There’s a lot of debate this week about the UK’s role in the world. 🇬🇧

A new PM

Maybe a new trade deal with India.🇮🇳

A debate that started with #brexit of course

But what about the EU’s role in the world?

#StateofEU @friendsofeurope @africaeuropefdn

A new PM

Maybe a new trade deal with India.🇮🇳

A debate that started with #brexit of course

But what about the EU’s role in the world?

#StateofEU @friendsofeurope @africaeuropefdn

The EU is the world’s largest trading bloc. 🇪🇺

But in reality, it’s hemorrhaging influence in emerging markets and developing countries.

Why?

Partly because China, Russia, Turkey, and Gulf states have massively increased investments and military support.

#StateofEU

But in reality, it’s hemorrhaging influence in emerging markets and developing countries.

Why?

Partly because China, Russia, Turkey, and Gulf states have massively increased investments and military support.

#StateofEU

Russia, the largest supplier of weapons to Africa, now provides 44 percent of major arms to the region. sipri.org/sites/default/…

China committed about US$160 billion in infrastructure financing in Africa between 2000 and 2020. bu.edu/gdp/chinese-lo…

China committed about US$160 billion in infrastructure financing in Africa between 2000 and 2020. bu.edu/gdp/chinese-lo…

But it's also because of Europe’s own pattern of decisions.

💉Hoarding COVID-19 vaccines

⛽️Stopping investments in natural gas in poorer countries while continuing to invest in fossil fuels at home.

💶Failing to deliver on financial promises.

The list could go on

#StateofEU

💉Hoarding COVID-19 vaccines

⛽️Stopping investments in natural gas in poorer countries while continuing to invest in fossil fuels at home.

💶Failing to deliver on financial promises.

The list could go on

#StateofEU

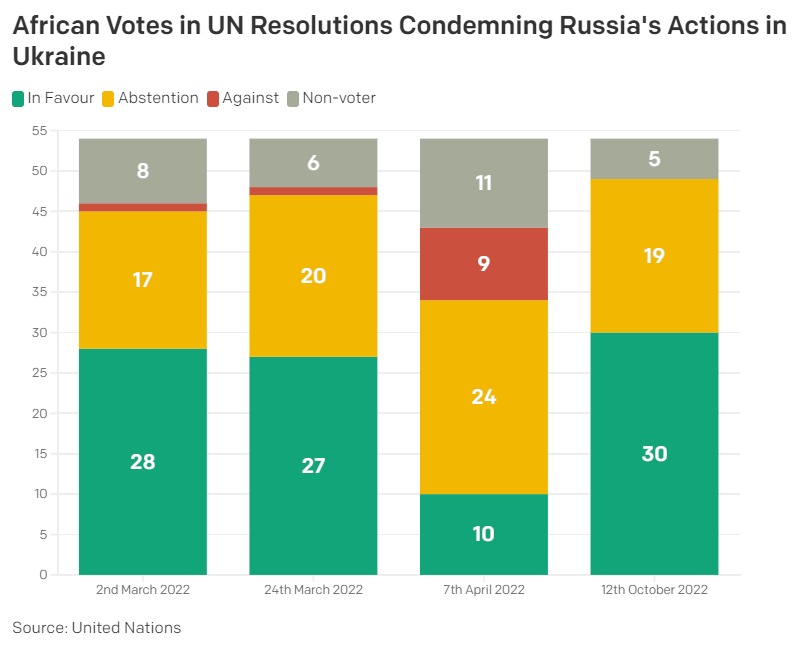

Many Europeans were shocked when successive votes at the UN condemning Russia’s actions in Ukraine were met with abstentions from emerging economies.

#StateofEU

#StateofEU

There are a number of reasons for this:

👉Not wanting to take sides in other's conflicts

👉A sense of western hypocrisy vis a vis other conflicts

👉And a need to keep their options open because of the crises they face.

👉Not wanting to take sides in other's conflicts

👉A sense of western hypocrisy vis a vis other conflicts

👉And a need to keep their options open because of the crises they face.

Sri Lanka is a country grappling with a debt and cost of living crisis.

It abstained from condemning Russia

The next day it announced a deal to procure cheap Russian gas.

ft.com/content/59e4ff…

It abstained from condemning Russia

The next day it announced a deal to procure cheap Russian gas.

ft.com/content/59e4ff…

And while the EU gives a LOT in aid, it is not all well received.

Much of it does good - but in a much less visible way than China’s roads, ports, hospitals, etc.

Much of it does good - but in a much less visible way than China’s roads, ports, hospitals, etc.

In some cases, what the EU thinks is doing good, is perceived by those countries as hypocritical preaching and self-serving market protectionism.

carnegieeurope.eu/2022/06/29/sou…

carnegieeurope.eu/2022/06/29/sou…

The EU’s foreign policy chief @JosepBorrellF said

“We have to be much more on “listening mode…We think that we know better what is in other people’s interests.”

This was before he made some unfortunate remarks about Europe being a garden...

dw.com/en/eu-top-dipl…

“We have to be much more on “listening mode…We think that we know better what is in other people’s interests.”

This was before he made some unfortunate remarks about Europe being a garden...

dw.com/en/eu-top-dipl…

Europe preaches about the rule of law and democracy when it comes to nations.

But is totally relaxed about a democratic deficit when it comes to global institutions.

This has real-world implications. #StateofEU

But is totally relaxed about a democratic deficit when it comes to global institutions.

This has real-world implications. #StateofEU

Southern countries are impacted by crises created in and by other regions:

👉the Global Financial Crisis began in the US housing market

👉#COVID-19 began in China

👉Russia’s invasion of Ukraine contributed to global food and energy crises

That's before we get to #climate

👉the Global Financial Crisis began in the US housing market

👉#COVID-19 began in China

👉Russia’s invasion of Ukraine contributed to global food and energy crises

That's before we get to #climate

Yet, African countries in particular have almost no say over the responses.

As a result the responses serve richer countries and make the crises *worse* in poorer countries.

Here's why 👇

As a result the responses serve richer countries and make the crises *worse* in poorer countries.

Here's why 👇

The @IMFNews & @worldbank were established in 1944 to safeguard the stability of the international financial system and finance post-war reconstruction.

But their governance remains “anachronistic and ineffective” according to India’s Foreign Minister @DrSJaishankar

#StateofEU

But their governance remains “anachronistic and ineffective” according to India’s Foreign Minister @DrSJaishankar

#StateofEU

A ‘gentleman’s agreement’ means that Europe gets to choose the Managing Director of the IMF and the United States chooses the World Bank president.

There's more of an open competition for the President of Belarus... #StateofEU

There's more of an open competition for the President of Belarus... #StateofEU

The voting shares of these institutions are highly unequal.

The Euro Area (342 million people) controls roughly 20% @WorldBank votes.

Africa (54 countries, 1.4 billion people) has a voting share of 7%.

The Euro Area (342 million people) controls roughly 20% @WorldBank votes.

Africa (54 countries, 1.4 billion people) has a voting share of 7%.

In July, Senegal’s President called for an African Union seat at the G20. lemonde.fr/afrique/articl…

Japan and the US have been responsive to calls for more African representation at the UN Security Council

But Europe is conspicuously absent. 🇪🇺

Japan and the US have been responsive to calls for more African representation at the UN Security Council

But Europe is conspicuously absent. 🇪🇺

If Europe really wants to build influence, it should deliver on its financing promises.

But it should also listen and back an African Union seat at the @G20org

Then follow up with supporting more African representation on the boards of the @IMFnews and @WorldBank.

#stateofEU

But it should also listen and back an African Union seat at the @G20org

Then follow up with supporting more African representation on the boards of the @IMFnews and @WorldBank.

#stateofEU

I wrote about this issue for @ECFR here ecfr.eu/article/seats-…

Today the @AfricaEuropeFdn meets in Brussels to discuss this and many other Europe Africa issues.

#StateofEU

Today the @AfricaEuropeFdn meets in Brussels to discuss this and many other Europe Africa issues.

#StateofEU

As ever, if you want more visit data.one.org and sign up for one.org/Aftershocks

• • •

Missing some Tweet in this thread? You can try to

force a refresh