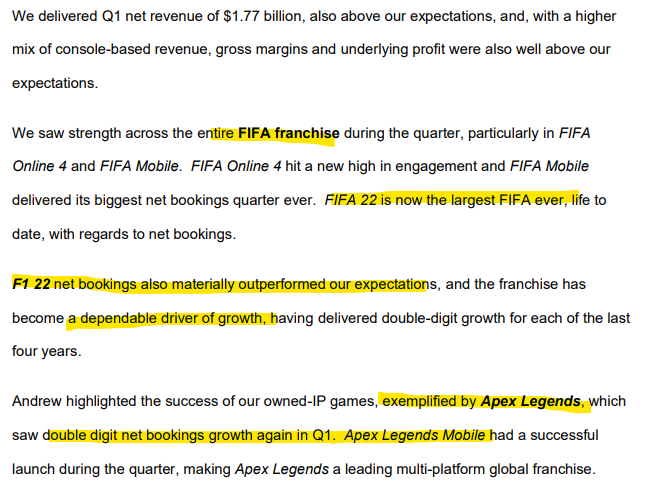

1/ Let's take a look at some of EA's prepared remarks and take a deeper look at why their quarter bucked the industry "dip". The big hitters for EA: #FIFA, #F122, and #ApexLegends. Sounds like F1 has worked out better than expected.

2/ Where things get confusing to the outside reader is when it comes to accounting. Net Bookings represent a slight decline YoY, but because of how revenue is accounted for in GAAP, more of it [revenue] was financially booked this last quarter. This is normal BTW.

3/ How does this happen? Generally speaking, GAAP demands companies recognize revenue in the quarter that the product is realized. If someone "books" (pre-purchases) a game months before the launch quarter, the revenue can't be accounted for until the product launches.

4/ Bookings and revenue CAN line up, but it depends on the product mix and when products launch. This quarter makes the gap more apparent. Bookings are more of an indicator, while revenue is the trailing result. Yes, there is a bit of a "dip" in bookings this last quarter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh