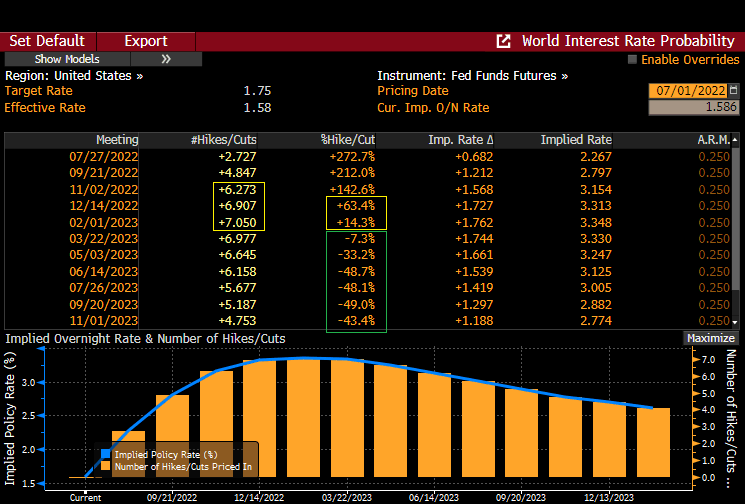

1) #Fed funds futures update.

Pricing only 0.78 hikes over 2 meetings (Dec '22/Feb '23). So basically 100% chance of Dec or Feb pause and ~20% chance of 0 hikes after Nov.

Implied Dec rate 3.31% vs 3.78% peak few W ago.

$SPY $QQQ $TLT $GLD #Commodities

Pricing only 0.78 hikes over 2 meetings (Dec '22/Feb '23). So basically 100% chance of Dec or Feb pause and ~20% chance of 0 hikes after Nov.

Implied Dec rate 3.31% vs 3.78% peak few W ago.

$SPY $QQQ $TLT $GLD #Commodities

https://twitter.com/ResearchQf/status/1539704926187802632

2) Notice small prob of a cut in Mar and significant prob of cuts every meeting thereafter?

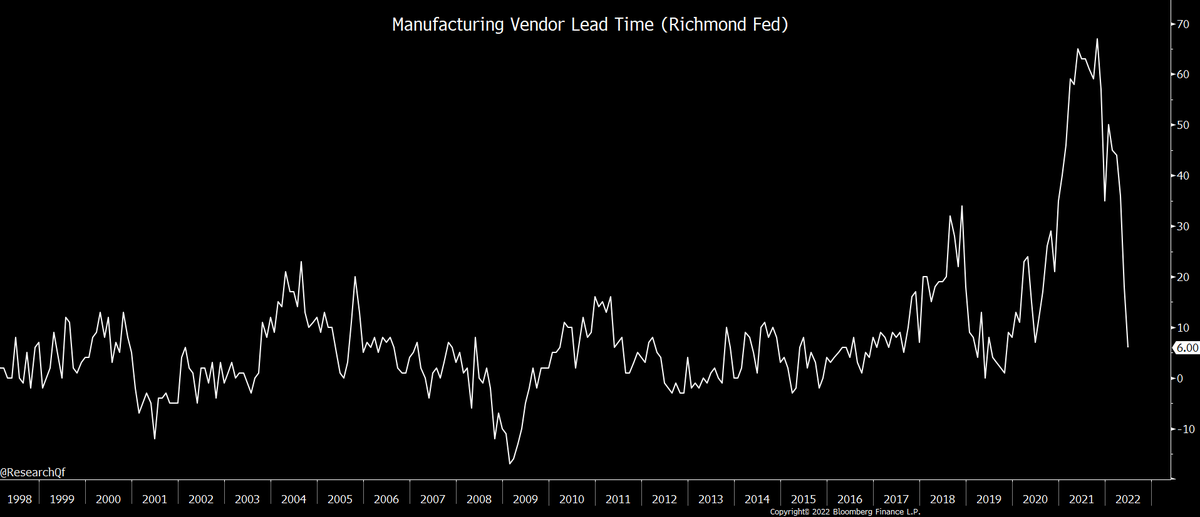

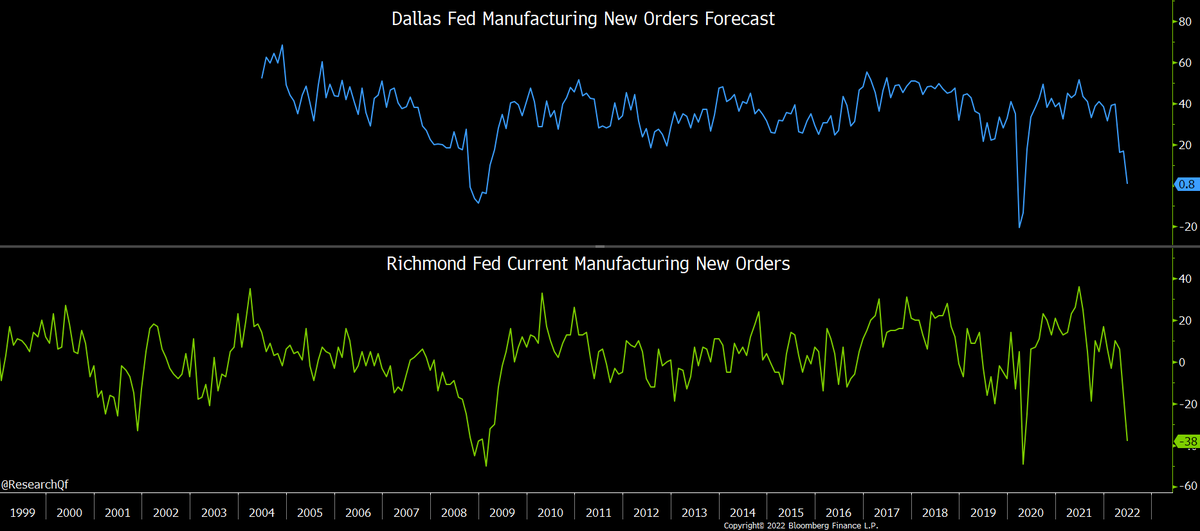

What happens if ISM < 50 within few M (fed hasn't hiked with ISM < 50 since 70's)?

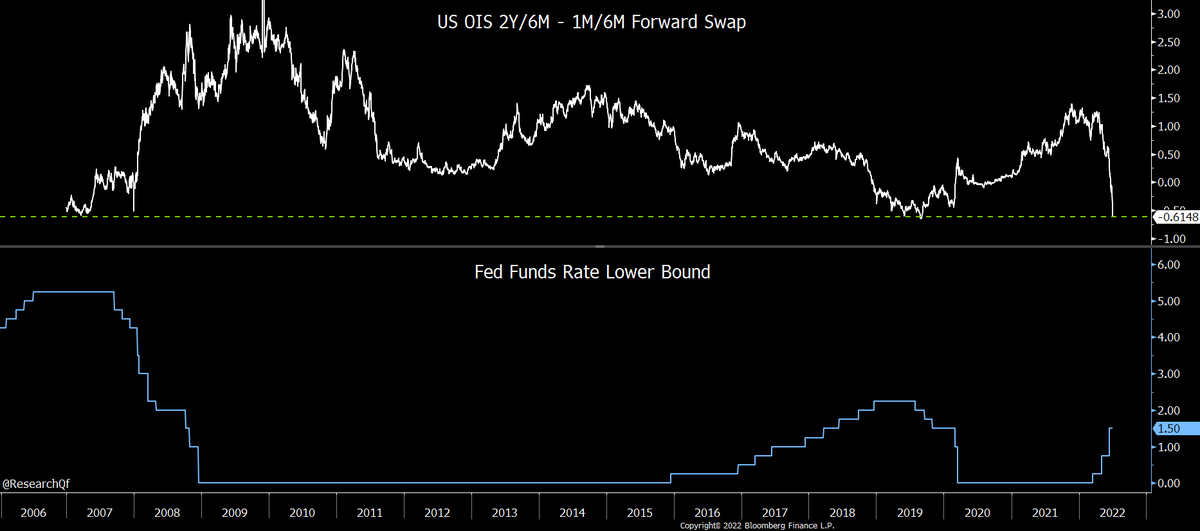

OIS 2Y-1M #yield spread 6M forward (1M is decent proxy for overnight rate) ...

What happens if ISM < 50 within few M (fed hasn't hiked with ISM < 50 since 70's)?

OIS 2Y-1M #yield spread 6M forward (1M is decent proxy for overnight rate) ...

https://twitter.com/ResearchQf/status/1542873667474001921

3) inverted 61 bps. Using OIS swaps which are more accurate vs Treasuries (Btw how was 1M Treasury yielding 60 bp less than overnight rate last W? You get the idea).

Give this thought. Market is pricing 2Y yield ~60 bps LOWER than Fed funds rate 6M from now!

Fed paused when ...

Give this thought. Market is pricing 2Y yield ~60 bps LOWER than Fed funds rate 6M from now!

Fed paused when ...

4) OIS 2Y-1M 6M forward was less inverted last 2 cycles.

And a cut followed when inversion hit similar level in '07 and '19.

Fed clearly not cutting in Jul. But it does signal rising risk of another big policy error.

High frequency fundamental and ...

And a cut followed when inversion hit similar level in '07 and '19.

Fed clearly not cutting in Jul. But it does signal rising risk of another big policy error.

High frequency fundamental and ...

https://twitter.com/ResearchQf/status/1542256070063685633

5) economic data will remain super important next few months.

Depending on near term data, that ~35% chance of pause in Dec will easily become large with only 10-15 bps changes in implied Fed funds rates. And also easily morph into a tangible chance of a pause in Nov.

Depending on near term data, that ~35% chance of pause in Dec will easily become large with only 10-15 bps changes in implied Fed funds rates. And also easily morph into a tangible chance of a pause in Nov.

• • •

Missing some Tweet in this thread? You can try to

force a refresh