#MustRead #NIFTY #CostOfCapital

How Does #Rising #InterestRates/ #CostOfCapital/#DiscountingRate Impact Stock #Valuations. A STUDY of large Cap INDIAN Stocks

A long THEAD, pls stay with me...Exercise Shows a #StockWise Impact of Higher Discounting Rates & Implied Long Term Growth

How Does #Rising #InterestRates/ #CostOfCapital/#DiscountingRate Impact Stock #Valuations. A STUDY of large Cap INDIAN Stocks

A long THEAD, pls stay with me...Exercise Shows a #StockWise Impact of Higher Discounting Rates & Implied Long Term Growth

https://twitter.com/TheFactFindr/status/1582798223508656128

Exercise based on Div Discounting Model (DDM) for Current GSEC vs 8.5% GSEC (Every Justification for it to be 9%).

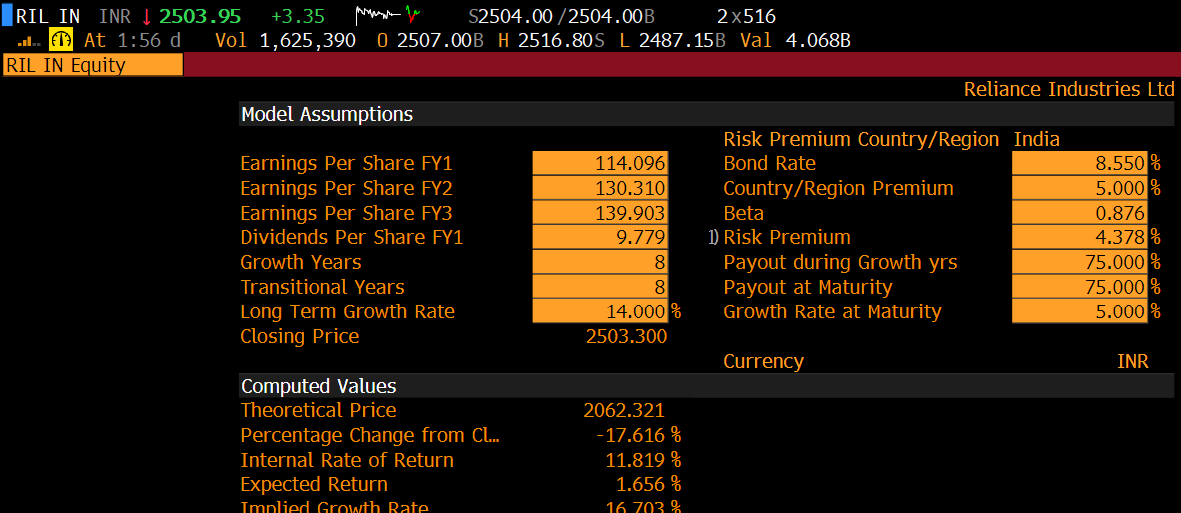

Starting with #Reliance

Tab 1: Stk px implies 14% CAGR LT Growth (8yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (14% CAGR) @ 8.55% GSEC

=>18% Lower Fair Value(Rs2062)

Starting with #Reliance

Tab 1: Stk px implies 14% CAGR LT Growth (8yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (14% CAGR) @ 8.55% GSEC

=>18% Lower Fair Value(Rs2062)

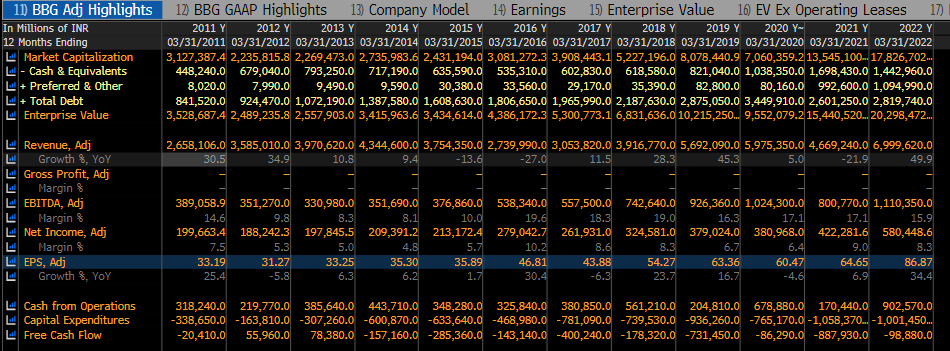

Higher Global Interest Rates to counter Inflation => lower Growth. Past 11yrs, High Growth & Low Interest Rate Environment, RIL growth: Revenues ($ linked) at 9.2% CAGR & EPS at 9% CAGR over FY11-22... So Assuming EPS growth @ 14% CAGR in prev tweet is AGGRESSIVE

Same Exercise, with 8.55% GSEC & say 12% LT Growth rate => 28% Lower Fair Value of Rs1791

Separately Reliance has been portrayed as India's Alibaba or Tencent or a combo. See how their Valuations have crashed (Premium to Discount) despite higher ROEs.

Separately Reliance has been portrayed as India's Alibaba or Tencent or a combo. See how their Valuations have crashed (Premium to Discount) despite higher ROEs.

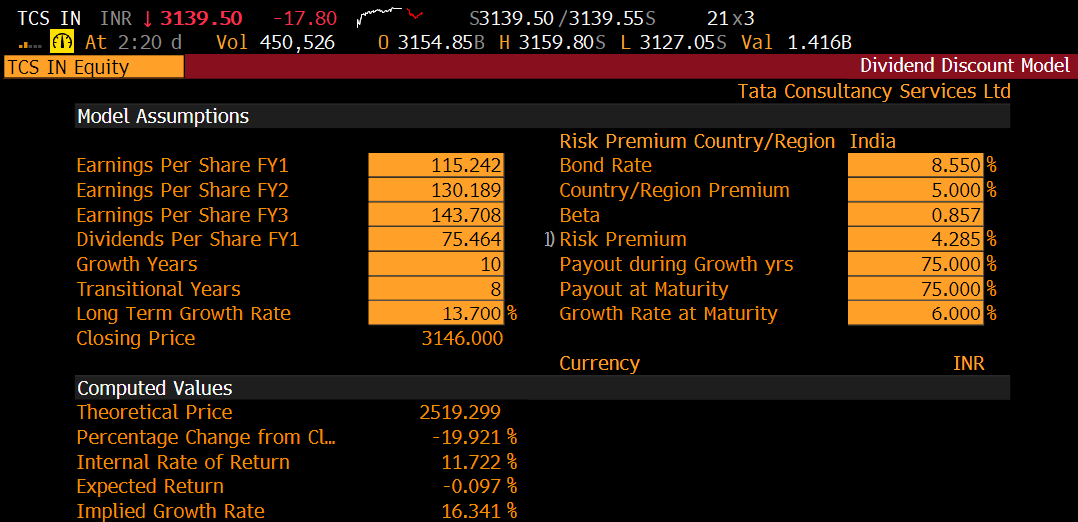

#TCS: Exercise using Div Discounting Model (DDM) for Current GSEC vs 100bps higher (8.55%) GSEC (Every Justification for it to be 9%).

Tab 1: Stk px implies 13.7% CAGR LT Growth (10yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (12% CAGR) @ 8.55% GSEC

=>20% Lower Fair Value (Rs2519)

Tab 1: Stk px implies 13.7% CAGR LT Growth (10yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (12% CAGR) @ 8.55% GSEC

=>20% Lower Fair Value (Rs2519)

#INFY: Exercise using Div Discounting Model (DDM) for Current GSEC vs 100bps higher (8.55%) GSEC (Every Justification for it to be 9%).

Tab 1: Stk px implies 13.5% CAGR LT Growth (10yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (13.5% CAGR), 8.55% GSEC

=>18% Lower Fair Val (Rs1228)

Tab 1: Stk px implies 13.5% CAGR LT Growth (10yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (13.5% CAGR), 8.55% GSEC

=>18% Lower Fair Val (Rs1228)

Accenture (22.7x Fwd PE) has Grown 2x the Revenue Growth rate of TCS (25.4x Fwd) & INFY (23.7x) with best Margin Stability.

Until Dec-21 Correction of ACN commenced, its PE traded at a premium to TCS/INFY. Now its at a discount. Either ACN Rallies or TCS/INFY de-rate Further.

Until Dec-21 Correction of ACN commenced, its PE traded at a premium to TCS/INFY. Now its at a discount. Either ACN Rallies or TCS/INFY de-rate Further.

#AsianPaints: Div Discounting Model (DDM) for Current GSEC vs 100bps higher (8.55%) GSEC (Every Justification for it to be 9%).

Tab 1: Stk px implies 21.5% CAGR LT Growth (10yr + 10yr) @ 7.45% GSEC

Tab 2: Same Growth (21.5% CAGR) @ 8.55% GSEC

=>26% Lower Value (Rs2274)

Tab 1: Stk px implies 21.5% CAGR LT Growth (10yr + 10yr) @ 7.45% GSEC

Tab 2: Same Growth (21.5% CAGR) @ 8.55% GSEC

=>26% Lower Value (Rs2274)

Continuing on #AsianPaints. Its Long Term Rev & EPS growth is 12% and 11.7% Respectively. Assuming generous 15% Long Term Growth (10yrs + 10yrs) at 8.55% GSEC, its fair value can be Rs1201/sh (or 61% lower). RECALL, there is NO assumption here of Market Share loss to new Entrants

• • •

Missing some Tweet in this thread? You can try to

force a refresh