0/ June 8 - 14 was severe for crypto and the broader financial markets as the U.S. CPI resulted in a strong reaction.

$BTC recorded red candles every day from June 7, which meant there was not enough buying power. The intensified sell-off on June 13 caused a $4,100 loss for it.

$BTC recorded red candles every day from June 7, which meant there was not enough buying power. The intensified sell-off on June 13 caused a $4,100 loss for it.

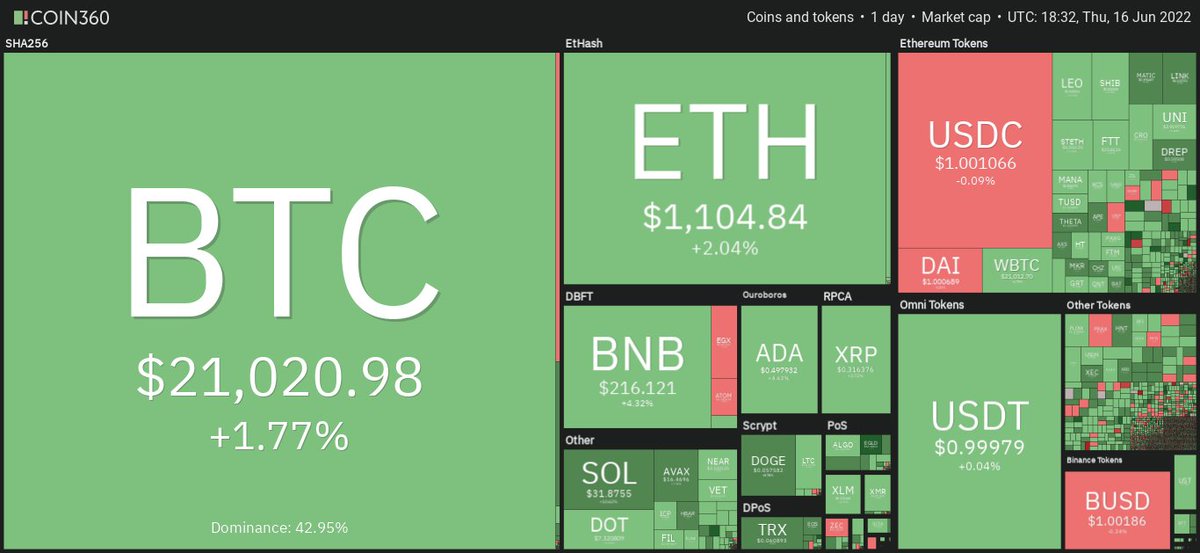

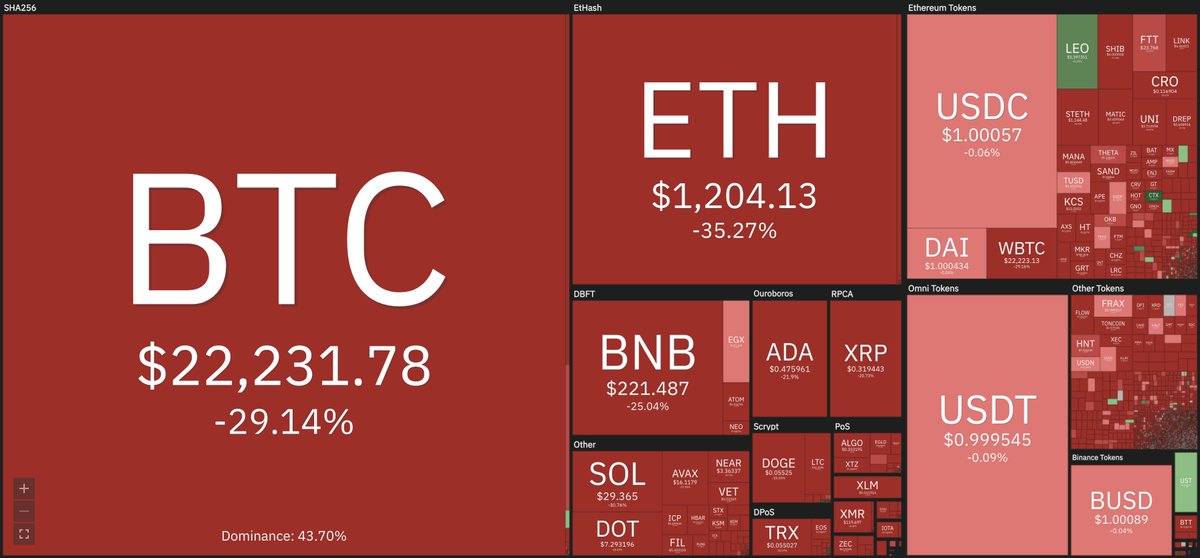

1/ In this period:

$BTC briefly touched $20.8k, falling by 29% in a week

$ETH traded below $1.2k, down ~75% from ATH

The total crypto market cap dropped below $1T

The Crypto Fear & Greed index touched 8 points

Over 240,000 traders suffered from losses in $1.3B crypto liquidations

$BTC briefly touched $20.8k, falling by 29% in a week

$ETH traded below $1.2k, down ~75% from ATH

The total crypto market cap dropped below $1T

The Crypto Fear & Greed index touched 8 points

Over 240,000 traders suffered from losses in $1.3B crypto liquidations

2/ $ETH lost its share of the total market cap due to several reasons. The troubles with its #DeFi space, or $stETH "depegging" & @CelsiusNetwork insolvency crisis, plus the delayed difficulty bomb caused the mess.

ETHBTC ratio slid from the high of 0.076 on May 11 to 0.0509.

ETHBTC ratio slid from the high of 0.076 on May 11 to 0.0509.

3/ $LEO was the only top cryptocurrency to see green, partly thanks to the massive burns.

$CEL surged as Celsius returned 28.1M of $DAI to @MakerDAO to avoid $WBTC liquidation & supplied roughly 8,000 $ETH to @AaveAave to save its $stETH position.

Others include stablecoins.

$CEL surged as Celsius returned 28.1M of $DAI to @MakerDAO to avoid $WBTC liquidation & supplied roughly 8,000 $ETH to @AaveAave to save its $stETH position.

Others include stablecoins.

4/ $CRV & $CVX were 98.6% and 93.4% down from their ATHs. Both DEXes saw massive drawdowns in TVL and decreasing trading volume.

$TRX was hit after $USDD #stablecoin lost its peg. Tron's TVL was plunging to April 2022 levels when it hadn't launched #USDD and a lending platform.

$TRX was hit after $USDD #stablecoin lost its peg. Tron's TVL was plunging to April 2022 levels when it hadn't launched #USDD and a lending platform.

5/ $WAVES closed the week with a significant 42.9% loss.

$LTC recorded -29.6% in price following delistings from major Korean exchanges due to its privacy modifications for the coin (MWEB). @binance announced to end support for LTC transactions sent through the MWEB function.

$LTC recorded -29.6% in price following delistings from major Korean exchanges due to its privacy modifications for the coin (MWEB). @binance announced to end support for LTC transactions sent through the MWEB function.

6/ Despite the catastrophe, hedge funds and investment managers still believe in the market's rebound and $BTC's likeliness to hit $100k.

There is still huge leverage in the system, and we can expect more deleveraging if BTC goes lower.

There is still huge leverage in the system, and we can expect more deleveraging if BTC goes lower.

7/ News:

Bank of America Survey: Consumers Aren’t Done With Crypto Yet: cutt.ly/CJ6Pmsq

@HuobiGlobal launches $1B investment arm focused on DeFi and Web3: cutt.ly/1J6PAjx

Goldman Sachs executes its first trade of Ether-linked derivative: cutt.ly/gJ6PZEW

Bank of America Survey: Consumers Aren’t Done With Crypto Yet: cutt.ly/CJ6Pmsq

@HuobiGlobal launches $1B investment arm focused on DeFi and Web3: cutt.ly/1J6PAjx

Goldman Sachs executes its first trade of Ether-linked derivative: cutt.ly/gJ6PZEW

8/ @CelsiusNetwork turmoil is part of a broader macro picture: cutt.ly/FJ6AwWa

#NFT floor prices are falling along with the broader crypto market: cutt.ly/7J6AieV

@opensea announces new security features to protect users from NFT scams: cutt.ly/YJ6AfWs

#NFT floor prices are falling along with the broader crypto market: cutt.ly/7J6AieV

@opensea announces new security features to protect users from NFT scams: cutt.ly/YJ6AfWs

9/ The bear market can be coming, but we can't let it take us down. Our mental health & well-being are the most important.

It hurts to see the portfolio sinking, but remember that you have more things to take care of. Useful tips from @0xRusowsky👇

0xrusowsky.substack.com/p/how-to-menta…

It hurts to see the portfolio sinking, but remember that you have more things to take care of. Useful tips from @0xRusowsky👇

0xrusowsky.substack.com/p/how-to-menta…

10/ More market insights and infographics? Subscribe to our newsletter to explore: coin360.com

Follow us on #Twitter and #Telegram for the latest updates!

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

Follow us on #Twitter and #Telegram for the latest updates!

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

• • •

Missing some Tweet in this thread? You can try to

force a refresh