A bit of myth busting... the #BoE hasn't spent £65 billion to prop up the economy / bail out pension funds / save #KwasiKwarteng (or any variation)...

Instead, it has said it will buy gilts in 13 daily auctions, with a limit of £5bn each day.

Today it did just £22 *million*...

Instead, it has said it will buy gilts in 13 daily auctions, with a limit of £5bn each day.

Today it did just £22 *million*...

https://twitter.com/BruceReuters/status/1576933176823656449

The aim of this policy is to cap gilt yields by signalling that the Bank will act as the buyer of last resort to prevent forced sales by pension funds from driving yields even higher.

If this signal is credible, the Bank will not actually have to buy anywhere near £65 billion.,,

If this signal is credible, the Bank will not actually have to buy anywhere near £65 billion.,,

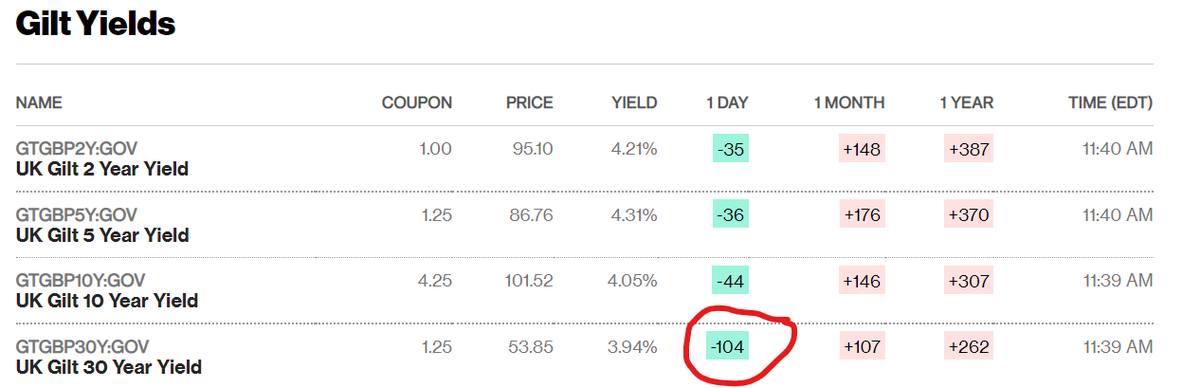

The fact that it bought just £22 million today can also be seen as a sign that it is more comfortable with where yields are now. (Longer dated yields have fallen to around 4%.)

Note also that offers to sell today amounted to less than £2bn - a sign that the panic is easing.

Note also that offers to sell today amounted to less than £2bn - a sign that the panic is easing.

Ps. the idea that this has 'cost the taxpayer £65 billion' (or whatever) is nonsense.

The Bank of England is buying bonds using new money. These bonds have value and pay interest, so the Bank could even make a profit.

The Bank of England is buying bonds using new money. These bonds have value and pay interest, so the Bank could even make a profit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh