How to buy the dip, and not get wrecked.

- Thread Time 🧵-

#axotrade #cardano #cardanocommunity #ada #defi $ada

- Thread Time 🧵-

#axotrade #cardano #cardanocommunity #ada #defi $ada

[Disclaimer]

This thread will necessarily talk in vague terms and avoid giving concrete examples, as the goal is to teach financial principles - not to give you an excuse to YOLO your life savings away.

Only ever invest money you can afford to lose. Every trade carries risk.

This thread will necessarily talk in vague terms and avoid giving concrete examples, as the goal is to teach financial principles - not to give you an excuse to YOLO your life savings away.

Only ever invest money you can afford to lose. Every trade carries risk.

1/ Intro

A phrase that is often repeated in the crypto world is to "buy the dip". The idea is that if you buy when prices are low, you'll be able to sell high. This is not always the case, you need a strategy to approach buying assets - don't just blindly throw money around.

A phrase that is often repeated in the crypto world is to "buy the dip". The idea is that if you buy when prices are low, you'll be able to sell high. This is not always the case, you need a strategy to approach buying assets - don't just blindly throw money around.

2/ Portfolio Management

In the coming weeks, we will be talking about how to find and assess good investments, but to start with, assuming you have some already, we'll discuss how to structure yourself in choppy waters and accumulate more of whatever it is you want to get.

In the coming weeks, we will be talking about how to find and assess good investments, but to start with, assuming you have some already, we'll discuss how to structure yourself in choppy waters and accumulate more of whatever it is you want to get.

3/ On Timing the Market

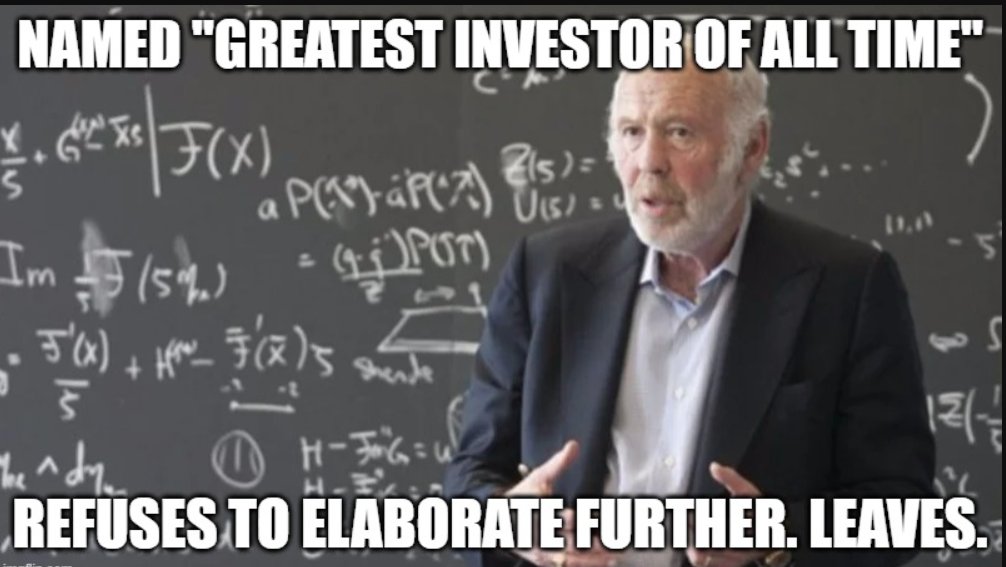

Buying when the market is lowest, and selling when the market is highest, is a bit of a pipe dream. It's close to impossible to guess this - perhaps the exception being Jim Simons, a fund manager who made billions developing mathematical models.

Buying when the market is lowest, and selling when the market is highest, is a bit of a pipe dream. It's close to impossible to guess this - perhaps the exception being Jim Simons, a fund manager who made billions developing mathematical models.

4/ Dealing With One's Ignorance

For us mere mortals, we're left having to buy and sell assets at what we consider fair prices. It's not about optimizing every percentage point but executing trades that you can live with.

You don't know when we're hitting a bottom or top!

For us mere mortals, we're left having to buy and sell assets at what we consider fair prices. It's not about optimizing every percentage point but executing trades that you can live with.

You don't know when we're hitting a bottom or top!

5/ Don't Wait For Dips

Since we don't know the future, assuming that the current prices are what you consider fair and sustainable, there's no shame in buying now rather than later, assuming you're investing for the longer term and you believe in your investment thesis.

Since we don't know the future, assuming that the current prices are what you consider fair and sustainable, there's no shame in buying now rather than later, assuming you're investing for the longer term and you believe in your investment thesis.

6/ Opportunistic Trading

On the other hand, if you believe prices are too high or you're just looking to add more if the price goes lower, then there are two main means by which you can structure your investment strategy without incurring additional costs - Ladder Orders & DCA.

On the other hand, if you believe prices are too high or you're just looking to add more if the price goes lower, then there are two main means by which you can structure your investment strategy without incurring additional costs - Ladder Orders & DCA.

7/ Dip Within a Dip

An issue that a lot of people encounter when they "buy the dip", as in they buy when the price of an asset falls in value, is that the dip keeps dipping, but by then they've shot all their ammo, and have nothing left in the chamber.

An issue that a lot of people encounter when they "buy the dip", as in they buy when the price of an asset falls in value, is that the dip keeps dipping, but by then they've shot all their ammo, and have nothing left in the chamber.

8/ Pick Your Shots

Don't shoot all your bullets at once. You can do this with "Ladder Orders." This is just a fancy way of saying that you will buy at price points below the current price.

For instance, if the price is $10, you can place orders to buy at $9,$7.5, $6, etc.

Don't shoot all your bullets at once. You can do this with "Ladder Orders." This is just a fancy way of saying that you will buy at price points below the current price.

For instance, if the price is $10, you can place orders to buy at $9,$7.5, $6, etc.

9/ A Note on Ladder Orders

Some platforms, especially old-style DEXs (almost all of them) don't have this functionality built in. But you can make your own version of it by placing orders at different intervals; you can also adjust the cost weighting of each one.

Some platforms, especially old-style DEXs (almost all of them) don't have this functionality built in. But you can make your own version of it by placing orders at different intervals; you can also adjust the cost weighting of each one.

10/ Stairway to Heaven

You can change how much money (the weight) you put in per step on the Ladder Order. For instance, if you have $100 to invest in a token, you can divide that capital across each level. They don't need to be the same, you can value each step differently.

You can change how much money (the weight) you put in per step on the Ladder Order. For instance, if you have $100 to invest in a token, you can divide that capital across each level. They don't need to be the same, you can value each step differently.

11/ Different Types of Steps

There are two ways in which to place a buy order for a token: Limit and Market orders.

- Limit Orders only buy at the price they were set at.

- Market-if touched orders buy at whatever the price is when activated, until an order is filled.

There are two ways in which to place a buy order for a token: Limit and Market orders.

- Limit Orders only buy at the price they were set at.

- Market-if touched orders buy at whatever the price is when activated, until an order is filled.

12/ Uses for Limit Orders

As these orders only purchase assets at the price they were set for or better, they are great for the very start of a ladder. That way, if there's a market trend reversal while purchasing your tokens, you won't buy at worse prices than you wanted.

As these orders only purchase assets at the price they were set for or better, they are great for the very start of a ladder. That way, if there's a market trend reversal while purchasing your tokens, you won't buy at worse prices than you wanted.

13/ Uses for Market-if Touched Orders

These orders start purchasing at any available price once they're triggered, so they should be placed deeper in your ladder. If the dip is large enough, you'll get lucky and purchase more tokens at even better prices than you planned.

These orders start purchasing at any available price once they're triggered, so they should be placed deeper in your ladder. If the dip is large enough, you'll get lucky and purchase more tokens at even better prices than you planned.

14/ The Average Bear

The main problem with a ladder order is that it assumes you already have cash sitting on the sidelines, waiting to be deployed. Most people aren't in that position, so we have to be a bit creative in how we approach things - enter Dollar-Cost-Averaging (DCA)

The main problem with a ladder order is that it assumes you already have cash sitting on the sidelines, waiting to be deployed. Most people aren't in that position, so we have to be a bit creative in how we approach things - enter Dollar-Cost-Averaging (DCA)

15/ DCA

Take your savings, and invest a fixed amount of it on a regular basis, that's DCA. How often "on a regular basis" means, is entirely up to you - it can be once a week, a month, etc. This ensures you'll buy high and low, so on average, it'll be a decent price.

Take your savings, and invest a fixed amount of it on a regular basis, that's DCA. How often "on a regular basis" means, is entirely up to you - it can be once a week, a month, etc. This ensures you'll buy high and low, so on average, it'll be a decent price.

16/ Salary & DCA

Because of its cyclical and fixed nature, many people tie their DCA strategy directly with their paycheck and invest a fixed percentage thereof. Some platforms even allow you to keep an active order open, which you top up when you have money available.

Because of its cyclical and fixed nature, many people tie their DCA strategy directly with their paycheck and invest a fixed percentage thereof. Some platforms even allow you to keep an active order open, which you top up when you have money available.

17/ Structuring Around One's Ignorance

Buying the dip without going broke and overinvesting, relies on emotional control and having a plan. DCA, Ladder Trades, etc. are expressly designed to work around one's biases -

You are your own worst enemy while investing.

Buying the dip without going broke and overinvesting, relies on emotional control and having a plan. DCA, Ladder Trades, etc. are expressly designed to work around one's biases -

You are your own worst enemy while investing.

18/ Conclusion

This is just the beginning of a long journey. Over the coming weeks, we'll be discussing the nuances of investing, the red flags to avoid, as well as how DeFi has so far failed you as investors.

For now, we wish you farewell and happy bear markets!

This is just the beginning of a long journey. Over the coming weeks, we'll be discussing the nuances of investing, the red flags to avoid, as well as how DeFi has so far failed you as investors.

For now, we wish you farewell and happy bear markets!

If you enjoyed this thread, please like, retweet the first post, and subscribe to @axotrade 🧵

Make sure to check out our ongoing #TradFiTales series too:

axo.trade/newsroom/posts…

Make sure to check out our ongoing #TradFiTales series too:

axo.trade/newsroom/posts…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh