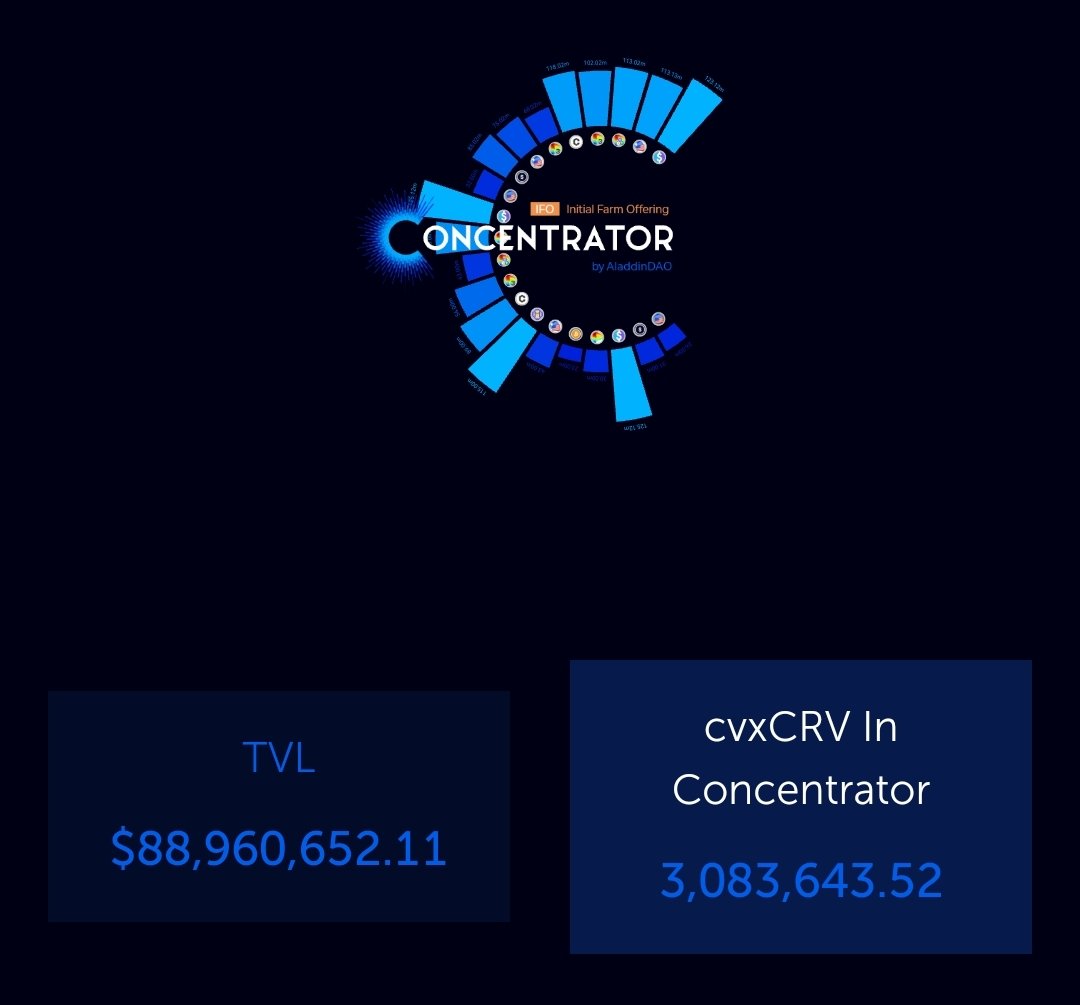

1/11 You don't like IMPERMANENT LOSS, here are some Yield Farming Strategy on stable assets on @0xconcentrator during their #IFO, i.e earning their brand new token $CTR. First, TVL has gone +66% since IFO launches on 14/07. APY are subject to $CTR price and LP prices. 🧵👇💪

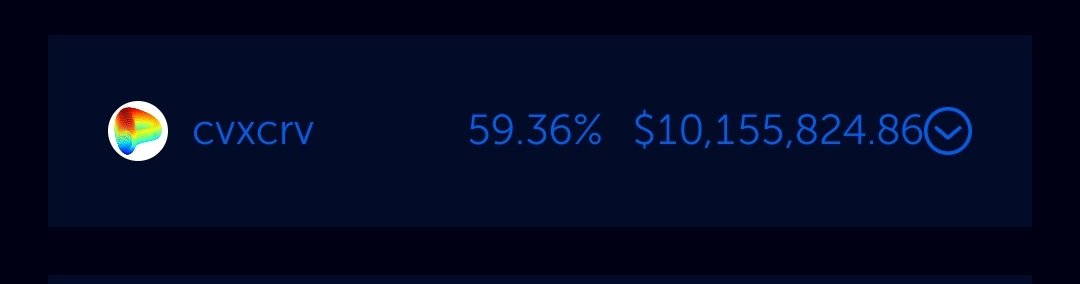

2/11 Token from @CurveFinance : $cvxCRV is pegged to $CRV. LP cvxCRV/CRV, 59% APY

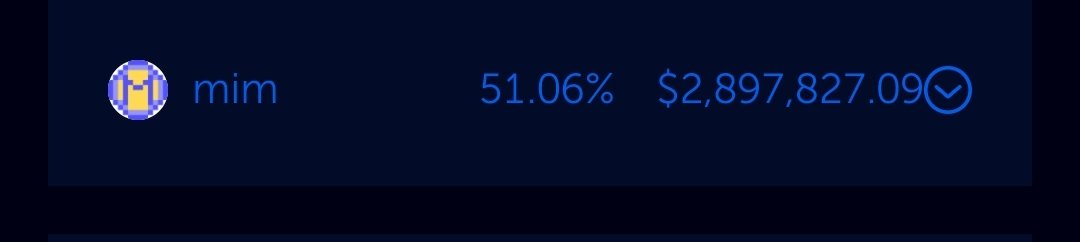

3/11 Token from @MIM_Spell : LP $MIM / $3CRV, 51% APY

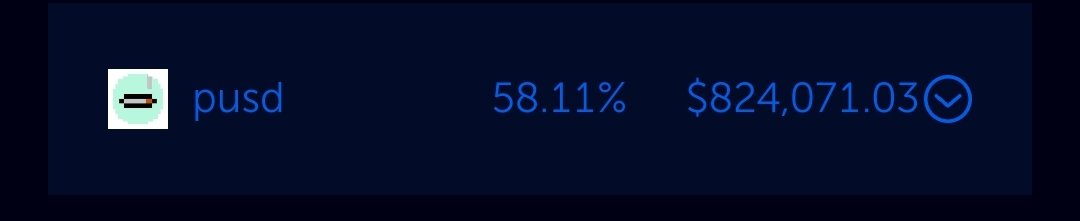

4/11 token from @JPEGd_69 : LP $PUSD / $3CRV, 58% APY

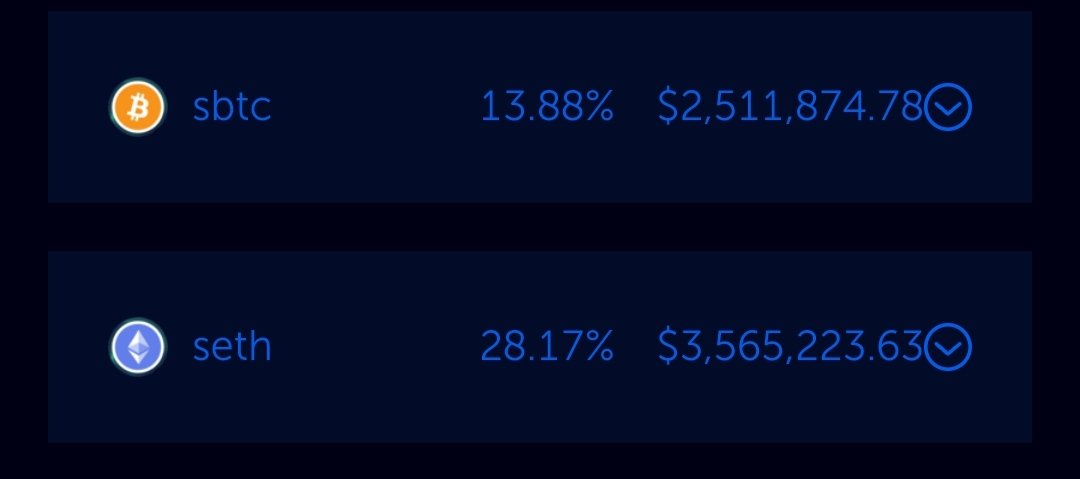

5/11 Tokens from @synthetix_io : LP $wBTC / $sBTC / $renBTC 13,9% APY & $wETH / $sETH 28% APY

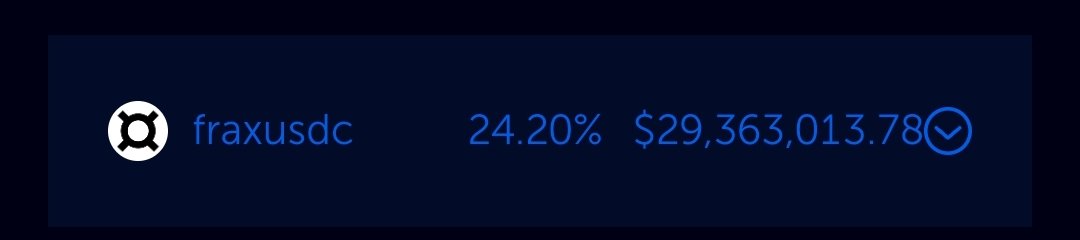

6/11 The ultimate basepool from @fraxfinance : LP $FRAX / $USDC 24% APY

7/11 You can talk about impermanent LESS and not Loss without talking about @AlchemixFi with their LP $alUSD / $3CRV at 17,8% APY & $alETH / $ETH 31,5% APY

8/11 Token from @InverseFinance : LP $DOLA (stablecoin) / $3CRV, 64% APY

9/11 Honestly, one of my future personal move (NFA), going to the $3EUR Pool comprising $agEUR from @AngleProtocol, $EURt from @Tether_to and $EURs from @stasisnet at 25,7% APY. F

10/11 Finally for those who wonder: but for sake, what is $3CRV ? it's the basepool from @CurveFinance made of the 3 biggest stablecoins as such: $USDC + $USDT + $DAI. Finally if you want to know more about @0xconcentrator check my video 👇

https://twitter.com/Subli_Defi/status/1547205475149774848?s=20&t=B_eOfz2fqRpWplTIocRvDA

11/11 So my farming strategy is simple:

Instead of keeping assets i'm exposed in my #web3 wallet, i deposit in a Liquidity Pool WITHOUT IL, and earning a new token $CTR of a protocol built on top of the most recognized and flywheel effect of #DeFi @ConvexFinance.

Instead of keeping assets i'm exposed in my #web3 wallet, i deposit in a Liquidity Pool WITHOUT IL, and earning a new token $CTR of a protocol built on top of the most recognized and flywheel effect of #DeFi @ConvexFinance.

If you liked this summary made on 17/07/2022, and like me you're allergic to #ImpermanentLoss, please feel free to share by retweeting the 1st post:

https://twitter.com/Subli_Defi/status/1548442955270107139?t=WJCpdotXOl6v6kPv82rhTg&s=19

@threadreaderapp Unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh