We recently published our Q3 State of Crypto: Market Pulse where we dug into five sub-sectors: Market Overview, Layer 1s, Defi, NFTs, and Gamefi.

Here are some interesting finds from our #Layer1 section: A thread 👇🧵

#Binance

Here are some interesting finds from our #Layer1 section: A thread 👇🧵

#Binance

1/ Monthly Transactions: Across the sample set, Solana had the highest increase in transactions in Q3 (+58%) after experiencing a significant fall in Q2. Avalanche continued to track lower,, falling 65% QoQ in Q3.

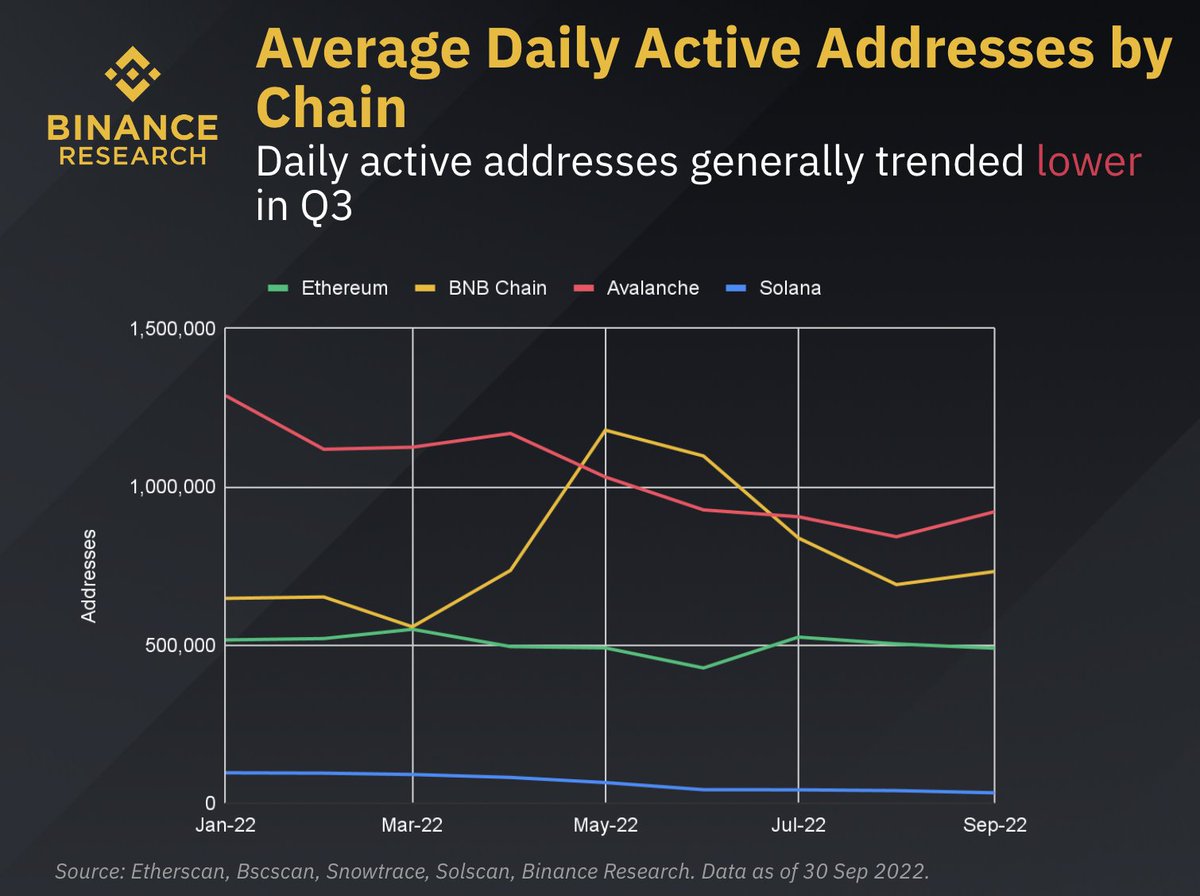

2/ Average Daily Active Addresses: With the exception of Ethereum, daily active addresses generally trended lower in Q3. Ethereum ended with a slight increase (5%), likely contributed by the Merge. BNB Chain, Solana, and Avalanche ended with -33%, -1%, and -23% QoQ respectively.

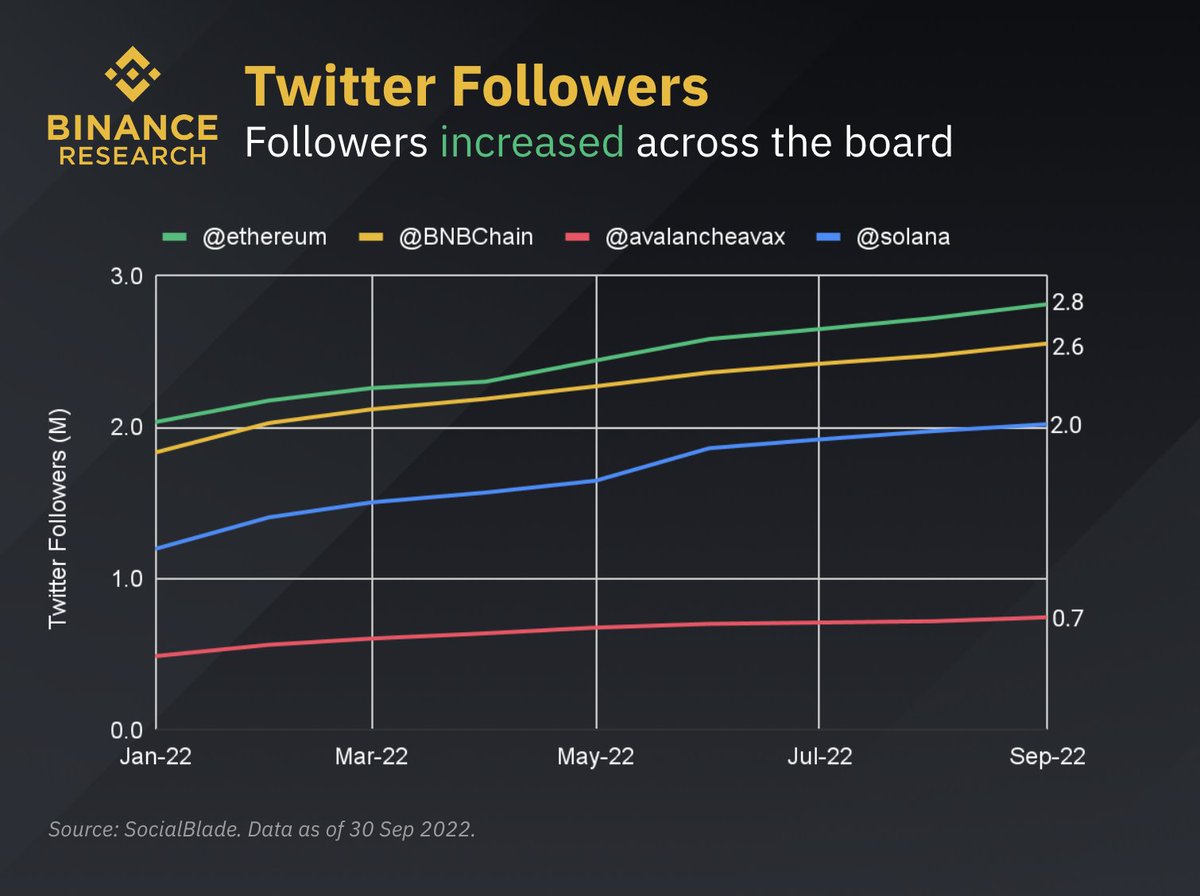

3/ Twitter Followers: Twitter followers across all measured chains continued to increase in Q3. @ethereum currently has the highest number of followers (~ 2.8M), whereas @solana witnessed the largest growth (+16% QoQ).

4/ #Ethereum Transaction Fees: Looking at transaction fees for Ethereum in particular, we found that average fees generally declined, in correlation with the fall of activity on the network. Average transaction fees in Q3 were around US$2.61 vs $12.50 in Q2, a sharp fall of 79.1%

5/ #BNB Chain Transaction Fees: BNB Chain users paid an average of US$0.25 in Q3 vs US$0.30 in Q2, a slight decline, in correlation to reduced network activity.

6/ Want to learn more? Have a look at the full report - Q3 State of Crypto: Market Pulse

Check it out here! 👇

research.binance.com/en/analysis/3q…

Check it out here! 👇

research.binance.com/en/analysis/3q…

• • •

Missing some Tweet in this thread? You can try to

force a refresh