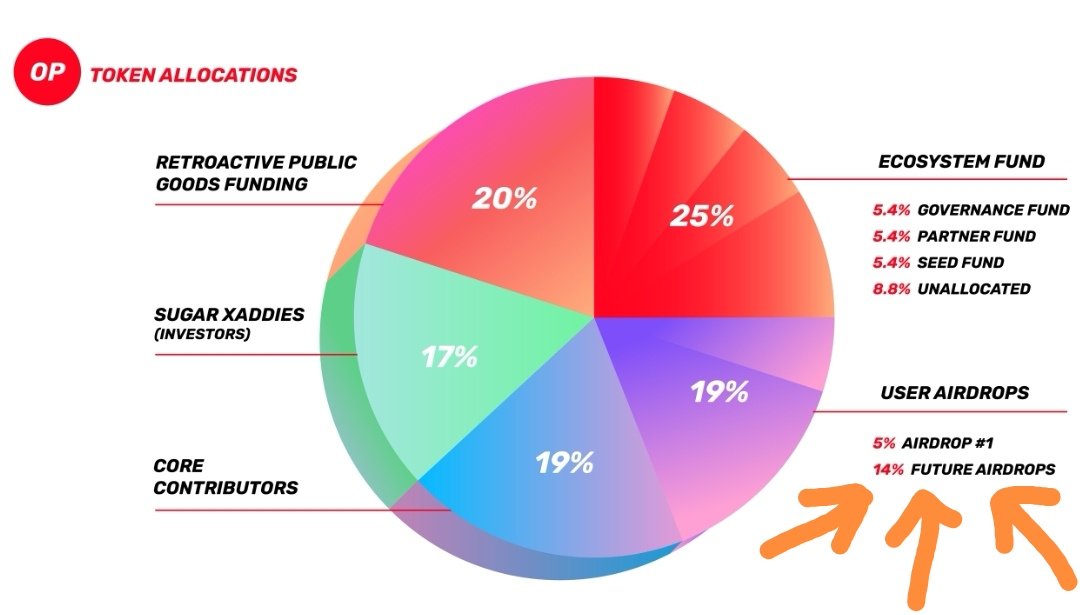

1/11 So as you may know recent $OP tolen #Airdrop was just #1 and others are planned to bootstrapp the #blockchain. So here is my play for #Airdrop #2 on @optimismPBC

2/11 @optimismPBC is described as healthy public goods, lead by the community. So i'm guessing that serving that purpose may help to become eligible, and get rewarded if you help the ecosystem to grow.

Note: i was not eligible for #1 #Airdrop

Note: i was not eligible for #1 #Airdrop

4/11 i bridge $ETH from #Ethereum to @optimismPBC using official bridge, and just made a nice and short tutorial to guide you step by step:

5/11 I plan to be active Within the community by:

- joining and contributing on the #discord server: discord.gg/optimism

- joining and contributing on the #discord server: discord.gg/optimism

6/11 - being active on the governance forum: gov.optimism.io

you can find Pretty interesting subjects such as all protocols applying for Phase 1 grants, as well as ideas like "Change the use of OP tokens from a governance token to the main network token for gas payment"

you can find Pretty interesting subjects such as all protocols applying for Phase 1 grants, as well as ideas like "Change the use of OP tokens from a governance token to the main network token for gas payment"

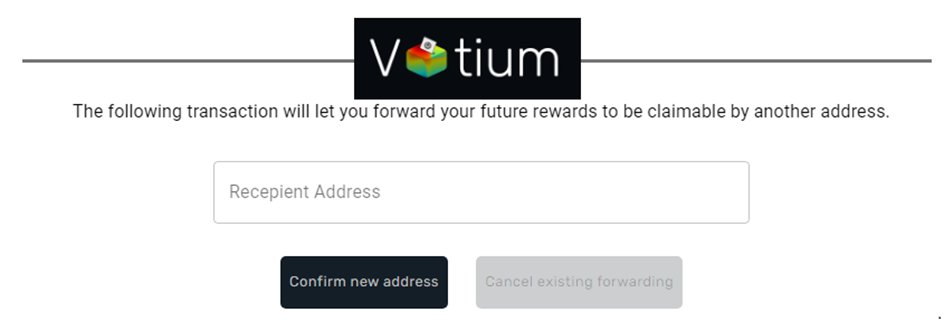

7/11 then i'll make sure i can vote or delegate my vote to contribute to the development of @optimismPBC ecosystem (you have to delegate to a person, that can be yourself) : app.optimism.io/airdrop/delega…

8/11 then make sure to have your delegated vote before the June 23rd, as "Voting Cycle 2 runs June 23 — July 6 and will vote on any GovFund Phase 1 proposals marked as “ready” by the start of the Voting Cycle". Vote takes place : snapshot.org/#/opcollective…

9/11 Finally, i bought the official NFT from Optimism Collective on @quixotic_io : quixotic.io

10/11 This is my strategy, so if you wish to add yours, fell free to comment below, and don't forget to subscribe to @optimismPBC twitter page, and mine as well if you liked this 🧵.

11/11 Don't hesitate to share around you, you're all here #WAGMI !

https://twitter.com/Subli_Defi/status/1539338117806800897?t=70Zzu1pI0WLjjaWGKIhJ9A&s=19

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh