1/n #RED #ALERT !! This has to REACH MAXIMUM people so people #RETWEET. You will Understand ONLY when you have read it. I have been talking about the Impact of Interest Rates on #AssetAllocation. There could be NOBODY ELSE world-over who understands this, better than #LarryFink

2/n In response to a question potential for client rebalancing into fixed income just as rates and markets eventually stabilize.

ANSWER: “Traditional 60-40 allocations are certainly at a balance, and portfolio liquidity profiles have also been impacted.”

ANSWER: “Traditional 60-40 allocations are certainly at a balance, and portfolio liquidity profiles have also been impacted.”

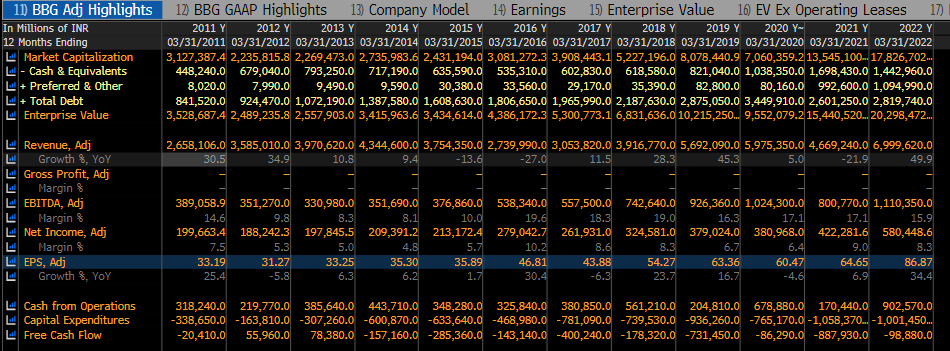

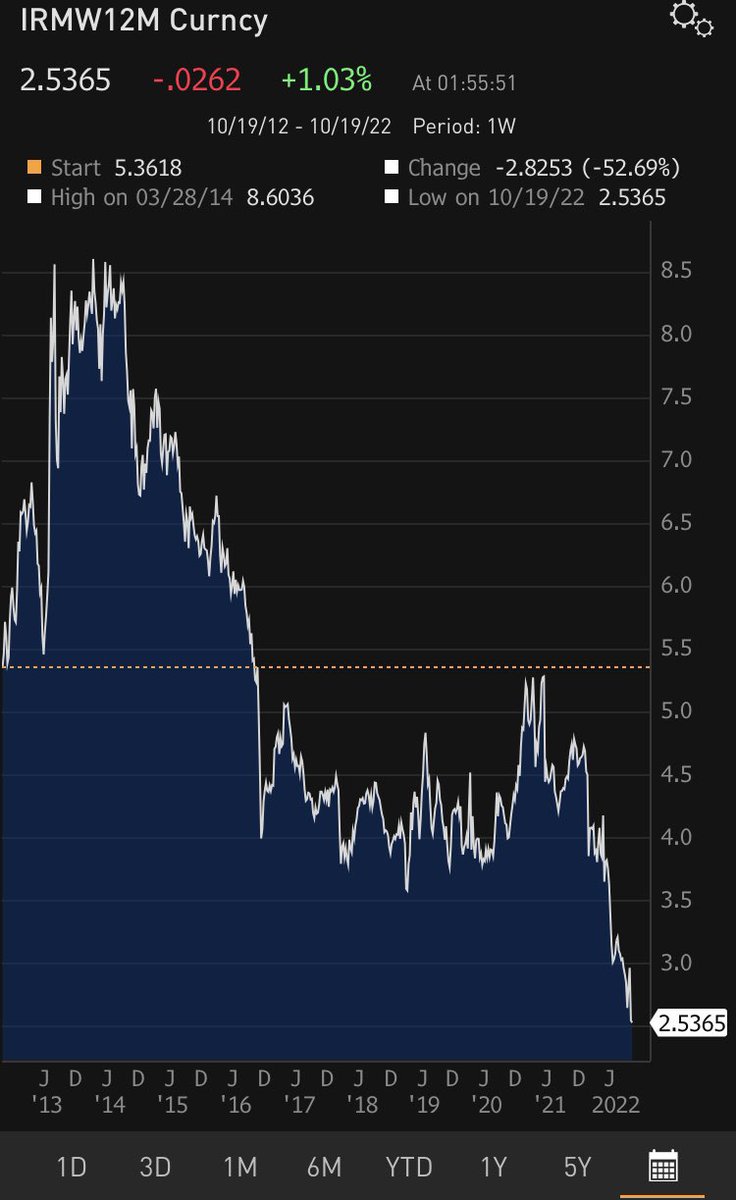

3/n “for the first time in years, investors can actually earn very attractive yields without taking much duration or credit risk. Just a year ago, the U.S. two-year treasury notes were yielding 25 basis points”

4/n “And today, they're earning 4%, corporate bonds are over 5% and high yield is above 9%. SO LET GIVE YOU A HELPFUL CONTEXT”

5/n “If we go back in 1995, to get a 7.5% yield, which is what many institutions were looking for, a portfolio could be in 100% bonds.” = Basically ZERO EQUITIES

6/n “If you fast forward 10 years, in 2005, it had to be 50% bonds, 40% equities, and 10% alternatives.”

7/n “Then move another 10 years. And in 2016, you needed only 15% bonds, 60% equities, and 25% alternatives. This describes the growth of several markets.” => PEAK EQUITIES EXPOSURE in #AssetAllocation

8/n “Now today, to get that same 7.5% yield, a portfolio could be in 85% bonds and then 15% equities and alternatives. And as you know, over the last several years, most of our clients, both institutional and retail, have been UNDEROWNERSHIP in fixed income.”

9/n WHAT DOES THIS MEAN for you as an INVESTOR ?

First, #AssetAllocation from Equities (60% exposure) & Alternatives (PE, VC at 25%) will SHRINK to 15% of Asset Allocation

Second, #AssetAllocation will first happen via Liquidating Equity ETFs since it’s the MOST LIQUID ASSETS

First, #AssetAllocation from Equities (60% exposure) & Alternatives (PE, VC at 25%) will SHRINK to 15% of Asset Allocation

Second, #AssetAllocation will first happen via Liquidating Equity ETFs since it’s the MOST LIQUID ASSETS

10/n Third, REMEMBER that ETFs have the HIGHEST EXPOSURE to #MomentumStocks since INDICES give higher Exposure to Momentum Stocks and #Fresh #Additions to the Index are #MomentumStocks. So #MomentumStocks are fastest to Fall

11/n Forth, REMEMBER that ETFs when they BUY stocks, they #doNOTcare about #Valuations.

Similarly, When ETFs sell stocks, they #DoNOTCare about #Valuations either.

ETFs do NOT HOLD CASH to Buy the Dip which is the case with ACTIVE Fund Managers

Similarly, When ETFs sell stocks, they #DoNOTCare about #Valuations either.

ETFs do NOT HOLD CASH to Buy the Dip which is the case with ACTIVE Fund Managers

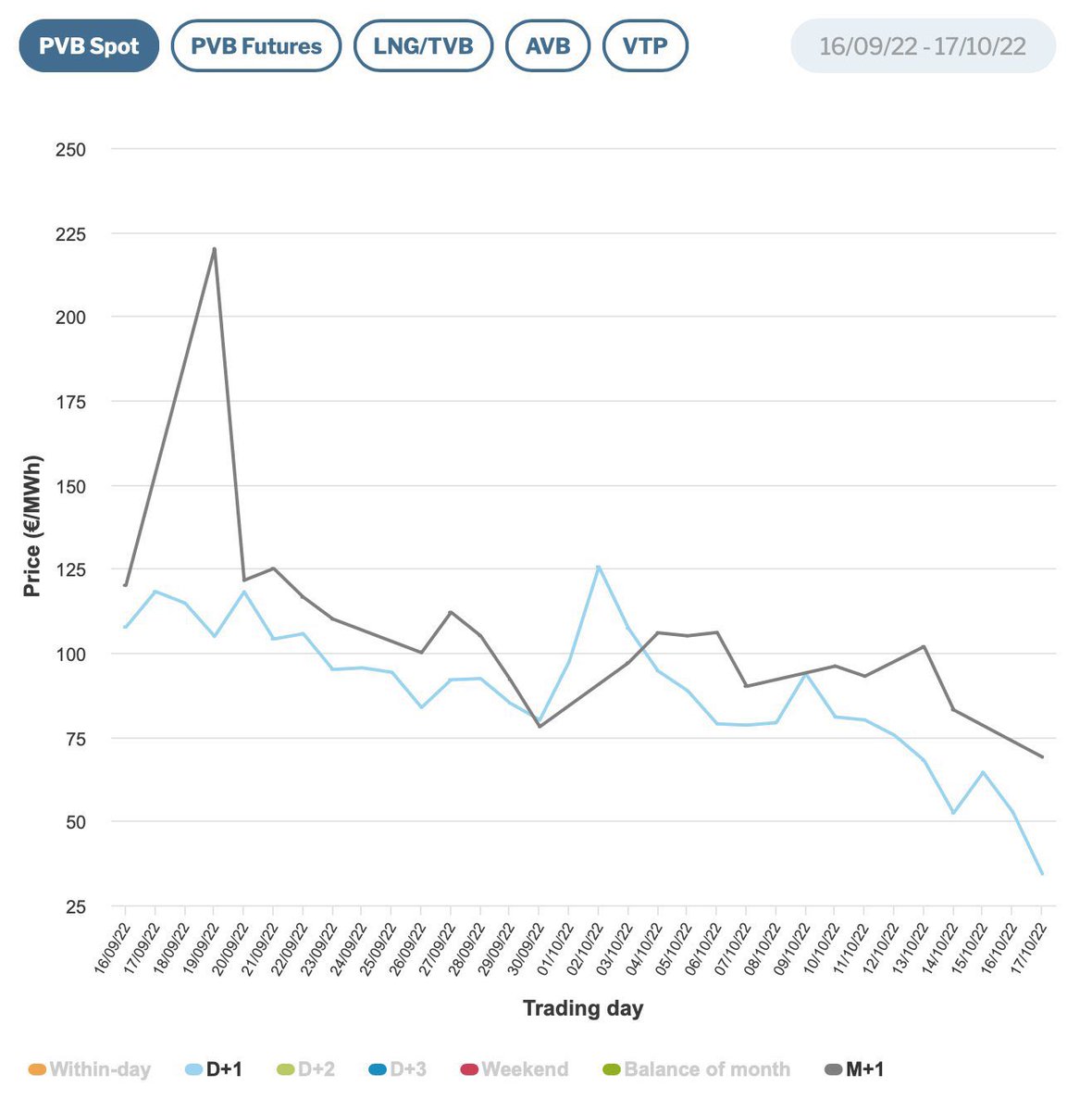

12/n Since Any #AssetAllocator wants to Reduce CURRENCY risk first, they are likely to SELL International Exposures first. That Means #EmergingMarkets will be among the first to be Sold

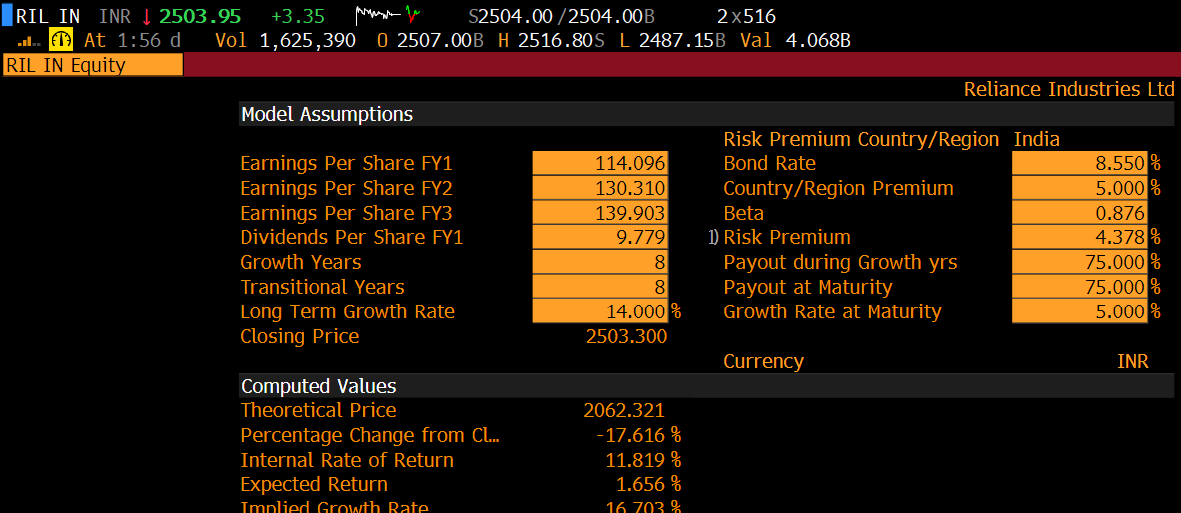

13/n WHERE DOES THAT LEAVE INDIA? unfortunately, likes of @licofindiacares, @socialepfo & First Time Retail SIPs are keeping Indian Markets Expensive providing FII/FPIs/ETFs an wonderful EXIT at a Good Price.

14/n The Latest @BankofAmerica (BAML) Global Fund Manager survey asking Fund Managers their 12 month Intentions indicates that INDIA is what they PLAN to SELL to fund exposure to other Markets.

15/n @RBI has a hard JOB at hand managing consistent Negative FPI outflows. INR will keep depreciating. I guess at some point Domestic Investors will Panic.

CASH IS KING/ KINDLY #Retweet if you found this useful. Am sure you have coz I know the Quality of this Thread.😊

CASH IS KING/ KINDLY #Retweet if you found this useful. Am sure you have coz I know the Quality of this Thread.😊

https://twitter.com/thefactfindr/status/1582798223508656128

I will follow up with a THREAD on what happens to various stocks when the Cost of Funding Goes bad

• • •

Missing some Tweet in this thread? You can try to

force a refresh