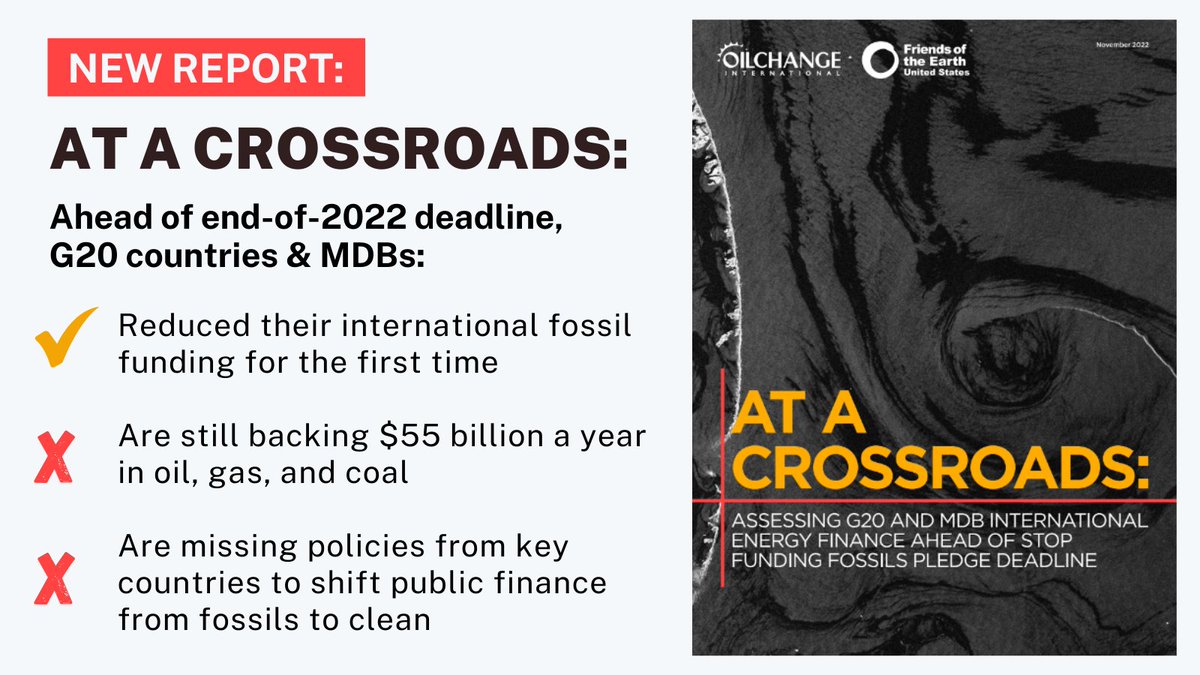

NEW REPORT: We looked under the hood of G20 countries' international public finance for energy ahead of their Very Big Deadline to #StopFundingFossils.

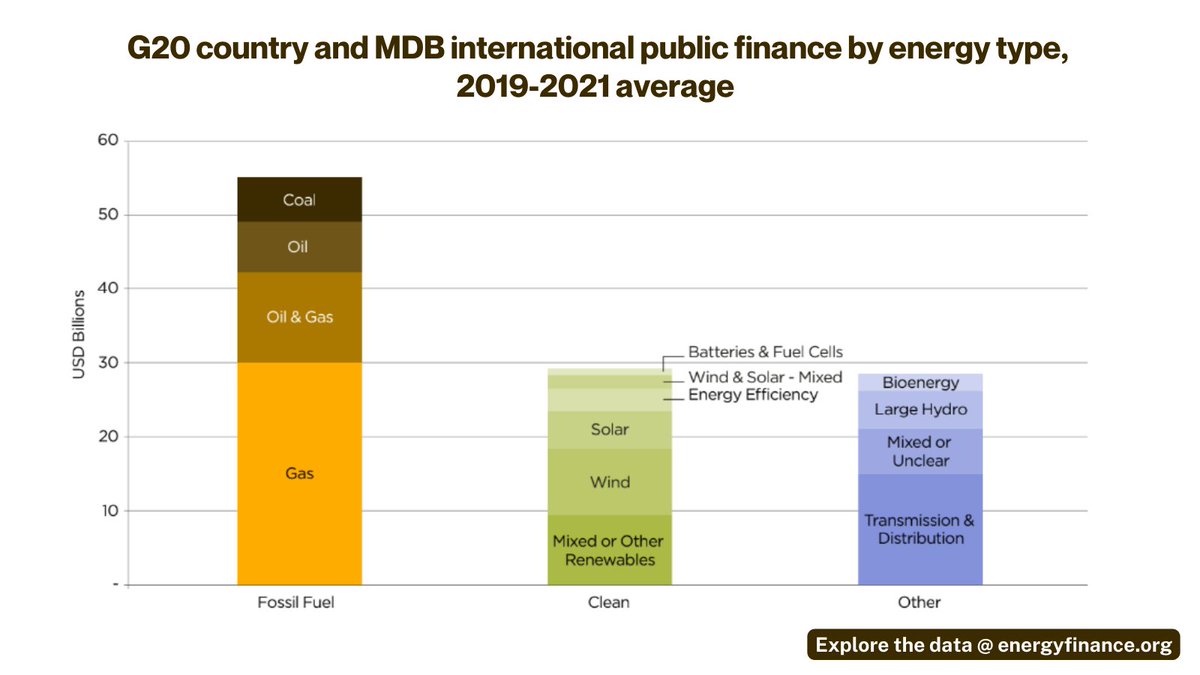

🧵Here's more on the $55 billion / yr in fossil fuel money we found & how we can stop it 🧵

priceofoil.org/g20-at-a-cross…

🧵Here's more on the $55 billion / yr in fossil fuel money we found & how we can stop it 🧵

priceofoil.org/g20-at-a-cross…

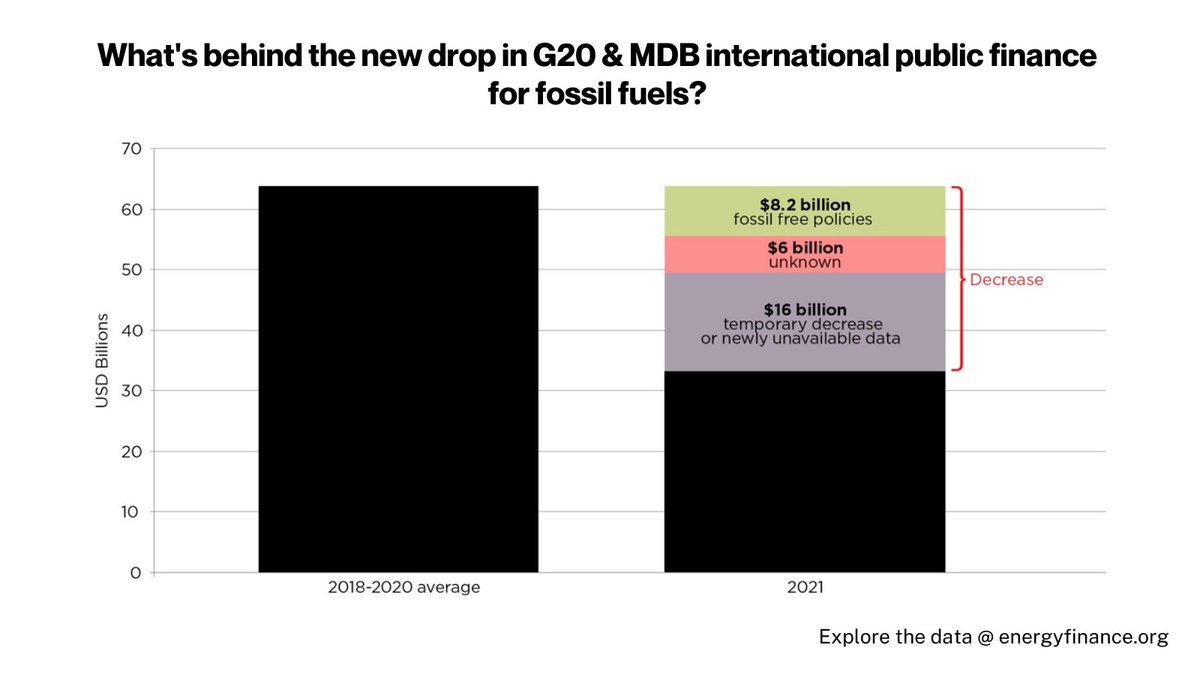

GOOD NEWS: Public 💵 for fossils just dropped for the first time, and ~1/3 of this is from action from UK, @EIB, & others.

BAD NEWS: The rest of the drop is (a) just noise, (b) already overturned in early 2022 data, or (c) from worse data availability!

priceofoil.org/g20-at-a-cross…

BAD NEWS: The rest of the drop is (a) just noise, (b) already overturned in early 2022 data, or (c) from worse data availability!

priceofoil.org/g20-at-a-cross…

But there is a growing 🌊 of countries adding more fossil free public finance policies that could mean this trend continues. For this to happen, @OlafScholz, @JustinTrudeau, @POTUS, @ItalyMFA_int need to show up at #COP27 with policies too! priceofoil.org/g20-at-a-cross…

📈 Some other key points 📈

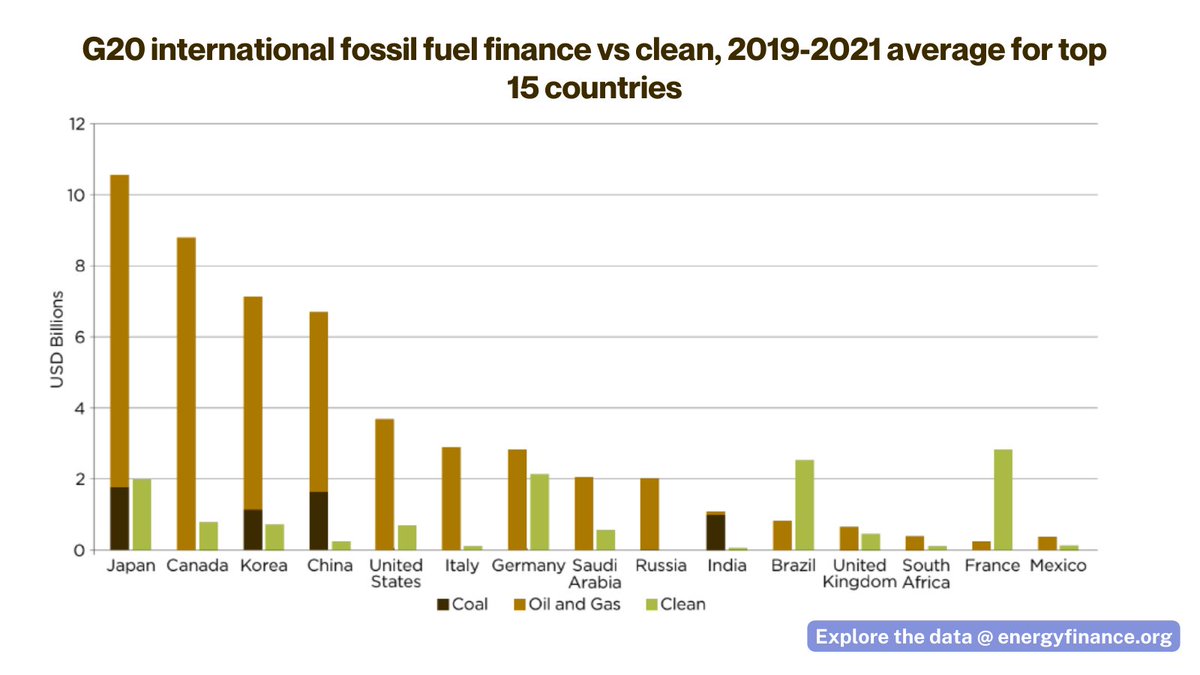

🇨🇦 🇯🇵 🇰🇷 🇨🇳 are the largest providers of public finance for fossil fuels, providing more than half of all #G20 public finance for fossil fuels (more than $30 billion a year!) priceofoil.org/g20-at-a-cross…

🇨🇦 🇯🇵 🇰🇷 🇨🇳 are the largest providers of public finance for fossil fuels, providing more than half of all #G20 public finance for fossil fuels (more than $30 billion a year!) priceofoil.org/g20-at-a-cross…

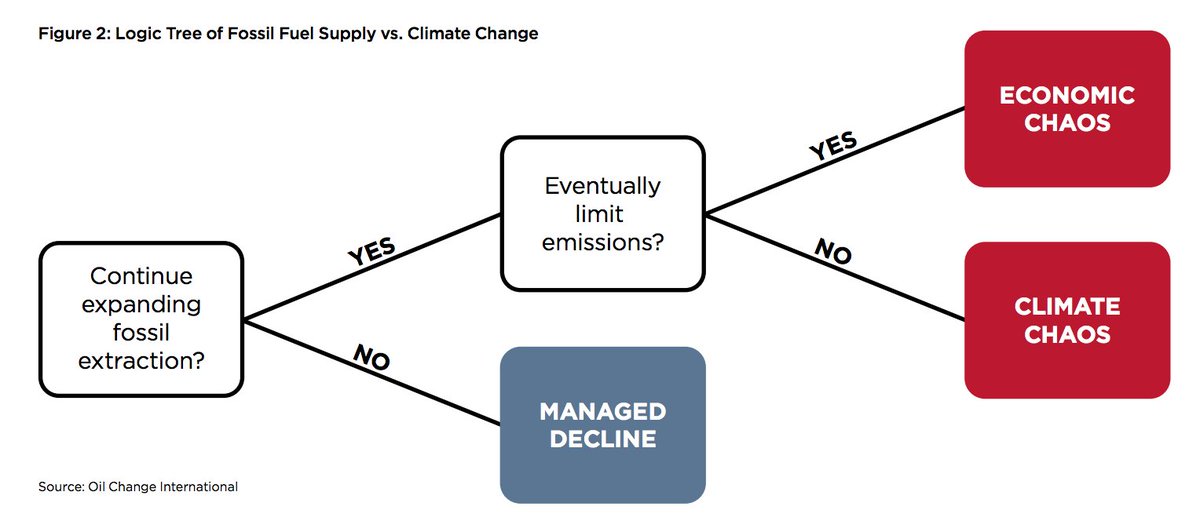

It's a myth that fossil fuel $ is good for development.

1) Little of it flows to the lowest income countries

2) It rarely supports energy access. In the top low-income recipient, Mozambique, 99.7% flowed to projects for export + extraction, not local use. #MozLNG

1) Little of it flows to the lowest income countries

2) It rarely supports energy access. In the top low-income recipient, Mozambique, 99.7% flowed to projects for export + extraction, not local use. #MozLNG

Fossil gas still receives more 💰 than any other energy source 🚩, despite @IEA and @IPCC_CH findings that clean energy investment is the way to an energy secure future. priceofoil.org/g20-at-a-cross…

Public banks have huge leverage and could be the institutions building a globally just #GreenNewDeal. But they can’t play this role until this chart gets A LOT greener. See how different countries and MDBs stack up here: energyfinance.org/#/tracker

The #StopFundingFossils pledge could unlock much needed multilateral climate momentum! But, wealthy countries at #COP27 need to:

📣 Get peers to #StopFundingFossils

💸 Pay fair share of #ClimateDebtJustice & #ClimateFinance

🌞 Fund RE & a just transition

🛢️#KeepitintheGround (!!)

📣 Get peers to #StopFundingFossils

💸 Pay fair share of #ClimateDebtJustice & #ClimateFinance

🌞 Fund RE & a just transition

🛢️#KeepitintheGround (!!)

• • •

Missing some Tweet in this thread? You can try to

force a refresh