Something that's been on my list to research for a while is @TeamKujira $KUJI. Below is a summary of my research and analysis of it.

#CosmosEcosystem #Altcoin #Kuji #Kujira #Dex #Terra #Liquidation #Analysis #DYOR

#CosmosEcosystem #Altcoin #Kuji #Kujira #Dex #Terra #Liquidation #Analysis #DYOR

Firstly, a disclaimer. After compiling what I needed to see, I bought a small high-risk-high-return $Kuji bag a few days ago as mostly a long term hold. This isn't a shill, it's me "placing my money where my mouth is". Maybe your assessment of the situation will be different.

1. #Kujira is a project that has migrated to its own chain after the #Terra collapse. It's now a sovereign chain, splitting #DeFi offerings into into #dApps which provide order-book, liquidation and staking/governance capabilities.

2. The order book, titled "Fin" is functional and working well. The margin trading is not released yet, but the main functionality is smooth. The main stablecoin in use is @axelarcore's USDC. It'd be nice to see some native IBC stables, eventually.

3. The Liquidation dApp "Orca" will allow users to "liquidate multiple assets across the whole of Cosmos at the click of a button. No bots, no code, no problems.". I like this concept and it has potential. I'd be a huge fan if it can replace MEV bots. ALL MEV IS BAD MMKAY!?

4. The governance/staking dApp is "Blue". Firstly, I like how the UI hides validators and doesn't sort by size - this will be great for decentralisation and I think other projects should take note. The staking mechanics are intertwined with tokenomics and are quite novel.

5. There is no inflation. Users who stake instead receive rewards based on protocol revenue, and those rewards are paid out in a "Basket of crypto" manner 0_o. The problem I see here is that there isn't much of a penalty for not being staked, so the staked percentage may be low

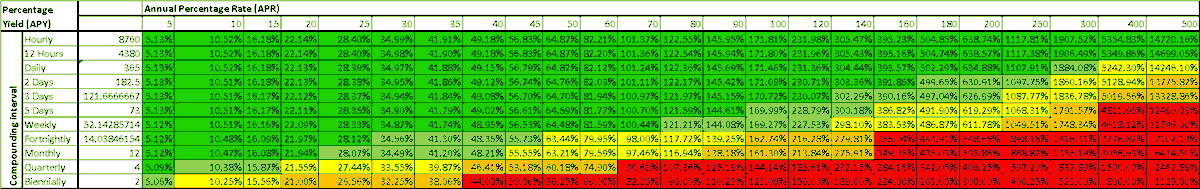

6. The APR for staking is currently very low (0.41%), which is worse than at a fiat bank - however, because there is no inflation it's actually better than other #CosmosEcosystem DEXs. There are still a lot of staked tokens, and I think many of these would be non-retail.

7. Continuing on tokenomics, during the migration from #Terra, for some reason, 30 million community tokens were burnt, meaning that VCs and the team will hold a higher percentage of tokens

9. The vesting schedule is pretty quick too. There are currently ~76mil tokens, with a max of ~120 in Nov'23. That's around 3 mil tokens released a month. Keep in mind that if this was seen as inflation, the equivalent rate would be 47%, which is reasonable and not a red flag.

10. Their roadmap has progressed quickly so far, and these are the next few items on the list. Since they've hit all their other targets, I think it's probable that they will hit these too.

11. The Devs/Team are Anon. I usually don't like investing in anon teams, as it increases the risk of rug pulls many times over. However, looking at their GitHub there are some really well-known Devs that have pitched in, increasing my confidence of this project delivering.

12. Also, it seems like $KUJI could be making a play for its own stablecoin. There's a lot of stables being developed within IBC, so I think the chances of any particular one reaching adoption is slim (only bullish on $SHD which I hold). However, it's a potential extra reward.

13. Price. The price is increasing as $Kuji becomes more known. Maybe it'll drop again, IDK - make your own assessment when to buy in. However, the MC is 54mil - which makes this project relatively cheap compared to $OSMO (497 mil), but much more than $ROWAN (13mil).

14. Alongside the price rising, $Kuji is also currently #5 on @mapofzones by IBC volume, with a steady increase of transactions seen over the past 30 days, meaning it's probably not a one-off pump.

15. The idea that tipped me towards buying $KUJI is that most people invest/gamble with their emotions and KUJI has a following from #Terra that may be emotionally invested and have some loss-aversion from the collapse, meaning $Kuji may not struggle for publicity like other DEXs

16. Upcoming competitors for the order book (and liquidations?) are @SeiNetwork and @dydx. These may be better, only time will tell. However, $KUJI has a decent first-mover advantage. If people get excited about their order-book, then they could pump as much as $OSMO did, which

17. was 1/3 of ATOM's market cap, or an equivilent of $1B (18x) now. That's a maximum and I really don't expect it to reach or overtake $OSMO though (8x).

18. Reminder: be wary of buying during a pump!

https://twitter.com/Cosmodiver/status/1553429358496432129?s=20&t=tvQ9zJMpB70nbg-7lZmBzQ

19. PS, @martyvb2 showed me @BlackWhaleDeFi. It's a community-run market maker for the #Kujira order-book. It looks really interesting, but is outside the scope of this thread (DYOR)

medium.com/@blackwhalemon…

blackwhale.money

medium.com/@blackwhalemon…

blackwhale.money

That's it! This thread is purely my analysis and logic that may help you #DYOR.

If you have gained something from this thread, please follow/like & retweet the first post.

If you have anything you want to discuss, please leave a comment!

If you have gained something from this thread, please follow/like & retweet the first post.

If you have anything you want to discuss, please leave a comment!

PS:

Looks like point #12 was correct:

Looks like point #12 was correct:

https://twitter.com/TeamKujira/status/1556627154238070788?t=9_jb68pdZRwBmg9JbvlmSQ&s=19

@mappum I thought this was a good system - just drawing your attention to it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh