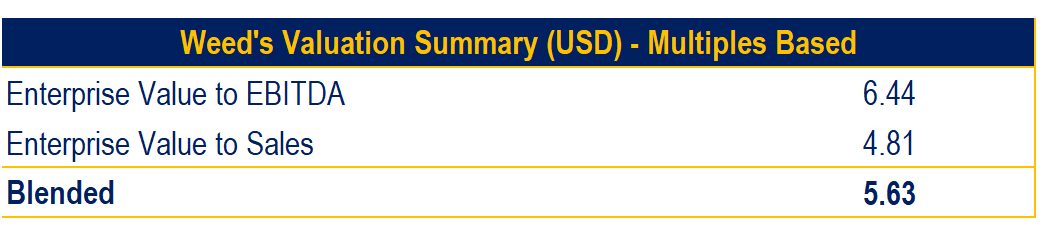

My updated NAV model:

Company: @ElectraBMC

Sector: #Materials #Refining #Mining

Ticker: $ELBM

CEO: @TrentMell

Recycling Peers: $ABML $LICY

Refining Peers: None (domestically)

#Cobalt #Manganese #Graphite #Nickel #Lithium #Aluminum #BlackMass #EV

*I'm Long-Bullish|Not advice*

Company: @ElectraBMC

Sector: #Materials #Refining #Mining

Ticker: $ELBM

CEO: @TrentMell

Recycling Peers: $ABML $LICY

Refining Peers: None (domestically)

#Cobalt #Manganese #Graphite #Nickel #Lithium #Aluminum #BlackMass #EV

*I'm Long-Bullish|Not advice*

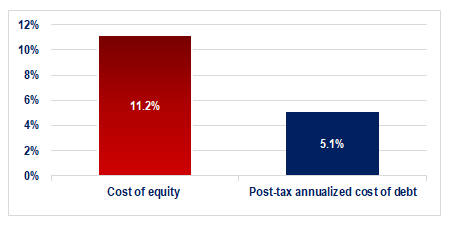

#WACC breakdown

Only results through 2030 have been shown....

Only results through 2030 have been shown....

Only results through 2030 have been shown....

Only results through 2030 have been shown....

Only results through 2030 have been shown....

Only results through 2030 have been shown....

BTW,

🔘I hold a long stock position in $ELBM and i have a bullish outlook on the company.

🔘I’m in no way affiliated with the company’s operations or employees.

🔘I have no access to any MNPI data on the company.

🔘I hold a long stock position in $ELBM and i have a bullish outlook on the company.

🔘I’m in no way affiliated with the company’s operations or employees.

🔘I have no access to any MNPI data on the company.

@UnrollHelper unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh