#RealEstate sales are cyclical - millions of transactions worth trillions of USD processed per annum globally

Settlement times can be lengthy/laborious

#Blockchain & #NFTs solve this through immutability and fractional ownership

This @OriginsNFT article takes a closer look👇🧵

Settlement times can be lengthy/laborious

#Blockchain & #NFTs solve this through immutability and fractional ownership

This @OriginsNFT article takes a closer look👇🧵

INDUSTRY BACKGROUND:

According to @Savills last valuation, the global real estate property valuation was around $326.5T in 2020

The real estate market can be broken up into three segments:

According to @Savills last valuation, the global real estate property valuation was around $326.5T in 2020

The real estate market can be broken up into three segments:

Focusing on the largest segment (residential) - according to @CoreLogicInc there were 7 million residential units sold in 2021, totalling $2.8T of transaction volume

The @OECD has released a price index which shows the growth of the real estate price index between 2015 and 2022

The average global increase is 53% (index of 153) over this seven year period, with #Turkey having the highest index of 282 and #SaudiArabia with the lowest of 86

The average global increase is 53% (index of 153) over this seven year period, with #Turkey having the highest index of 282 and #SaudiArabia with the lowest of 86

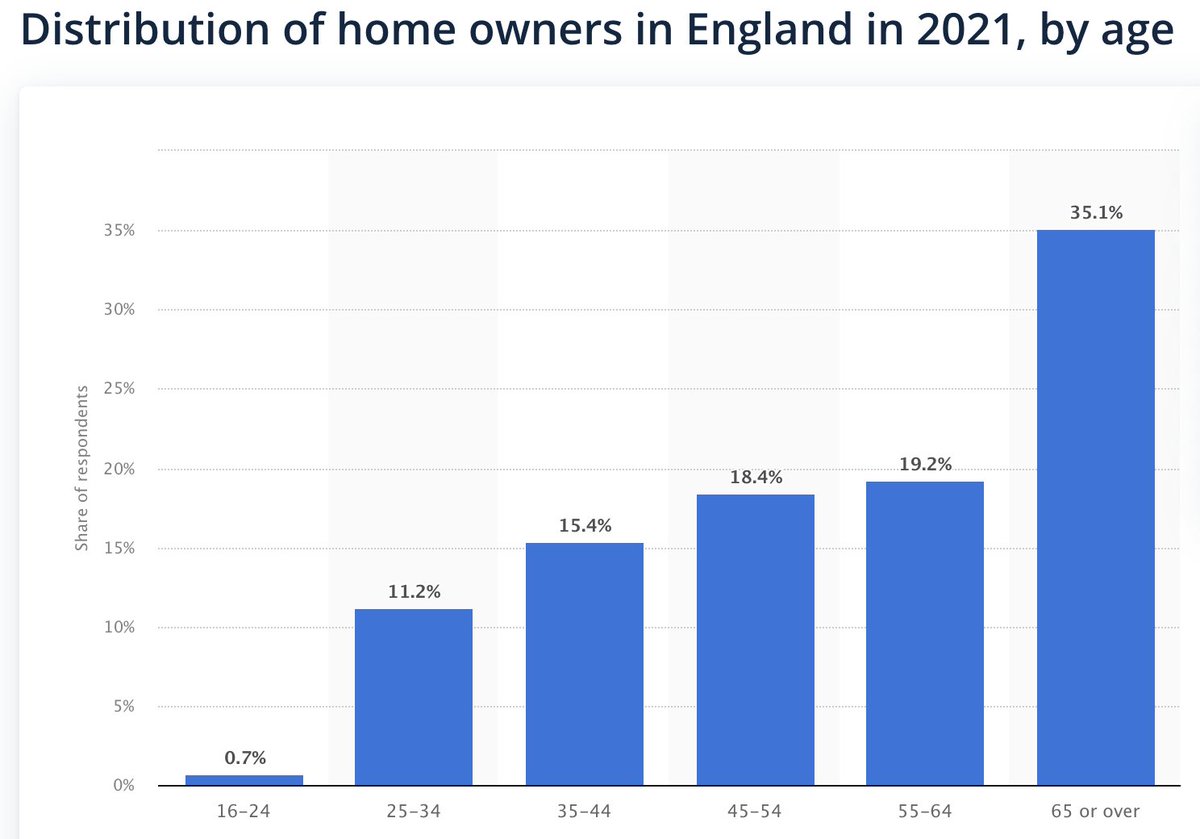

Homeowners tend to be older which may have implications for adoption of new technology

This age mix differs slightly from one country to the next but in general holds true

According to @StatistaCharts 35% of UK homeowners are aged 65 or above, very few <24 year olds own a home

This age mix differs slightly from one country to the next but in general holds true

According to @StatistaCharts 35% of UK homeowners are aged 65 or above, very few <24 year olds own a home

Many homeowners are aware of the lengthy settlement process for the relatively illiquid asset class

Those that are not yet homeowners may be struggling to get their foot on the property ladder

Blockchain, and NFTs specifically, can provide a solution for both problems👇

Those that are not yet homeowners may be struggling to get their foot on the property ladder

Blockchain, and NFTs specifically, can provide a solution for both problems👇

INDUSTRY CHALLENGES & BLOCKCHAIN SOLUTIONS:

1/UNREGISTERED PROPERTIES:

For more historic buildings the deeds are often fragile, delicate and sometimes illegible

An authority could set up a permissioned blockchain and register the property as an NFT...

1/UNREGISTERED PROPERTIES:

For more historic buildings the deeds are often fragile, delicate and sometimes illegible

An authority could set up a permissioned blockchain and register the property as an NFT...

...The population of the NFT collection would scale with the number of properties on chain

The properties for each NFT could reflect the key features of the home

Or a property could be reflected as an NFT collection. Each item in the collection could be fault or aspect...

The properties for each NFT could reflect the key features of the home

Or a property could be reflected as an NFT collection. Each item in the collection could be fault or aspect...

...of the properties of each NFT indicating the quality of that part of the property

The meta data of this NFT could then be updated depending on resolved problems

The meta data of this NFT could then be updated depending on resolved problems

2/LONG SETTLEMENT TIMES:

The “chain” can be a stressful process with a “domino effect” if this is broken

Many people are reliant on a quick transaction and if a buyer pulls out then the funds may not be available for the purchase of another property, causing delays...

The “chain” can be a stressful process with a “domino effect” if this is broken

Many people are reliant on a quick transaction and if a buyer pulls out then the funds may not be available for the purchase of another property, causing delays...

...NFT Solution:

A/More efficient verification process of the transacting parties, reduced solicitor involvement and surveying fees, leading to a reduction in costs

The NFT provides certification of product ownership with a unique immutable signature

A/More efficient verification process of the transacting parties, reduced solicitor involvement and surveying fees, leading to a reduction in costs

The NFT provides certification of product ownership with a unique immutable signature

B/Reliable data of the properties in the chain can help when selecting a buyer as to the likelihood of their sale falling through

This provides transparency over the execution risk of the sale

This provides transparency over the execution risk of the sale

3/UNAFFORDABLE PROPERTIES - FRACTIONAL OWNERSHIP:

Properties are becoming astronomically expensive, with the average property price to median earnings ratios at an all time high: ...

Properties are becoming astronomically expensive, with the average property price to median earnings ratios at an all time high: ...

With sole ownership of a property becoming unattainable for many, the ability to fractionally own a property through an NFT collection is becoming a reality

Many DAOs were set up in 2021 to own fractions of expensive NFTs, like @cryptopunksnfts or @BoredApeYC ...

Many DAOs were set up in 2021 to own fractions of expensive NFTs, like @cryptopunksnfts or @BoredApeYC ...

The closest we have in existing markets is a real estate investment trust (“REITS”)

The advantage of using NFTs is that it is all automated, less manual interaction effectively providing an optimal structure

Or, NFTs can be the underlying assets for #REIT investments

The advantage of using NFTs is that it is all automated, less manual interaction effectively providing an optimal structure

Or, NFTs can be the underlying assets for #REIT investments

4/UNATTAINABLE MORTGAGES:

Obtaining a #mortgage can be an arduous and drawn-out process

NFTs that represent a digital version of a real world asset can be used as collateral to automate the lending process...

Obtaining a #mortgage can be an arduous and drawn-out process

NFTs that represent a digital version of a real world asset can be used as collateral to automate the lending process...

There are cryptocurrency lending platforms that offer loans based on crypto assets held in the wallet

Similar platforms can be developed for NFTs where lenders would receive repayments using blockchain

Buyers can then borrow against the NFT using Defi or TradFi on chain

Similar platforms can be developed for NFTs where lenders would receive repayments using blockchain

Buyers can then borrow against the NFT using Defi or TradFi on chain

5/OPAQUE PROPERTY VALUATIONS:

Guide prices can be varied and relatively subjective. The data points used to establish fair value may not come from reliable sources

Having the property represented as an NFT can enable a global open order book & transparent list of transactions

Guide prices can be varied and relatively subjective. The data points used to establish fair value may not come from reliable sources

Having the property represented as an NFT can enable a global open order book & transparent list of transactions

6/GOV'T SEIZED ASSETS:

One should never underestimate the power of governments/regulatory authorities

In developing countries political turmoil can be rife which leads to new authorities entering power

Property can be seized and repurposed...

One should never underestimate the power of governments/regulatory authorities

In developing countries political turmoil can be rife which leads to new authorities entering power

Property can be seized and repurposed...

...Blockchain is a decentralized tech that spans the borders of nation states

A centralized authority will need to collaborate with all nations to be able to shut it down - Immutable records

If that dictator is overthrown, a record exists that indicates the original owner

A centralized authority will need to collaborate with all nations to be able to shut it down - Immutable records

If that dictator is overthrown, a record exists that indicates the original owner

7/PROPERTY FRAUD:

Property fraud is rife and on the rise, particularly after the Pandemic when transactions and meetings are more frequently performed virtually

NFTs can help with verification through an immutable historical record of the transfer of title deeds in digital form

Property fraud is rife and on the rise, particularly after the Pandemic when transactions and meetings are more frequently performed virtually

NFTs can help with verification through an immutable historical record of the transfer of title deeds in digital form

8/CYBER ATTACKS:

Cyber attacks on centralized government authorities are becoming more frequent

Systems are shut down, compromized and records are at risk of being tampered with

Blockchain provide a decentralized database which helps security

A UK cyber attack example:

Cyber attacks on centralized government authorities are becoming more frequent

Systems are shut down, compromized and records are at risk of being tampered with

Blockchain provide a decentralized database which helps security

A UK cyber attack example:

9/SEASONALITY:

Builders and the construction industry are adversely impacted by seasonality

Winter months tend to have less construction activity or project work available due to adverse weather conditions...

Builders and the construction industry are adversely impacted by seasonality

Winter months tend to have less construction activity or project work available due to adverse weather conditions...

Building in royalties on secondary sales of properties, and their digital title, can offer an additional revenue stream that provides a more steady flow of funds in those periods with less project work

The process may incentivize better buildings, with more durable buildings

The process may incentivize better buildings, with more durable buildings

REAL WORLD CASE STUDIES:

1/@PropyInc is an NFT marketplace specializing in property

@arrington listed an apartment as an NFT in May 2021, through the real estate platform

He had purchased the same property by using @ethereum smart contracts in 2017

1/@PropyInc is an NFT marketplace specializing in property

@arrington listed an apartment as an NFT in May 2021, through the real estate platform

He had purchased the same property by using @ethereum smart contracts in 2017

@PropyInc @arrington @ethereum 2/ Prometheus, completed the sale of two luxury homes in #Portugal through #cryptocurrency (#ADA)

The transaction was able to comply with local #KYC laws

The transaction was able to comply with local #KYC laws

3/@FineandCountry brought to market a property known as Hampton Hall, a £29m luxury mansion in Surrey, where in addition to the sale of the physical property the developer offered the buyer rights of first refusal on an NFT containing the copyright blueprint and a virtual version

4/The @HMLandRegistry piloted its first #blockchain transaction in 2019, by running a previously completed sale through their blockchain prototype

Through the assistance of @getyoti - Buyer and Seller identities were confirmed via mobile interface

The demo only took 10 mins

Through the assistance of @getyoti - Buyer and Seller identities were confirmed via mobile interface

The demo only took 10 mins

5/@RedSwanCRE is a Commercial Real Estate (“CRE”) tokenized marketplace

It enables investors to purchase part of a commercial real estate property with as little as $1k via their tokenized marketplace offerings

It enables investors to purchase part of a commercial real estate property with as little as $1k via their tokenized marketplace offerings

RISKS:

1/Insufficient education

2/Lack of infrastructure

3/Resistance from incumbent market leaders

4/Lacking a robust legal framework

5/Clarity over what the NFT is a representative of

1/Insufficient education

2/Lack of infrastructure

3/Resistance from incumbent market leaders

4/Lacking a robust legal framework

5/Clarity over what the NFT is a representative of

More detail on these risks has been included in the full article

Sources to the diagrams/images & SEO links have also been included within the full article👇

Sources to the diagrams/images & SEO links have also been included within the full article👇

That's all for this thread

Full @OriginsNFT article available at:

mirror.xyz/origins-resear…

If you found this thread useful, consider:

✅ Follow

@S4mmyEth for more content like this

🔔 Enable notifications

🔄 Retweeting the first tweet

Full @OriginsNFT article available at:

mirror.xyz/origins-resear…

If you found this thread useful, consider:

✅ Follow

@S4mmyEth for more content like this

🔔 Enable notifications

🔄 Retweeting the first tweet

• • •

Missing some Tweet in this thread? You can try to

force a refresh