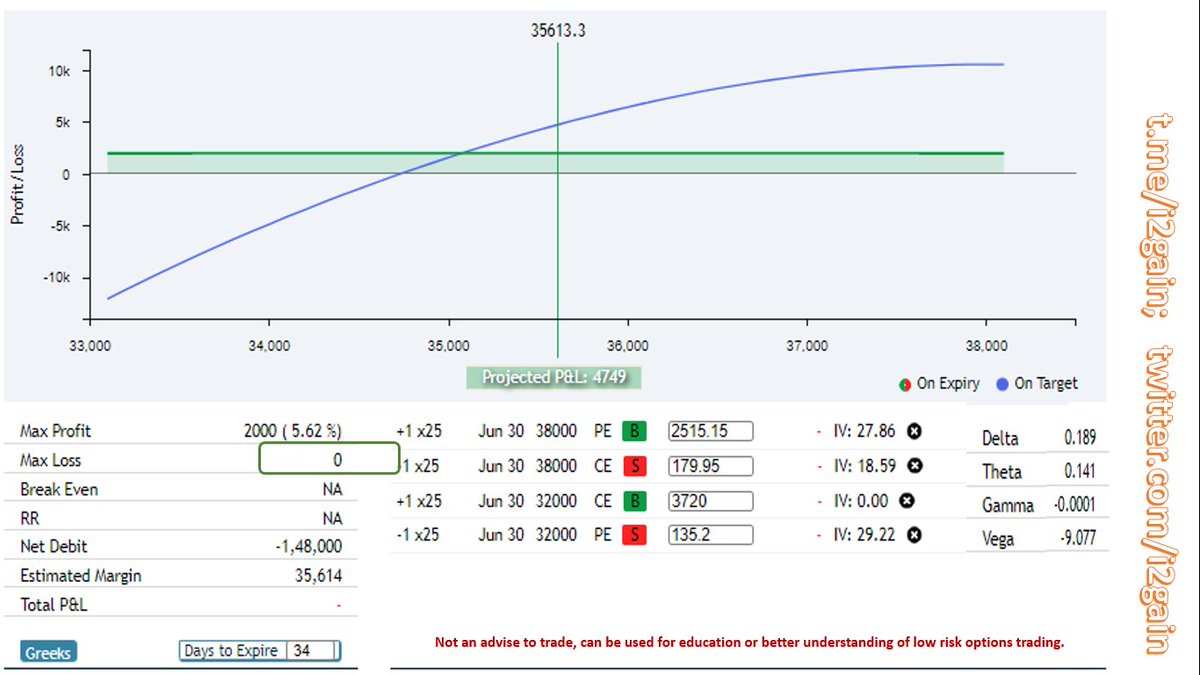

Sharing a 0 loss of 100 success probability #BankNifty Strategy for learning and research putposes, pls check all the tweets for a thorough understanding of concept.

#NiftyBank #optionstrading #nifty #Nifty50

#NiftyBank #optionstrading #nifty #Nifty50

Focus on understanding the concept or idea of buying deep in the money options that have very little premium and selling deep OTM options that have zero intrinsic value.

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

You may enter these legs in software or excel that you use and check the breakeven range, the prices are Friday's closing prices.

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

I use Trudata's Option Decoder, have crossed checked this on Excel too. It is indeed a ZERO LOSS strategy. But real ROI is not as high as 5.62%, we'll understand it in next slides.

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

The real ROI is less than 1 % in we calculate it on total cost, including price of long side options. But with some adjustments the profit can be raised, still keepin it safe or very low risk.

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

This is another one using same strikes, altering buy sell ratio to 1:2, breakeven range is still safe, Delta n Vega indicate adequate safety, the real net ROI is about 3%, not bad for such a wide breakeven strategy

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

Similarly the buy sell ratio can be tweeked further or, sell side strikes can be a tad shifted closer to ATM to raise the profitability. The concept may give 5-6% return keeping breakeven range in safe levels.

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

#BankNifty #NiftyBank #optionstrading #nifty #Nifty50 #SGXNifty

Queries w.r.t. above are welcome, use comments or DMs to reach out to me.

Join t.me/i2gain for more of such low risk trading ideas and detailed analysis of #Nifty and #BankNifty.

Join t.me/i2gain for more of such low risk trading ideas and detailed analysis of #Nifty and #BankNifty.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh