Why $BRK's 2019-20 purchase of #Japan Inc is a potential #stagflation trade for the history books

🧵 follows

In this week’s PBL (just out!) we PiggyBack:

Warren Buffett’s Berkshire Hathaway into Japanese trading houses

Read/join free @SubstackInc:

piggyback.one/p/buffetts-inf…

1/X

🧵 follows

In this week’s PBL (just out!) we PiggyBack:

Warren Buffett’s Berkshire Hathaway into Japanese trading houses

Read/join free @SubstackInc:

piggyback.one/p/buffetts-inf…

1/X

Let's get to it:

August 31, 2020. $BRK sent out a release that left its many U.S.-focused watchers curious:

Berkshire disclosed having 5+% stakes in all five of #Japan's "big five" general trading houses (Sogo Shosha) after purchasing over 12 months in Tokyo Stock Exchange

2/X

August 31, 2020. $BRK sent out a release that left its many U.S.-focused watchers curious:

Berkshire disclosed having 5+% stakes in all five of #Japan's "big five" general trading houses (Sogo Shosha) after purchasing over 12 months in Tokyo Stock Exchange

2/X

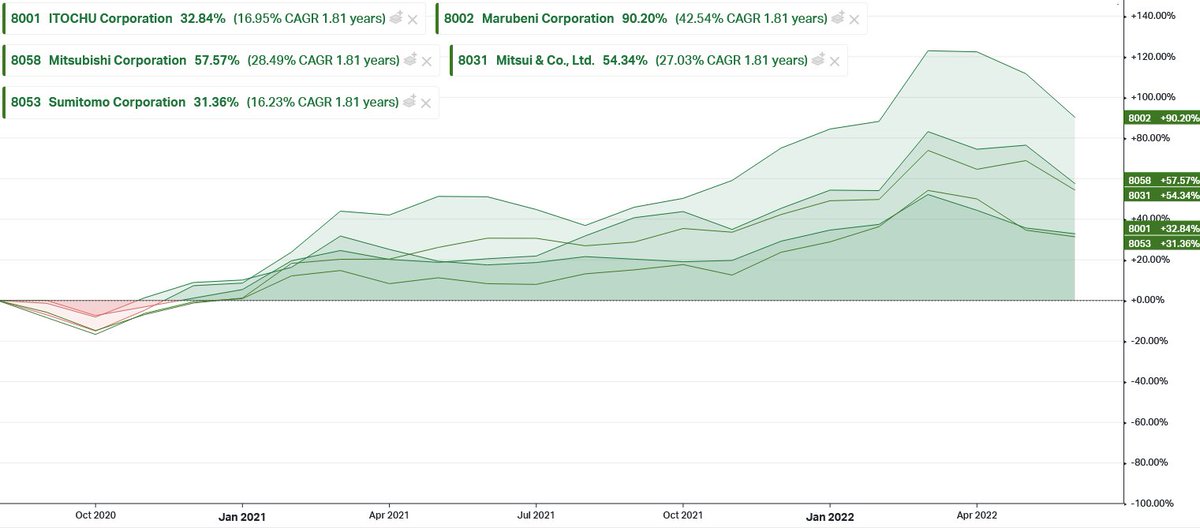

Buffett's / $BRK's "big five"

1 Itochu 🇯🇵TYO:8001|🇺🇸 $ITOCY

2 Marubeni Corp 🇯🇵TYO:8002|🇺🇸 $MARUY

3 Mitsubishi Corp 🇯🇵TYO:8058|🇺🇸 $MTSUY

4 Mitsui & Co 🇯🇵TYO:8031, 🇺🇸 $MITSY

5 Sumitomo Corp 🇯🇵TYO:8053|🇺🇸 $SSUMY

Chart @theTIKR

Disclosure: Long 1+2+3+4+5 piggyback.one/p/legal-discla…

3/X

1 Itochu 🇯🇵TYO:8001|🇺🇸 $ITOCY

2 Marubeni Corp 🇯🇵TYO:8002|🇺🇸 $MARUY

3 Mitsubishi Corp 🇯🇵TYO:8058|🇺🇸 $MTSUY

4 Mitsui & Co 🇯🇵TYO:8031, 🇺🇸 $MITSY

5 Sumitomo Corp 🇯🇵TYO:8053|🇺🇸 $SSUMY

Chart @theTIKR

Disclosure: Long 1+2+3+4+5 piggyback.one/p/legal-discla…

3/X

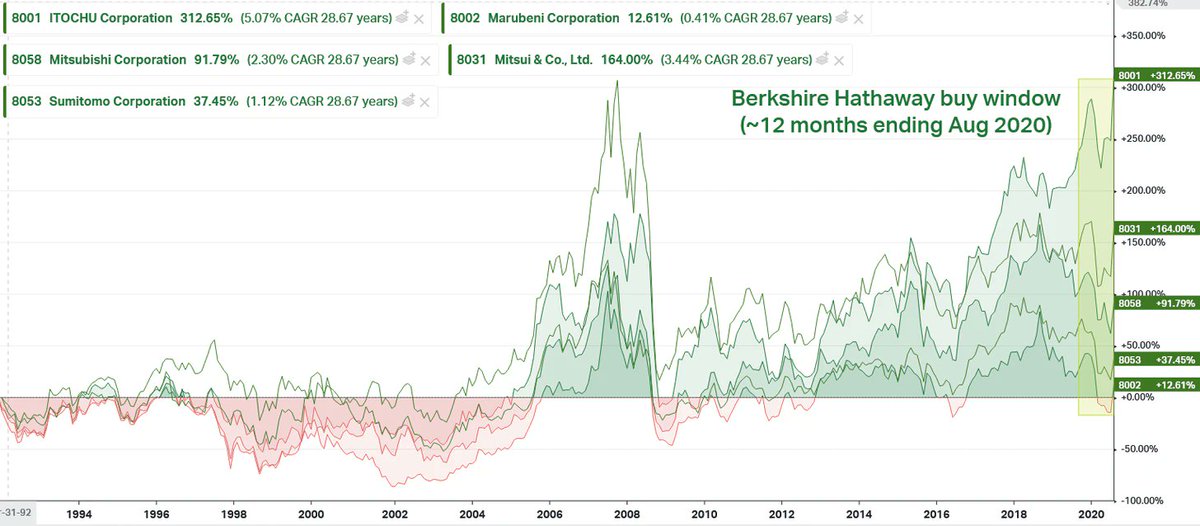

From 1992, following the slow depletion of Japan's 80s bubble, these Sogo Shosha stocks produced a mere 3% per year in mean/median annual total returns (CAGR, JPY) up until $BRK:s disclosure.

But, as we say in #valueinvesting "price is what you pay"...

Chart: @KoyfinCharts

4/X

But, as we say in #valueinvesting "price is what you pay"...

Chart: @KoyfinCharts

4/X

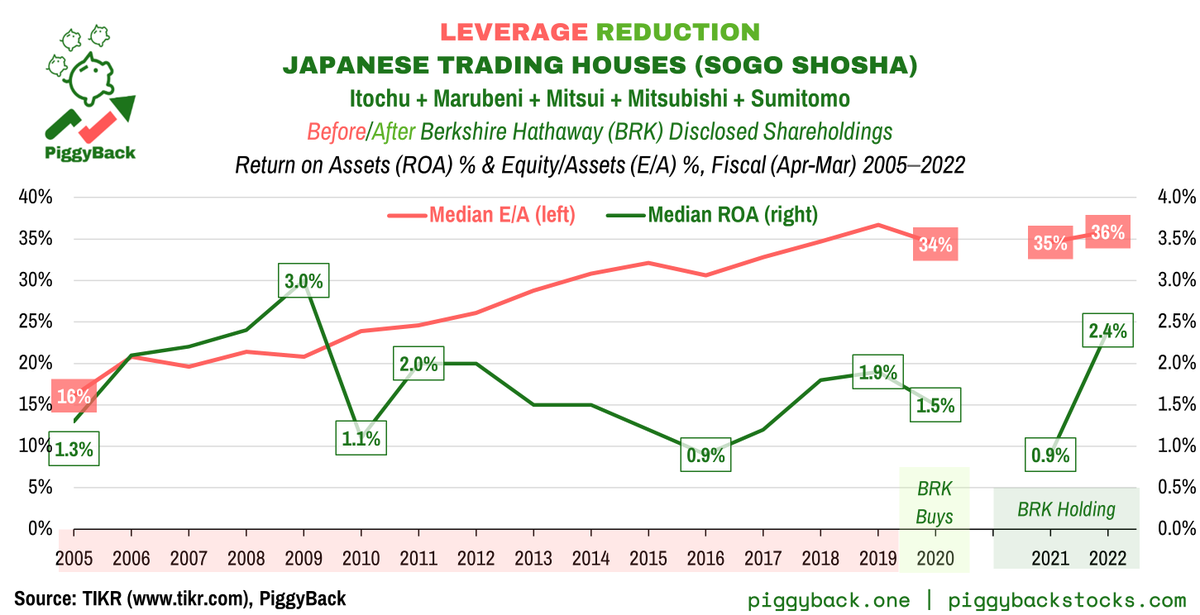

Now securities returns and fundamentals can be very different, even over decades.

As businesses, $BRK's Japanese trading houses are very exposed to the physical trading of #commodities and goods. They are cyclical.

Notice how the ROE% follows commodities?

Chart: @theTIKR

5/X

As businesses, $BRK's Japanese trading houses are very exposed to the physical trading of #commodities and goods. They are cyclical.

Notice how the ROE% follows commodities?

Chart: @theTIKR

5/X

Under the hood of ROE, a promising trend is that the trading houses have deleveraged. From 16% median Equity/Assets in 2005 to 34% 2020

Why? A shift of focus

From: asset-intensive/high competition/lower margin trading

To: higher-return/higher-risk investing

Chart: @theTIKR

6/X

Why? A shift of focus

From: asset-intensive/high competition/lower margin trading

To: higher-return/higher-risk investing

Chart: @theTIKR

6/X

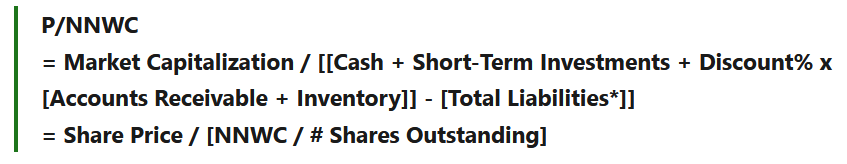

The underlying value Berkshire got seems OK/possibly improving.

What about the price $BRK paid?

Not surprising to #valueinvesting community, Buffett can still wait for opportunistic discounts 🎣

Sogo Shoshas got there after 2010s commodities bear market 📉

Chart @theTIKR

7/X

What about the price $BRK paid?

Not surprising to #valueinvesting community, Buffett can still wait for opportunistic discounts 🎣

Sogo Shoshas got there after 2010s commodities bear market 📉

Chart @theTIKR

7/X

How has #Buffett & Co done 1 year + 10 months after $BRK's disclosure?

Returns: Not bad, >25% median&mean annual total returns (CAGR). Chart: @KoyfinCharts

Fundamentals: Trading houses benefit from pandemic supply constraints + commodities inflation

Valuation: Chart above

8/X

Returns: Not bad, >25% median&mean annual total returns (CAGR). Chart: @KoyfinCharts

Fundamentals: Trading houses benefit from pandemic supply constraints + commodities inflation

Valuation: Chart above

8/X

Our takeaways after "piggybacking" Buffett & Berkshire to Japan?

...

piggyback.one/i/60642782/pig…

Summary of

“Buffett's Inflation Bet With The House(s)”

Issue 3 of new, 100% independent PiggyBack Letter @SubstackInc

1) 💡?

2) #valueinvesting?🧮

3) Free?🫰

Join:🚪🐖!

Share:📣🐖!

X/X

...

piggyback.one/i/60642782/pig…

Summary of

“Buffett's Inflation Bet With The House(s)”

Issue 3 of new, 100% independent PiggyBack Letter @SubstackInc

1) 💡?

2) #valueinvesting?🧮

3) Free?🫰

Join:🚪🐖!

Share:📣🐖!

X/X

• • •

Missing some Tweet in this thread? You can try to

force a refresh