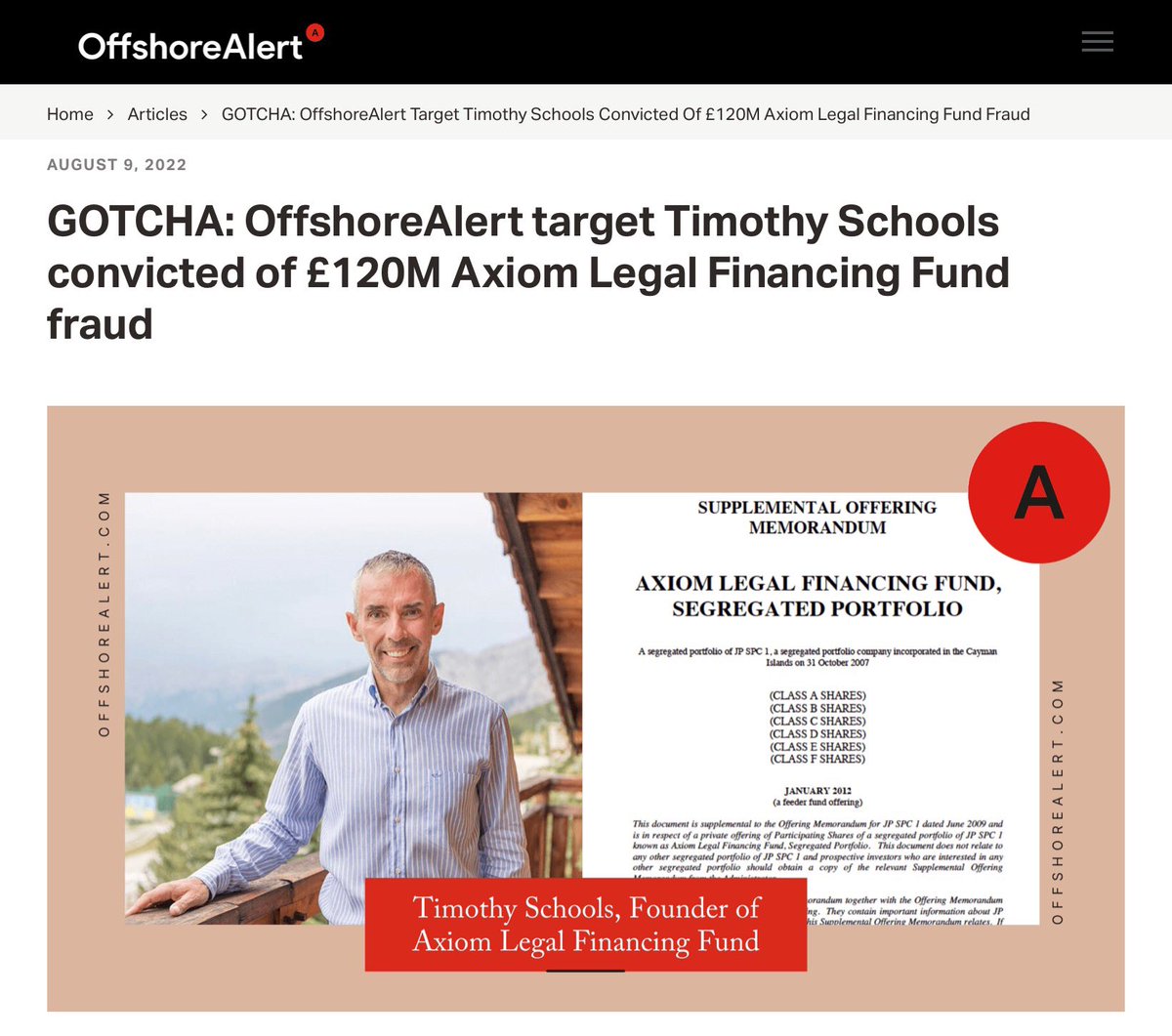

@ArmitageJim @premnsikka - 1/ A corrupt solicitor: ‘Timothy Schools’, who named his firm ‘ATM’ because it was "a cash machine" for litigation awards has been convicted of a notorious #fraud - the £120m #Axiom Legal Financing Fund “Axiom”. Axiom was launched in 2009 as an …

2/ offshore fund (+ its associated ‘fund manager’ - Tangerine Investment Management’ - “#Tangerine”), purportedly providing litigation finance to small UK solicitors firms for low value high volume claims. It was peddled to the UK public & expats widely by a large web of …

3/ @theFCA made men/women & their associated unauthorised cold calling cowboys in the FCA’s SIPPshittery, @TPRgovuk’s pension liberation scams + allegedly ‘wrapped’ (in purportedly ‘insurance bonds’/SIPPs) by the FCA’s ‘Big Fish’ & peddled particularly to older …

https://twitter.com/ianbeckett/status/1535948634587545601

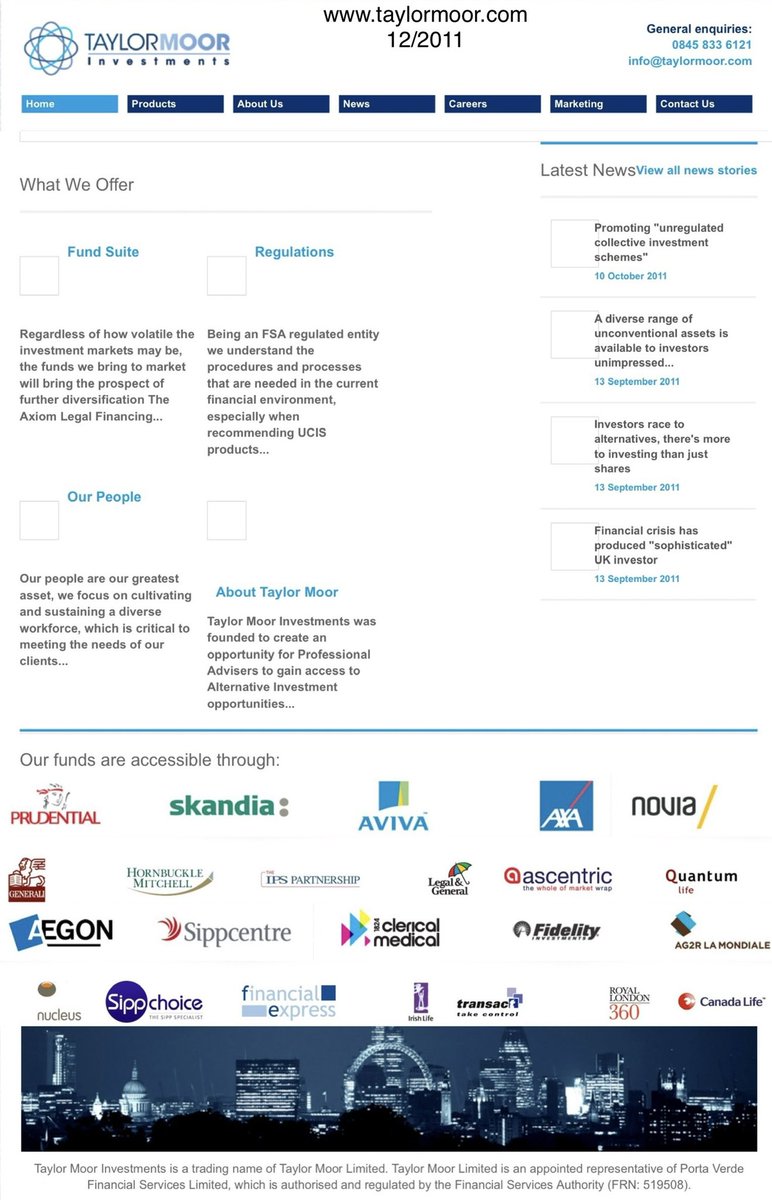

4/ UK residents/expats by FCA made men/women & unregulated cold calling cowboys (incl. notorious offshore #QROPS ops + shady ‘EU passported in’ ops). At the heart of the UK element of the scandal was allegedly an initially unregulated op #TaylorMoor, allegedly run by a duo of …

5/ ‘lead generators’ Alistair Moncrieff & Malcolm Dixon, who allegedly pushed 3 infamous not so little numbers: #Axiom, #Quadris (international-adviser.com/isle-of-man-gr…) & #PATF (Protected Asset TEP Fund plc - maltatoday.com.mt/comment/blogs/…). The FCA’s rotten register of ‘Big Fish’ & commission/…

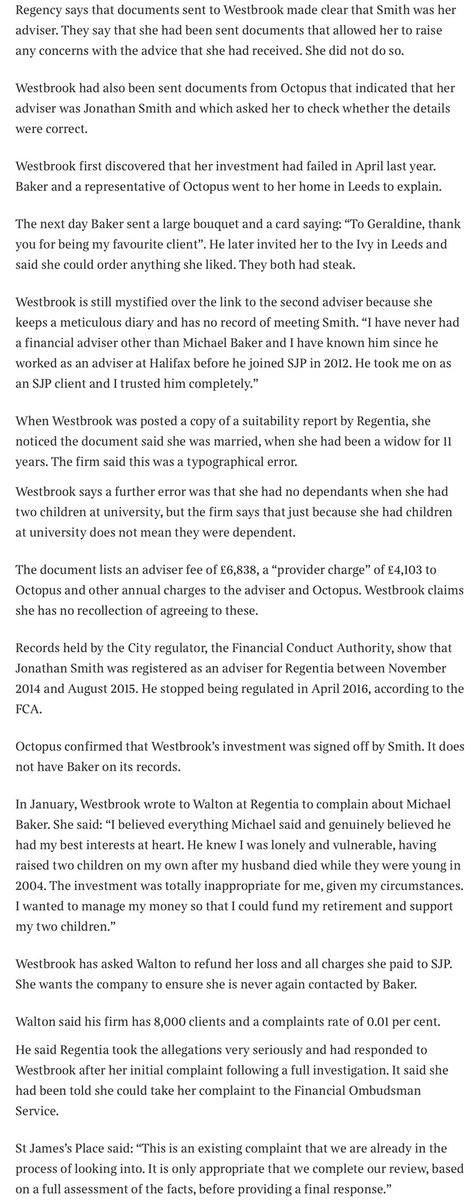

6/ fee greedy IFA’s were only too happy to ‘wrap’ +/or peddle these to the public. In mid 2011 Taylor Moor was authorised via the regulatory cat-flap (A.R.) by one of the FCA’s notorious ‘regulatory hotels’: Porta Verde Financial Services Ltd (given a pitiful fine “for its …

7/ A.R.’s unacceptable high pressure **Insurance** sales practices” as it’s honchos claimed poverty). Taylor Moor’s 2012 website proudly outed the FCA’s ‘Big Fish’, allegedly involved in ‘wrapping’ its ‘product’ (incl. Axiom). As the Axiom shit hit the FCA’s fan …

8/ in late 2012 after being exposed by #OffshoreAlert, the FCA blanketed the whole scandal in a ‘fog’, including Taylor Moor, which Offshore Alert alleged received ~ £1.8m in commissions from distributing the ~£120m Axiom fund. Out of this ‘FCA fog’ strode …

9/ messrs Dixon & Moncrieff to their subsequent ops. Malcolm Dixon would allegedly have a role in the #DolphinTrust (aka #GPG) $billion scandal (drive.google.com/file/d/1AEDyYd…). Alistair Moncrieff would re-up as a FCA made man amidst a bevy of lead, SEO & claims data ops …

10/ to star in a rather strange purported FCA auth insurance portal op: Life & General Ltd T/A #BeProtectedInsurance (imploded with Israeli #adtech op #MediaForce as an enormous creditor). Next on the FCA auth agenda: evaporating personal insolvency (IVA) portal ops ..

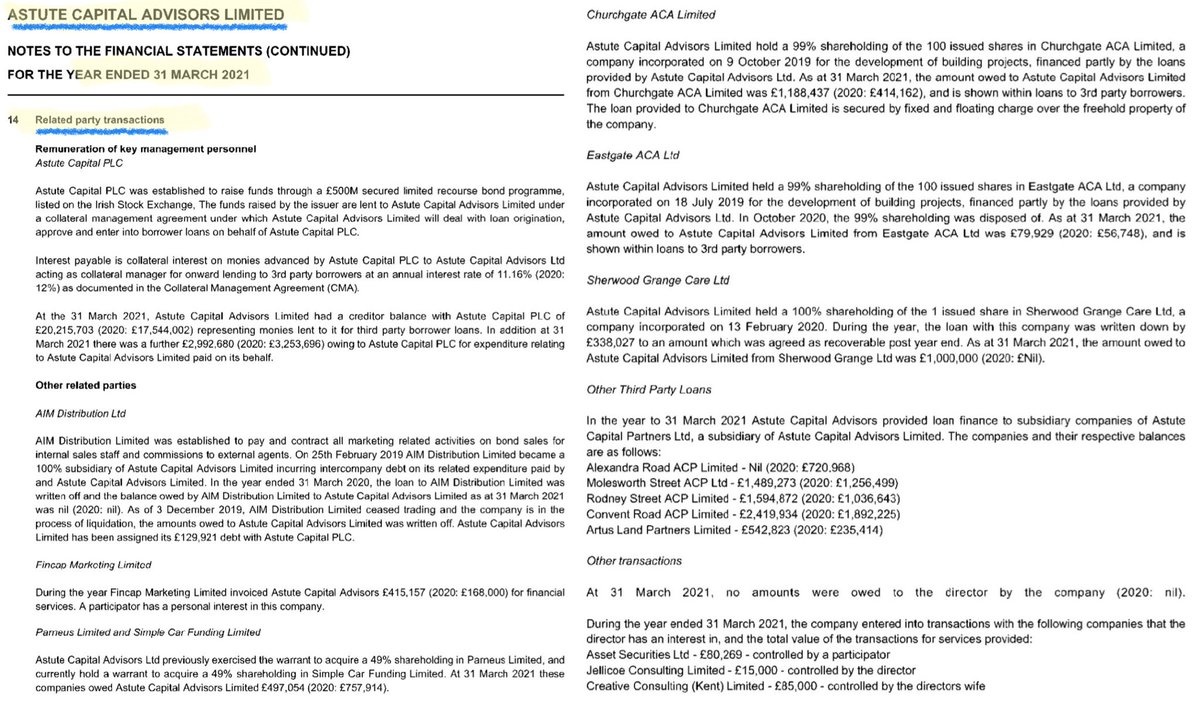

11/ Valmont Financial Ltd (Valmont Ventures Ltd) & Tomorrows MG Ltd (T/A National Debt Help etc). Meanwhile, with the #AstuteCapital PLC op it was time to play the FCA’s so called ‘listed bond’ mayhem (mirror.co.uk/news/thats-ric…), the plans for another bond (Credit Assets PLC) …

12/ allegedly evaporated with the fallout from the FCA being under a firestorm for turning a blind eye to ‘mini-bond mayhem’. Alistair Moncrieff’s latest ops: the purported whiskey cask investment op tango’ing twosome of ClicksPay Ltd & Blackford Casks Ltd doing the old …

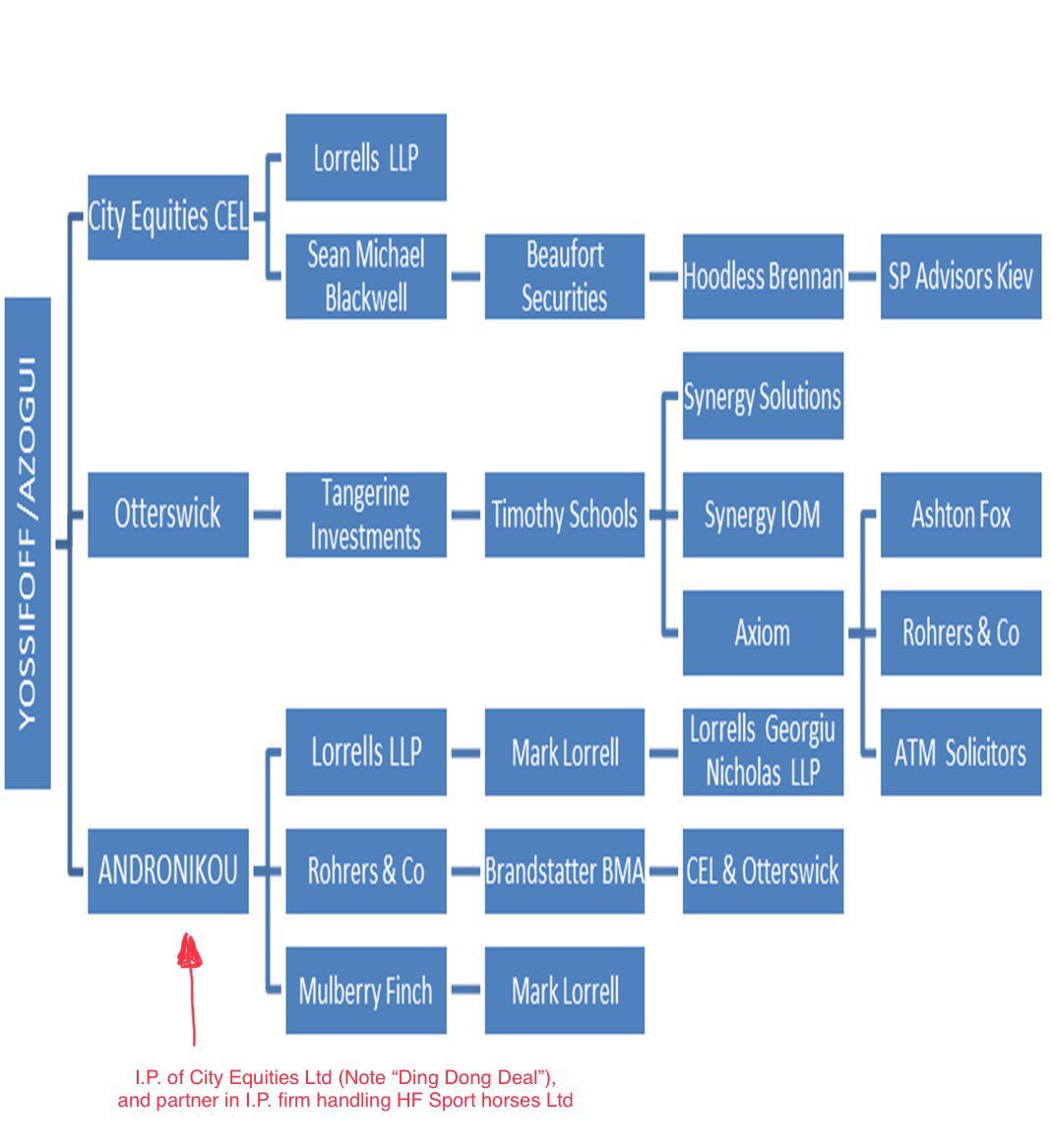

13/ ‘common name switcheroo’. Back to where we started, in the Caymans with Axiom, Tangerine & Timothy Schools. We’ve been here before + met allegedly #LCF mini-bond scandal ‘endgame’ player Whyke & his wingman: the notorious Israeli lawyer Yoram Yossifoff, allegedly linked …

https://twitter.com/ianbeckett/status/1297884493144035328

14/ to the Israeli/Russian underworld (

https://twitter.com/ianbeckett/status/1134527241742929920), formerly owner of the Park Lane Club in Londonski (

https://twitter.com/ianbeckett/status/1524789794009661440) + entwined with #CityEquities & the ‘ding dong deal’. Those looking closely at the alleged CityEquities/Axiom corporate interactions …

15/ will note a familiar face: ‘Brandstätter BMA’, the Austrian law firm of Juergen Brandstätter which we also saw in the gestation of the FCA’s ever increasingly notorious #emoney op #Viola & it’s associated ops. LCF’s Whyke was formerly a partner of ICAEW firm …

https://twitter.com/ianbeckett/status/1502948427143032836

16/ #ClarksonHyde: (A) auditors of the notorious #AssetLife minibond scandal (entwined with #LCF & #AngloWealth minibond scandals), the Knifton clan’s ops & also auditors to insolvent LCF ‘borrower’ op ‘Lakeview UK Investments plc’. (B) some of whose partners were allegedly …

17/ linked to the gestation of the ‘Knifton/Seakens carbon credit scheme’ (Knifton Jnr & LCF linked Paul Seakens were subsequently shut down) + on and on it goes. When we writeup the wider web of the #Safehands scandal, we’ll come across another so called ‘litigation finance’ op.

https://twitter.com/ianbeckett/status/1540342334814126081

18/18 As always, the blind eyed financial regulator (@theFCA) & its defunct predecessor (#FSA) didn’t see a thing, hear a thing or do much about anything at all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh