https://t.co/cj4MdlOYfN

Farmer+Builder: @base /

Advisor: @Extrafi_io /

Ambassador: @OpenCover, insure your funds @ https://t.co/0lG5mKWSgk

5 subscribers

How to get URL link on X (Twitter) App

2/14 First thing first, subscribe to my newsletter to access the complete article related to this thread & receive updates about @base & the @Optimism Superchain:

2/14 First thing first, subscribe to my newsletter to access the complete article related to this thread & receive updates about @base & the @Optimism Superchain:

According to @RWA_xyz, Tokenized assets (RWAs) represent $176 billion today, or nearly $15 billion excluding stablecoins, across 150+ tokenized asset issuers on 20+ public blockchains

According to @RWA_xyz, Tokenized assets (RWAs) represent $176 billion today, or nearly $15 billion excluding stablecoins, across 150+ tokenized asset issuers on 20+ public blockchains

2/14 In this thread i will summarize:

2/14 In this thread i will summarize:

1/ You don't know what is a gate ? I have u covered

1/ You don't know what is a gate ? I have u coveredhttps://twitter.com/Subli_Defi/status/1627986523311456256?t=vPQZykcls4PtUjhWVCQNXw&s=19

What is this #NFT collection from @0xhoneyjar ranking top 2 on @opensea trading volume on @optimismFND ?

What is this #NFT collection from @0xhoneyjar ranking top 2 on @opensea trading volume on @optimismFND ?

2/ In this 🧵, i will show you:

2/ In this 🧵, i will show you:

2/12 In this thread, i'll present @NestedFi, a decentralized protocol that allows you to:

2/12 In this thread, i'll present @NestedFi, a decentralized protocol that allows you to:

2/13 $CTR aka @0xconcentrator is a Money Lego built on top of @ConvexFinance , working in sync with the @0xC_Lever protocol while it’s disguised as a simple autocompounder. @0xconcentrator is at the heart of the @aladdindao suite of burgeoning protocols.

2/13 $CTR aka @0xconcentrator is a Money Lego built on top of @ConvexFinance , working in sync with the @0xC_Lever protocol while it’s disguised as a simple autocompounder. @0xconcentrator is at the heart of the @aladdindao suite of burgeoning protocols.

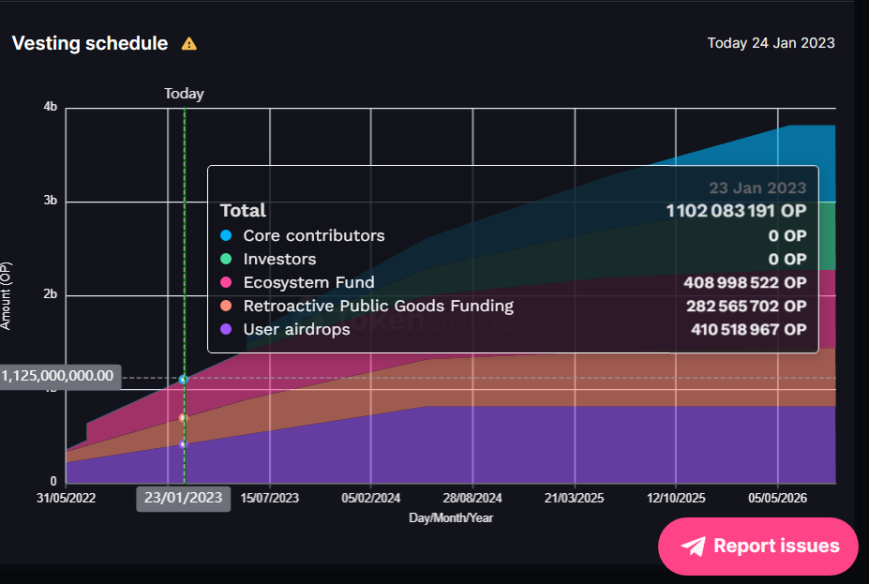

Data provided by @Token_Unlocks have been taken from the doc and showed on 25 January "23 a total of 1.1 billion of $OP unlocked

Data provided by @Token_Unlocks have been taken from the doc and showed on 25 January "23 a total of 1.1 billion of $OP unlocked

2/21 This list is my own & include projects i follow since months or years, either as an investor, contributor or just by curiosity

2/21 This list is my own & include projects i follow since months or years, either as an investor, contributor or just by curiosity

2/16 Objective: Auto-Maximize your veVELO amount by enjoying weekly Locking Bonus

2/16 Objective: Auto-Maximize your veVELO amount by enjoying weekly Locking Bonus

First of all, you don't know @VelodromeFi ?

First of all, you don't know @VelodromeFi ?

First of all, if you would like to read the full article, you can download it here: drive.google.com/file/d/1nHkQPn…

First of all, if you would like to read the full article, you can download it here: drive.google.com/file/d/1nHkQPn…

Why it's important to produce content: Cause you identify gaps between what you think you understood & what you actually did

Why it's important to produce content: Cause you identify gaps between what you think you understood & what you actually did

I think the best part of @twobitidiot on this intro is this statement:

I think the best part of @twobitidiot on this intro is this statement:

#NFT market cap is estimated around 7-10b$

#NFT market cap is estimated around 7-10b$

In 2022 the #ethereum blockain saw a major milestone: #themerge: move from POW to POS

In 2022 the #ethereum blockain saw a major milestone: #themerge: move from POW to POS

#bitcoin cannot be integrated as a reserve currency or used widely due to its volatility. However, collateralized stablecoins coul play that role and be used as currency

#bitcoin cannot be integrated as a reserve currency or used widely due to its volatility. However, collateralized stablecoins coul play that role and be used as currency

#crypto regulation is the next big thing to come and imo could kick off the new bull market as new institutions/funds will come in, regulations should cover:

#crypto regulation is the next big thing to come and imo could kick off the new bull market as new institutions/funds will come in, regulations should cover:

Remember all centralized places that fell down this year. A well made summary done by @cmsintern

Remember all centralized places that fell down this year. A well made summary done by @cmsinternhttps://twitter.com/cmsintern/status/1605604428194598915?t=Cp_EADL89XFDcxSBmGoWQg&s=19

Crypto is inevitable. Despite people loosing money due to Greed, there hasn't been so strong fundations being built during those times.

Crypto is inevitable. Despite people loosing money due to Greed, there hasn't been so strong fundations being built during those times.