🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Global Macro Review 07/03/22 🇺🇸

1/9

Powell is committed to fighting #inflation and cares not whether you lose 💰 during the war.

“The process is highly likely to involve some pain, but the worst pain…”

Let’s dig into the early campaign results 🧮!

Global Macro Review 07/03/22 🇺🇸

1/9

Powell is committed to fighting #inflation and cares not whether you lose 💰 during the war.

“The process is highly likely to involve some pain, but the worst pain…”

Let’s dig into the early campaign results 🧮!

2/9

The $USD +0.91% ♉️ is becoming more dear against major currency pairs with $AUD -1.97%, $GBP -1.49%, and $EUR -1.17% on the week

Chart: $USD +6.3% (T) = 3 mos, +9.75% YTD

The $USD +0.91% ♉️ is becoming more dear against major currency pairs with $AUD -1.97%, $GBP -1.49%, and $EUR -1.17% on the week

Chart: $USD +6.3% (T) = 3 mos, +9.75% YTD

3a/9

The UST curve both flattened and steepened with 10/2s ↘️ to 5BPS and 30/5s ↗️ to 23.2 BPS

Chart: $IVOL +2.76% (w), +4.9% (T)

The UST curve both flattened and steepened with 10/2s ↘️ to 5BPS and 30/5s ↗️ to 23.2 BPS

Chart: $IVOL +2.76% (w), +4.9% (T)

3b/9

With the @AtlantaFed projecting a technical recession for 1H23, USTs caught a bid

$IEF +2.2% (w) -3.1% (T)

$TLT +3.1% (w) -12.5% (T)

Chart: $TLT is +7.1% from the HE 🤮, but T level is still 10 pts overhead

With the @AtlantaFed projecting a technical recession for 1H23, USTs caught a bid

$IEF +2.2% (w) -3.1% (T)

$TLT +3.1% (w) -12.5% (T)

Chart: $TLT is +7.1% from the HE 🤮, but T level is still 10 pts overhead

3c/9

Riskier corporate, junk, and convertible bonds faired less well 🐻

$LQD +1.2% (w) -8.25% (T)

$HYG -0.95% (w) -9.75% (T)

$CWB -1.9% (w) -16.1% (T)

Chart: $HYG has lost 13% of its value with dividends reinvested since its late December peak

Riskier corporate, junk, and convertible bonds faired less well 🐻

$LQD +1.2% (w) -8.25% (T)

$HYG -0.95% (w) -9.75% (T)

$CWB -1.9% (w) -16.1% (T)

Chart: $HYG has lost 13% of its value with dividends reinvested since its late December peak

3d/9

Treasury market vol hit a new cycle high with MOVE 144.17. Tough spot to buy USTs with vol a these levels, but may be worth the risk

Treasury market vol hit a new cycle high with MOVE 144.17. Tough spot to buy USTs with vol a these levels, but may be worth the risk

4a/9

Metals 🐻 continued to get pummeled with industrial metals taking the brunt of the abuse

$DBB -4.05% (w) -26.05% (T)

$COPPER -3.75% (w) -23.25% (T)

Chart: $SILVER collapsed this week -6.9% and now -20.2% over (T) duration

Metals 🐻 continued to get pummeled with industrial metals taking the brunt of the abuse

$DBB -4.05% (w) -26.05% (T)

$COPPER -3.75% (w) -23.25% (T)

Chart: $SILVER collapsed this week -6.9% and now -20.2% over (T) duration

4b/9

Chart: $GOLD -1.55% (w) tested the May 16 low in the early hours Friday and remains 🐻 (T) -6.35%.

$GVZ 20.17 🔺

Chart: $GOLD -1.55% (w) tested the May 16 low in the early hours Friday and remains 🐻 (T) -6.35%.

$GVZ 20.17 🔺

5/9

Hydrocarbons continue to struggle but 🛢 and ⛽️ have hung onto ♉️ (T)

$WTIC +0.75% (w) +9.25% (T)

$BRENT -1.5% (w) +6.4% (T)

$GASO -2.4% (w) +17.15% (T)

$NATGAS -8.75% (w) +0.15% (T) neutral

$OVX 49.40 🔺

Chart: $GASO - Powell’s new inflation metric - is -13.2% in 4 wks

Hydrocarbons continue to struggle but 🛢 and ⛽️ have hung onto ♉️ (T)

$WTIC +0.75% (w) +9.25% (T)

$BRENT -1.5% (w) +6.4% (T)

$GASO -2.4% (w) +17.15% (T)

$NATGAS -8.75% (w) +0.15% (T) neutral

$OVX 49.40 🔺

Chart: $GASO - Powell’s new inflation metric - is -13.2% in 4 wks

6/9

For whatever reason, grains 🐻 continue to succumb to the deflationary 🌊 of selling

$CORN -9.85% (w) -17.35% (T)

$WHEAT -9.65% (w) -14.05% (T)

$SOYB -2.05% (w) -11.85% (T)

$SUGAR -1.1% (w) -6.55% (T)

Chart: $DBA -3.6% (w) -8.1% (T)

For whatever reason, grains 🐻 continue to succumb to the deflationary 🌊 of selling

$CORN -9.85% (w) -17.35% (T)

$WHEAT -9.65% (w) -14.05% (T)

$SOYB -2.05% (w) -11.85% (T)

$SUGAR -1.1% (w) -6.55% (T)

Chart: $DBA -3.6% (w) -8.1% (T)

7a/9

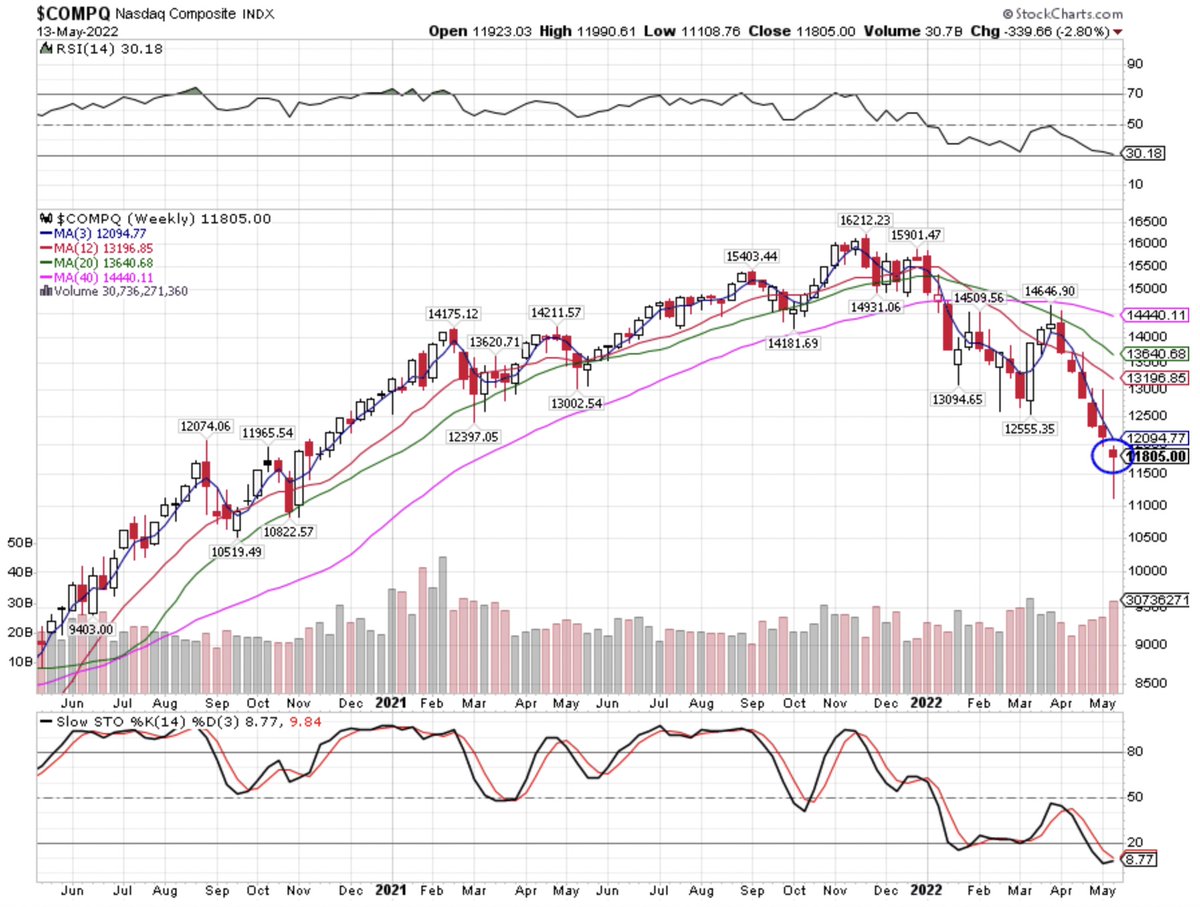

The 🐻 market rally in US equities was quickly snuffed out by more selling

$IWM -2.1% (w) -17.4% (T)

$SPX -2.2% (w) -15.85% (T)

$COMPQ -4.15% (w) -21.95% (T)

Chart: Despite the rally in USTs, $COMPQ bore the brunt of the selling abuse

The 🐻 market rally in US equities was quickly snuffed out by more selling

$IWM -2.1% (w) -17.4% (T)

$SPX -2.2% (w) -15.85% (T)

$COMPQ -4.15% (w) -21.95% (T)

Chart: Despite the rally in USTs, $COMPQ bore the brunt of the selling abuse

7b/9

Divergence in US equity sectors with #quad4 equities ↗️

$XLU +4.1% (w) -4.8% (T)

$XLP +0.5% (w) -4.45% (T)

$XLV +0.35% (w) -6.1% (T)

Tech and consumer ↘️

$XLY -4.75% (w) -24.4% (T)

$XLK -4.55% (w) -19.6% (T)

Chart: $XLU ↗️ 2 weeks in a row

Divergence in US equity sectors with #quad4 equities ↗️

$XLU +4.1% (w) -4.8% (T)

$XLP +0.5% (w) -4.45% (T)

$XLV +0.35% (w) -6.1% (T)

Tech and consumer ↘️

$XLY -4.75% (w) -24.4% (T)

$XLK -4.55% (w) -19.6% (T)

Chart: $XLU ↗️ 2 weeks in a row

8a/9

Internat’l indices continued to diverge with China & HK ↗️, the rest ↘️

$SSEC +1.15% (w) +3.2% (T)

$HSI +0.65% (w) -0.8% (T)

$NIKK -2.1% (w) -6.25% (T)

$DAX -2.35% (w) -11.3% (T)

$CAC -2.35% (w) -11.25% (T)

$KOSPI -2.6% (w) -15.85% (T)

Chart: $KOPSI -13.7% (t) = 4 wks

Internat’l indices continued to diverge with China & HK ↗️, the rest ↘️

$SSEC +1.15% (w) +3.2% (T)

$HSI +0.65% (w) -0.8% (T)

$NIKK -2.1% (w) -6.25% (T)

$DAX -2.35% (w) -11.3% (T)

$CAC -2.35% (w) -11.25% (T)

$KOSPI -2.6% (w) -15.85% (T)

Chart: $KOPSI -13.7% (t) = 4 wks

9a/9

Objectively, Powell’s demand destruction campaign has been effective in reducing asset prices for energy, metals, grains, and equities.

Indeed, core #PCE declined for the 3rd month in a row

Objectively, Powell’s demand destruction campaign has been effective in reducing asset prices for energy, metals, grains, and equities.

Indeed, core #PCE declined for the 3rd month in a row

https://twitter.com/tdarling1/status/1542498624235622400?s=20&t=zqM93GNOmZdgUHEQ2CQ7Qw

9b/9

With a technical recession now forecast by the @AtlantaFed, earnings projections must come down

Stay 🩳 $XLY $XLK; long $USD $VIXM $SH $CTA $KBA; and begin to stick your toe in the $TLT 💦🦈

Have a super profitable 💰 week!

#oldwallwarrior

With a technical recession now forecast by the @AtlantaFed, earnings projections must come down

Stay 🩳 $XLY $XLK; long $USD $VIXM $SH $CTA $KBA; and begin to stick your toe in the $TLT 💦🦈

Have a super profitable 💰 week!

#oldwallwarrior

• • •

Missing some Tweet in this thread? You can try to

force a refresh