Good evening,

I’m sharing one of my NAV modeling (cashflow) results.🧵

Company: Permian Resource Corporation

Sector: O&G

Ticker: $PR (NYSE)

Current SP: $9.04

My Estimated NAV: $18.06

Peers: $SM $CPE $CTRA $DVN $FANG $MTDR $PDCE

*Not investment advice*

#WTI #Brent #Permian #POM

I’m sharing one of my NAV modeling (cashflow) results.🧵

Company: Permian Resource Corporation

Sector: O&G

Ticker: $PR (NYSE)

Current SP: $9.04

My Estimated NAV: $18.06

Peers: $SM $CPE $CTRA $DVN $FANG $MTDR $PDCE

*Not investment advice*

#WTI #Brent #Permian #POM

Merger Transaction capitalization (CDEV and Colgate)

***$176,092,000 net opening cash post merger***

***$176,092,000 net opening cash post merger***

While im currently long in $PR and hold a bullish outlook, I still reserve my own level of conservatism.

Specifically in WTI realization.

PR projects 96%~99%

But i use a lower 90% for my analysis. This is based on CDEV’s average history & because we have no Colgate history.

Specifically in WTI realization.

PR projects 96%~99%

But i use a lower 90% for my analysis. This is based on CDEV’s average history & because we have no Colgate history.

Link to SEC filings permianres.com/investor-relat…

Energy Prices used in model:

YYYY: Oil - NatGas - NGL

2022: $90 - $6.75 - $81

2023: $85 - $6.50 - $78

2024: $75 - $5.25 - $63

2025: $65 - $4.55 - 55

2026+: $60 - $4.20 - $50

* (per Bbl)

YYYY: Oil - NatGas - NGL

2022: $90 - $6.75 - $81

2023: $85 - $6.50 - $78

2024: $75 - $5.25 - $63

2025: $65 - $4.55 - 55

2026+: $60 - $4.20 - $50

* (per Bbl)

Don’t overlook this WACC!

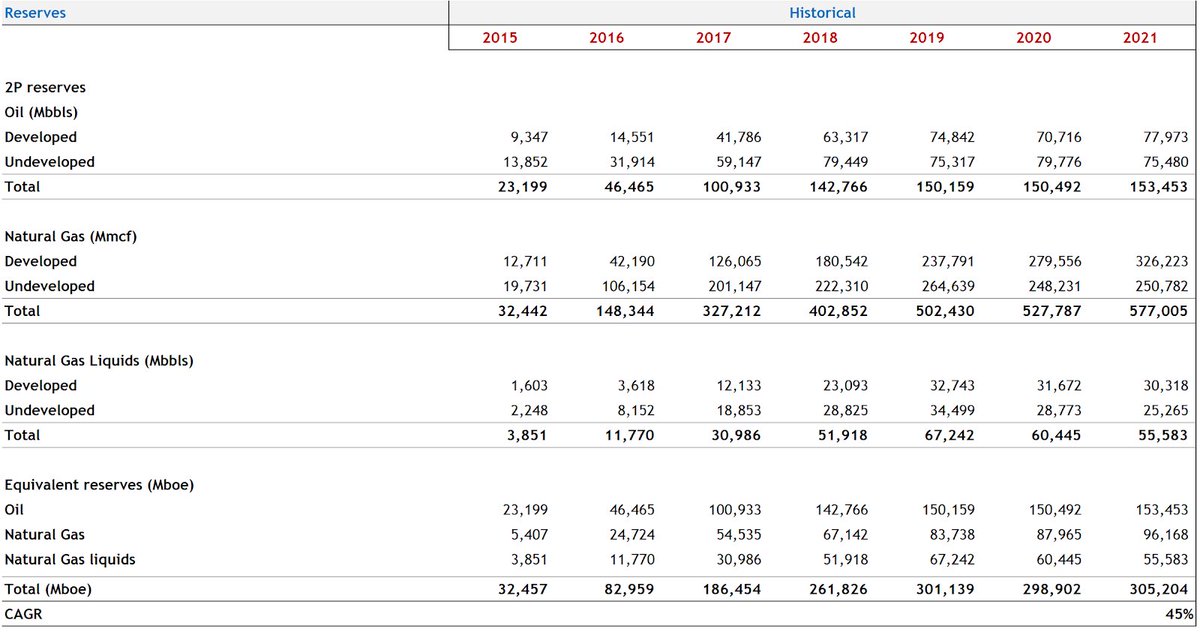

Forecasted production mixes must not be doné sloppily…..must closely examine inventory.

Important slide here….

BTW,

🔘I hold a long stock position in $PR and i have a bullish outlook on the company.

🔘I’m in no way affiliated with the company’s operations or employees.

🔘I have no access to any MNPI data on the company.

🔘I hold a long stock position in $PR and i have a bullish outlook on the company.

🔘I’m in no way affiliated with the company’s operations or employees.

🔘I have no access to any MNPI data on the company.

@UnrollHelper unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh