Why Total-Value-Locked is a nonsense metric that will make you poor.

- Thread Time 🧵-

#cardano #ada $ada #CardanoVasil

- Thread Time 🧵-

#cardano #ada $ada #CardanoVasil

1/ Intro

This month, 2 Solana developer brothers admitted to pretending to be 11 different devs, who jointly created Dapps that accounted for $7.5bn in value.

The catch? It was all fake. Every single dollar was counted SEVERAL times over.

coindesk.com/layer2/2022/08…

This month, 2 Solana developer brothers admitted to pretending to be 11 different devs, who jointly created Dapps that accounted for $7.5bn in value.

The catch? It was all fake. Every single dollar was counted SEVERAL times over.

coindesk.com/layer2/2022/08…

2/ Identity Crisis

This event made many investors wonder whether commonly used investing metrics are manipulable. Chief among them is Total-Value-Locked (TVL), which many investors thought was the key to finding valuable protocols in the DeFi space

Does TVL have any value?

This event made many investors wonder whether commonly used investing metrics are manipulable. Chief among them is Total-Value-Locked (TVL), which many investors thought was the key to finding valuable protocols in the DeFi space

Does TVL have any value?

3/ TVL

This metric is meant to represent the Total Value Locked in a protocol that cannot be easily liquidated or moved due to lockup conditions. The higher this metric, the more trust, network effects and positive momentum there is for a project... Or so the theory goes.

This metric is meant to represent the Total Value Locked in a protocol that cannot be easily liquidated or moved due to lockup conditions. The higher this metric, the more trust, network effects and positive momentum there is for a project... Or so the theory goes.

4/ Valuating Digital Assets

Tech corps are difficult to price, as growth is nonlinear and direct costs are more or less fixed (Twitter has similar infrastructure costs servicing 1m people vs 1bn). Same happens with crypto, thus investors create new metrics for estimating value.

Tech corps are difficult to price, as growth is nonlinear and direct costs are more or less fixed (Twitter has similar infrastructure costs servicing 1m people vs 1bn). Same happens with crypto, thus investors create new metrics for estimating value.

5/ Gaming the System

As we learned during the Dotcom era, the issue is that when startups see investors using a certain valuation metric, they restructure their business to inflate their own metric.

Thus the number not only becomes unusable, but dangerous and misleading.

As we learned during the Dotcom era, the issue is that when startups see investors using a certain valuation metric, they restructure their business to inflate their own metric.

Thus the number not only becomes unusable, but dangerous and misleading.

6/ The Dangers of TVL

TVL is an attempt to measure popularity and community commitment. But since the same dollars can be ‘folded’ into themselves, and count as more $, it gives a skewed picture of how much adoption there is. TVL might even end up being a sign of inefficiency.

TVL is an attempt to measure popularity and community commitment. But since the same dollars can be ‘folded’ into themselves, and count as more $, it gives a skewed picture of how much adoption there is. TVL might even end up being a sign of inefficiency.

7/ High TVL = Inefficiency

Imagine you have a protocol that has $1bn in daily trading volume, but a TVL of $100bn. That is not efficient, as it implies that 99% of the capital is underutilized. High TVL, without high trading volume, might just imply bloat, NOT desirability.

Imagine you have a protocol that has $1bn in daily trading volume, but a TVL of $100bn. That is not efficient, as it implies that 99% of the capital is underutilized. High TVL, without high trading volume, might just imply bloat, NOT desirability.

8/ TVL Was Mainly For DEXs

In traditional DEXs, where you lock your assets in a jointly-owned smart contract, you need large liquidity. Otherwise, minor withdrawals of any token cause massive slippage - difference between the expected and final execution price.

In traditional DEXs, where you lock your assets in a jointly-owned smart contract, you need large liquidity. Otherwise, minor withdrawals of any token cause massive slippage - difference between the expected and final execution price.

9/ Next-Generation DEXs

In the future, when liquidity will be modeled efficiently, and users don’t need to pool their assets, the goal will be the opposite - a low TVL that serves a volume far higher than itself. This will be the era of hyper-efficient DeFi.

In the future, when liquidity will be modeled efficiently, and users don’t need to pool their assets, the goal will be the opposite - a low TVL that serves a volume far higher than itself. This will be the era of hyper-efficient DeFi.

10/ Why TVL Got Popular

DEXs were the first large-scale smart contract projects, so their operational standards framed our understanding of the rest of the DeFi industry. That said, these early assumptions have become increasingly outdated and incentivize unhealthy protocols.

DEXs were the first large-scale smart contract projects, so their operational standards framed our understanding of the rest of the DeFi industry. That said, these early assumptions have become increasingly outdated and incentivize unhealthy protocols.

11/ Going to the LUNA

A perfect example is LUNA where a high initial TVL increased its coin value, allowing its treasury to purchase more BTC, increasing its TVL and then token value. Every TVL increase weakened the protocol, as people wondered how this was at all sustainable

A perfect example is LUNA where a high initial TVL increased its coin value, allowing its treasury to purchase more BTC, increasing its TVL and then token value. Every TVL increase weakened the protocol, as people wondered how this was at all sustainable

12/ ADA & TVL

ADA is often mocked for its low TVL, supposedly making it a poor investment. Yet this utilitarian assessment completely ignores user experience.

Are you going to place your money somewhere where it's LOCKED for months, or instantly available?

ADA is often mocked for its low TVL, supposedly making it a poor investment. Yet this utilitarian assessment completely ignores user experience.

Are you going to place your money somewhere where it's LOCKED for months, or instantly available?

13/ Suitcase Logic

If you put $1m into a $5 suitcase, the bag is only worth $1m + $5 until you take the million dollars

If you want the suitcase to increase in value, then you must increase people's demand for the bag, not just hope some millionaire places their net worth there

If you put $1m into a $5 suitcase, the bag is only worth $1m + $5 until you take the million dollars

If you want the suitcase to increase in value, then you must increase people's demand for the bag, not just hope some millionaire places their net worth there

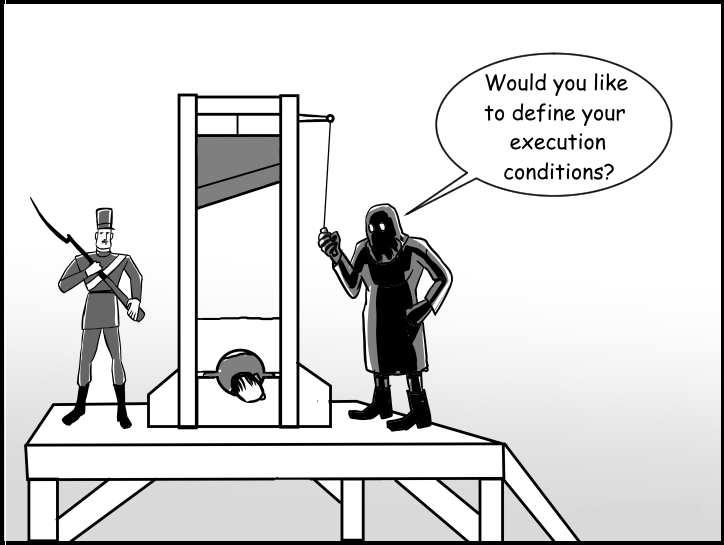

14/ Kidnapped Value

We should not have a valuation metric based on Stockholm Syndrome, where a protocol is only valuable in direct proportion to how much value it can kidnap from its users.

Not only is this capital inefficient, but misaligns the desires of users and developers.

We should not have a valuation metric based on Stockholm Syndrome, where a protocol is only valuable in direct proportion to how much value it can kidnap from its users.

Not only is this capital inefficient, but misaligns the desires of users and developers.

15/ Blockchains Survive Via Community

As most crypto projects are open source, projects live and die by community adoption and network effects gained from their widespread use. Any honest metric should take into account value created for their users, not just locked value.

As most crypto projects are open source, projects live and die by community adoption and network effects gained from their widespread use. Any honest metric should take into account value created for their users, not just locked value.

16/ What Even is Locked?

Due to the fact that TVL isn’t based on sound principles, and grew organically, everyone has a different definition. Sites will arbitrarily decide not to include certain “locked value” but others do. We should standardize what “locking value” even means.

Due to the fact that TVL isn’t based on sound principles, and grew organically, everyone has a different definition. Sites will arbitrarily decide not to include certain “locked value” but others do. We should standardize what “locking value” even means.

17/ Proposed Solution

TVL is an outdated and AMM-specific metric. We need metrics that measure intrinsic value. Only by measuring the intrinsic value we can estimate what the suitcase is really worth.

TVL is an outdated and AMM-specific metric. We need metrics that measure intrinsic value. Only by measuring the intrinsic value we can estimate what the suitcase is really worth.

18/ Useful Metrics

For instance, trading platforms should have low slippage, deep liquidity (especially around the spread aka the current price), and high transaction volume (being popular).

For instance, trading platforms should have low slippage, deep liquidity (especially around the spread aka the current price), and high transaction volume (being popular).

19/ Shadows and Dust

The chief factor that we ought to consider is the utility that a protocol provides and how effectively it does so - all else is secondary and manipulable. It’s not to say that we should never consider financial metrics, but the map is not the territory.

The chief factor that we ought to consider is the utility that a protocol provides and how effectively it does so - all else is secondary and manipulable. It’s not to say that we should never consider financial metrics, but the map is not the territory.

20/ Conclusion

TVL is a metric we invented to measure value in an evolving industry. However, as we saw in the case of the Solana brothers, TVL has failed to account for the complexity of crypto - it's nonsense!

It's time to put TVL in a drawer and lock it there for good.

TVL is a metric we invented to measure value in an evolving industry. However, as we saw in the case of the Solana brothers, TVL has failed to account for the complexity of crypto - it's nonsense!

It's time to put TVL in a drawer and lock it there for good.

If you enjoyed this thread, please like, retweet, and subscribe to

@CardanoMaladex 🧵

Make sure to check out our ongoing #TradFiTales series too:

blog.maladex.com/tradfi-tales-c…

@CardanoMaladex 🧵

Make sure to check out our ongoing #TradFiTales series too:

blog.maladex.com/tradfi-tales-c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh