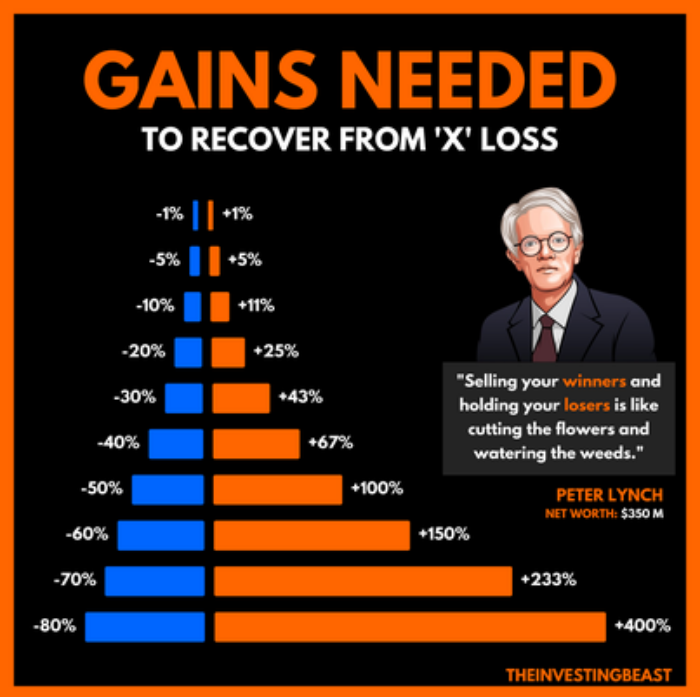

Risk Management is the most important factor in trading, and MUST be at the core of your trading strategy. If you made a ton of money in 2021, and then lost 80% of it in 2022 so far, you're not going to be a trader for very long.

How to create your own risk management plan:

🧵👇

How to create your own risk management plan:

🧵👇

1. Come up with a set amount that you want to allocate for long term investing, and an amount for short term trading. Long term should heavily outweigh your short term trading. For example, 80% long term investing, and 20% for short term trading. Keep these accounts separate.

1a. For long term investing, you should be using high time frame charts ONLY when deciding to buy/sell. The charts can give great indications of these buy/sell signals.

Decide how much for one asset, and scale in/out with multiple buys/sells over time. This is called averaging.

Decide how much for one asset, and scale in/out with multiple buys/sells over time. This is called averaging.

1b. For short term trading, decide how much of your total capital you are willing to risk on one trade. Then, how much of that capital you are willing to lose. Many short term traders use somewhere between 5%-7% for their stop loss. With leverage, this may need to be higher.

1c. Everyone has different risk appetites. What I consider a lot of risk may be very little to you. What matters most, is that you create rules for yourself, and stick to them no matter what. Got stopped out? Don't chase it. Just move on, there will always be another trade.

1d. Long term trading means holding for long periods of time. With stocks, you can stay in for years, like with 401k plans.

For crypto, it's far better to buy and sell based on higher time frame signals. Bear markets take away up to 90% of profits. Extreme patience is required.

For crypto, it's far better to buy and sell based on higher time frame signals. Bear markets take away up to 90% of profits. Extreme patience is required.

2. Fear and Greed are the main reasons traders lose. Fear of missing out(FOMO), or fear of losing after investing and seeing red.

Greed is the main reason traders don't make any money. Many times traders will be well into profits, only to watch it turn negative. Take profits!

Greed is the main reason traders don't make any money. Many times traders will be well into profits, only to watch it turn negative. Take profits!

2a. To be successful at anything , you need confidence. Without confidence, there's bound to be emotion. There's simply no room for this in trading, and will only lead to fear/greed. Learn and understand technical analysis, and market psychology, and you will gain confidence.

3. What does fear/greed have to do with risk management?

Having planned entries, stop losses, and take profit points for your trades eliminates the emotion involved. If you have rules, and you follow them, then you can be a robot without emotions.

Be a robot.🤖

Having planned entries, stop losses, and take profit points for your trades eliminates the emotion involved. If you have rules, and you follow them, then you can be a robot without emotions.

Be a robot.🤖

3b. Pre-plan your trades. This goes for long term and short term. If the chart is showing a buy signal on a HTF, pick the point for retest of support to start scaling in. Don't get scared of a little red unless there's a real sell signal. That's what your stop loss is for.

3c. If you're well into profits on a long term investment, take profits on the first sell signal you see on a weekly/daily time frame. This could be the cross of moving averages, major fib retracements, etc. Then WAIT. And sometimes it requires waiting a very long time.

4. Calculating Expected Return

Setting stop loss(SL) and take profit(TP) points are needed to calculate your expected return. The importance of this calculation cannot be overstated, as it forces you to think through your trades and rationalize them. 🧠

Setting stop loss(SL) and take profit(TP) points are needed to calculate your expected return. The importance of this calculation cannot be overstated, as it forces you to think through your trades and rationalize them. 🧠

4a. When you enter a position, you should already know where your SL and TP points are. With these, you can measure your risk/reward ratio. If your SL is -7%, and your TP +21%, then your risk/reward ratio is 3.0. This is a good risk/reward ratio.

4b. If all of your trades are set up this way, and have a ratio above 2.0, then all you need to do is win 50% of your trades. If you take 10 trades, and lose 5 at -7%, and win 5 at +20% or more, you will be net positive overall.

Creating a trading plan and risk management profile that fits your personal financial situation is something that everyone MUST do if they want to make it in this game. If you're just throwing money at the market without a plan, you're giving your money to the ones who have one.

If you found this to be valuable, like and retweet! I hope this reaches as many people as possible, and ultimately saves you money. If you'd like to learn how to become a more confident and informed investor, you can join my Discord TA channel in Defi Dojo. Links in bio. #Groot

• • •

Missing some Tweet in this thread? You can try to

force a refresh