🧵about stuff I've learned about @CoinFLEXdotcom and @MarkDavidLamb. started looking into these characters in depth a few days before they became a hot item so this is an attempt to consolidate what i've learned.

Q: What is CoinFLEX?

A: It's not an average crypto exchange.

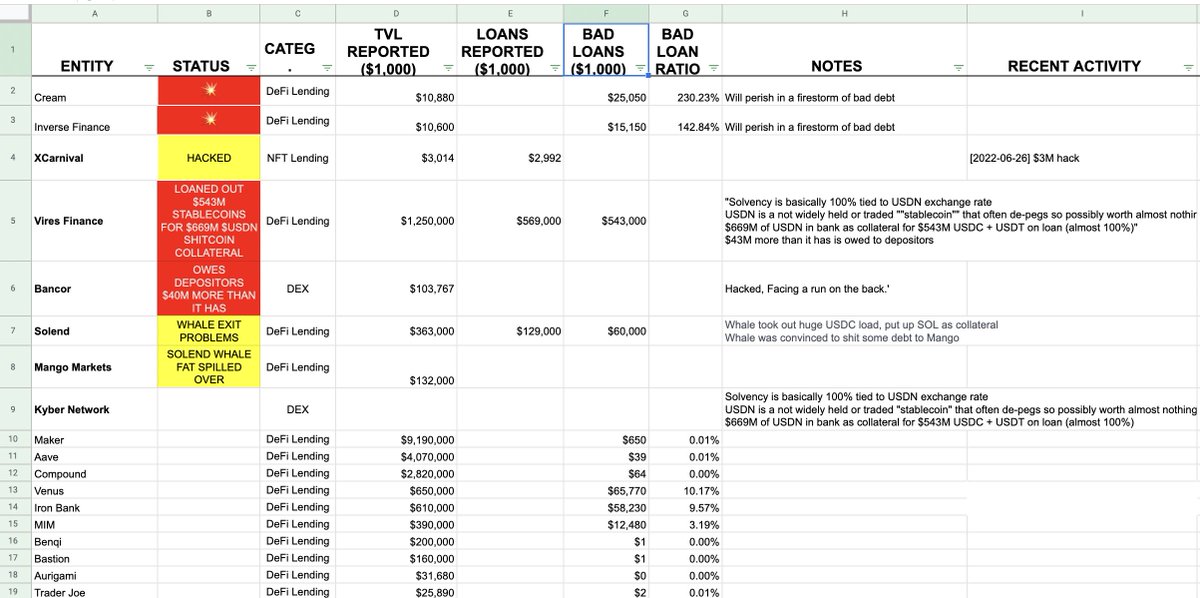

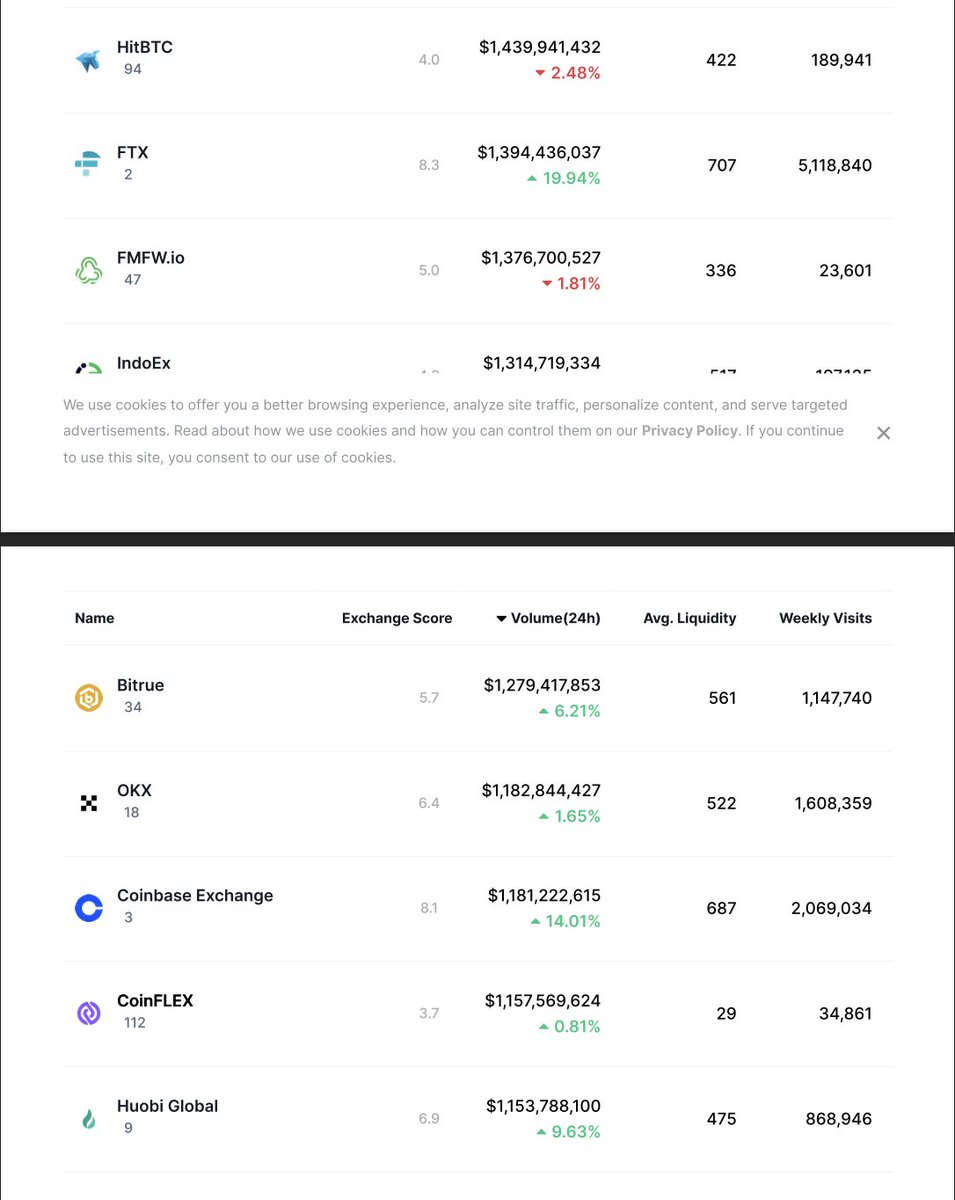

Start with the fact that this mostly unknown CEX does huge volume. Some days its volume makes it the 3rd largest #CEX in the world on CMC.

Nums are manipulated but Binance owns CMC. I'm sure top 10 spots aren't free.

A: It's not an average crypto exchange.

Start with the fact that this mostly unknown CEX does huge volume. Some days its volume makes it the 3rd largest #CEX in the world on CMC.

Nums are manipulated but Binance owns CMC. I'm sure top 10 spots aren't free.

Many days CoinFLEX's volume makes it a peer of major exchanges like Coinbase, FTX, and Huobi. See yesterday's CMC rankings in pics.

Retail traders think of CoinFLEX as a small market mostly built around a small altcoin, $BCH (Bitcoin Cash). $BCH trades can't create this volume.

Retail traders think of CoinFLEX as a small market mostly built around a small altcoin, $BCH (Bitcoin Cash). $BCH trades can't create this volume.

Q: How does CoinFlex trade that kind of volume?

A: CoinFLEX PR materials say something important: Biz was launched as a derivatives market. 1st to offer 'physically deliverable crypto futures.' Whatever that kookbabble means, they do seem to have been an early derivatives market

A: CoinFLEX PR materials say something important: Biz was launched as a derivatives market. 1st to offer 'physically deliverable crypto futures.' Whatever that kookbabble means, they do seem to have been an early derivatives market

Not only that but they planned to target "commercial hedging including OTC trading desks, mining firms, and global proprietary trading companies."

In other words, they planned to do B2B trading as well as retail.

In other words, they planned to do B2B trading as well as retail.

Interestingly they received funding from @DCGco and @polychaincap, two monster crypto VC funds.

Funds like that don't generally come in for small amounts and they definitely don't invest in a niche business like a $BCH focused exchange. Size of stake in CoinFLEX was private.

Funds like that don't generally come in for small amounts and they definitely don't invest in a niche business like a $BCH focused exchange. Size of stake in CoinFLEX was private.

Q: Who are CoinFLEX's users?

A: There aren't very many. If we look at the web traffic (3rd party data that's not as manipulable as volume) we see that the exchanges doing similar volume have MILLIONS of weekly visitors.

CoinFlex? 32,000.

Some of the lowest traffic of any CEX.

A: There aren't very many. If we look at the web traffic (3rd party data that's not as manipulable as volume) we see that the exchanges doing similar volume have MILLIONS of weekly visitors.

CoinFlex? 32,000.

Some of the lowest traffic of any CEX.

CoinFLEX, it turns out, is an EXTREME outlier on the "$ volume per visitor" metric.

An exchange doing the same kind of trading volume with 1% of the users means that each of those users must be trading 100x the volume for it to come out the same.

CoinFLEX is unique this way.

An exchange doing the same kind of trading volume with 1% of the users means that each of those users must be trading 100x the volume for it to come out the same.

CoinFLEX is unique this way.

The 100x average $/visitor CoinFLEX clocks means that those visitors must be making really big trades - most likely B2B trades, among the various whales and probably even among the exchanges themselves.

And, it seems, derivates trades. Like they planned.

And, it seems, derivates trades. Like they planned.

This lead me to speculate that perhaps CoinFLEX was running a dark market for large derivative trades, totally invisible to everyone else. No one I asked thought this was possible. Got flamed on r/Buttcoin. "Just a $BCH backwater."

My analysis on reddit:

reddit.com/r/Buttcoin/com…

My analysis on reddit:

reddit.com/r/Buttcoin/com…

Then @MarkDavidLamb went on BloombergTV yesterday and confirmed that there was very large derivatives trading going on that could use more "transparency."

He later implied that Roger Ver got rekt in this market.

He later implied that Roger Ver got rekt in this market.

https://twitter.com/Cryptadamist/status/1541582069830193155

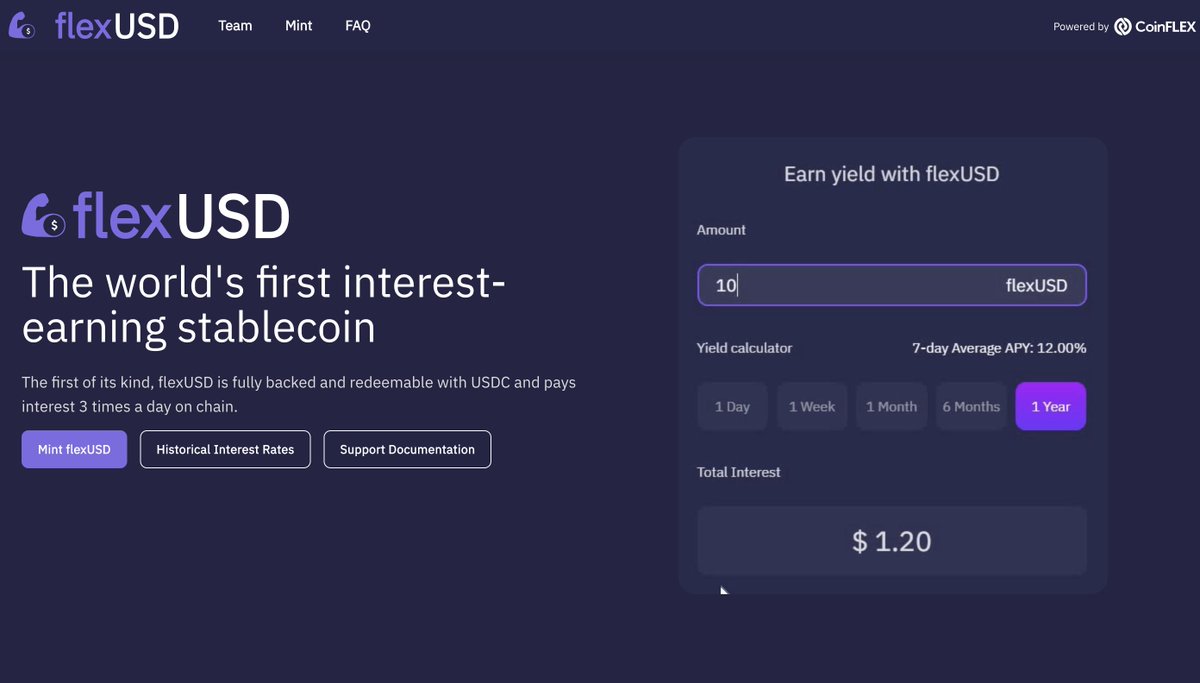

Q: What is FlexUSD?

A: FlexUSD is a "stablecoin" offering "yield" created by @MarkDavidLamb, allegedly pegged to $1 with some kind of nutso derivs strategy that involves $BCH.

A: FlexUSD is a "stablecoin" offering "yield" created by @MarkDavidLamb, allegedly pegged to $1 with some kind of nutso derivs strategy that involves $BCH.

Q: What happened with $BCH?

A: Some folks on r/btc started noticing a lot of waves in their small marketplace recently... apparently an enormous pile of $BTC had moved into @Binance's hot wallet and started selling itself.

A: Some folks on r/btc started noticing a lot of waves in their small marketplace recently... apparently an enormous pile of $BTC had moved into @Binance's hot wallet and started selling itself.

Q: What happened with #FlexUSD?

A: It de-pegged. Hard. And curiously right around the time this $BCH.

Recall that the backing for the FlexUSD pegging mechanism - the actual value - was apparently entirely $BCH.

Hmm.

A: It de-pegged. Hard. And curiously right around the time this $BCH.

Recall that the backing for the FlexUSD pegging mechanism - the actual value - was apparently entirely $BCH.

Hmm.

Q: Was #FlexUSD depegging related to this enormous sale of $BCH being sold?

A: The timing makes it unlikely that there is another explanation.

There were other events that make the link seem stronger. r/btc folks did a bunch of digging, compiled here:

reddit.com/r/btc/comments…

A: The timing makes it unlikely that there is another explanation.

There were other events that make the link seem stronger. r/btc folks did a bunch of digging, compiled here:

reddit.com/r/btc/comments…

Q: What about CoinFLEX halting trading - was that related?

A: CoinFLEX halted trading on June 23rd, right in line with all these events.

But only retail was halted, because they are clocking $1B in derivatives trading on CoinGecko. $1M in retail.

A: CoinFLEX halted trading on June 23rd, right in line with all these events.

But only retail was halted, because they are clocking $1B in derivatives trading on CoinGecko. $1M in retail.

Q: What does this say about the future of #FlexUSD?

A: If $BCH backing FlexUSD is being sold on Binance at the rate of about $3M per day it looks likely to hit $0. Retail left holding the bag.

Their FAQ is clear: this is risk free, unless the counterparty fucks you.

A: If $BCH backing FlexUSD is being sold on Binance at the rate of about $3M per day it looks likely to hit $0. Retail left holding the bag.

Their FAQ is clear: this is risk free, unless the counterparty fucks you.

Q: What is Mark Lamb doing to make #FlexUSD holders whole?

A: Based on his answers in the CoinFLEX support groups, he doesn't seem to respect FlexUSD to even give them straight answers. "EOD." "Soon."

A: Based on his answers in the CoinFLEX support groups, he doesn't seem to respect FlexUSD to even give them straight answers. "EOD." "Soon."

We have also heard NUMEROUS reports of people being banned from the CoinFlex support channel by @MarkDavidLamb for trying to ask questions about withdrawals or any connections between the sale of $BCH on @Binance and the #FlexUSD de-peg

We also heard from someone who tried to inform the CoinFLEX user base about what was going on with the weird $BCH situation. According to them as soon as they posted a link to the reddit thread that raised questions they got banned.

Immediately Mark Lamb reached out by DM:

Immediately Mark Lamb reached out by DM:

Q: Do honest exchange owners often admit to unknown telegram accounts that they are keeping critical info from their frantic customers and then make up numerous seemingly untrue excuses to try to get that telegram user to reveal their contact info?

A: sus. very sus.

A: sus. very sus.

Q: Do CEX owners offer up their phone number to unknown Telegram users and say things like "Call me and maybe it will force me to disclose more information to the public faster"?

A: Having a lambo in place of a soul means their actions can be hard to predict.

A: Having a lambo in place of a soul means their actions can be hard to predict.

Q: Why is the CEO of a derivative desk that does $1B/day in business PERSONALLY doing all the customer support work during a crisis? And why is he ignoring most of his users' questions while banning anyone trying to warn the other users about FlexUSD problems?

A: sus. mad sus.

A: sus. mad sus.

Q: How does @rogerkver fit into all of this?

A: Roger Ver is a vocal supporter of $BCH as well as an early investory in #CoinFLEX.

coindesk.com/markets/2019/0…

A: Roger Ver is a vocal supporter of $BCH as well as an early investory in #CoinFLEX.

coindesk.com/markets/2019/0…

Q: How's that investment going?

A: Mark Lamb is blaming Roger Ver for CoinFLEX Trading halt, saying Roger Ver owes CoinFLEX $47M and implying it's money Ver lost on trades in the derivatives dark market. Ver says he doesn't owe CoinFLEX anything. They are both threatening to sue

A: Mark Lamb is blaming Roger Ver for CoinFLEX Trading halt, saying Roger Ver owes CoinFLEX $47M and implying it's money Ver lost on trades in the derivatives dark market. Ver says he doesn't owe CoinFLEX anything. They are both threatening to sue

Q: What does Cryptadamus think is going on with Mark Lamb's appearance on BloombergTV yesterday flogging some bullshit #rvUSD PonziCoin?

A:

A:

https://twitter.com/Cryptadamist/status/1541859901340893185

🚨 CORRECTION: "an enormous pile of $BCH had moved into @Binance's hot wallet and started selling itself."

I also wrote a couple of more words about this story a few days ago in #TheCryptocalypseChronicles, Vol. 1 over on Medium.

medium.com/@michelcryptda…

medium.com/@michelcryptda…

Other bits:

- mudslinging mustelid @otteroooo was one of those banned by Mark Lamb

- Famous poker pro @DougPolkVids seems mad, has vowed to go public on July 1st

- @CoinFLEXdotcom June "special offer" looks like a $ grab right before halt.

read more:

reddit.com/r/btc/comments…

- mudslinging mustelid @otteroooo was one of those banned by Mark Lamb

- Famous poker pro @DougPolkVids seems mad, has vowed to go public on July 1st

- @CoinFLEXdotcom June "special offer" looks like a $ grab right before halt.

read more:

reddit.com/r/btc/comments…

Q: which is most probable?

1. Lamb took Ver's $BCH as collateral for bad trade

2. Ver yanked his $BCH out of #FlexUSD before Lamb could seize it

3. Lamb is working w/other CEXes (e.g. @Binance) to liquidate Ver

4. Ver is working w/other CEXes to liquidate Lamb

A: no idea

1. Lamb took Ver's $BCH as collateral for bad trade

2. Ver yanked his $BCH out of #FlexUSD before Lamb could seize it

3. Lamb is working w/other CEXes (e.g. @Binance) to liquidate Ver

4. Ver is working w/other CEXes to liquidate Lamb

A: no idea

... but no matter which explanation it is, one thing is clear:

No one involved gives a fuck about what happens to the retail bagholders holding #FlexUSD.

No one involved gives a fuck about what happens to the retail bagholders holding #FlexUSD.

NOW: the #IHaveMetMoreInquisitiveSheep awards for terrible journalism!

🔥🔥🔥GRAND PRIZE🔥🔥🔥

@sonalibasak: had Mr. Lamb on TV spouting pure PonziFi

⚠️RUNNERS UP⚠️

@Yueqi_Yang @immy_jn @mikeybellusci @onceatraveler @itstaylorlocke

No one asked a single question about retail

🔥🔥🔥GRAND PRIZE🔥🔥🔥

@sonalibasak: had Mr. Lamb on TV spouting pure PonziFi

⚠️RUNNERS UP⚠️

@Yueqi_Yang @immy_jn @mikeybellusci @onceatraveler @itstaylorlocke

No one asked a single question about retail

Notable that CoinFLEX offers a sketchy "automated market maker" that turns its users into HFT machines who probably place more trades than most. Part of why in the screenshot txt I say the odds are 50/50 there's dark derivatives trading going on.

coinflex.com/blog/automated…

coinflex.com/blog/automated…

this thread is mad long but i just cannot help adding this screenshot of "ArenaAMM+", a high frequency trading algo that CoinFLEX's users can use to "farm yield."

iposit to my fellow humans that this League Of Legends version of the stock market is who we really are:

iposit to my fellow humans that this League Of Legends version of the stock market is who we really are:

• • •

Missing some Tweet in this thread? You can try to

force a refresh