On page 24 of its opposition, the SEC attempts to split proverbial legal hairs by conceding #XRP is not a security per se (“this case presents no such question”), while simultaneously arguing all XRP, including XRP traded in today’s “secondary market … represents” a security. 👇

Remarkably, the SEC claims it is not arguing XRP is a security per se, but instead, arguing XRP is a representation of a security.

What does that even mean?

When does an asset transform from being an asset (🥃, an 🍊, 🦫 or #BTC) to also “representing” an investment contract?

What does that even mean?

When does an asset transform from being an asset (🥃, an 🍊, 🦫 or #BTC) to also “representing” an investment contract?

The SEC must prove #XRP IS an investment contract. But the SEC unilaterally changed its burden to proving only a “representation” of an investment contract.

The SEC doesn’t get to make up the law in order to satisfy a political desire to regulate a new evolving asset class.

The SEC doesn’t get to make up the law in order to satisfy a political desire to regulate a new evolving asset class.

The SEC’s theory regarding #XRP is the functional equivalent of arguing the Oranges 🍊 in Howey were not only oranges 🍊 but also “represented” the embodiment of the investment contract w/ the W.J. Howey Company.

The SEC’s argument is tantamount to legal gobbledygook.

The SEC’s argument is tantamount to legal gobbledygook.

Current SEC Commissioner, @HesterPeirce, seems to agree. The SEC’s precarious expansion of Howey (as applied to #XRP), is so intellectually dishonest, Commissioner Peirce publicly criticized the SEC’s theory when she stated:

“What we’ve done now is said the orange 🍊 groves are kind of like the security.”

- @HesterPeirce on the Thinking Crypto YouTube Channel. 👇

- @HesterPeirce on the Thinking Crypto YouTube Channel. 👇

Personally, I believe the SEC lawyers have crossed an ethical line and lack the good faith required to make such an absurd argument. Their theory is certainly not supported by caselaw b/c a glaring omission from the SEC’s brief is a single cite supporting its outlandish theory.

The SEC cites no legal authority whatsoever supporting the radical departure from needing to prove an actual investment contract to proving a representation of an investment contract (whatever the heck that means).

But what makes the SEC’s argument in the #XRP case even more egregious is that it completely contradicts statements made by the SEC itself.

The SEC’s farfetched #XRP theory is a direct contradiction of public guidance provided by the SEC itself. In fact, as stated, according to the SEC (and 76 years of caselaw) any asset or commodity can be utilized as a security whether that asset be 🍊, 🥃, 🦫s, or even #BTC.

Until the filing of this case, the SEC had never made a material distinction between #Bitcoin, #Ether or #XRP. The SEC as a regulator made very clear that:

“Whether a cryptocurrency is considered a security will depend on the characteristics and use of the cryptocurrency.”👇

“Whether a cryptocurrency is considered a security will depend on the characteristics and use of the cryptocurrency.”👇

The Emails👆from the OIEA consistently provided the same exact guidance regardless of whether it was discussing #Bitcoin, #Ether or #XRP.

The SEC’s theory regarding #XRP also contravenes proclamations made from the most senior officials at the SEC.

Read Hinman’s 2018 Speech:

The SEC’s theory regarding #XRP also contravenes proclamations made from the most senior officials at the SEC.

Read Hinman’s 2018 Speech:

“The token - or coin or whatever the digital

information packet is called [XRP]- all by itself is not a security, just as the 🍊 groves in Howey were not.”

Hinman noted that when dealing w/ digital assets like Bitcoin, ETH and XRP:

"The digital asset itself is simply code."

information packet is called [XRP]- all by itself is not a security, just as the 🍊 groves in Howey were not.”

Hinman noted that when dealing w/ digital assets like Bitcoin, ETH and XRP:

"The digital asset itself is simply code."

Hinman also emphasized "that the analysis of

whether something [XRP] is a security is not static and does not strictly inhere to the instrument."

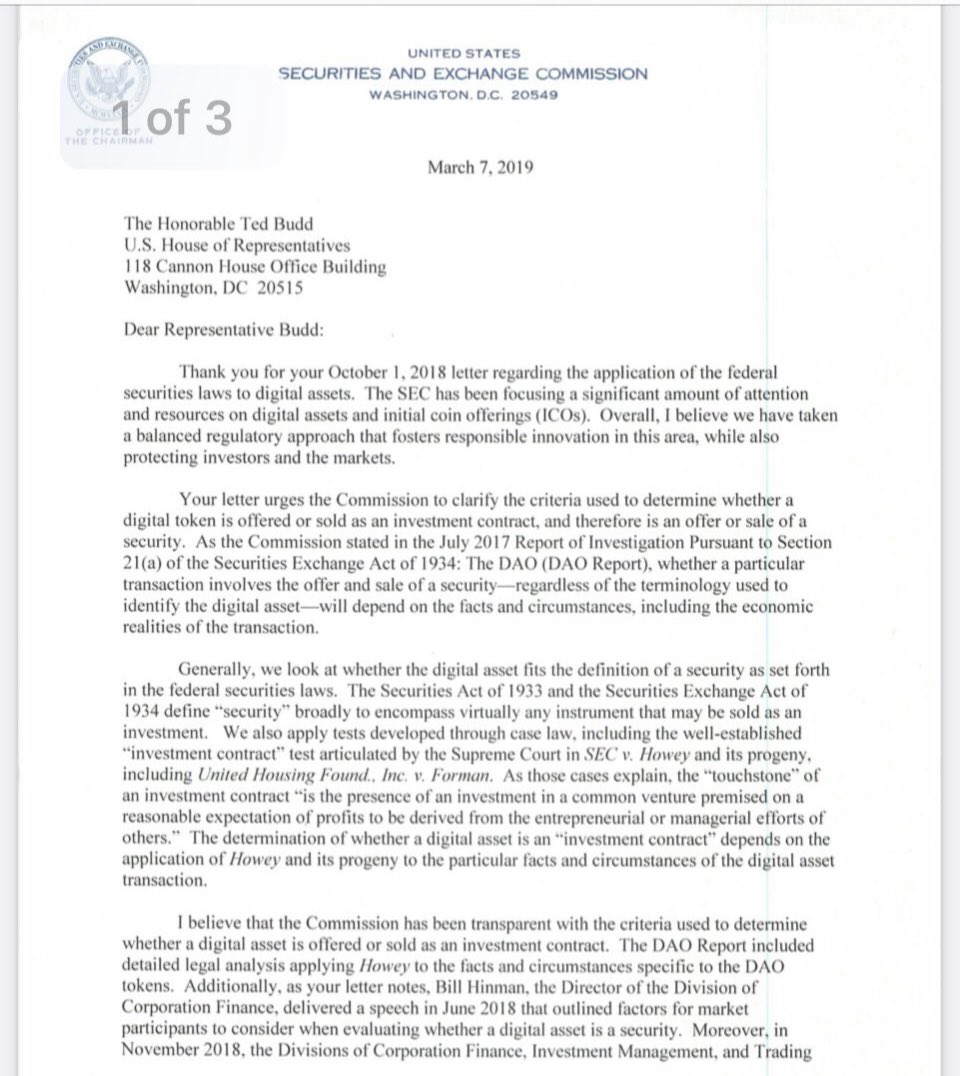

Chairman Clayton agreed when he wrote to

Congressman @TedBuddNC:

whether something [XRP] is a security is not static and does not strictly inhere to the instrument."

Chairman Clayton agreed when he wrote to

Congressman @TedBuddNC:

“I agree [with Director Hinman] that the analysis of whether a digital asset is offered or

sold as a security is not static and does not strictly inhere to the instrument.”👇

sold as a security is not static and does not strictly inhere to the instrument.”👇

“A digital asset may be offered and

sold initially as a security b/c it meets the definition of an investment contract, but that designation may

change over time if the digital asset later is offered and sold in such a way that it will no longer meet that

definition.”

-J Clayton

sold initially as a security b/c it meets the definition of an investment contract, but that designation may

change over time if the digital asset later is offered and sold in such a way that it will no longer meet that

definition.”

-J Clayton

The SEC’s #XRP theory clearly contradicts the SEC’s public statements. Relevant caselaw offers the SEC ZERO support.

In SEC 🆚 Shavers, #Bitcoin was utilized in a scheme the Court found constituted an illegal securities offering. #BTC itself was NOT considered the security.

In SEC 🆚 Shavers, #Bitcoin was utilized in a scheme the Court found constituted an illegal securities offering. #BTC itself was NOT considered the security.

In addition to the #Bitcoin example we have #Telegram explicitly holding, as Hinman stated, that the token itself is NEVER the security.

“The security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”

“The security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”

Telegram was an ICO and unlike this case, involved contracts signed by #Gram purchasers. Thus, if there ever existed a case where the token itself constituted the security, it would be #Telegram.

Yet, Judge Castel held:

“the ‘security’ was neither the #Gram Purchase Agreement nor the #Gram but the entire scheme that comprised the Gram Purchase Agreements and the accompanying understandings and undertakings made by Telegram.”

“the ‘security’ was neither the #Gram Purchase Agreement nor the #Gram but the entire scheme that comprised the Gram Purchase Agreements and the accompanying understandings and undertakings made by Telegram.”

The only conceivable way to attempt to prove the extraordinary claim that XRP itself represents a security is to prove secondary market sales, independent of Ripple, were acquired by investors who entered into a common enterprise w/ Ripple, and all other XRP holders,

based on the promises and inducements offered by Ripple, which caused those secondary market acquirers to expect profits from Ripple’s efforts.

Yet, as stated, the majority of #XRPHolders were completely unaware of the Company Ripple when they first acquired #XRP.

Yet, as stated, the majority of #XRPHolders were completely unaware of the Company Ripple when they first acquired #XRP.

Thousands of #XRPHolders acquired #XRP for non-investment reasons. There are several #XRP debit cards 💳 that allow you to use #XRP as a substitute for fiat currency. Some #XRPHolders get paid in #XRP. These use cases don’t even satisfy the first prong of Howey (an investment).

https://twitter.com/_globalid/status/1422569991879208962

Tens of thousands of #XRPHolders stake their #XRP for interest or collateralize their #XRP to secure a fiat loan - thus obtaining a financial benefit completely independent of Ripple (this fails the common enterprise factor as well as relying on the efforts of Ripple factor).

While the skilled lawyers from both sides strategize their next move in order to gain a competitive litigation advantage, innocent users, developers, investors and holders of XRP, with no connection to these Defendants, fretfully await the outcome.

Will you do anything about it?

Will you do anything about it?

Now read these additional facts about the case.

https://twitter.com/johnedeaton1/status/1500936261057622032

• • •

Missing some Tweet in this thread? You can try to

force a refresh