$DJED MECHANISM

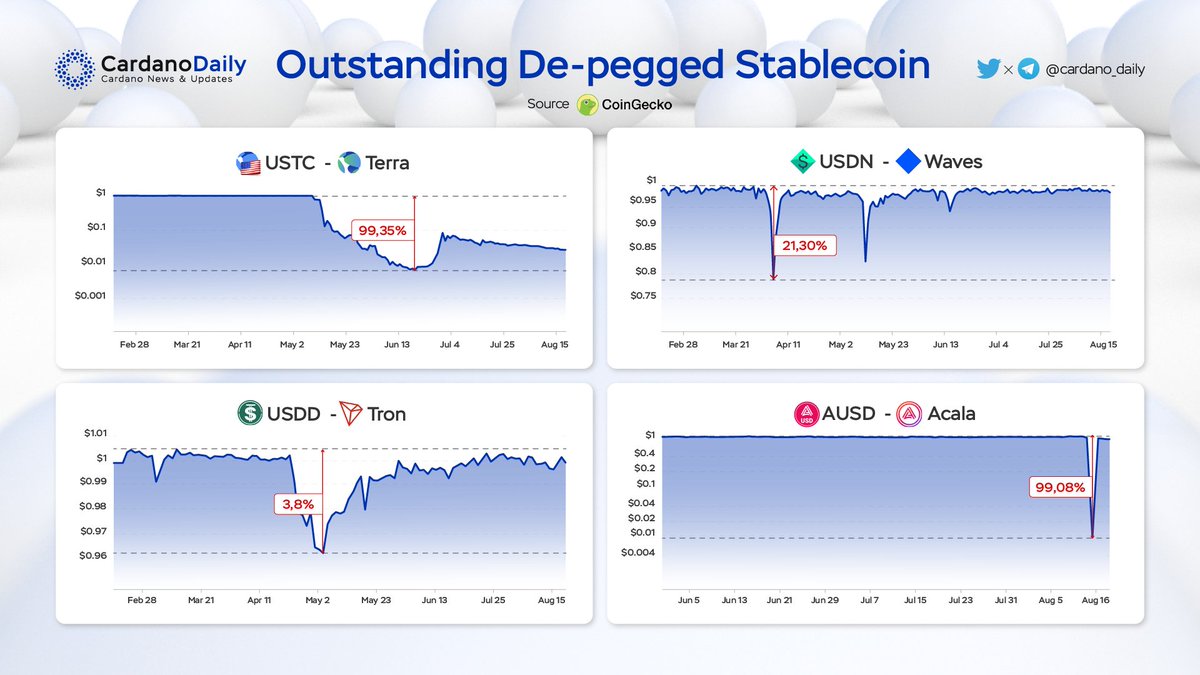

Yesterday, we had an exposure to the de-peg stablecoin on the crypto market. Before diving any deeper, let’s just get to understand our ecosystem’s stablecoin - $DJED @DjedStablecoin

#mechanism $DJED #stablecoin

Yesterday, we had an exposure to the de-peg stablecoin on the crypto market. Before diving any deeper, let’s just get to understand our ecosystem’s stablecoin - $DJED @DjedStablecoin

#mechanism $DJED #stablecoin

@DjedStablecoin 1. Djed is a crypto-backed algorithmic stablecoin contract that acts as an autonomous bank. It operates by keeping a reserve of base coins, and minting and burning stablecoins and reserve coins.

#mechanism $DJED #stablecoin

#mechanism $DJED #stablecoin

@DjedStablecoin 2. The contract maintains the peg of stablecoins to a target price by buying and selling stablecoins, using the reserve, and charging fees, which accumulate in the reserve

#mechanism $DJED #stablecoin

#mechanism $DJED #stablecoin

@DjedStablecoin 3. The operating mechanism is as simple as other algo-stablecoin, always ensuring $1 worth of $DJED can be exchanged for $1 worth of $ADA by minting and burning $DJED.

However, the mechanism to maintain its peg is another story to understand.

#mechanism $DJED #stablecoin

However, the mechanism to maintain its peg is another story to understand.

#mechanism $DJED #stablecoin

@DjedStablecoin 4. $$DJED’s algorithm is based on a collateral ratio in the range of 400%-800% for $DJED and $Shen. $ADA prices fluctuations are offset by Shen, covering shortfalls and guaranteeing the collateralization rate.

#mechanism $DJED #stablecoin

#mechanism $DJED #stablecoin

@DjedStablecoin 5. The ADA reserve pool is not managed by market makers, but by users who mint the $Shen reserve coin and add $ADA to the pool. This provides a decentralized aspect to the $DJED mechanism. $Shen holders are incentivized to provide liquidity through fees.

#mechanism #stablecoin

#mechanism #stablecoin

@DjedStablecoin 6. As $DJED can be over collateralized (up to 8x), the risk of $DJED being unpegged decreases. This means that for every 1 $DJED minted, there are $4-$8 worth of $SHEN in the reserve pool

#mechanism $DJED #stablecoin

#mechanism $DJED #stablecoin

@DjedStablecoin 7. If the ratio falls below 400%, users will not be able to mint $DJED, and $SHEN holders won’t be able to burn their $SHEN.

If the ratio exceeds beyond 800% users will not be able to mint more $SHEN.

#mechanism $DJED #stablecoin

If the ratio exceeds beyond 800% users will not be able to mint more $SHEN.

#mechanism $DJED #stablecoin

@DjedStablecoin 8. In the event of a market dip there is a security blanket for $DJED holders that ensures its sustainability.

#mechanism $DJED #stablecoin

#mechanism $DJED #stablecoin

@DjedStablecoin 9. The minting of new $SHEN is also supervised in order to maintain the balances stabilized, and ensure there will always be enough ADA in the pool to provide a dollar equivalent value to the $DJED when burning it.

#mechanism $DJED #stablecoin

#mechanism $DJED #stablecoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh