Now Live: CoinGecko's Q3 2022 #Cryptocurrency Report 📊

From examining the #crypto market landscape to analyzing Bitcoin and Ethereum, how DeFi is making a recovery and NFT winter, here are 6 highlights you shouldn't miss! 👇

From examining the #crypto market landscape to analyzing Bitcoin and Ethereum, how DeFi is making a recovery and NFT winter, here are 6 highlights you shouldn't miss! 👇

1/ Total #crypto market cap inched higher 📈

• Crypto's total market cap rallied up to ~$1.2T in August, before falling again to end the quarter at 6.5% higher than at the end of Q2.

• After Q2’s significant drop of 50% QoQ, the market was mainly in consolidation mode in Q3.

• Crypto's total market cap rallied up to ~$1.2T in August, before falling again to end the quarter at 6.5% higher than at the end of Q2.

• After Q2’s significant drop of 50% QoQ, the market was mainly in consolidation mode in Q3.

2/ A muted quarter for stablecoins 🤫

• The Top 15 stablecoins lost 3% of their market cap (-$4.7B).

• $USDC's market cap fell 16% after OFAC's sanction of Tornado Cash.

• $BUSD grew the most, increasing 18% due to inflows from USDC and @binance's BUSD auto-conversion.

• The Top 15 stablecoins lost 3% of their market cap (-$4.7B).

• $USDC's market cap fell 16% after OFAC's sanction of Tornado Cash.

• $BUSD grew the most, increasing 18% due to inflows from USDC and @binance's BUSD auto-conversion.

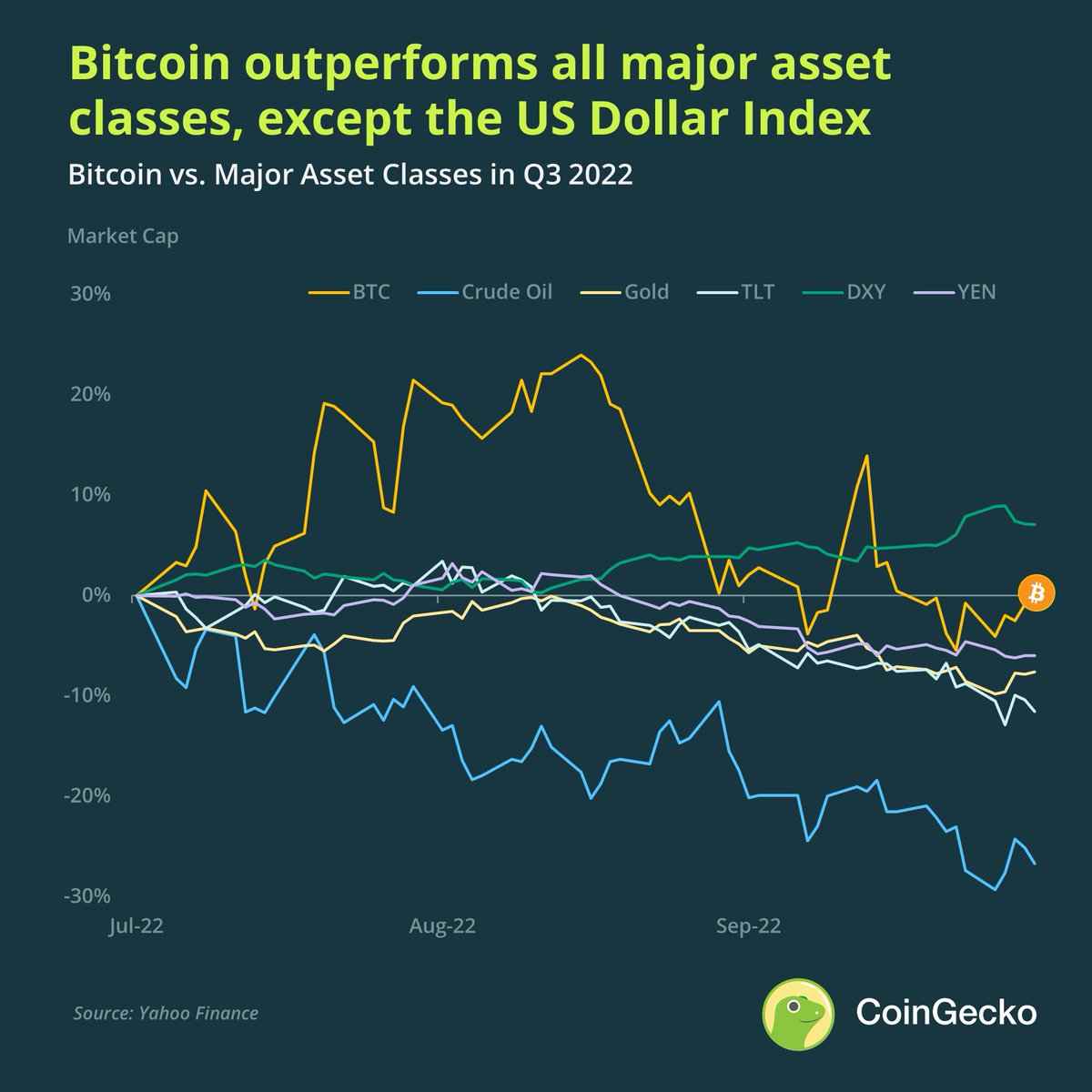

3/ USD reigns supreme, but #Bitcoin comes in at number 2 ✌️

• Bitcoin managed to outperform other asset classes except for the US Dollar Index (DXY).

• However from a YTD perspective, Bitcoin still experienced the largest loss of -58% among all other asset classes.

• Bitcoin managed to outperform other asset classes except for the US Dollar Index (DXY).

• However from a YTD perspective, Bitcoin still experienced the largest loss of -58% among all other asset classes.

4/ Macroeconomic factors overshadow @ethereum’s merge 🐼

• #Ethereum finally saw a rally in early Q3 which peaked at $1,982 in mid-August before tumbling back down.

• A combination of high CPI and anticipation of FOMC hike resulted in a selloff days before the Merge.

• #Ethereum finally saw a rally in early Q3 which peaked at $1,982 in mid-August before tumbling back down.

• A combination of high CPI and anticipation of FOMC hike resulted in a selloff days before the Merge.

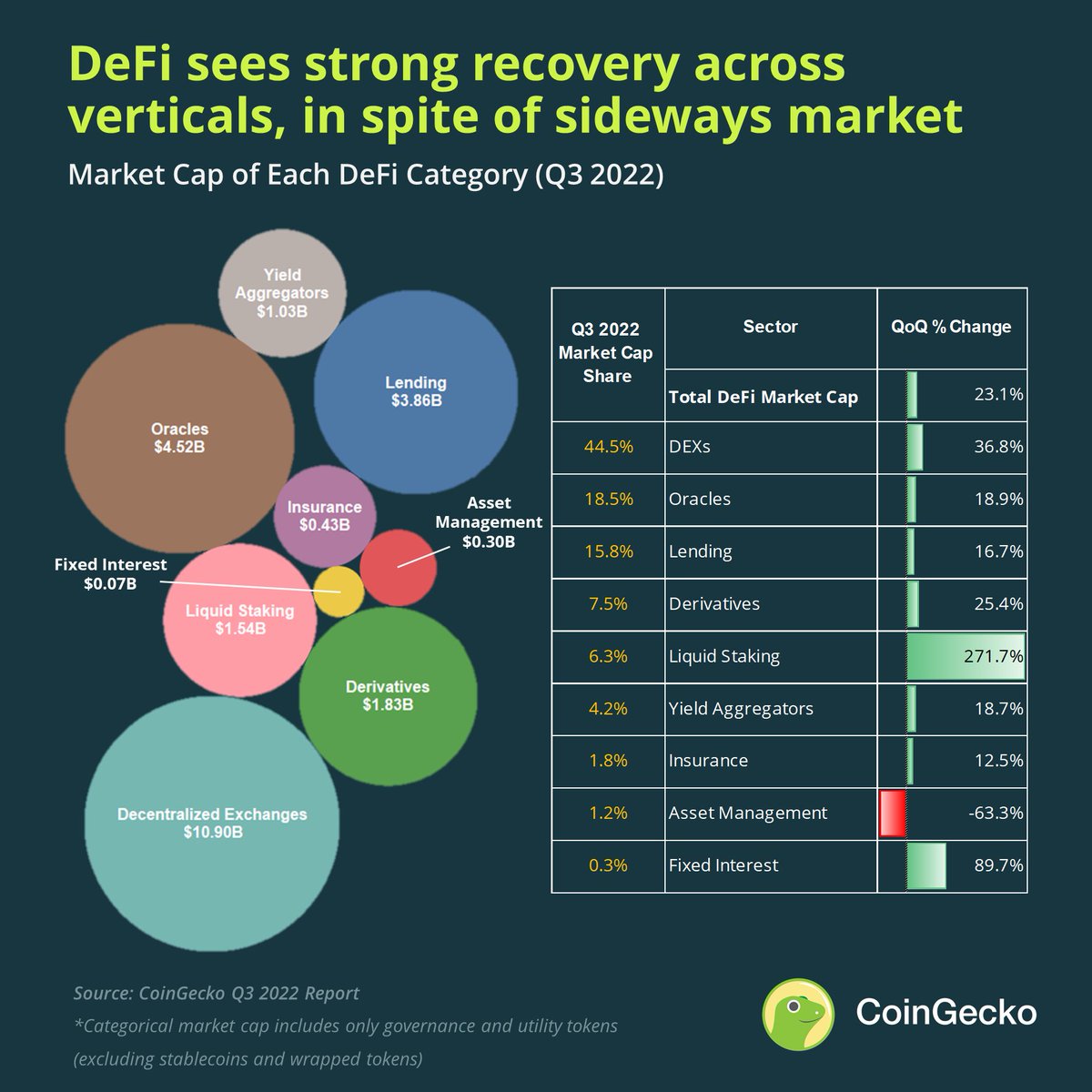

5/ #DeFi makes a comeback 🥊

• DeFi enjoyed a decent rebound with a market cap growth of ~31% QoQ.

• All sectors saw an uplift in market cap except for asset management.

• The liquid staking sector nearly tripled its market cap to $1.54B in Q3.

• DeFi enjoyed a decent rebound with a market cap growth of ~31% QoQ.

• All sectors saw an uplift in market cap except for asset management.

• The liquid staking sector nearly tripled its market cap to $1.54B in Q3.

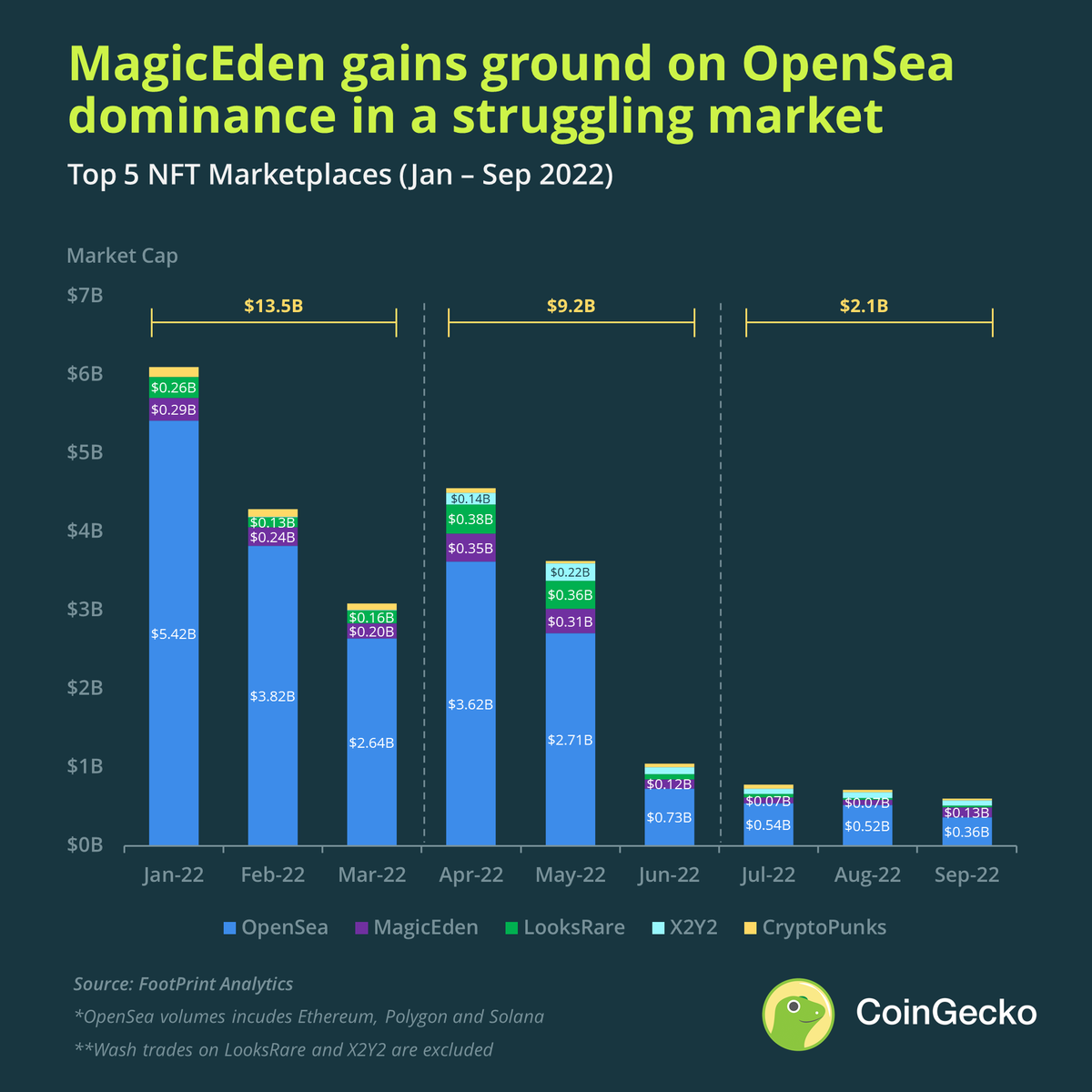

6/ #NFT winter is here ❄️

• Top 5 NFT market places saw a 71% fall in QoQ trading volume.

• With its recent foray into #Ethereum and headline-grabbing launch of @y00tsNFT, @MagicEden was the only NFT marketplace that saw growth in September, doubling its MoM volume.

• Top 5 NFT market places saw a 71% fall in QoQ trading volume.

• With its recent foray into #Ethereum and headline-grabbing launch of @y00tsNFT, @MagicEden was the only NFT marketplace that saw growth in September, doubling its MoM volume.

7/ ...and that’s all we're sharing here on Twitter! 🤫

Want the full scoop? Check out the full report here: gcko.io/xpbca9r

Want the full scoop? Check out the full report here: gcko.io/xpbca9r

RT and follow us if found our Q3 report interesting! 💚

What was your personal #crypto highlight in the past 3 months? Let us know 👇

What was your personal #crypto highlight in the past 3 months? Let us know 👇

https://twitter.com/coingecko/status/1582673121928101888

• • •

Missing some Tweet in this thread? You can try to

force a refresh