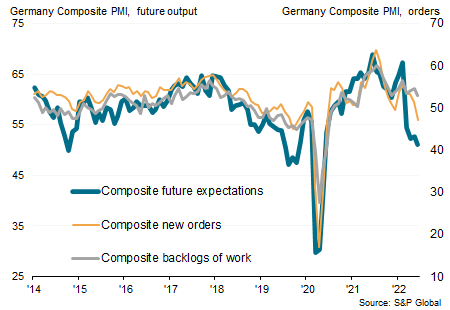

Flash #Germany #PMI Composite Output Index falls to 51.3 in June (May 53.7, consensus 53.1), a 6-month low and indicative of GDP contracting. As with France, consensus well and truly missed

More at bit.ly/3OhVVnF

More at bit.ly/3OhVVnF

Manufacturing Output Index at 49.0 (May: 51.2) amid steepest drop in factory orders for two years. Services PMI at 5-month low of 52.4 (May: 55.0) with demand also now falling.

German businesses also reported their lowest confidence towards future activity for over two years in June, led by worsening prospects in manufacturing. This points to a worsening economic decline in coming months

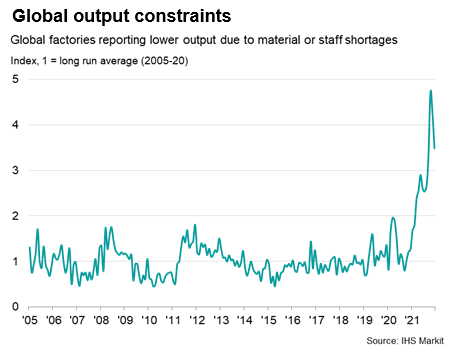

One brighter note came from an easing in the number of supply chain delays, in turn linked to weaker demand, which also helped reduce producer price inflation in #Germany

The flash German #PMI data for June also showed a cooling of inflationary pressures in terms of prices charged for goods and services. Still elevated, but off recent peaks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh