1 New to investing?

2 Confused by #fintwit jargon?

3 Do we trust people presenting “valuation” to know what they don't know?

(Hint: “my-laser-eyed-golden-skin-ape-pic-is-worth-at-least-twice-your-diamond-skin-ape-pic” = relative pricing. Not valuation)

Follow #PiggyBack🧵

1/X

2 Confused by #fintwit jargon?

3 Do we trust people presenting “valuation” to know what they don't know?

(Hint: “my-laser-eyed-golden-skin-ape-pic-is-worth-at-least-twice-your-diamond-skin-ape-pic” = relative pricing. Not valuation)

Follow #PiggyBack🧵

1/X

Equity = Assets - Liabilities

But what asset and liability values are we going to use?

The answer as always: it depends on what we are going to use it for.

Here is a summary of equity metrics, from the most conservative:

2/X

But what asset and liability values are we going to use?

The answer as always: it depends on what we are going to use it for.

Here is a summary of equity metrics, from the most conservative:

2/X

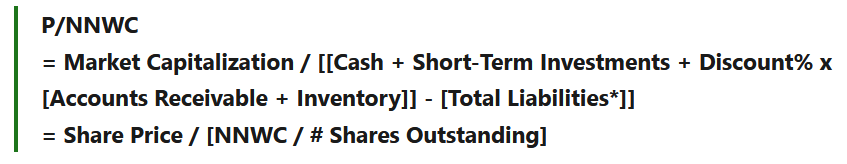

Price/”Net-Net” Working Capital (P/NNWC)

Classic Graham/Dodd strategy

Assumes: Use only most liquid current assets, deduct subjective discounts.

Conditions (often missed in screens):

1) Not consuming assets (melting ice cube/negative cash-flow)

2) Historical profitability

3/X

Classic Graham/Dodd strategy

Assumes: Use only most liquid current assets, deduct subjective discounts.

Conditions (often missed in screens):

1) Not consuming assets (melting ice cube/negative cash-flow)

2) Historical profitability

3/X

Net-Net P/NNWC continued:

Pro: Diversified #netnet:s = good, aggressive mean reversion strategy w. downside protection in liquidation

Con: Few investable #netnets in efficient markets. Find decent quality by accepting other risks. E.g. #smallcap, less efficient geographies

4/X

Pro: Diversified #netnet:s = good, aggressive mean reversion strategy w. downside protection in liquidation

Con: Few investable #netnets in efficient markets. Find decent quality by accepting other risks. E.g. #smallcap, less efficient geographies

4/X

Price/Net Current Asset Value (P/NCAV)

A simpler but much less conservative #liquidation proxy than net-nets

Graham and Dodd described screening for 2/3 x NCAV stocks, but that is an arbitrary workaround.

In short: #Piggyback would advise against using NCAV standalone

5/X

A simpler but much less conservative #liquidation proxy than net-nets

Graham and Dodd described screening for 2/3 x NCAV stocks, but that is an arbitrary workaround.

In short: #Piggyback would advise against using NCAV standalone

5/X

P/NCAV continued:

Pro: Very fast, easy to calculate/#screen

Con: Not all current assets are worth 100% book. Especially not intangible current assets, if operations shut down. So no good liquidation estimate. Not good for “asset plays” in ignoring long-term, quality assets

6/X

Pro: Very fast, easy to calculate/#screen

Con: Not all current assets are worth 100% book. Especially not intangible current assets, if operations shut down. So no good liquidation estimate. Not good for “asset plays” in ignoring long-term, quality assets

6/X

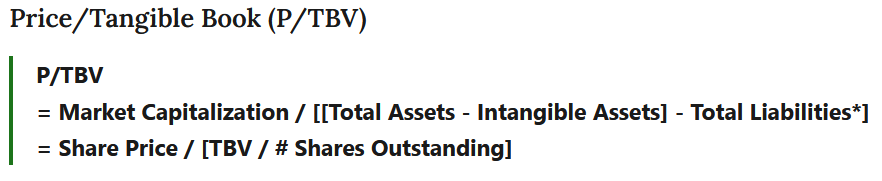

Price/Tangible Book (P/TBV)

#PiggyBack's preferred book metric for quick screening for "asset play"-type #stocks to analyze further

Pro: Very fast, easy to calculate. In #screeners. Ignores intangible assets = partial #goodwill cleanup

Con: Other accounting flaws distort

7/X

#PiggyBack's preferred book metric for quick screening for "asset play"-type #stocks to analyze further

Pro: Very fast, easy to calculate. In #screeners. Ignores intangible assets = partial #goodwill cleanup

Con: Other accounting flaws distort

7/X

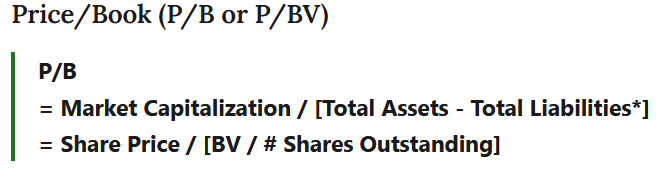

Price/Book (P/B or P/BV)

Go-to equity book value in academic literature

Pro: Very fast, easy to calculate/screen. Widely available long-term historical data. Easy to relate to multiples (P/E), popular #valuation models

Con: Very distorted by accounting including goodwill

8/X

Go-to equity book value in academic literature

Pro: Very fast, easy to calculate/screen. Widely available long-term historical data. Easy to relate to multiples (P/E), popular #valuation models

Con: Very distorted by accounting including goodwill

8/X

.#Accounting = rules-based, backward-looking records

Equity investor use:

1 Model input

2 For early hints of significant risks/opportunities

Accounting does NOT:

1 Assess investments' economic returns (above #costofcapital)

2 Offer book values estimates for #intrinsicvalue

9/X

Equity investor use:

1 Model input

2 For early hints of significant risks/opportunities

Accounting does NOT:

1 Assess investments' economic returns (above #costofcapital)

2 Offer book values estimates for #intrinsicvalue

9/X

To move from screening toward #valuation:

1 Collect, analyze more info

2 Make forward-looking assumptions

In other words, draw maps of what is likely to happen next. This makes us more confident of #intrinsicvalue in:

1 Balance sheets

2 Earnings power

3 Franchise growth

10/X

1 Collect, analyze more info

2 Make forward-looking assumptions

In other words, draw maps of what is likely to happen next. This makes us more confident of #intrinsicvalue in:

1 Balance sheets

2 Earnings power

3 Franchise growth

10/X

“Don’t tell me you buy companies at low P/E ratios and high dividends or whatever it is. That is not valuing the company, that’s just running screens. Maybe one in a hundred actually values companies.”

— @AswathDamodaran in recent @InvestLikeBest joincolossus.com/episodes/75305… ~50m

11/X

— @AswathDamodaran in recent @InvestLikeBest joincolossus.com/episodes/75305… ~50m

11/X

This distinction of “#valueinvesting” screening (factor tilt/tool to get to interesting market areas) vs investment valuation is made much clearer by @AswathDamodaran.

Highly recommend(!) the underfollowed @SubstackInc edition of “Musings on Markets” aswathdamodaran.substack.com

12/X

Highly recommend(!) the underfollowed @SubstackInc edition of “Musings on Markets” aswathdamodaran.substack.com

12/X

Now moving on to fundamental analysis that is not yet complete valuation.

Price / Reproduction Value:

1 Attempt to explain the cost for competitors to hypothetically "recreate" company's assets in place

2 Usually, by collecting/adjusting reasonable market price points

13/X

Price / Reproduction Value:

1 Attempt to explain the cost for competitors to hypothetically "recreate" company's assets in place

2 Usually, by collecting/adjusting reasonable market price points

13/X

Price / Reproduction Value (continued):

Pro: May highlight “hidden” values in complex capital structures

Con: May require considerable data sourcing effort. Not a complete fundamental valuation framework, lacks forward perspective + return on capital-cost of capital links

14/X

Pro: May highlight “hidden” values in complex capital structures

Con: May require considerable data sourcing effort. Not a complete fundamental valuation framework, lacks forward perspective + return on capital-cost of capital links

14/X

Price/Net Asset Value (NAV)

With NAV we have finally reached valuation(!)

Pro: Combine some consistent valuation framework + reasonable forward-looking assumptions. Then NAV is #intrinsicvalue estimate that may capture the fundamental #riskreward of the investment

15/X

With NAV we have finally reached valuation(!)

Pro: Combine some consistent valuation framework + reasonable forward-looking assumptions. Then NAV is #intrinsicvalue estimate that may capture the fundamental #riskreward of the investment

15/X

Price/NAV continued:

Con: Valuing #stocks is much more time/resource-consuming than pricing #stocks. Nor is it just applying some quantitative filter (like our favorite value stock screens)

#PiggyBack suggest investors focus their valuation efforts/research reading diet➡️

16/X

Con: Valuing #stocks is much more time/resource-consuming than pricing #stocks. Nor is it just applying some quantitative filter (like our favorite value stock screens)

#PiggyBack suggest investors focus their valuation efforts/research reading diet➡️

16/X

Price/NAV continued:

Perhaps obvious, but in #valueinvesting we benefit if our valuation, or research we read, focus on situations/themes that we:

* Have reason to believe may be mispriced

* Already have committed to (change our mind)

* Wish to learn more about (new idea)

17/X

Perhaps obvious, but in #valueinvesting we benefit if our valuation, or research we read, focus on situations/themes that we:

* Have reason to believe may be mispriced

* Already have committed to (change our mind)

* Wish to learn more about (new idea)

17/X

P/NAV continued:

Caveat 1 - Valuation does not mean:

1 Extremely complex or large models

2 Including the most info or establishing closest insider access

Such analysis will be highly detailed

If lacking common sense + probabilistic thinking it may also be very biased

18/X

Caveat 1 - Valuation does not mean:

1 Extremely complex or large models

2 Including the most info or establishing closest insider access

Such analysis will be highly detailed

If lacking common sense + probabilistic thinking it may also be very biased

18/X

P/NAV continued:

Caveat 2 - Valuation can be (badly) corrupted

Valuation models are mechanical. Assumptions can be corrupted to arrive at basically any NAV “needed”

Research with #conflictsofinterest/lack of independence?

Trust business/sector insights - NOT valuation(!)

19/X

Caveat 2 - Valuation can be (badly) corrupted

Valuation models are mechanical. Assumptions can be corrupted to arrive at basically any NAV “needed”

Research with #conflictsofinterest/lack of independence?

Trust business/sector insights - NOT valuation(!)

19/X

BEYOND VALUE - Ventures

In #stockmarket:s, #ventures tend to be found in high-valuation micro/small caps + tech

Usually:

1 Tech/business innovation

2 Early-stage/explosive growth

3 Some low-probability shot at future industry leadership

4 Outside #valueinvesting tool set

20/X

In #stockmarket:s, #ventures tend to be found in high-valuation micro/small caps + tech

Usually:

1 Tech/business innovation

2 Early-stage/explosive growth

3 Some low-probability shot at future industry leadership

4 Outside #valueinvesting tool set

20/X

BEYOND VALUE - “Fair” Market Folly

Market prices for liquid securities are set where demand meets supply for the day. This has nothing to do with long-term fundamentals or valuation

Pricing without valuation also means that we allow any level of short-run #overvaluation➡️

21/X

Market prices for liquid securities are set where demand meets supply for the day. This has nothing to do with long-term fundamentals or valuation

Pricing without valuation also means that we allow any level of short-run #overvaluation➡️

21/X

BEYOND VALUE - “Fair” Market Folly continued:

Eventually, we no longer value with common-sense fundamentals

Most participants:

1 Chase price #momentum

2 Use loose relative multiples (“my-laser-eyed-golden-skin-ape-pic-is-worth-at-least-twice-your-diamond-skin-ape-pic”)

22/X

Eventually, we no longer value with common-sense fundamentals

Most participants:

1 Chase price #momentum

2 Use loose relative multiples (“my-laser-eyed-golden-skin-ape-pic-is-worth-at-least-twice-your-diamond-skin-ape-pic”)

22/X

BEYOND VALUE - “Fair” Market Folly continued:

Other practitioners and promoters will still use valuation frameworks, like discounted cash flow models

But study “valuations” of high-fliers/glamour/#growthstocks carefully as they may rely on extremely aggressive assumptions

23/X

Other practitioners and promoters will still use valuation frameworks, like discounted cash flow models

But study “valuations” of high-fliers/glamour/#growthstocks carefully as they may rely on extremely aggressive assumptions

23/X

BEYOND VALUE - “Fair” Market Folly continued

Sometimes skeptical #valueinvestor:s are proven not just short-term, but downright wrong on high-priced #stocks.

Some speculative investments simply materialize into strong fundamentals, that grow beyond "high" current prices

24/X

Sometimes skeptical #valueinvestor:s are proven not just short-term, but downright wrong on high-priced #stocks.

Some speculative investments simply materialize into strong fundamentals, that grow beyond "high" current prices

24/X

BEYOND VALUE - “Fair” Market Folly continued:

Statistically, investors do however lose out over the market cycles by chasing the highest valuation "glamour" parts of the #stockmarket.

Markets do simply not seem to learn to not overvalue shiny, popular objects of their day

25/X

Statistically, investors do however lose out over the market cycles by chasing the highest valuation "glamour" parts of the #stockmarket.

Markets do simply not seem to learn to not overvalue shiny, popular objects of their day

25/X

BEYOND VALUE - “Fair” Market Folly continued:

Multiples >100x earnings, or worse revenue, call for extreme success. Do NOT accept them as likely on just “this time is different” storytelling.

#GreaterFool speculation is very different from valuing speculative investments

26/X

Multiples >100x earnings, or worse revenue, call for extreme success. Do NOT accept them as likely on just “this time is different” storytelling.

#GreaterFool speculation is very different from valuing speculative investments

26/X

This summarizes "Shades of Value" - a new investor intro to fundamental equity metrics/definitions commonly used in #valueinvesting.

We love to see more #stockmarket-readers of our free weekly PiggyBack Letter @SubstackInc:

piggyback.one/p/shades-of-va…

Thanks and very welcome!

X/X

We love to see more #stockmarket-readers of our free weekly PiggyBack Letter @SubstackInc:

piggyback.one/p/shades-of-va…

Thanks and very welcome!

X/X

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh