Intraday trading O-H-L Strategy

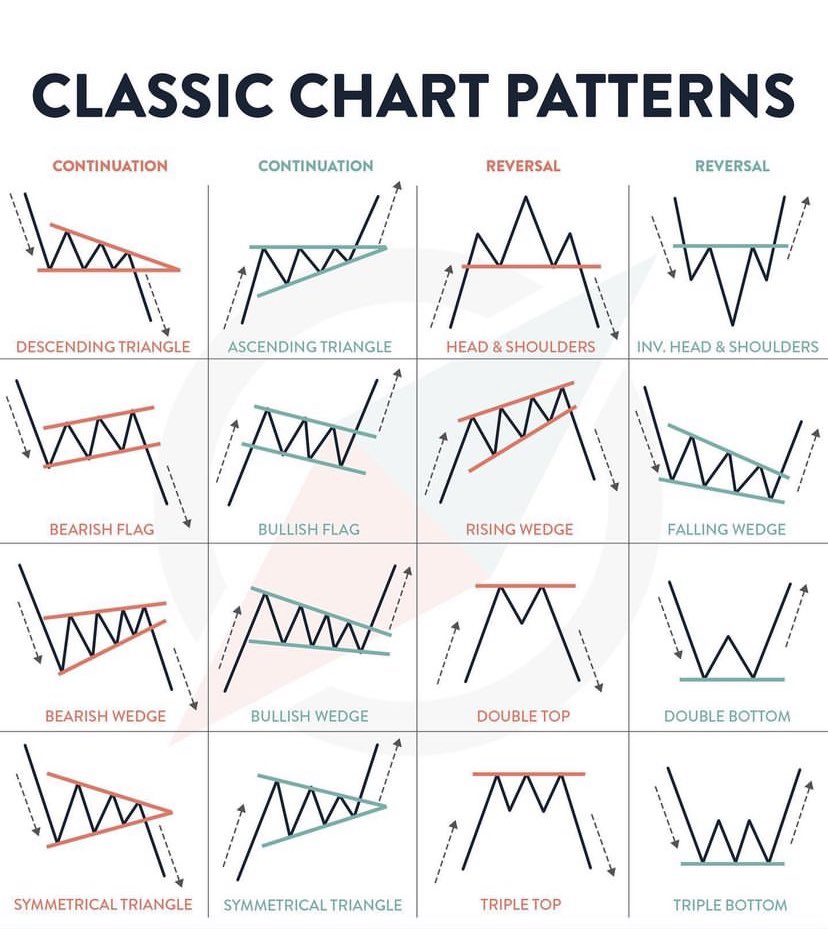

This is a very popular Intraday Strategy with good Accuracy. In this strategy, a Buy signal is generated when a Stock or Index has same value for Open and Low, while a Sell signal is generated when it has same value for Open & High @valuelevels

This is a very popular Intraday Strategy with good Accuracy. In this strategy, a Buy signal is generated when a Stock or Index has same value for Open and Low, while a Sell signal is generated when it has same value for Open & High @valuelevels

This is Tried and Tasted Strategy. Traders should follow 100% disciplined in executing those strategies with Risk and Money management Rules.

Traders can keep the Stop loss at 1% from Entry level or Previous Days High or Low levels.

Traders can keep the Stop loss at 1% from Entry level or Previous Days High or Low levels.

Take ENTRY after 9.30 AM

Check Stocks where Open=High OR Open=Low (before 9.30 AM)

RULE: Open=High means SELL AND Open=Low means BUY

#StocksToTrade

#stockstowatch #StockMarket

#Nifty #sensex #banknifty

#TechnicalTrades

Check Stocks where Open=High OR Open=Low (before 9.30 AM)

RULE: Open=High means SELL AND Open=Low means BUY

#StocksToTrade

#stockstowatch #StockMarket

#Nifty #sensex #banknifty

#TechnicalTrades

Buy Stocks where Open=Low above the High of 1st 15 minutes Candle

Sell Stocks Where Open=High Below the Low of 1st 15 minutes Candle.

Sell Stocks Where Open=High Below the Low of 1st 15 minutes Candle.

Traders can use a time frame of 5 to 15 minutes.

Traders can Book Profits As per their risk appetite or End of the day

For best results practice/paper trade this strategy for 30 trading sessions first

Get live free scanners

valuelevels.in

Traders can Book Profits As per their risk appetite or End of the day

For best results practice/paper trade this strategy for 30 trading sessions first

Get live free scanners

valuelevels.in

For trading ideas with @valuelevels Join Free Group Chat t.me/TRADEVL

• • •

Missing some Tweet in this thread? You can try to

force a refresh