Happy Friday! The Weekly Market Highlights is an initiative from the #Binance Research team to round up the week, summarizing key market events and views from the team.

Let's get the ball rolling 🧵👇

Let's get the ball rolling 🧵👇

1/ Macro

U.S. inflation in September increased by 8.2% year-on-year, stronger than expectations of 8.1%. Despite hot inflation data, stock markets staged a turnaround during the trading day and closed higher, suggesting that inflation concerns may have been somewhat priced in.

U.S. inflation in September increased by 8.2% year-on-year, stronger than expectations of 8.1%. Despite hot inflation data, stock markets staged a turnaround during the trading day and closed higher, suggesting that inflation concerns may have been somewhat priced in.

2/ Macro (Cont.)

After this #CPI print, traders currently assign a 99% probability that the Fed will raise interest rates by 0.75% in November.

After this #CPI print, traders currently assign a 99% probability that the Fed will raise interest rates by 0.75% in November.

3/ L1

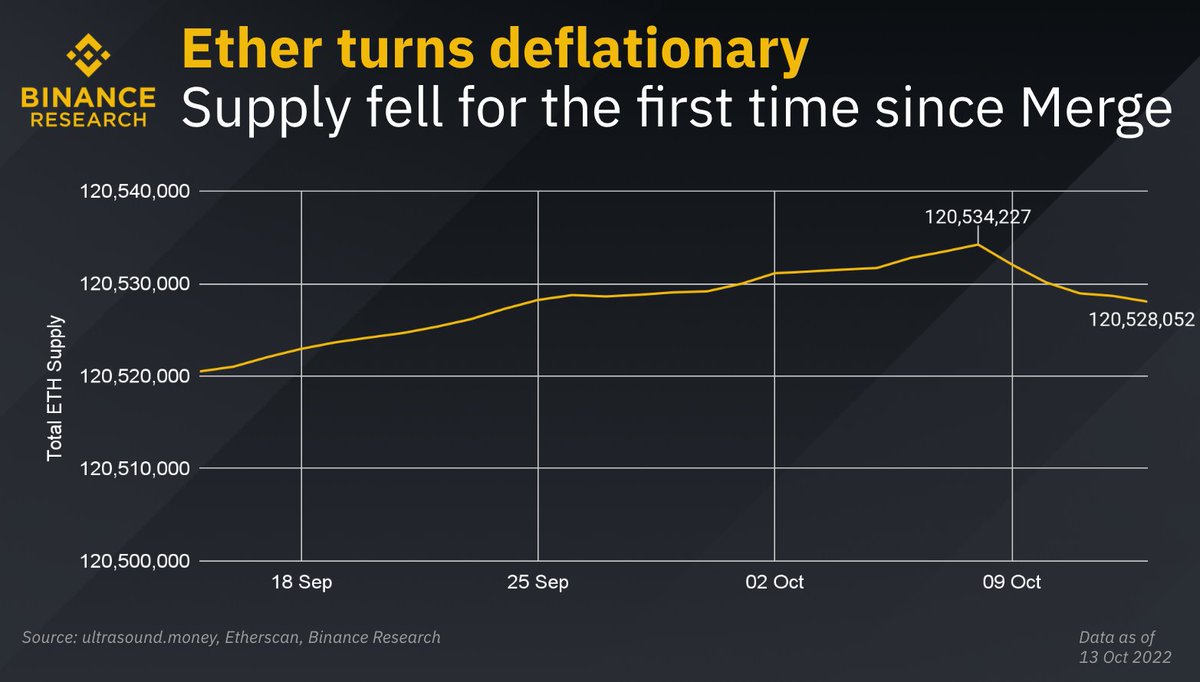

Did someone say deflation? Ether turned deflationary this week (more $ETH burned than issued) with a decline in the supply of more than 6,000 ETH since 8 Oct. This was contributed by the launch of a token that resulted in an increase in gas fees.

Did someone say deflation? Ether turned deflationary this week (more $ETH burned than issued) with a decline in the supply of more than 6,000 ETH since 8 Oct. This was contributed by the launch of a token that resulted in an increase in gas fees.

4/ L2

The race to launch a working zero-knowledge Ethereum Virtual Machine (“zkEVM”) is heating up. This week, @0xPolygon announced the launch of its public zkEVM testnet. @AaveAave, @Uniswap, and @LensProtocol will be amongst the first protocols to deploy on the zkEVM Testnet

The race to launch a working zero-knowledge Ethereum Virtual Machine (“zkEVM”) is heating up. This week, @0xPolygon announced the launch of its public zkEVM testnet. @AaveAave, @Uniswap, and @LensProtocol will be amongst the first protocols to deploy on the zkEVM Testnet

5/ L2 (Cont.)

@Scroll_ZKP released an upgraded version of their pre-Alpha testnet which enables smart contract deployment on Scroll and allows users to bridge ERC-20s and NFTs between Scroll's L1 and L2 testnets.

@Scroll_ZKP released an upgraded version of their pre-Alpha testnet which enables smart contract deployment on Scroll and allows users to bridge ERC-20s and NFTs between Scroll's L1 and L2 testnets.

6/ L2 (Cont.)

zkSync 2.0 is expected to launch on mainnet at the end of October. Additionally, @zksync's EVM-compatible L3 ‘Pathfinder’ prototype will be deployed to public testnet in 1Q 2023.

zkSync 2.0 is expected to launch on mainnet at the end of October. Additionally, @zksync's EVM-compatible L3 ‘Pathfinder’ prototype will be deployed to public testnet in 1Q 2023.

7/ DeFi

There were a few #DeFi exploits this week. Mango Markets, a Solana-based DeFi platform, was exploited for over US$100M. TempleDAO, a yield-farming DeFi protocol, was hacked for over US$2.3M.

There were a few #DeFi exploits this week. Mango Markets, a Solana-based DeFi platform, was exploited for over US$100M. TempleDAO, a yield-farming DeFi protocol, was hacked for over US$2.3M.

8/ NFTs

NFT royalties have sparked debate within the NFT community for a while now. This week, @DeGodsNFT, a popular Solana NFT project, has switched to a 0% royalty model as the founder cited the growing popularity of 0% royalty marketplaces as a major push factor.

NFT royalties have sparked debate within the NFT community for a while now. This week, @DeGodsNFT, a popular Solana NFT project, has switched to a 0% royalty model as the founder cited the growing popularity of 0% royalty marketplaces as a major push factor.

9/ NFTs (Cont.)

@opensea, an NFT marketplace, added support for Avalanche. This brings the total number of supported blockchains to seven: #Ethereum, #Polygon, #Klaytn, #Solana, #Optimism, #Arbitrum, and #Avalanche.

@opensea, an NFT marketplace, added support for Avalanche. This brings the total number of supported blockchains to seven: #Ethereum, #Polygon, #Klaytn, #Solana, #Optimism, #Arbitrum, and #Avalanche.

10/ Web2 x Crypto

@Google announced that it will allow selected customers to make payments for its cloud services with digital currencies starting next year.

@Google announced that it will allow selected customers to make payments for its cloud services with digital currencies starting next year.

11/ Interested to learn more? Be sure to check out the #Binance Research website for more project and macro research reports.

research.binance.com/en/analysis

research.binance.com/en/analysis

12/ Lastly, we would appreciate it if you could share with us any feedback you may have via this form.

That’s a wrap!

Binance Research

docs.google.com/forms/d/e/1FAI…

That’s a wrap!

Binance Research

docs.google.com/forms/d/e/1FAI…

• • •

Missing some Tweet in this thread? You can try to

force a refresh