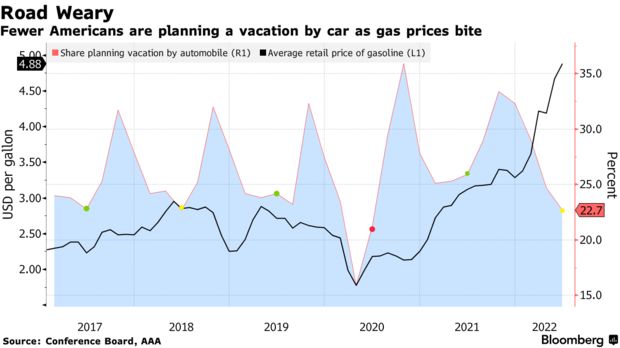

1) People intending to vacation by car fell to 22.7% in June (BN).

Lowest seasonally in > 4Y.

"36% of Americans surveyed this month intend to take a vacation within the next six months, the weakest June reading any ...

$SPY $QQQ $TLT $GLD #Commodities

bloomberg.com/news/articles/…

Lowest seasonally in > 4Y.

"36% of Americans surveyed this month intend to take a vacation within the next six months, the weakest June reading any ...

$SPY $QQQ $TLT $GLD #Commodities

bloomberg.com/news/articles/…

2) Y in data going back over 40 years, excluding 2020"

So at least some demand destruction may continue.

Avg US unleaded price was $4.88 yesterday vs $5.02 peak Jun 13.

But gas price spiked end of May into Jun. So avg Jun price MTD is $4.96 vs $4.56 ...

So at least some demand destruction may continue.

Avg US unleaded price was $4.88 yesterday vs $5.02 peak Jun 13.

But gas price spiked end of May into Jun. So avg Jun price MTD is $4.96 vs $4.56 ...

https://twitter.com/ResearchQf/status/1536416421508435968

3) avg in May (+ big M/M), which is one of the reasons why Cleveland M/M headline #CPI nowcast is still very high.

Gas price likely falls more, but even if price stops falling, avg price will be down M/M in Jul and becomes a NEGATIVE headwind to Jul CPI!

Gas price likely falls more, but even if price stops falling, avg price will be down M/M in Jul and becomes a NEGATIVE headwind to Jul CPI!

https://twitter.com/ResearchQf/status/1540083431320723456

4) Btw energy is modeled fairly accurately. Whether headline/core CPI is above/below consensus depends on all other components.

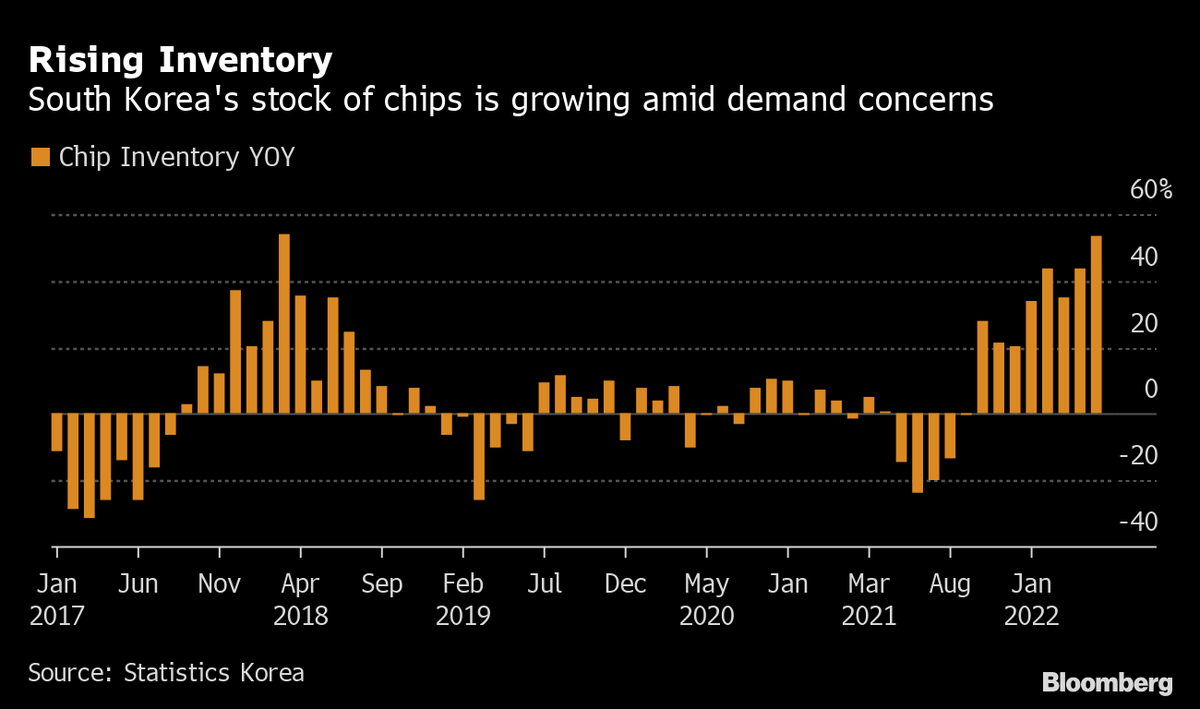

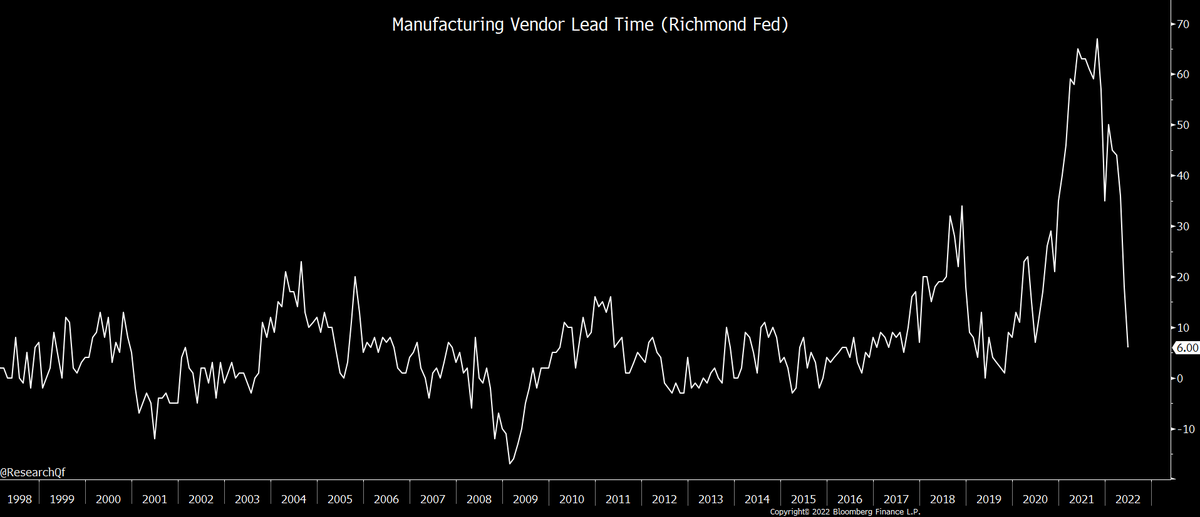

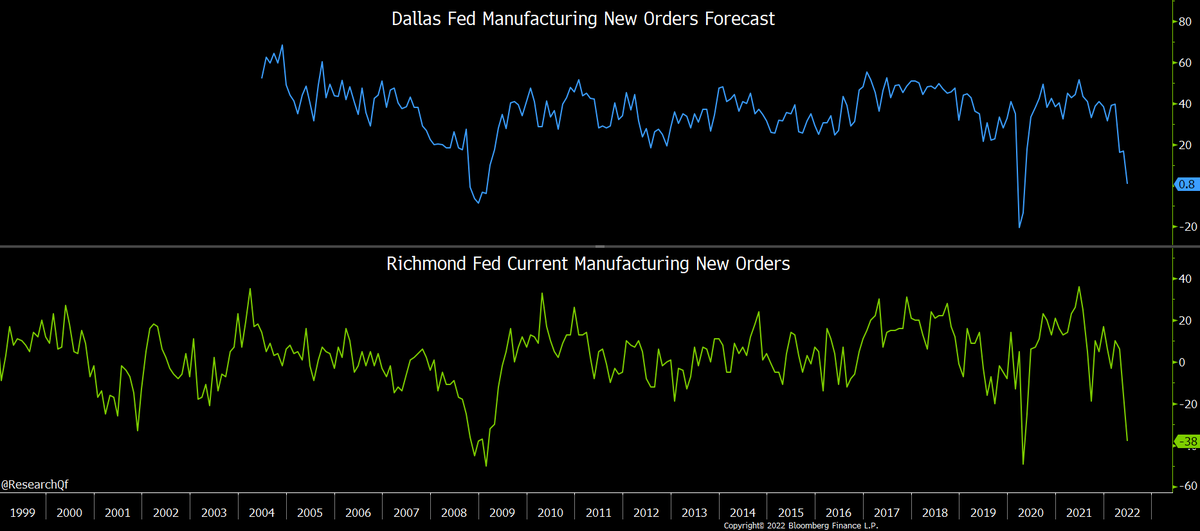

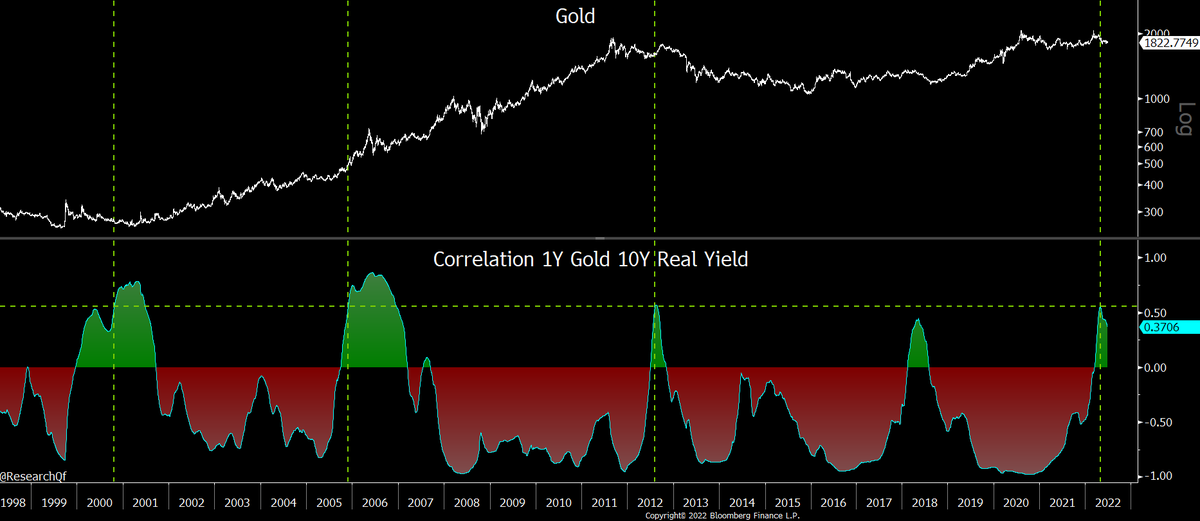

Given cyclical, commodity, demand, inventory dynamics discussed in various threads, remain confident core CPI peaked in Mar.

Given cyclical, commodity, demand, inventory dynamics discussed in various threads, remain confident core CPI peaked in Mar.

https://twitter.com/ResearchQf/status/1513893754352148483

• • •

Missing some Tweet in this thread? You can try to

force a refresh