PAUSED ACCOUNT of Chief Business Economist, S&P Global Market Intelligence, producing PMIs. Disclaimer https://t.co/nZveX1Nrx5

How to get URL link on X (Twitter) App

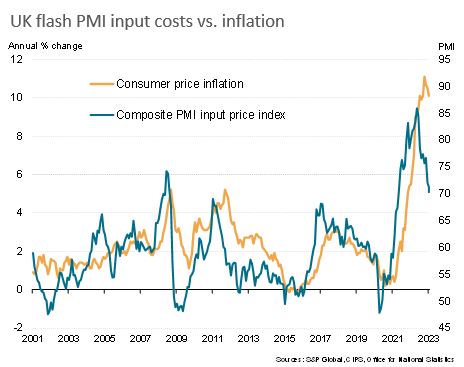

UK PMI input cost gauges also fell further, but only slightly to remain elevated. So #CPI #inflation should continue to moderate, but the Bank of England's 2% target still seems a long way off

UK PMI input cost gauges also fell further, but only slightly to remain elevated. So #CPI #inflation should continue to moderate, but the Bank of England's 2% target still seems a long way off

Survey highlights how headwinds are driving UK economic activity lower, though price pressures are thankfully cooling - albeit remaining elevated

Survey highlights how headwinds are driving UK economic activity lower, though price pressures are thankfully cooling - albeit remaining elevated

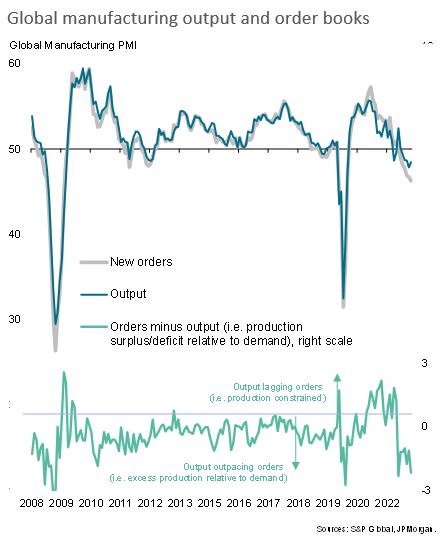

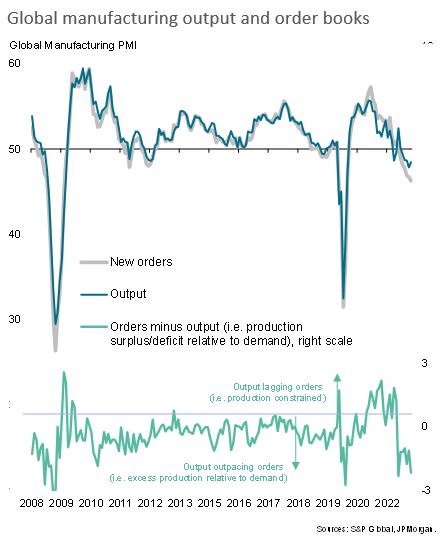

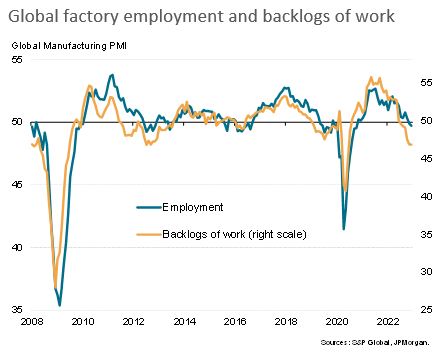

Factories around the world are now also shedding workers in response to worrying signs of excess operating capacity, according to @SPGlobalPMI data

Factories around the world are now also shedding workers in response to worrying signs of excess operating capacity, according to @SPGlobalPMI data

Of the 31 economies for which S&P Global PMI data are available for September, some 21 reported falling production. Myanmar and Taiwan are seeing the steepest downturns, followed by the Czech Republic and Poland.

Of the 31 economies for which S&P Global PMI data are available for September, some 21 reported falling production. Myanmar and Taiwan are seeing the steepest downturns, followed by the Czech Republic and Poland.

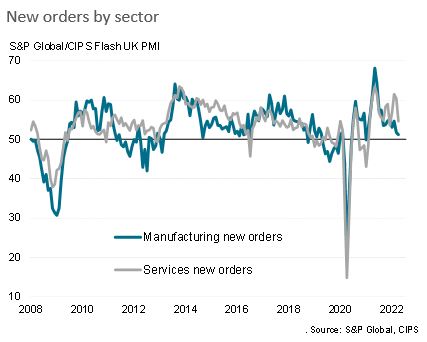

Manufacturing Output Index at 49.0 (May: 51.2) amid steepest drop in factory orders for two years. Services PMI at 5-month low of 52.4 (May: 55.0) with demand also now falling.

Manufacturing Output Index at 49.0 (May: 51.2) amid steepest drop in factory orders for two years. Services PMI at 5-month low of 52.4 (May: 55.0) with demand also now falling.

So French manufacturing is in a steep decline and the service sector is losing momentum rapidly.

So French manufacturing is in a steep decline and the service sector is losing momentum rapidly.

UK service sector business inflows grew at the slowest rate in 2022 to date. In manufacturing, order book growth has lost momentum, driven by an increasing loss of export sales, to result in the weakest rise in new orders since January 2021. 2/

UK service sector business inflows grew at the slowest rate in 2022 to date. In manufacturing, order book growth has lost momentum, driven by an increasing loss of export sales, to result in the weakest rise in new orders since January 2021. 2/

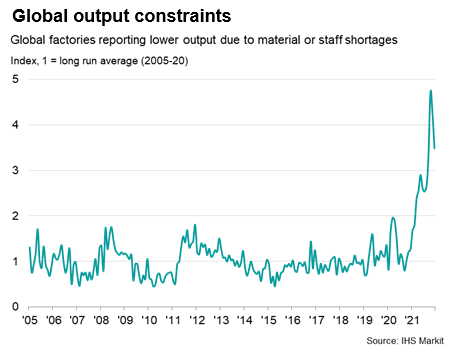

The PMI data in particular will help assess the economic impact of the Omicron variant. Global growth slowed to a 1½ year low in January with a sharp rise in the number of firms reporting output being constrained by staff shortages & illness linked to Omicron ...

The PMI data in particular will help assess the economic impact of the Omicron variant. Global growth slowed to a 1½ year low in January with a sharp rise in the number of firms reporting output being constrained by staff shortages & illness linked to Omicron ...

The December global PMI was pulled lower by a slowing of service sector growth, which slipped to the weakest for three months. In contrast, manufacturing growth accelerated to the fastest since July, albeit running behind that of services for the ninth month running.

The December global PMI was pulled lower by a slowing of service sector growth, which slipped to the weakest for three months. In contrast, manufacturing growth accelerated to the fastest since July, albeit running behind that of services for the ninth month running.

While the number of companies worldwide reporting that output was constrained by shortages continued to run at 3.5 times the long-run average in December, this is down from a record peak of 4.7 times the long-run average back in October.

While the number of companies worldwide reporting that output was constrained by shortages continued to run at 3.5 times the long-run average in December, this is down from a record peak of 4.7 times the long-run average back in October.

UK growth is looking increasingly lop-sided, however, with the upturn led by the services sector, and consumer-facing and hospitality firms in particular driving the expansion for a third month running. In contrast, manufacturing saw production growth slide to near-stagnation.

UK growth is looking increasingly lop-sided, however, with the upturn led by the services sector, and consumer-facing and hospitality firms in particular driving the expansion for a third month running. In contrast, manufacturing saw production growth slide to near-stagnation.

The further acceleration of price growth will add to concerns that the recent bout of inflation is proving less transitory than many suspected,

The further acceleration of price growth will add to concerns that the recent bout of inflation is proving less transitory than many suspected,

Part of the slowdown can be linked to weaker growth of new orders for construction work, but as the chart shows, activity has slowed much more sharply than demand for new work, so there are other factors at play 2/4

Part of the slowdown can be linked to weaker growth of new orders for construction work, but as the chart shows, activity has slowed much more sharply than demand for new work, so there are other factors at play 2/4

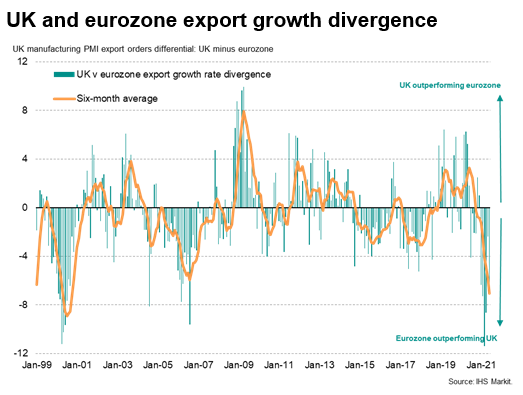

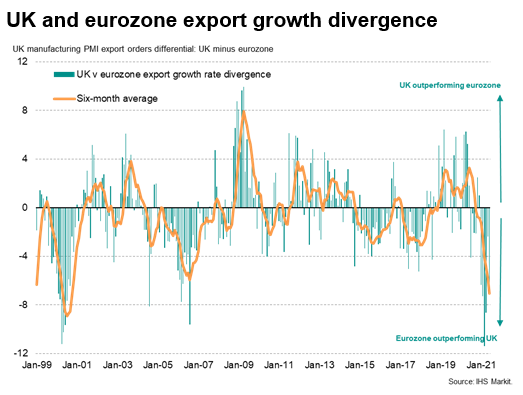

UK suppliers of components in particular have seen only a marginal increase in export sales in the past six months, while similar firms in the eurozone, in contrast, has seen record export growth of component export sales.

UK suppliers of components in particular have seen only a marginal increase in export sales in the past six months, while similar firms in the eurozone, in contrast, has seen record export growth of component export sales.

The eurozone meanwhile was alone among the four largest developed world economies in seeing growth accelerate in June, while Japan fell into a deeper contraction amid emergency measures to curb COVID-19 infections.

The eurozone meanwhile was alone among the four largest developed world economies in seeing growth accelerate in June, while Japan fell into a deeper contraction amid emergency measures to curb COVID-19 infections.

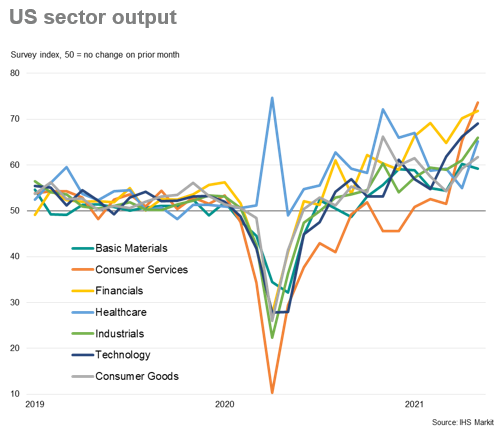

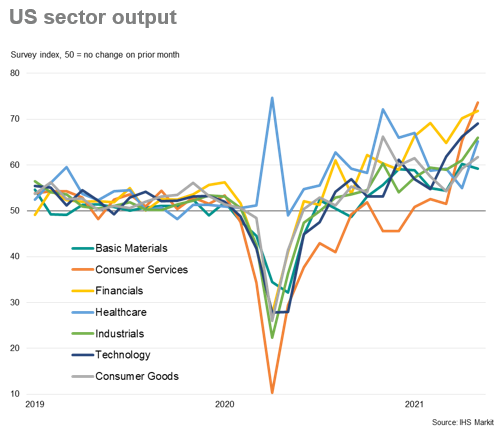

@IHSMarkit Here's the latest @IHSMarkitPMI US survey data tracked against historical @FOMC policy decisions, highlighting the unprecedented surge in economic activity ...

@IHSMarkit Here's the latest @IHSMarkitPMI US survey data tracked against historical @FOMC policy decisions, highlighting the unprecedented surge in economic activity ...

A key contributor to the relatively swift return of robust global #manufacturing growth in the recent months has been a revival in worldwide goods trade. There's some signs of this export boost fading though...

A key contributor to the relatively swift return of robust global #manufacturing growth in the recent months has been a revival in worldwide goods trade. There's some signs of this export boost fading though...

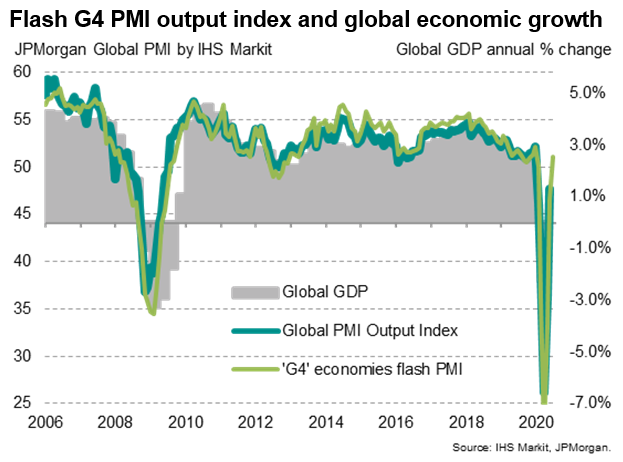

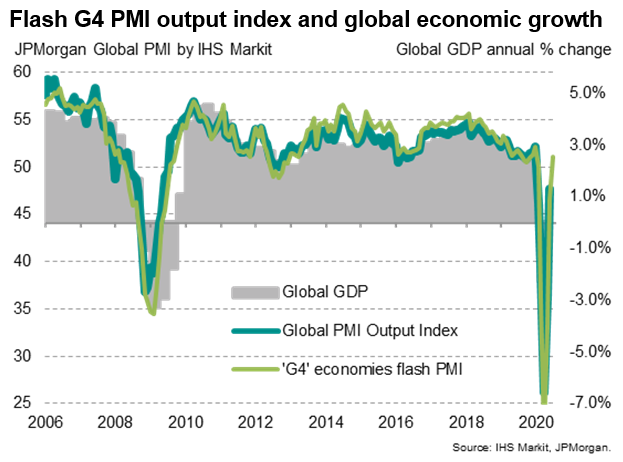

@IHSMarkitPMI The statistical historical relationship of the flash PMI with global #GDP suggests that the latest reading is broadly consistent with the global economy growing by 2% on a year ago, up from a signal of 0.2% growth in June.

@IHSMarkitPMI The statistical historical relationship of the flash PMI with global #GDP suggests that the latest reading is broadly consistent with the global economy growing by 2% on a year ago, up from a signal of 0.2% growth in June.

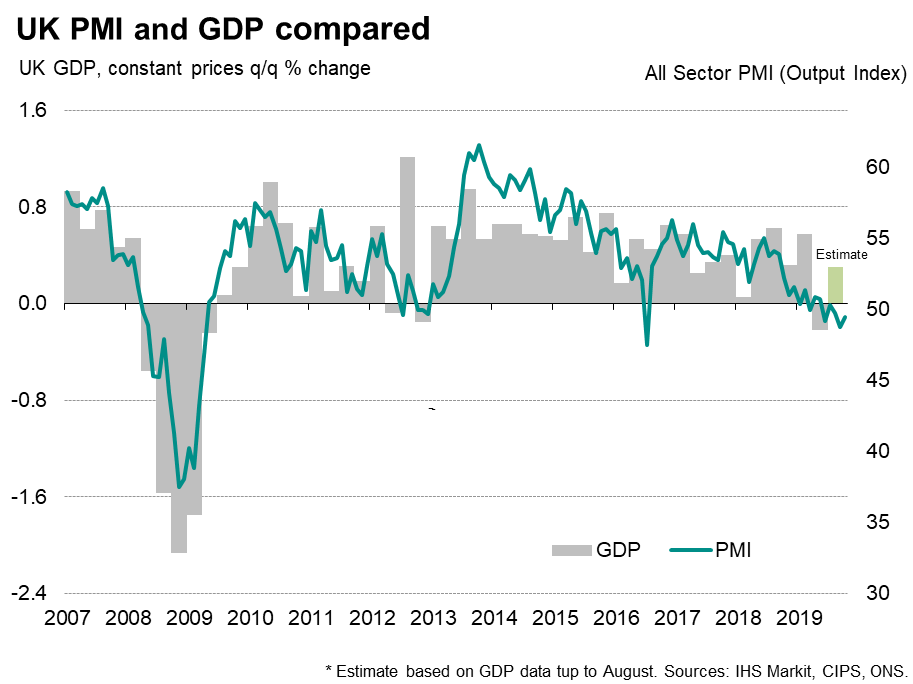

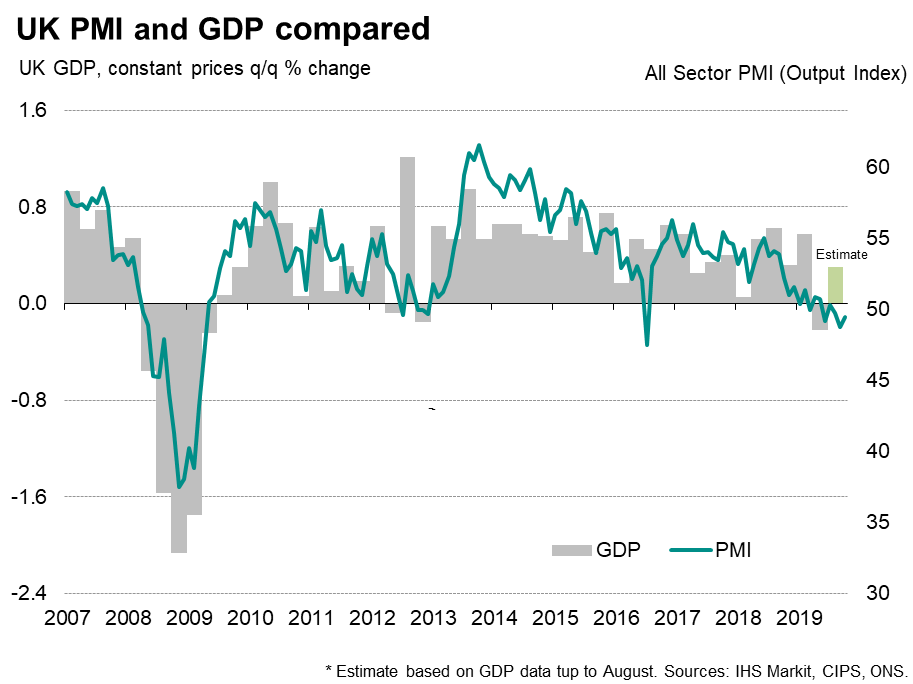

The Oct PMI indicates GDP q/q rate of fall of -0.1%, similar that signalled by in Q3. Official data are likely to have indicated more robust growth in Q3, the PMI warns that some of this strength reflects a pay-back from a steeper decline than signalled by the surveys in Q2 2/

The Oct PMI indicates GDP q/q rate of fall of -0.1%, similar that signalled by in Q3. Official data are likely to have indicated more robust growth in Q3, the PMI warns that some of this strength reflects a pay-back from a steeper decline than signalled by the surveys in Q2 2/