After #Benfica won their Champions League group ahead of PSG and Juventus, I thought it might be interesting to take a look at their finances. The 2021/22 accounts cover a season when they only finished 3rd in Primeira Liga, but reached the CL quarter-finals #SLBenfica #SLB

Benfica pre-tax loss widened from €34m to €42m (€35m after tax), despite revenue rising €75m (80%) from €94m to club record €169m, as profit from player sales fell €46m from €88m to €42m and expenses increased €37m (17%).

Benfica revenue growth driven by Champions League participation, which led to broadcasting increasing €48m (73%) from €66m to €114m, and match day, up €25m from €0.5m to €25m, due to the return of fans to the stadium. Commercial also rose €3m (10%) from €28m to €31m.

Benfica wage bill rose €16m (16%) from €97m to €113m, but player amortisation decreased €4m (8%) to €43m. Other expenses shot up €22m (46%) to €72m, mainly due to the higher costs of staging games with fans.

As a technical aside, it should be noted that these figures are based on the club’s individual accounts, as consolidated accounts are no longer published since the €99m sale of Benfica Estadio and Benfica TV to Benfica SGPS in July 2019.

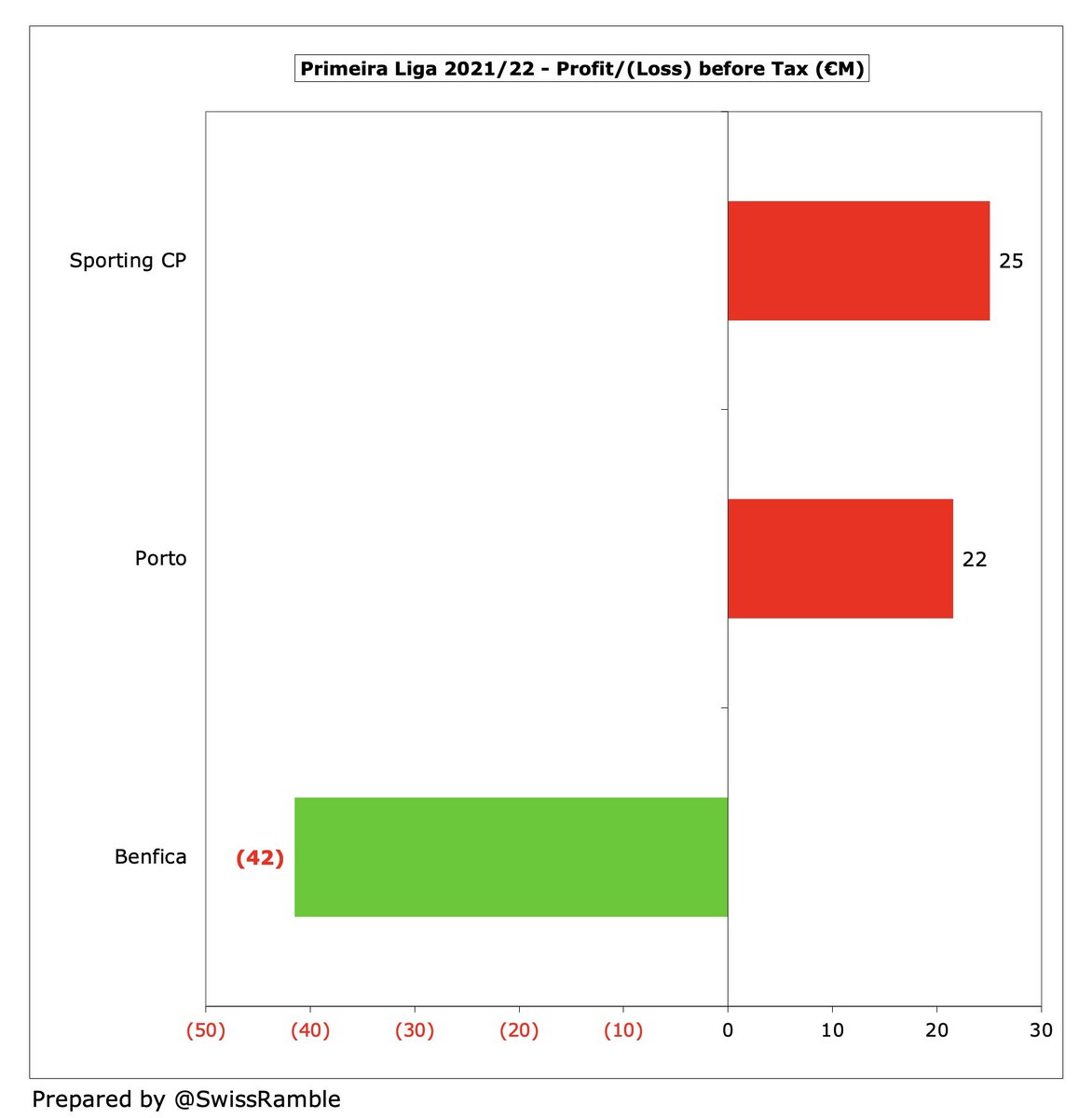

Benfica €42m pre-tax loss was in stark contrast to their principal Portuguese rivals, who both posted good profits: Sporting €25m and Porto €22m. This was largely due to the impact of the deflated transfer market on player sales in 2021/22.

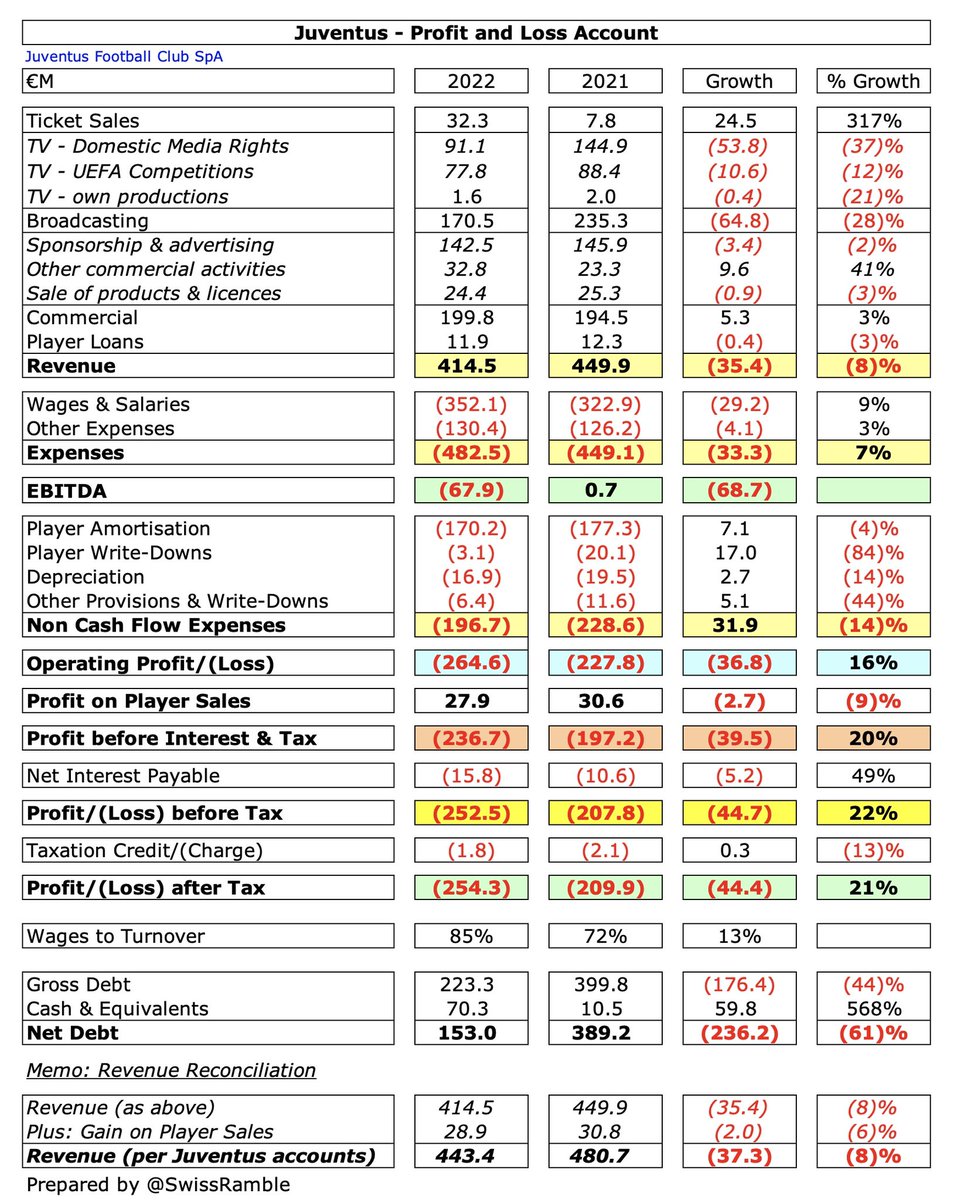

In fairness, Benfica have done much better than other leading European clubs during the pandemic, reporting an aggregate pre-tax €12m profit for 2019/20 and 2020/21, compared to huge losses at the likes of Barcelona €689m, PSG €350m and Inter €337m.

Benfica profit from player sales fell €46m from €88m to €42m, as transfers were mainly of previously purchased players, rather than academy products. For example, Darwin Nunez was sold to #LFC for €75m (potentially rising to €100m), but the gain was only €41m.

Benfica normally run a sustainable business model, but they have posted losses amounting to €76m in the past two years, partly due to the pandemic. In the previous 7 years, they had accumulated €187m profit, averaging €27m a season, with their last loss coming in 2013.

Benfica are very reliant on player sales, earning an impressive €734m in the last decade, including €389m in the last 5 years. However, 2021/22 €42m profit was easily the lowest since 2013. Only meaningful sale to date this season is Yaremchuk to Club Brugge €16m.

All clubs in Portugal depend on player trading, but this is especially the case for Benfica, whose €734m profit in last 10 years was even higher than Porto €500m and Sporting €398m. Includes big money sales of Joao Felix to Atleti €108m and Ruben Dias to #MCFC €66m.

In fact, in the 10 years up to 2021, no club in Europe has generated more profit from player sales than Benfica. Their €721m gain is just ahead of #CFC €720m, Monaco €697m and Juventus €673m. To put it into context, this is more than 5 times as much as #MUFC €141m.

Benfica operating loss narrowed from €113m to €73m, though still worse than their Portuguese rivals. The business model is to offset operating losses with profits from player sales, though this has not been possible in the last two years due to COVID.

Following last year’s growth, Benfica €169m revenue is the club’s highest ever, mainly due to their progress to the Champions League quarter-finals, which boosted both broadcasting and gate receipts.

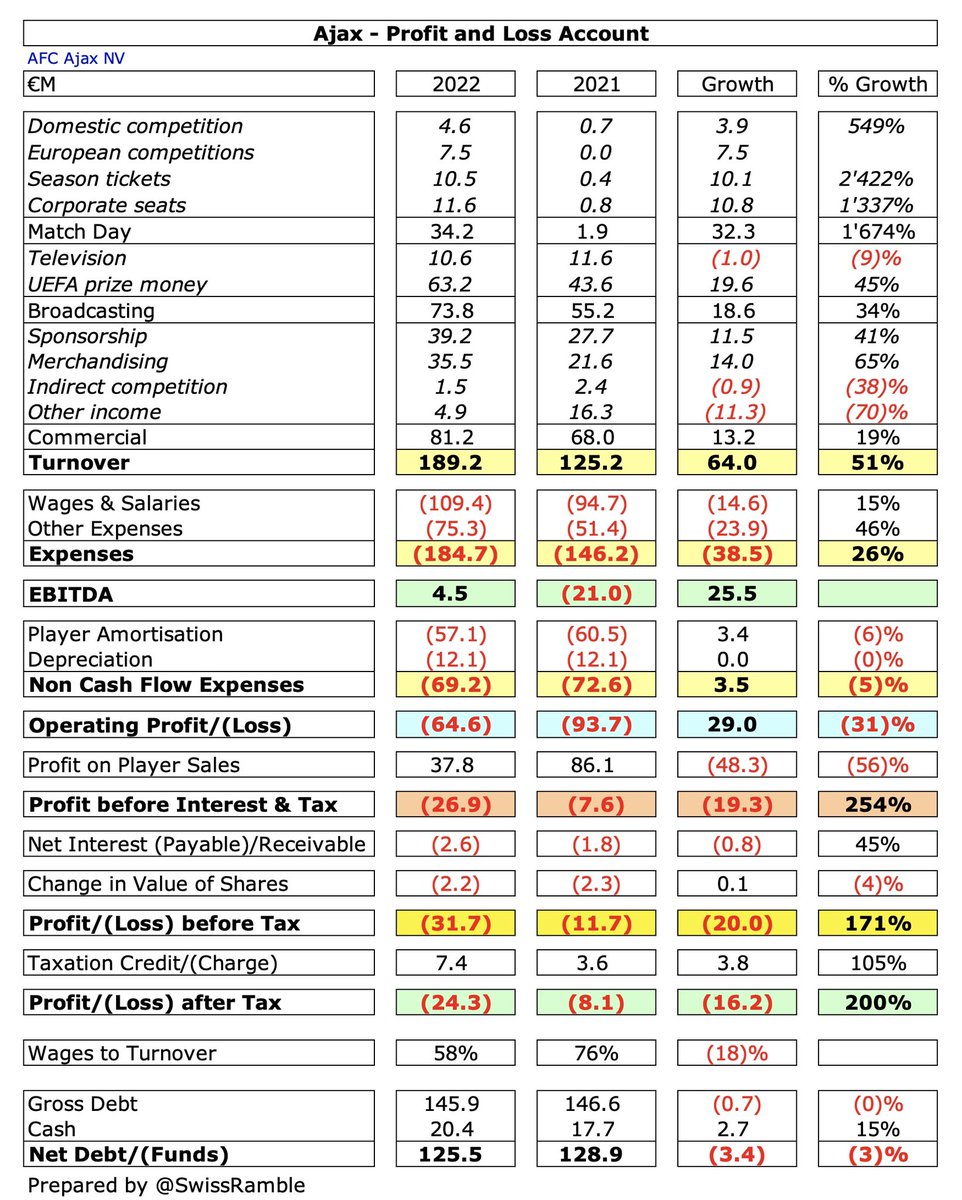

Benfica’s €169m revenue was higher than Porto €144m and Sporting €123m in 2021/22, though their relative position against Porto is basically dependent on which club does better in Europe, e.g. Benfica in 2022, Porto in 2021.

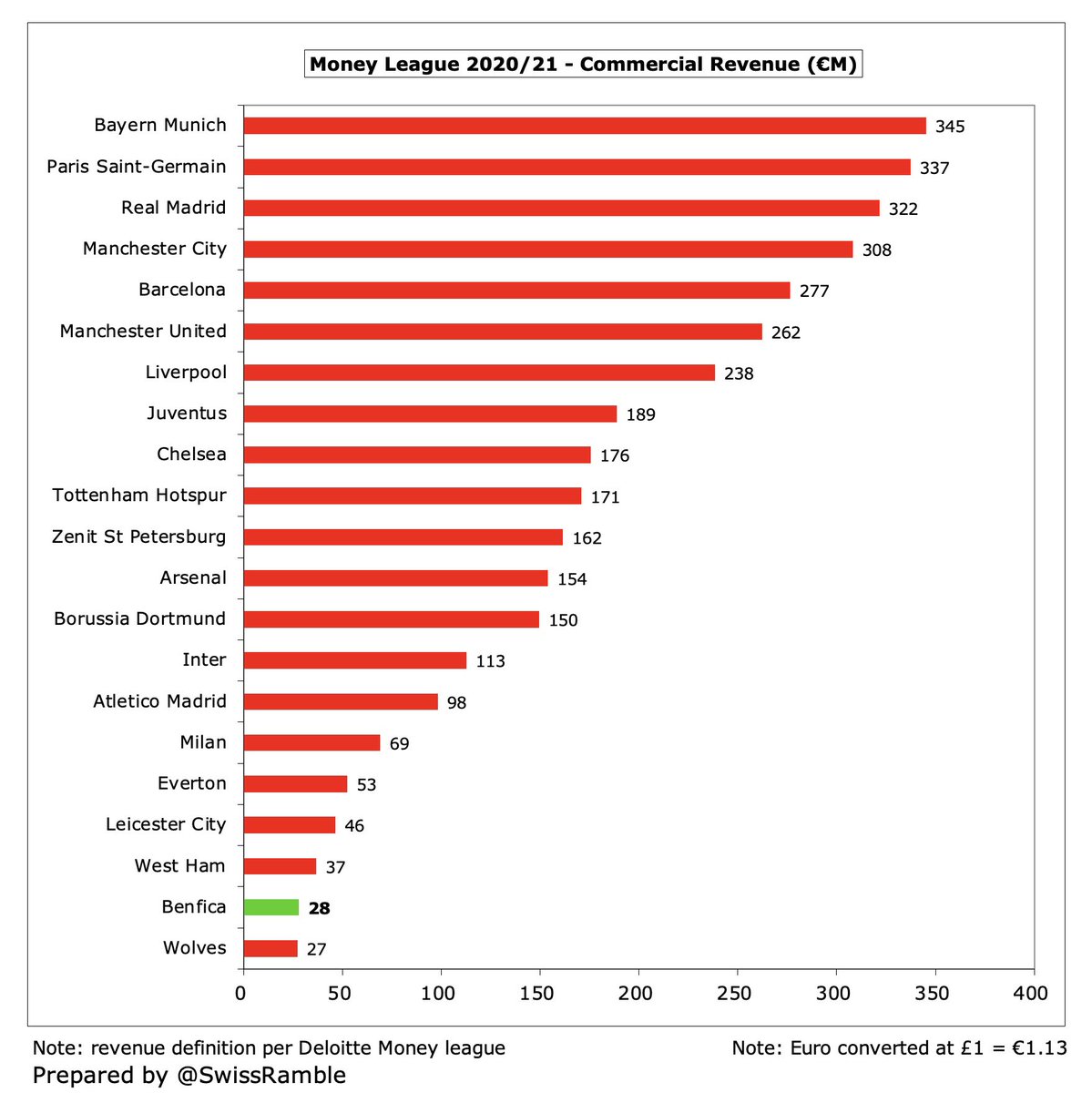

In 2021 Benfica dropped out of the Deloitte Money League with their €94m revenue a long way below 30th placed Lazio €164m, having been 23rd the previous season. This highlights that their operating revenue is far below the European elite, which is why they are a selling club.

Benfica broadcasting revenue rose €48m (73%) from €66m to €114m, a new club record. This was the highest in Portugal, ahead of Porto €90m and Sporting €73m, but by the same token is well below other leading European clubs.

Benfica have had an individual TV deal with NOS since 2015 (runs to 2027), though authorities discussing centralised rights to increase league’s competitiveness. Domestic TV money fell in 2021/22, as prior year included money for games played after accounting close in July 2020.

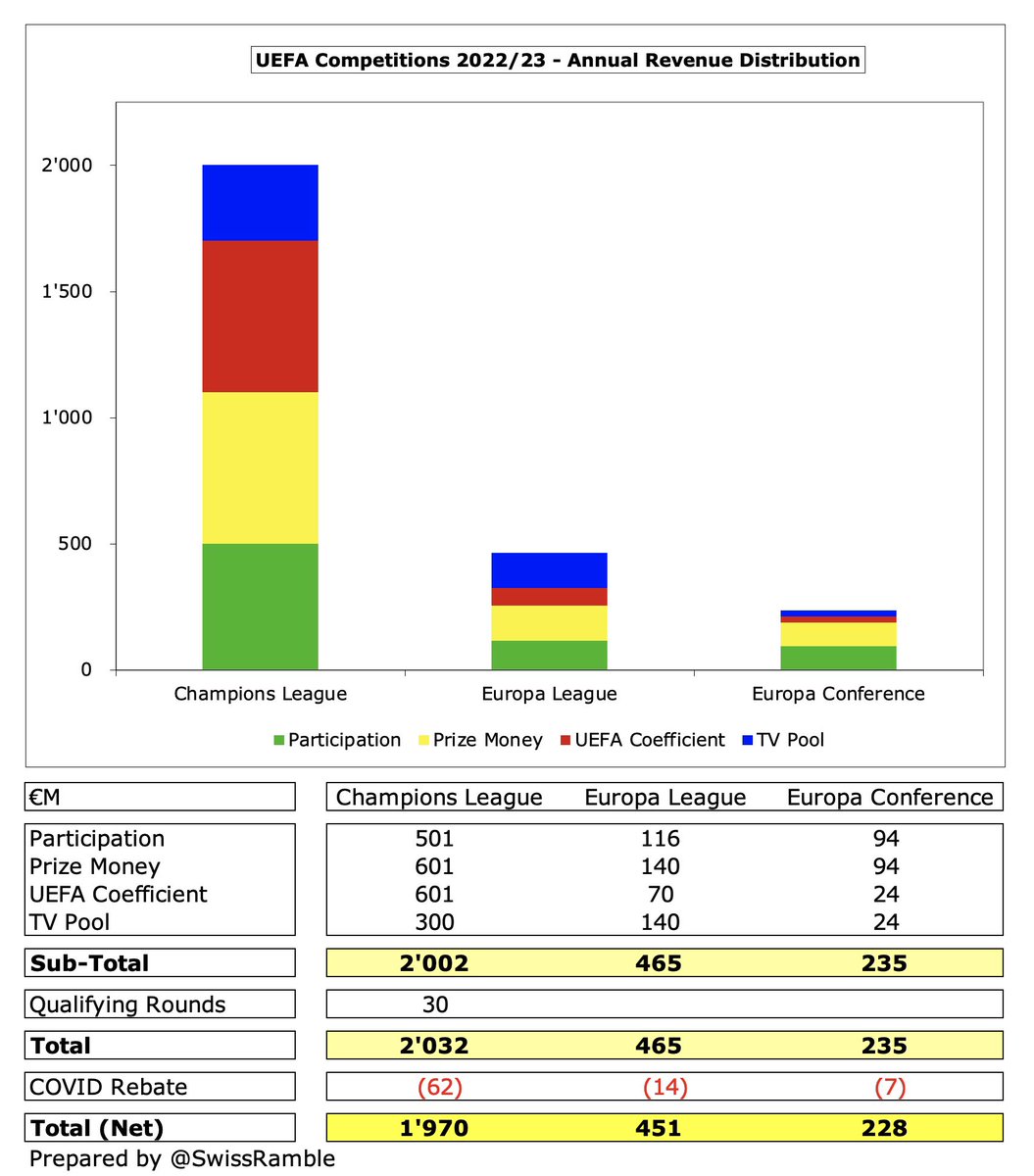

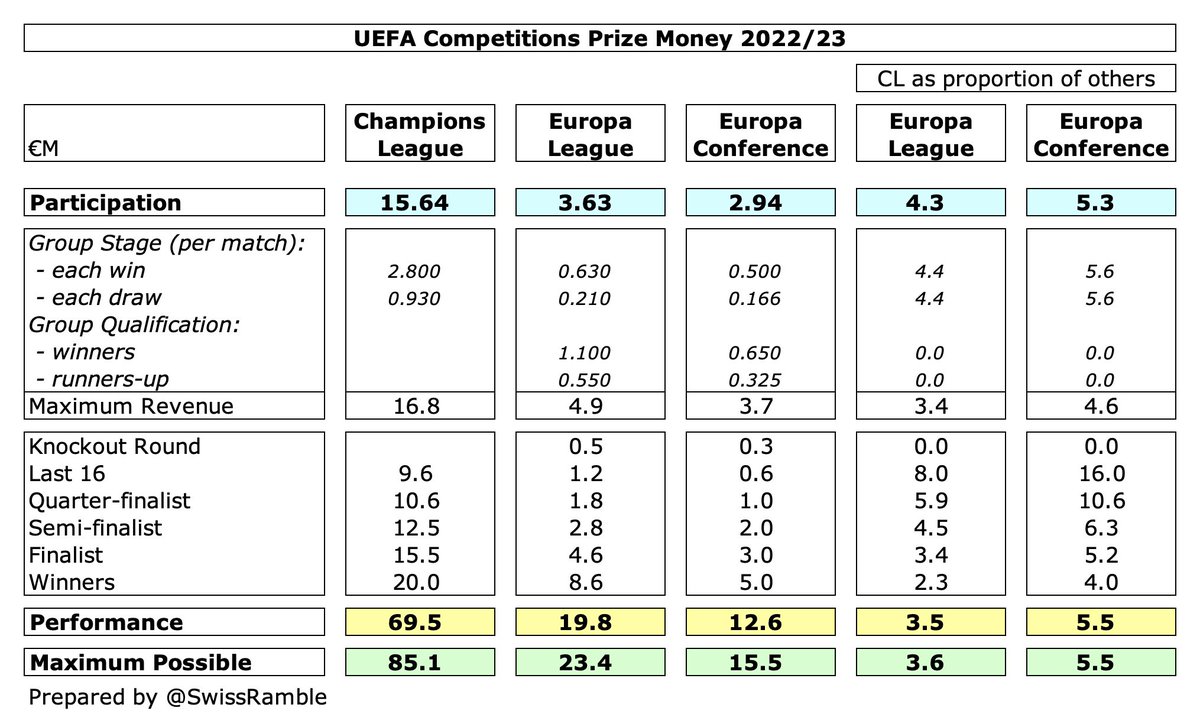

Benfica earned €64m from Europe in 2021/22 after reaching Champions League quarter-finals, which was €53m more than prior year’s €11m when they only reached the last 32 in the far less lucrative Europa League.

A large part of Benfica’s European money comes from the UEFA coefficient payment (based on performances over 10 years), where they were ranked 14th in the Champions League, thus receiving €22m. This distribution methodology rewards the club’s decent record in Europe.

Benfica have earned nearly €200m from European competition in the last 5 years, though this is less than rivals Porto €240m. Higher UEFA TV deal since 2019 is evident, e.g. €64m in 2022 much higher than €36m in 2016 (both QF). Suffered a hit in 2021 in Europa League.

The importance of Champions League qualification to the Benfica business model cannot be over-stated, as seen by the €61m they have earned to date in this season’s Champions League after qualifying for the last 16.

Benfica match day income rose €24.8m from €0.5m to €25.3m, due to the return of fans to the stadium, though some games were still played with restricted capacity. Nevertheless, still a club record for this revenue stream and higher than Sporting €17m and Porto €11m.

Benfica average attendance was down to 32,500 in 2021/22, due to the capacity restrictions imposed by the authorities, though still highest in Portugal, ahead of Porto 31,000 and Sporting 25,000. Before COVID struck, Benfica enjoyed crowds of 54,000.

Benfica commercial income rose €3m (10%) from €28m to €31m, as normal activity levels returned, plus new sleeve sponsorship with Betano. This income stream has been around the same level since 2016.

As a result, Benfica €31m commercial revenue is a fair bit lower than Porto €43m and similar to Sporting. Significantly less than the elite European clubs, six of whom generate more than €250m a year.

Benfica main sponsorship deals have been in place for a long time: (a) shirt sponsor Emirates since 2015; (b) kit supplier Adidas since 1997 – the deal is reportedly worth around €4.5m a year until 2027. Also have back-of-shirt deal with Portuguese beer Sagres.

Benfica wage bill rose €16m (16%) from €97m to €113m, mainly due to higher bonuses for Champions League. This means that wages have shot up over €50m (87%) in just 4 years. Much higher than Porto €83m and Sporting €67m.

However, Benfica’s wages are still much lower than top clubs in the major leagues, e.g. their €95m in 2020/21 was less than a fifth of PSG €503m. This makes it fairly inevitable that their young talent will move abroad sooner or later.

Following the increase in revenue, Benfica wages to turnover ratio decreased (improved) from 103% to 66%, though still higher than Porto 57% and Sporting 55%. However, Benfica’s ratio is close to its normal pre-COVID levels.

Benfica player amortisation, the annual charge to write-off transfer fees, fell €4m (8%) from €47m to €43m, though the club also booked €7m impairment to reduce the book value of certain players. Highest in Portugal, ahead of Porto €39m and Sporting €22m.

Benfica have been a selling club for many years. In fact, they have only had net spend one year in the last decade (and that was just €8m in 2021). In the last 5 years, they made €342m player purchases, but €528m sales produced €186m net sales.

For some perspective, Benfica €344m gross transfer spend in 5 years to 2021 was less than a third of Juventus, Barcelona, #MCFC and #CFC, all above €1.1bln. Nevertheless, their scouts still pick up good players for relatively little money, e.g. Enzo Fernandez from River Plate.

Benfica gross financial debt increased from €146m to €171m, comprising €142m bonds, €26m bank loans and €2m accrued interest. The club had been steadily reducing debt since €330m peak in 2014, but it has now risen from €100m 2 years ago, due to COVID & squad strengthening.

Despite the increase, Benfica €171m debt is a fair bit lower than Porto €280m, but higher than Sporting €158m. Miles below other leading European clubs, e.g. #CFC €1.7 bln, #THFC €964m, #MUFC €599m, Real Madrid €581m and Barcelona €533m.

Benfica interest payment increased from €6.0m to €8.7m in 2021/22, though this was still much lower than the €19.6m they paid in 2014. Also a lot less than Porto’s €20.6m interest last season.

Benfica transfer debt was also up, from €106m to €126m, so this has almost doubled from €64m in 2018. More than Sporting €110m and Porto €100m and reasonably high by European standards. However, on a net basis they have €10m receivables, as other clubs owe them €116m.

After adding back non-cash items, Benfica had €33m negative operating cash flow in 2021/22, offset by €43m player sales. Spent €48m on player purchases, €9m interest and €3m capex. Partly funded by €29m net new debt.

As a result, Benfica cash balance decreased €20m from €44m to €24m, though this was still much higher than Sporting and Porto, both €5m.

Even though Benfica posted large losses in the last 2 years, my model suggests that they were fine in terms of UEFA FFP, thanks to allowable deductions (infrastructure, academy, women’s football & community) and adjustment for COVID losses.

Benfica were hit by the resignation of their long-serving president in July 2021 following an investigation into tax fraud and money laundering, but he has been replaced by former player (and legend) Rui Costa.

Benfica’s ability to punch above their weight (given their relatively low revenue) is impressive, but it should be acknowledged that their business model is very reliant on 2 factors: (a) qualification for the Champions League; (b) large gains from player sales.

• • •

Missing some Tweet in this thread? You can try to

force a refresh