Manchester United’s 2021/22 accounts cover a season when they finished 6th in the Premier League and were eliminated in the last 16 of the Champions League. Manager Ole Gunnar Solskjaer was replaced by Ralf Rangnick, since succeeded by Erik ten Hag. Some thoughts follow #MUFC

#MUFC pre-tax loss shot up from £24m to £150m, despite revenue rising £89m (18%) from £494m to £583m, thanks to recovery from COVID and return of fans to the stadium, plus profit on player sales increasing £15m to £22m, as expenses rose £154m (29%) after investment in the squad.

#MUFC operational decline was exacerbated by the impact of the weakening of Sterling on non-cash finance costs, as unrealised forex losses on unhedged USD borrowings meant that net interest experienced an adverse swing of £75m from £13m recoverable prior year to £62m payable.

#MUFC net loss after tax only increased £23m from £92m to £115m, as there was a £34m tax credit due to the recognition of deferred tax assets in respect of losses arising in the year, compared to prior year’s £68m expense, following the write-off of US deferred tax assets.

Main reason for #MUFC revenue increase was match day, which rose £103m from £7m to £110m, due to return of fans to Old Trafford, while commercial was up £26m (11%) from £232m to £258m. However, broadcasting fell £40m (16%) to £215m, partly due to deferred income in prior year.

Investment in the squad meant #MUFC wages rose £62m (19%) from £323m to £384m and player amortisation increased £29m (24%) to £149m. Other expenses were up £41m (54%) to £118m, as stadium and Megastore re-opened, while £25m was booked for management changes.

#MUFC are the first English club to publish accounts for 2021/22, but their £150m pre-tax loss was only surpassed by #CFC £156m in 2020/21, even though prior year figures were severely impacted by the pandemic with almost all games played behind closed doors.

#MUFC profit from player sales tripled from £7m to £22m, mainly sale of Dan James to #LUFC and sell-on fee from Romelu Lukaku’s transfer from Inter to #CFC, though still not that big by Premier League standards, e.g. #MCFC £69m, #WWFC £61m and #LCFC £44m (all 2020/21 figures).

This is the third year in a row that #MUFC lost money, adding up to £195m in that period (impacted by COVID). The £150m pre-tax deficit in 2021/22 was the club’s worst ever, equivalent to losing around £3m a week, and was actually the third highest loss in Premier League history.

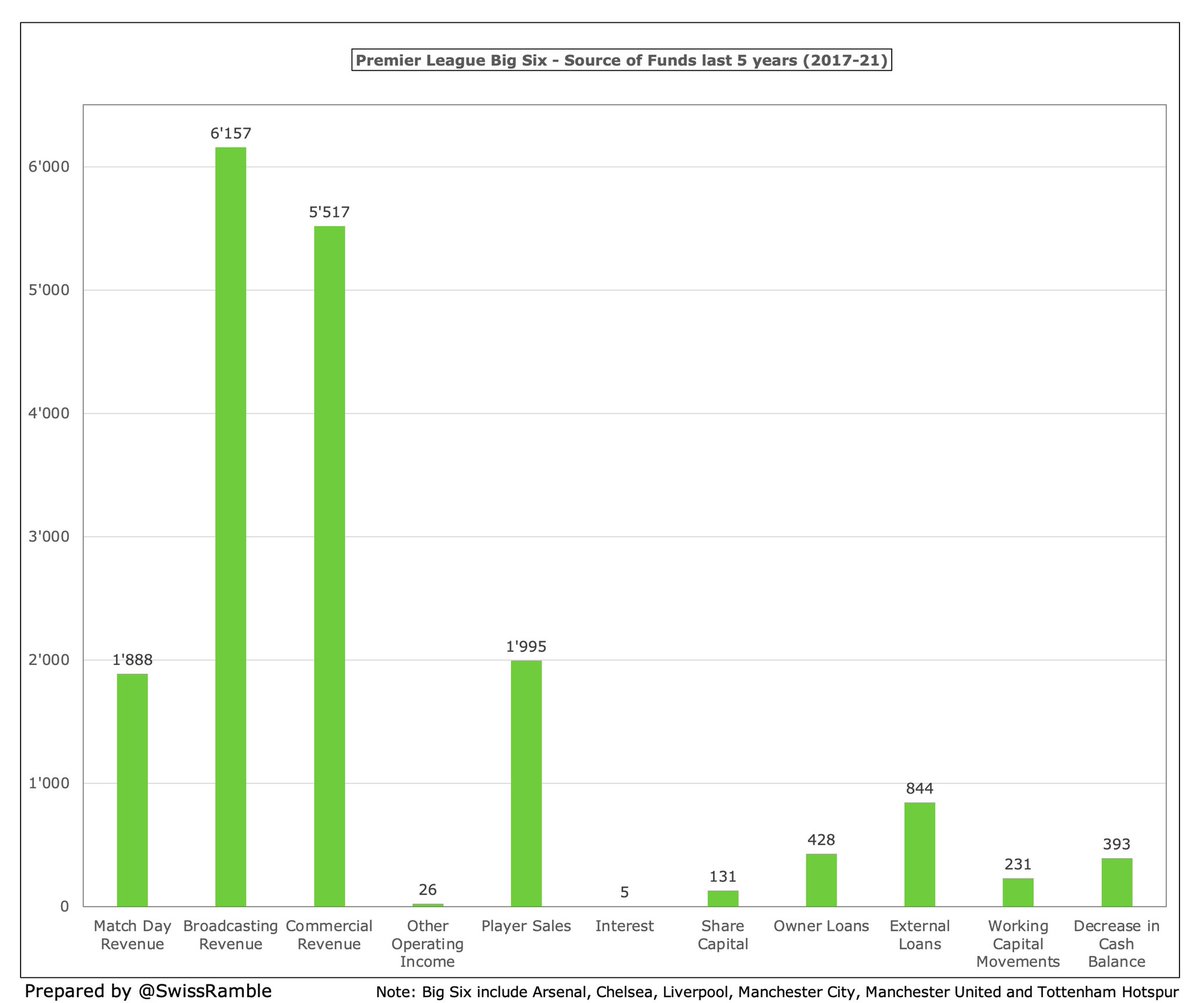

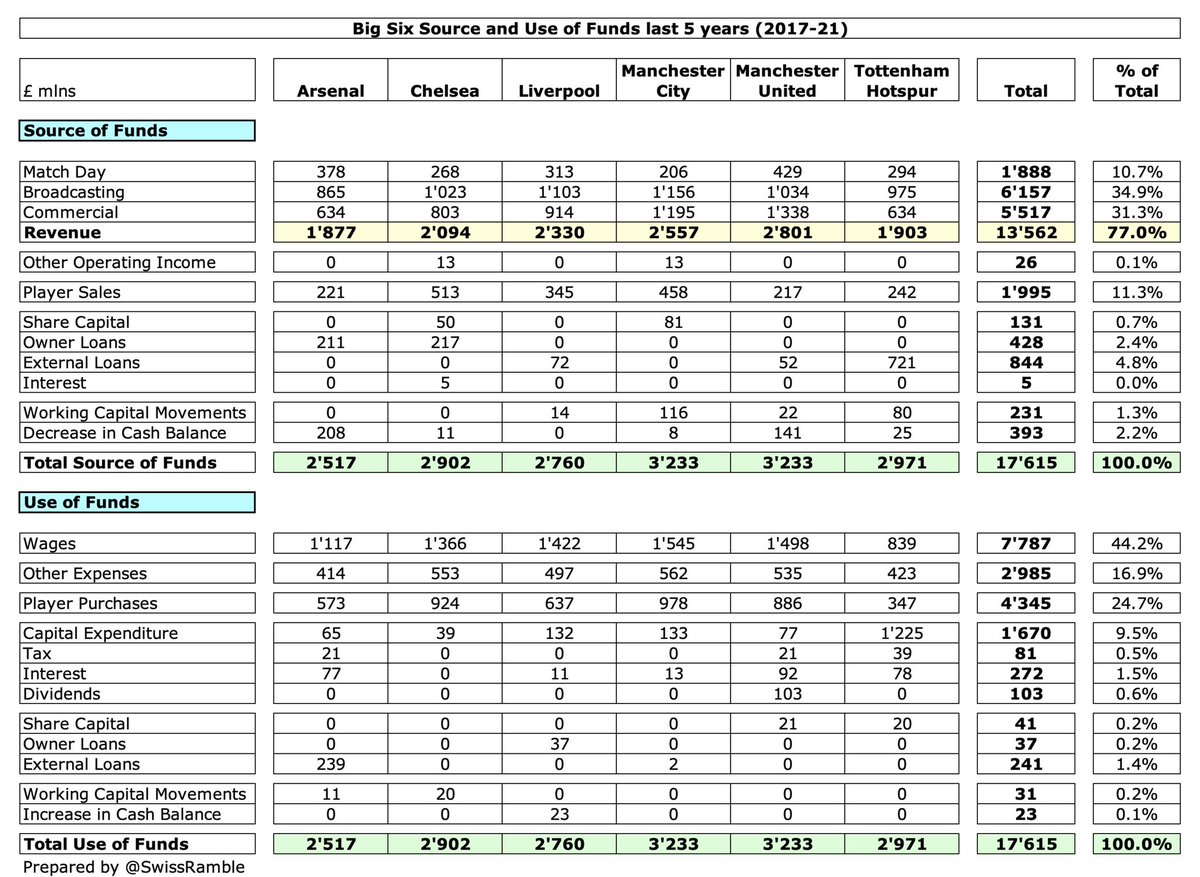

#MUFC results have rarely been boosted by player sales, only averaging £13m a year over last decade. In the 5 years up to 2021, United’s £81m profit from this activity was significantly lower than rest of the Big 6: #CFC £413m, #LFC £274m, #MCFC £221m, AFC £211m and #THFC £158m.

#MUFC included £24m for changes in manager (plus coaching staff): £10m for Solskjaer and £14m for Rangnick. That means that United have made £59m pay-offs since Sir Alex Ferguson retired, including £20m in 2019 for Jose Mourinho and his coaching team.

Excluding exceptionals, #MUFC operating loss nearly doubled from £44m to £85m, which was towards the lower end of the Premier League. Up until 2019, United had consistently reported operating profits, a rare achievement for a football club, but things have declined since then.

#MUFC revenue rebounded to £583m, but this was still £44m (7%) below the £627m peak before the pandemic struck. The club has advised that revenue will be in a range of £580m to £600m this season.

#MUFC £583m revenue is currently the highest in England (most recently published accounts), though both #MCFC and #LFC are likely to overtake United when they release 2021/22 figures, as they will also include much higher match day income.

Until 2019 #MUFC revenue was miles ahead of other English clubs, but the gap has closed considerably since then, making a mockery of Ed Woodward’s claim that “Playing performance doesn't really have a meaningful impact on what we can do on the commercial side of the business.”

In 2020/21 #MUFC dropped to 5th place in the Deloitte Money League, which ranks clubs globally in terms of revenue. This was United’s lowest ever position in Money League history, behind #MCFC, Real Madrid, Bayern Munich and Barcelona.

#MUFC commercial income rose £26m (11%) from £232m to £258m, thanks to new sponsorship agreements and the re-opening of the Megastore, though this was still not back to previous levels, partly due to no pre-season tour. Commercial growth has basically stalled since 2016.

While #MUFC commercial revenue has slowed down, the other Big Six clubs have benefited from solid growth in the last 5 years. That said, #MUFC £258m commercial income is higher than all other Premier League clubs except #MCFC £272m.

#MUFC figures included money from lucrative £64m Chevrolet shirt sponsorship, as contract extended to December 2021, but replaced in January by TeamViewer’s much lower £47m. Still have Adidas £75m kit agreement until 2025, while Tezos £20m training kit deal is more than AON £15m.

#MUFC broadcasting revenue fell £40m (16%) from £255m to £215m, as prior year accounts benefited from revenue deferred from 2019/20 for games played after end-June accounting close, plus there were fewer European games and a lower Premier League merit payment.

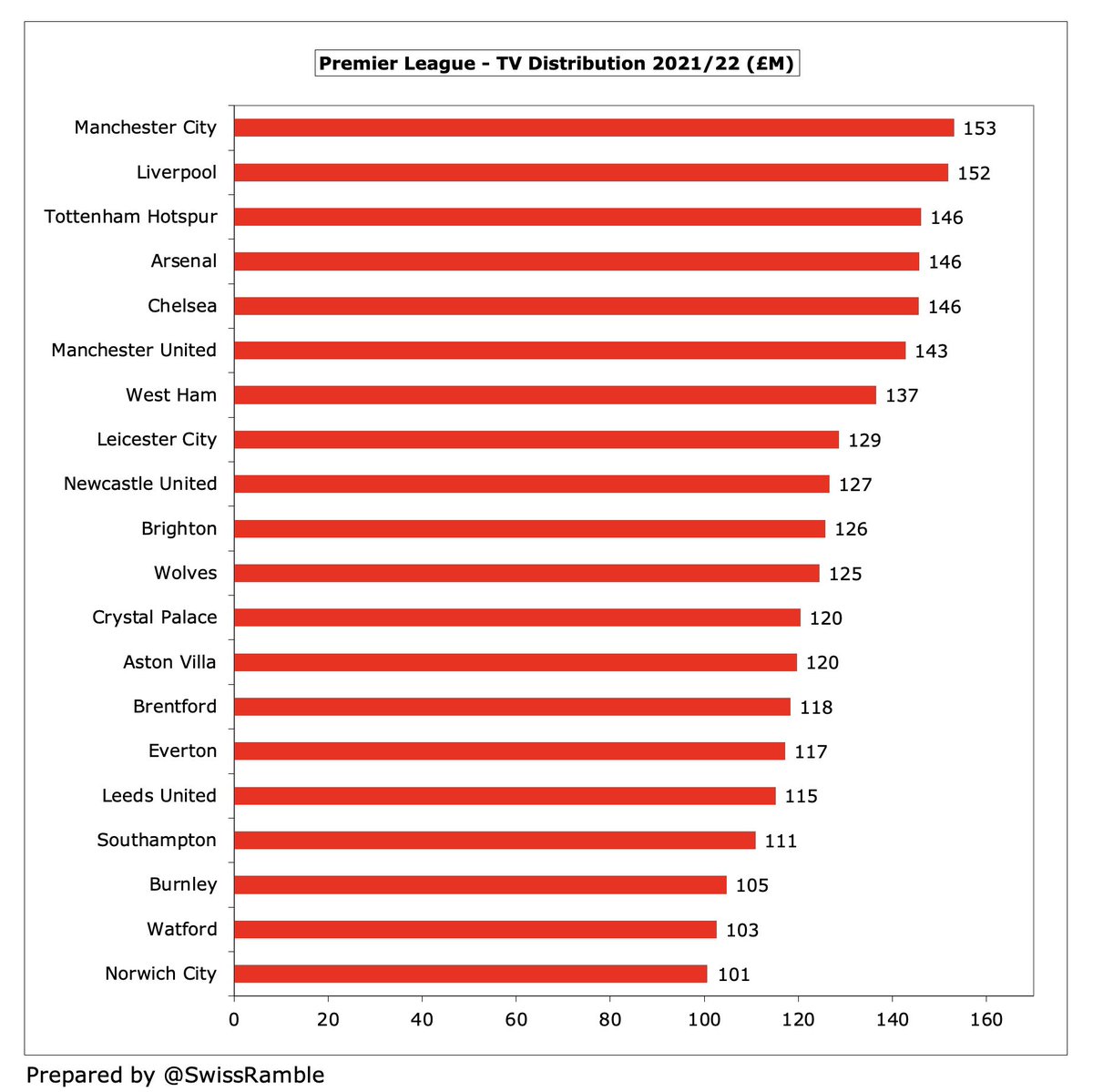

#MUFC received £143m from Premier League central TV distribution, £8m less than prior year, due to lower merit payment after dropping from 6th to 2nd. The 2020/21 accounts were boosted by £21m revenue deferred from 2019/20 due to the extended season (COVID delays).

I estimate that #MUFC received £68m for reaching the Champions League last 16 in 2021/22, slightly below £71m in 2020/21 (Champions League group stage £55m plus Europa League finalists £16m). That’s pretty good, but a lot lower than finalists #LFC £104m, #MCFC £96m and #CFC £80m.

#MUFC relatively poor performance in Europe means that they have earned “only” €321m in the last 5 years, which is not too shabby, but is over €150m less than #MCFC €479m and #CFC €478m. CFO Cliff Baty re-iterated, “This club needs to be in the Champions League.”

#MUFC match day income rose £104m from £7m to £111m, due to the return of fans to Old Trafford, while in 2020/21 all games except the final one were played behind closed doors. The only club likely to generate a similar amount in 2021/22 is #THFC, thanks to its new stadium.

Due to their high match day income, #MUFC revenue was more impacted by COVID than any other English club, but in 2021/22 they once again benefited from the largest crowds in the Premier League with their 73,000 average attendance being far above the next highest, #AFC 60,000.

#MUFC wage bill shot up £61m (19%) from £323m to £384m, as a result of “investment in the first team squad”, mainly the signings of Ronaldo, Varane and Sancho. That has once again taken United to the top of the English wages league, leapfrogging #MCFC £355m.

In fact, #MUFC £384m wage bill is comfortably the highest ever in the Premier League, despite only finishing 6th and missing out on the Champions League. If the club had enjoyed success on the pitch, then wages would have been even higher due to more bonus payments.

#MUFC wages to turnover ratio slightly increased from 65% to 66%. This is United’s highest ever (it was as low as 45% in 2017), but it is still one of the best in the Premier League.

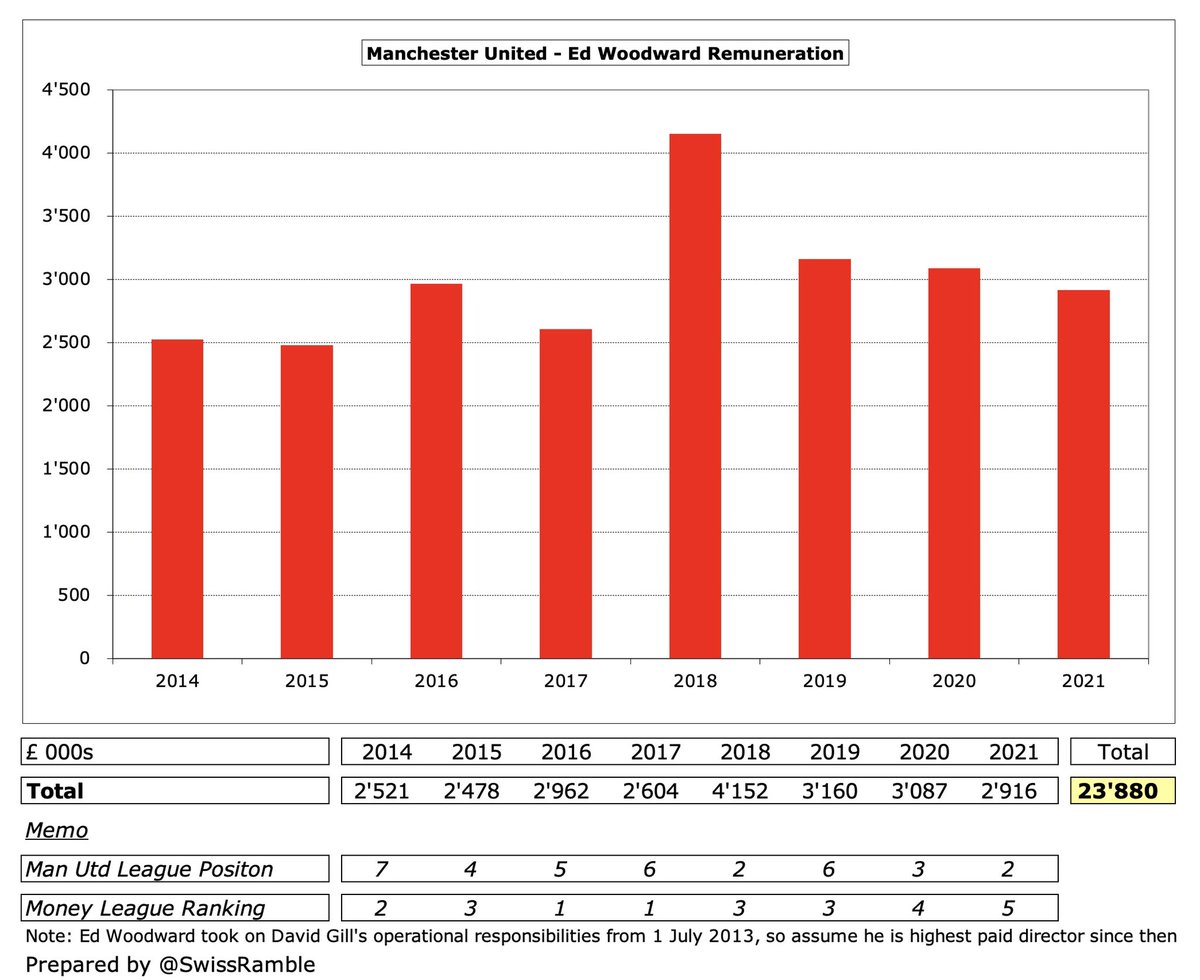

We will have to wait for another #MUFC company to publish its accounts before we know the highest paid director’s remuneration, but United fans will be delighted to see that Ed Woodward trousered £2.9m in 2020/21, the highest in England. He received a tidy £24m in 8 years.

#MUFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, rose £29m (24%) from £120m to £149m, the club’s highest ever. However, this was still lower than #CFC £162m in 2020/21.

#MUFC other expenses surged £41m (54%) from £77m to £118m, once again the highest in the Premier League, due to the impact of staging all home games in front of a full capacity crowd and costs related to increased activity at the Old Trafford Megastore.

#MUFC player purchases of £152m in 2021/22 were £36m higher than the prior season, when only #CFC and #MCFC spent more than United. This included the acquisitions of Jadon Sancho from Borussia Dortmund, Raphael Varane from Real Madrid and Cristiano Ronaldo from Juventus.

#MUFC splashed out £1.5 bln on transfers in last decade with nearly £800m in last 5 years alone, so they have spent money, just not as well as fans would have liked. Since these accounts closed, paid out another £218m, mainly on Antony, Casemiro, Lisandro Martinez and Malacia.

In fact, #MUFC £850m gross transfer spend in the 5 years up to 2020/21 was only surpassed in England by #MCFC & #CFC (both £992m), but it’s worth emphasising that this is money that the club has generated through its operations, not provided by the Glazers.

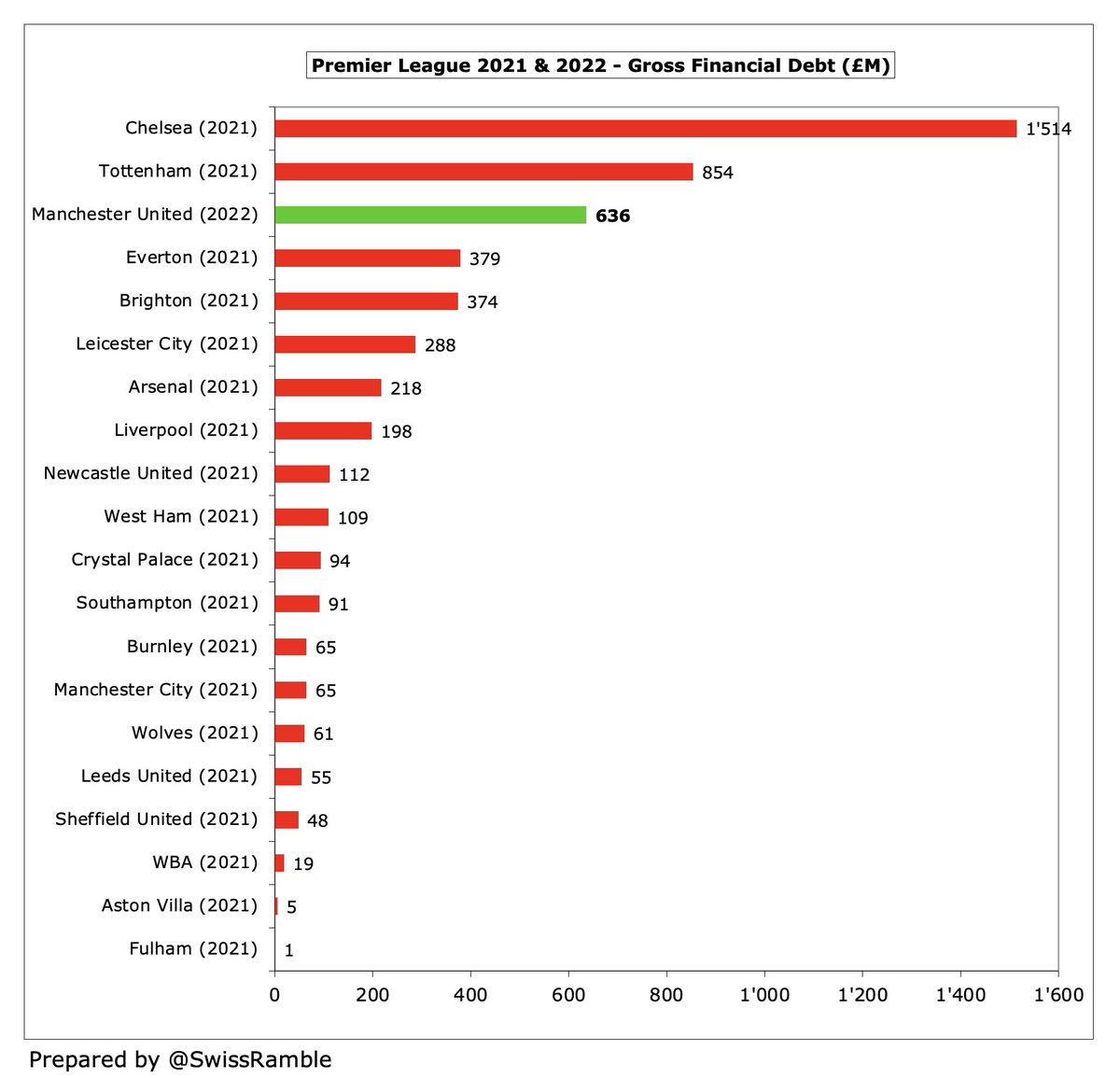

#MUFC net debt was up £95m (23%) from £420m to £515m, as gross debt rose £106m from £530m to £636m, the highest since 2010, slightly offset by £10m growth in cash. Increase driven by £65m forex losses due to fall in GBP plus £40m increase in drawdown from revolving facility.

Even after all the refinancings, #MUFC £636m gross debt is higher than the £604m owed after the Glazers’ arrival. United’s debt is 3rd highest in the PL, but #CFC £1.5 bln was provided interest-free by their owner (written-off since then), while #THFC £854m funded a new stadium.

Although it has fallen from its (sizeable) peak, #MUFC £21m interest payment in 2021/22 was still the highest in the Premier League. United have now paid a staggering three-quarters of a billion pounds in interest since the Glazers’ leveraged buy-out in 2005.

Looking at the 12 years up to 2021, #MUFC £517m interest payment was nearly three times as much as the next highest club, namely #AFC with £174m. Looked at another way, it was almost as much as the rest of the Premier League combined (£536m).

#MUFC transfer debt increased from £136m to £182m, the largest balance in the Premier League, so much of the player recruitment has been done on credit. In addition, contingent liabilities for certain events (winning trophies, appearances) are up to £112m, second highest in PL.

After adding back £166m non-cash items and £65m working capital movements, #MUFC had £122m operating cash flow in 2021/22, which was boosted by £30m player sales. Spent £115m on player purchases, dividends £34m, interest £21m, capex £8m and tax £5m. Funded by £39m external loans.

As a result, #MUFC cash balance increased by £10m (including £2m FX gain) from £111m to £121m, though this is over £180m down from the £308m peak three years ago. To quote chief executive Richard Arnold, the club has “effing burned through cash”.

Despite the financial challenges, #MUFC still found enough cash to pay shareholders (mainly the Glazers) a £34m dividend, including £11m deferred from 2020/21. United are the only Premier League club to pay dividends, adding up to a chunky £156m since 2016.

No owners in the Premier League take out more money than the Glazers with £187m leaving #MUFC since 2012 (dividends £166m, share buyback £21m). Meanwhile, others have put significant funds into their clubs, e.g. in 10 years up to 2021 #MCFC £684m, #CFC £516m and #AVFC £506m.

In contrast to the £43m paid each year in dividends & interest, #MUFC have spent very little on infrastructure, e.g. only £8m in 2021/22, and less than #LCFC & #FFC in the last decade. It is estimated that renovating Old Trafford (“a multi-year project”) would cost around £200m.

Despite #MUFC huge reported loss in 2021/22, they should continue to be fine with FFP, as losses are measured over a 3-year monitoring period and are offset by allowable deductions (infrastructure, academy, community & women’s football) and special dispensation for COVID impact.

#MUFC chief executive Richard Arnold concluded, “Everyone at the club is aligned on a clear strategy to deliver sustained success on the pitch and a sustainable economic model off it, to the mutual benefit of fans, shareholders and other stakeholders.”

#MUFC fans will obviously be most focused on events on the pitch, hoping that the club can mount a challenge in the Premier League and return to European glories. Despite the high transfer spend, that would be easier without the financial burden of the Glazers’ ownership.

• • •

Missing some Tweet in this thread? You can try to

force a refresh