1/3 HFs/MM Big Banks have been doing this to Many companies. Naked short them driving price action down, by creating synthetics with the options Chain, then using #darkpool sourcery to re package and send them offshore... They continue this cycle until a company is driven to Zero

Good Companies have been destroyed.

Those who Naked Shorted now don't have to worry about any of those FTDS that were Created, the Data Trail goes Dark. We bought into #AMC at 1$ Saving it was Dumb Luck.

🏴☠️We basically stumbled upon the Largest Financial Scam In All of History

Those who Naked Shorted now don't have to worry about any of those FTDS that were Created, the Data Trail goes Dark. We bought into #AMC at 1$ Saving it was Dumb Luck.

🏴☠️We basically stumbled upon the Largest Financial Scam In All of History

3/4 🦋The SHFs/MM/Big Banks Now have No way to Hide Those Billions of #AMC FTDS

-The Price isn't going to Zero, they know it, like I said 2 years ago there isnt Supply & Demand, Buying Pressure has been Swallowed & thrown into a Black Hole Over-Seas... We Now know Exactly how🏴☠️

-The Price isn't going to Zero, they know it, like I said 2 years ago there isnt Supply & Demand, Buying Pressure has been Swallowed & thrown into a Black Hole Over-Seas... We Now know Exactly how🏴☠️

I don't do the Trust me Bro Bullshit, I will be Writing a 🧵 That Shows Exactly How the 1% Have been Fu©King us, how Everything is Connected... How #AMC was Naked Shorted beginning 2016-2017, then as C-19 Hit The Drop to 1$(Smoke & 🪞) Plan to Destroy $AMC It's all Connected🌐🏴☠️

(1/10) (Intro/Preview Thread) 🏴☠️Everything You Need to Know, & Not Know...

🧵The☀️Never Sleeps on Crooked Elites 🗡️

#AMC was a🎯Prior to 2017...The SHFS/MM/Big Banks #Citadel began🩳 #Nakedshorting In Q4 2016

@AMCbiggums @BossBlunts1 @StonkVision @cvpayne @MickeyTPaulson

🧵The☀️Never Sleeps on Crooked Elites 🗡️

#AMC was a🎯Prior to 2017...The SHFS/MM/Big Banks #Citadel began🩳 #Nakedshorting In Q4 2016

@AMCbiggums @BossBlunts1 @StonkVision @cvpayne @MickeyTPaulson

(3/10)

"Tricia Rothschild"

-I served both retail investors and institutions who were keen to use technology to reduce friction and improve outcomes. As the Chief Product Officer and Co-Head of Global Markets at Morningstar-for 26 Yrs... Then Hired as President Apex Clearing🏴☠️

"Tricia Rothschild"

-I served both retail investors and institutions who were keen to use technology to reduce friction and improve outcomes. As the Chief Product Officer and Co-Head of Global Markets at Morningstar-for 26 Yrs... Then Hired as President Apex Clearing🏴☠️

(4/10) The Roths Run the IMF 🏦 Bank As well as the 🌎Bank... Info on it Short 🧵👇

https://twitter.com/ApeAverage/status/1498012998165745664?s=20&t=pppZXNnIu3X6zZGXpujiSw

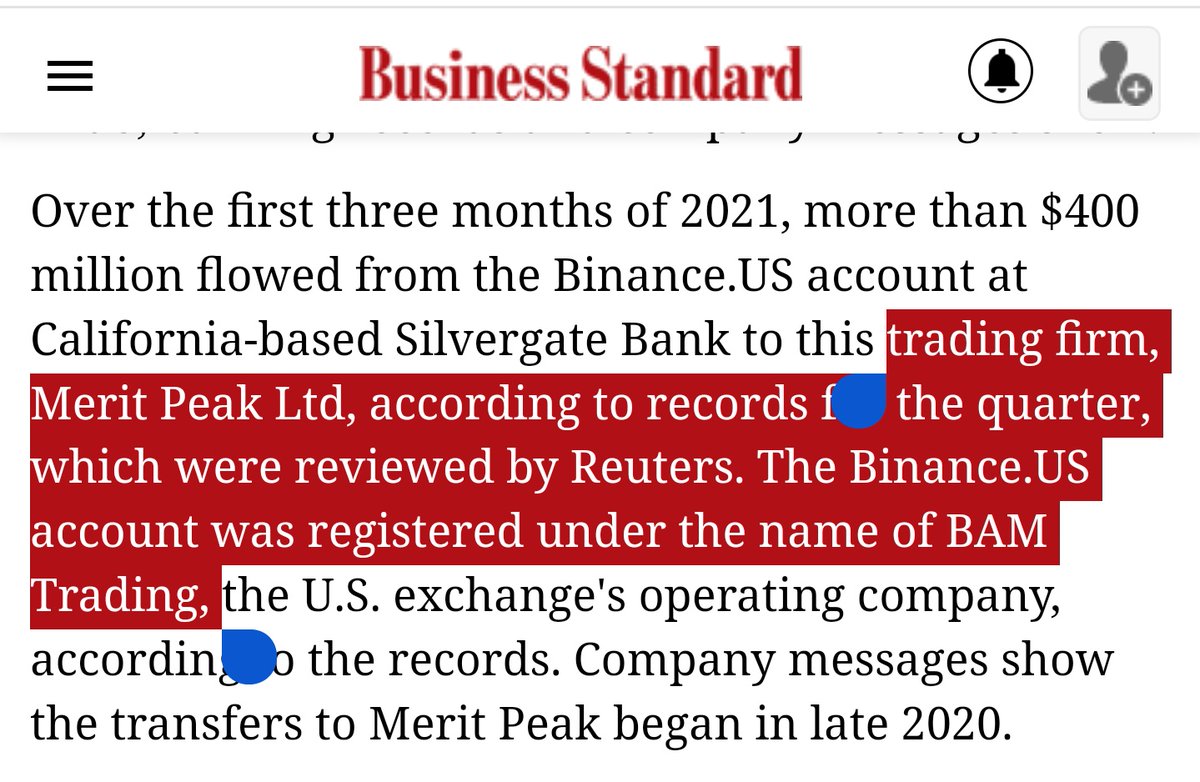

(5/10) LIQUIDITY CRISIS 👇Naked Short #AMC before Covid Drop Ended up getting #Citadel & Many others in a Hell of a Mess.

Read👇

Read👇

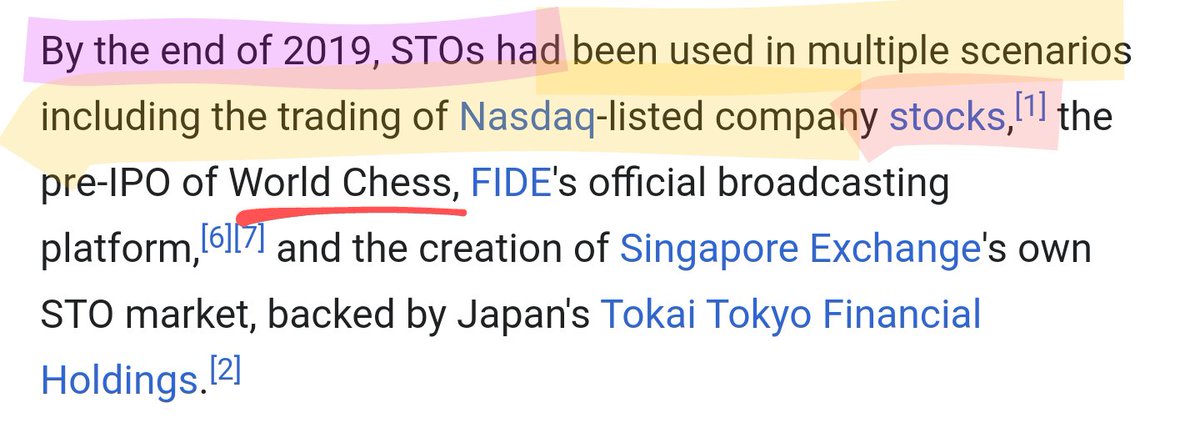

(6/10) 2019-2022

-Ipos Releases Exponential(liquid grab)

- #Crypto & how it has been Utilized, Mass Adopted by the 1% Knowing Decentralization was the Cure to this Broken Market... They knew they had to get their hands on that before a system where they don't control takes over

-Ipos Releases Exponential(liquid grab)

- #Crypto & how it has been Utilized, Mass Adopted by the 1% Knowing Decentralization was the Cure to this Broken Market... They knew they had to get their hands on that before a system where they don't control takes over

(7/10) Housing Market has Topped & is on its way 📉🔪 Mortgage Rates % Increasing, Home Values not dropping anywhere near enough to be equal to the Mortgage Rate Increase... Many sellers, Bad Outlook for the Economy, Few Buyers, HF also used Real Estate to Launder $👇

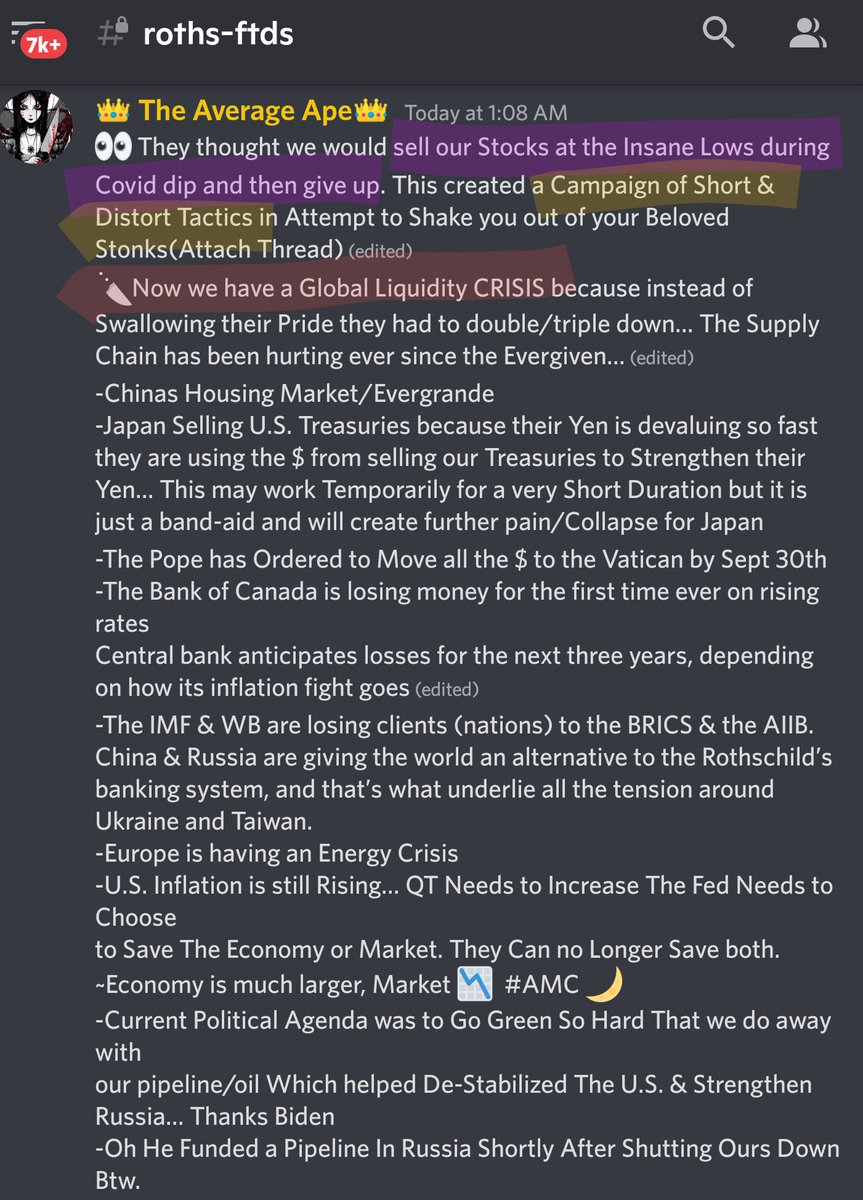

(8/10) They Thought We would Paper Hand our Stocks on the ©ovid 📉Which was used as a Mirage, More 💨🪞s to Hide (#Naked shorting-Options-#Darkpool-OffShore) this Massive International Financial Scandal🏴☠️

Now They have Created a 🌎 Liquidity Crisis

(READ👇)

Now They have Created a 🌎 Liquidity Crisis

(READ👇)

(9/10) They are Preparing for 🔪📉

The Global Financial System is Shifting before our 👀 The Big $ is Diving into #Crypto Buying Out Exchanges, -SEC Updated Pension Default Pot 1B-->35T...

#Citadel taking out Loans...

They Need to Re Structure a New System, They have no choice

The Global Financial System is Shifting before our 👀 The Big $ is Diving into #Crypto Buying Out Exchanges, -SEC Updated Pension Default Pot 1B-->35T...

#Citadel taking out Loans...

They Need to Re Structure a New System, They have no choice

(10/11) -1Extra Tweet

HF/MM/Brokers/Big Banks have been playing a 🎮with Your $ For Far to Long...

It's Now Time To Load That Smoking 🔫 That We have Found. The 🌎 Will Know Exactly How, These Corrupt Elite are Hiding FTDS Off-Shore, Destroying Companies/Lives 🏴☠️#AMC #AMCApe

HF/MM/Brokers/Big Banks have been playing a 🎮with Your $ For Far to Long...

It's Now Time To Load That Smoking 🔫 That We have Found. The 🌎 Will Know Exactly How, These Corrupt Elite are Hiding FTDS Off-Shore, Destroying Companies/Lives 🏴☠️#AMC #AMCApe

• • •

Missing some Tweet in this thread? You can try to

force a refresh