#GM!

1/ #Atlantic Straddles is the latest options product from @dopex_io. Compared to normal options, Atlantic has many advantages. Join us to dive deeper into the bottom of the Atlantic.

#DeFi #Cryptocurrency #Ethereum #Arbitrum #Options #Trading #Dopex $ETH $DPX $rDPX

1/ #Atlantic Straddles is the latest options product from @dopex_io. Compared to normal options, Atlantic has many advantages. Join us to dive deeper into the bottom of the Atlantic.

#DeFi #Cryptocurrency #Ethereum #Arbitrum #Options #Trading #Dopex $ETH $DPX $rDPX

2/ This thread has received generous inputs, thanks to @tztokchad and a superb breakdown video from @The_Babylonians!

@Tetranode

@witherblock

@SalomonCrypto

@RNR_0

@DAOJonesOptions

@PlutusDAO_io

@cobie

@0xsaitama_

@DeFi_Dad

@ethersole

@TheCryptoDog

@TaikiMaeda2

@Tetranode

@witherblock

@SalomonCrypto

@RNR_0

@DAOJonesOptions

@PlutusDAO_io

@cobie

@0xsaitama_

@DeFi_Dad

@ethersole

@TheCryptoDog

@TaikiMaeda2

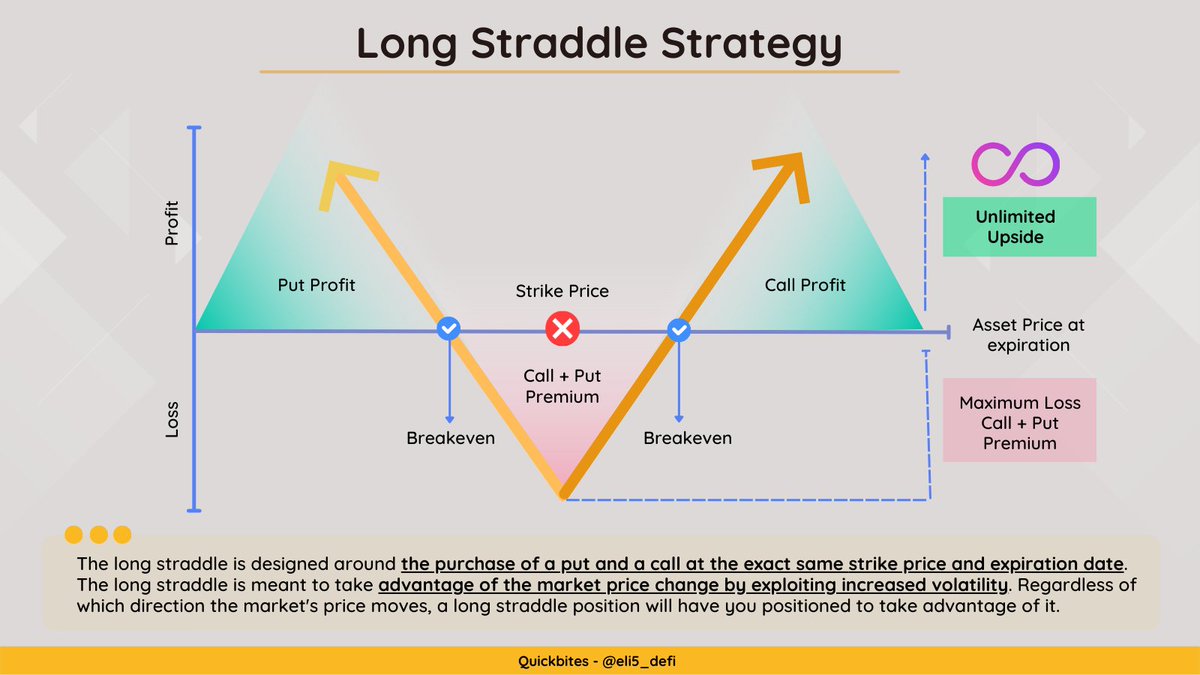

3/ A #straddle is a neutral #options strategy that involves simultaneously buying both a put option and a call option for the underlying asset. Investors employ a straddle when they anticipate a significant move but are unsure about whether the price will move up or down.

4/ The long #straddle is designed around the purchase of a put and a call at the exact same strike price. The long straddle is meant to take advantage of the market change by exploiting increased volatility regardless of which direction the market's price moves.

5/ In short #straddle, instead of purchasing a put and a call, a put and a call are sold in order to generate income from the #premiums. The trader only thrives when a short straddle is in a market with little or no volatility.

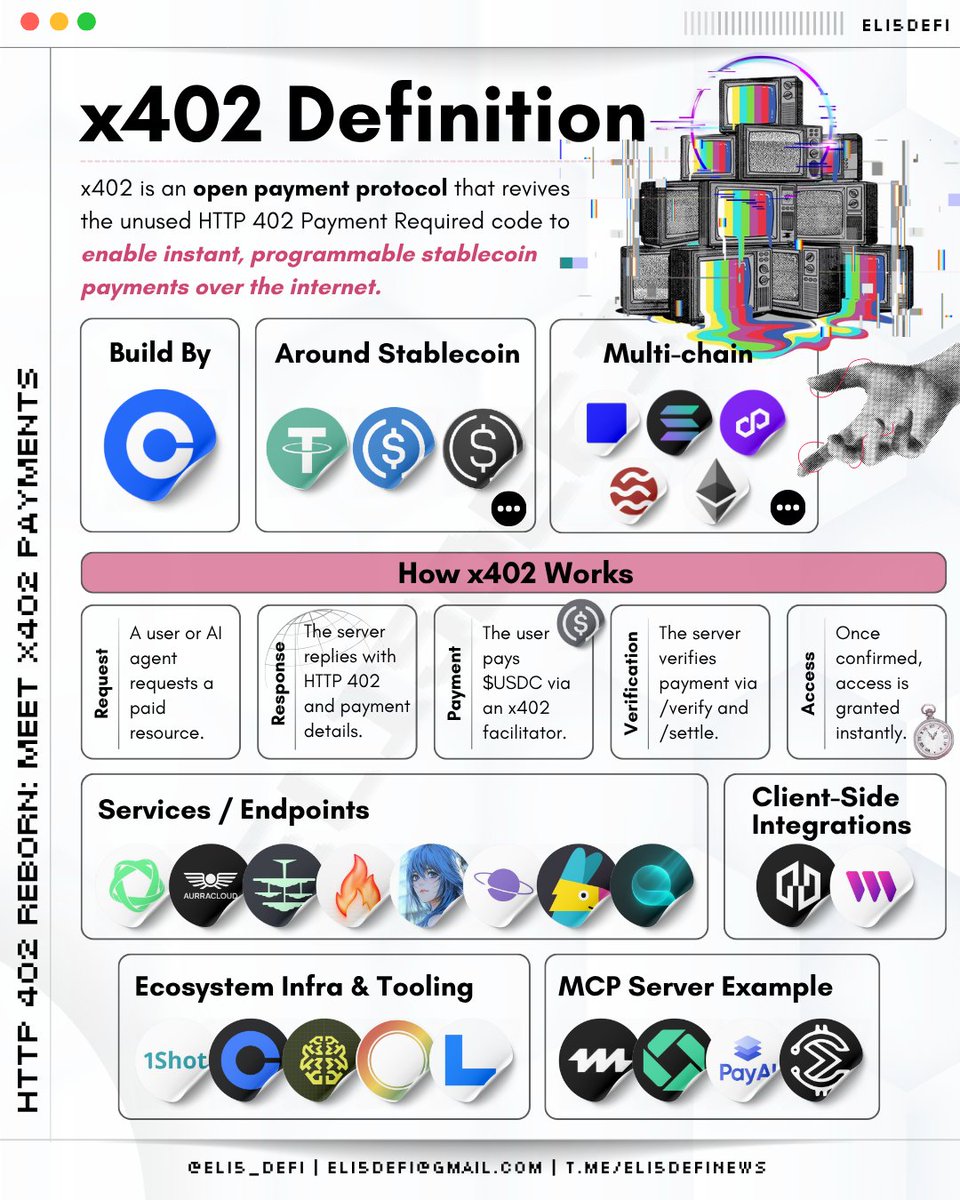

6/ #Atlantic Options is the latest product from the @dopex_io team to bring the straddles strategy on-chain but with designs that will minimize the risks for both the writers and the buyers. This strategy also enables the composability of underlying assets which previously locked

7/ For the buyer of the option, @dopex_io Atlantic is similar to the long #straddle strategy. The buyers will be in profit if the market is volatile (regardless of the direction) and loss will incur if the price goes sideways.

8/ Different from the conventional short straddle strategy, @dopex_io Atlantic uses a long spot as a 'Call' substitute to hedge the risk. When the price decreases and options expired, the writer is not at complete loss but instead will be ending up with USDC worth of spot assets

9/ As the writer only faces loss when the price is moving down, several hedging strategies can be utilized by the writer:

- Buying Puts options in @dopex_io

- Opening short position in perpetual like in @GMX_IO but require more active risk management

$rDPX $DPX $GMX $ETH

- Buying Puts options in @dopex_io

- Opening short position in perpetual like in @GMX_IO but require more active risk management

$rDPX $DPX $GMX $ETH

10/ Full documentation of @dopex_io Atlantic's Options can be found here:

- blog.dopex.io/articles/dopex…

- blog.dopex.io/articles/intro…

- blog.dopex.io/articles/dopex…

- blog.dopex.io/articles/dopex…

- blog.dopex.io/articles/intro…

- blog.dopex.io/articles/dopex…

11/ Credit for the amazing video breakdown from @The_Babylonians can be found on his YouTube channel below:

12/ Shout-out to the amazing CT educator below:

@SalomonCrypto

@blocmatesdotcom

@shivsakhuja

@rektdiomedes

@knowerofmarkets

@rektdiomedes

@BarryFried1

@0xHamz

@The_ReadingApe

@VirtualKenji

@ManoppoMarco

@tanoeth

@Storgan_ManleyX

@SalomonCrypto

@blocmatesdotcom

@shivsakhuja

@rektdiomedes

@knowerofmarkets

@rektdiomedes

@BarryFried1

@0xHamz

@The_ReadingApe

@VirtualKenji

@ManoppoMarco

@tanoeth

@Storgan_ManleyX

13/ Like our thread and want to hedge your writer position in perps? Say no more, you can use our #GMX referral link for 10% trading discount:

gmx.io/#/?ref=eli5defi

gmx.io/#/?ref=eli5defi

• • •

Missing some Tweet in this thread? You can try to

force a refresh