Manchester City’s 2021/22 accounts covered a season when they won the Premier League for the fourth time in five years (their sixth title in 11 years) and reached the semi-finals of the Champions League and the FA Cup. Some thoughts follow #MCFC

#MCFC chairman Khaldoon Al Mubarak noted that it was also the most successful financial year in the club’s history with chief executive Ferran Soriano highlighting that City broke the club records for both revenue and profits.

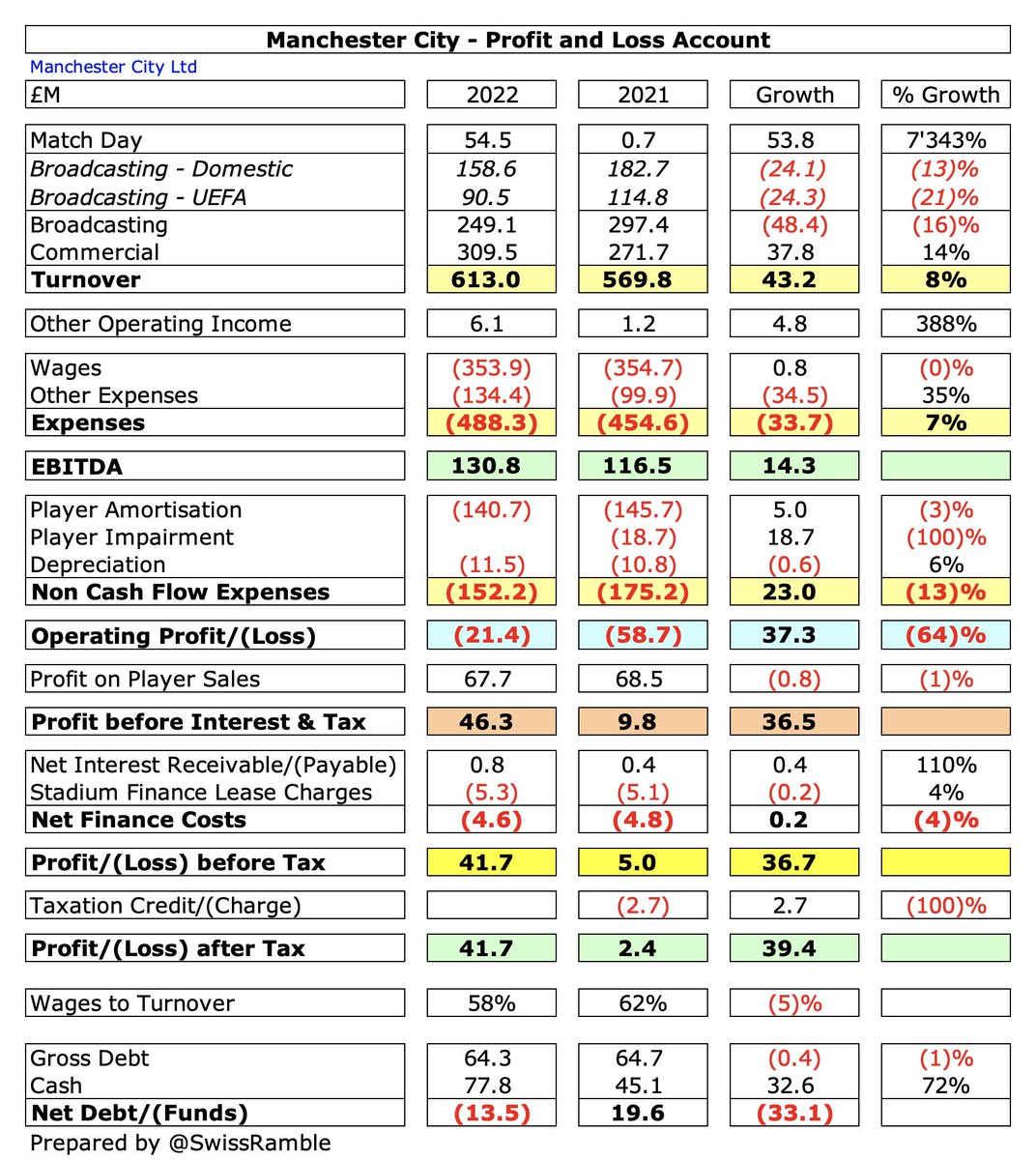

#MCFC pre-tax profit improved from £5m to £42m, as revenue rose £43m (8%) from £570m to £613m, thanks to recovery from COVID and the return of fans to the stadium, while operating expenses only increased £11m (2%). Profit from player sales was almost unchanged at £68m.

Main reason for #MCFC revenue increase was match day, which rose £53m from £1m to £54m, due to return of fans to the Etihad, while commercial was up £37m (14%) from £272m to £309m. However, broadcasting fell £48m (16%) to £249m, mainly due to deferred income in prior year.

#MCFC wage bill fell slightly by £1m to £354m, while player amortisation dropped £5m (3%) to £141m and there was no repeat of prior year’s £19m player impairment. However, other expenses were up £34m (35%) to £134m, due to the higher cost of staging games with fans.

Only 3 English club have to date published accounts for 2021/22, but #MCFC £42m pre-tax profit is very impressive. Prior year figures for other clubs were severely impacted by the pandemic with almost all games played behind closed doors. #WWFC boosted by £127m loan write-off.

#MCFC £42m profit is the best financial result of the leading European clubs that have reported 2021/22 figures to date. In stark contrast, large losses have been posted almost everywhere else, e.g. PSG £327m, Juventus £225m and Barcelona £157m (excluding their economic levers).

#MCFC financial performance has dramatically improved since the early days of the current ownership, when they posted some of the PL’s highest losses, including the worst ever (£197m in 2011). As Khaldoon said, “In many ways we are beginning to achieve our long-term ambition.”

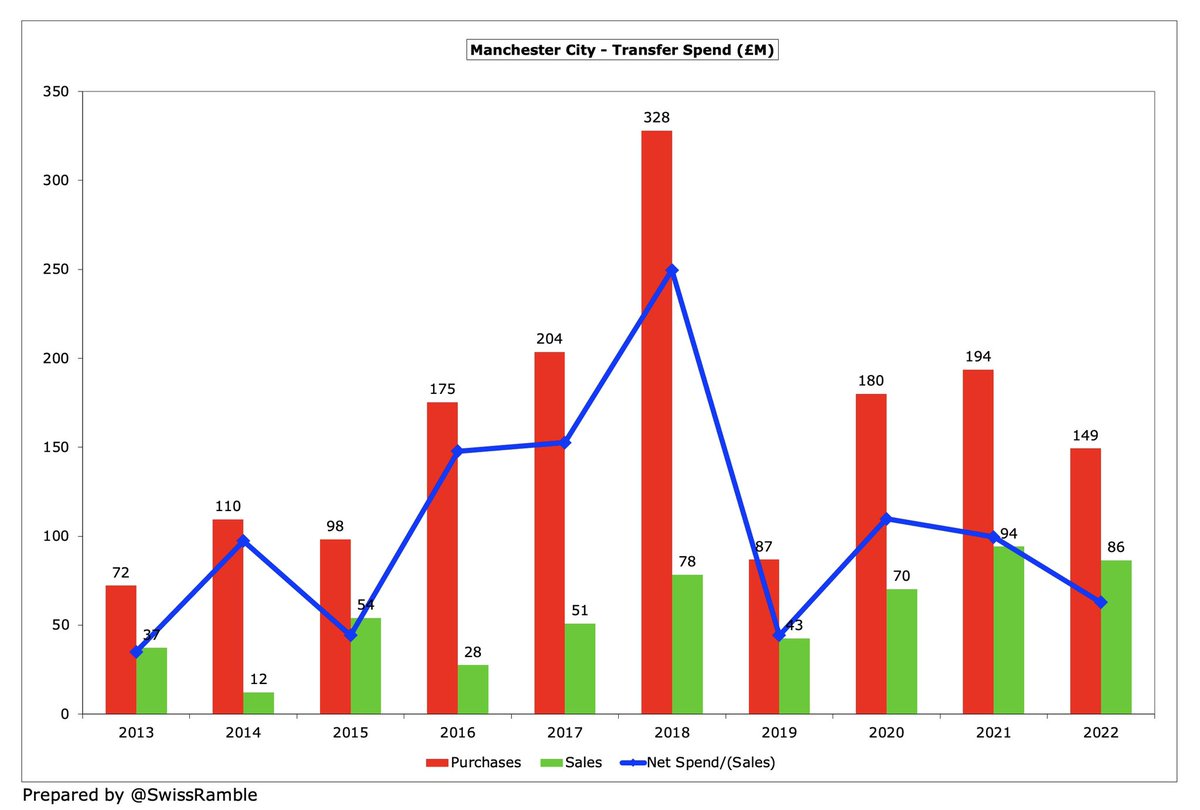

#MCFC profits were boosted by “significant” player trading, which generated a £68m gain, the highest in the Premier League. Mainly from the sale of Ferran Torres to Barcelona, but also included Jack Harrison to #LUFC, Lukas Nmecha to Wolfsburg and Ivan Ilic to Hellas Verona.

#MCFC have now reported profits in 7 of the last 8 years with the sole exception being the £125m loss in 2019/20, driven by COVID. The £42m profit last season is not only a club record, but more than double the previous high (£20m in 2016).

Player sales have become increasingly important to #MCFC, having made £137m profit in the last 2 seasons and over quarter of a billion in the last 5 years. This trend shows no sign of slowing down with substantial sales again this summer, such as Sterling, Jesus and Zinchenko.

What is striking is the high transfer fees #MCFC have achieved from the sale of academy products, e.g. this summer included Lavia, Bazunu, Edozie and Larios to Southampton for a reported £38m, representing pure profit in the accounts. Will look to emulate #CFC results here.

#MCFC operating loss (excluding player sales and interest) reduced from £59m to £21m, which is “normal” for City outside pandemic years. This was actually not too bad, as some clubs post enormous operating losses, e.g. #MUFC £85m in 2021/22, #CFC £159m in COVID-impacted 2020/21.

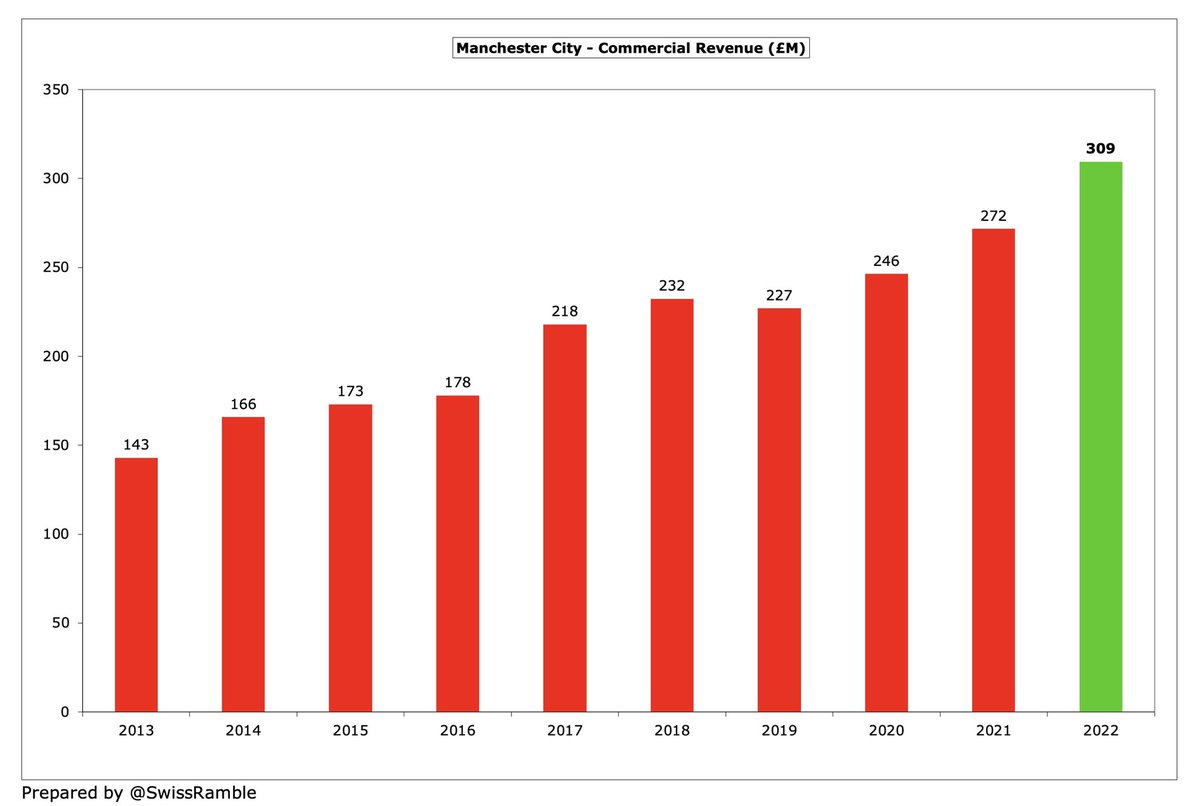

#MCFC revenue has increased £78m (15%) from the 2019 pre-pandemic level of £535m, entirely drive by commercial income, which is up £82m (36%). Commercial now accounts for over half of City’s total revenue.

#MCFC £613m revenue in 2022 is the second highest ever reported in the Premier League, only surpassed by #MUFC £627m in 2019. However, while United’s revenue has essentially not grown in the last 5 years, City’s is up by £160m (over a third).

As a result, #MCFC £613m revenue is now the highest in England, £30m more than #MUFC £583m. #LFC are also forecast to overtake United when they release 2021/22 figures, as they will include much higher match day income and commercial growth.

In 2020/21 #MCFC climbed 5 places to top the Deloitte Money League for the first time, with their £571m being just ahead of Real Madrid £567m, followed by Bayern Munich £541m and Barcelona £515m. However, likely to be overtaken by Real Madrid in 2021/22.

#MCFC broadcasting revenue fell £48m (16%) from £297m to £249m, as prior year accounts benefited from income deferred from 2019/20 for games played after end-June accounting close, while they only reached the Champions League semi-final compared to the final the prior year.

#MCFC received £153m from Premier League central TV distribution after winning the title, about the same as prior year. The 2020/21 accounts were boosted by estimated £26m revenue deferred from 2019/20 due to the extended season (COVID delays).

I estimate that #MCFC received £96m for reaching the Champions League semi-final in 2021/22, less than £105m in 2020/21, when they were finalists. That’s less than #LFC £104m, who got to the final, but a fair bit more than #CFC £80 and #MUFC £68m.

In fact, despite City’s issues with UEFA, the Champions League has been a nice little earner for #MCFC with nearly half a billion Euros (€479m) received in the last five years, around the same as #LFC €478m, but well ahead of #CFC €400m, #MUFC €321m and #THFC €255m.

#MCFC success in Europe means an improvement in their UEFA 10-year coefficient, which is an important element in the distribution of Champions League money. They could overtake #CFC in the UEFA rankings next season when 2012/13 drops out of the calculation.

#MCFC commercial income rose £37m (14%) from £272m to £309m, due to new sponsorship agreements and the return of concerts to the Etihad after COVID, which means this has grown 74% (£132m) since 2016. Soriano said, “more partners want to be commercially associated with City”.

As a result, #MCFC £309m commercial income is the highest in England, having overtaken #MUFC £258m, as fortunes have contrasted on the pitch. This the first time this revenue stream has exceeded £300m in the Premier League, though some will cast doubt on its provenance.

#MCFC Etihad deal worth £70m (shirt sponsorship £50m, naming rights £20m). Also have Puma kit supplier £65m, Nexen Tire sleeve sponsor £10m and OFX training kit £10m. #MUFC Chevrolet shirt sponsorship was £64m, but since replaced by TeamViewer at just £47m.

#MCFC match day income rose £53m from £1m to £54m, due to return of fans to the Etihad, while in 2020/21 all games except one were played behind closed doors. However, City revenue smallest of the Big Six, less than half of #MUFC £111m and #THFC (full season at new stadium).

#MCFC average attendance of 52,774 was only sixth highest in the Premier League, around 20,000 below their Manchester neighbours #MUFC 73,150 and slightly less than #LFC 53,027.

#MCFC other operating income rose £5m from £1m to £6m, though no details were provided. The highest amount booked here in 2020/21 was #CFC £12.6m, mainly due to unexplained recharges.

#MCFC wages fell slightly by £1m to £354m, which means they have remained around this level for the last 3 years, while #MUFC wages have increased £100m in the same period. That said, City’s wage bill has grown 80% from £198m in 2016.

As a result, #MCFC £354m wages are £30m lower than #MUFC £384m, but more than #CFC £333m and #LFC £314m (both 2020/21 figures). United’s 2021/22 wages are the highest ever in the Premier League, though City have the next three highest.

#MCFC wages to turnover ratio improved from 62% to 58%, one of the lowest (best) in the Premier League. Wages expected to rise after this summer’s signing of Erling Haaland, though the increase will be mitigated by the numerous departures.

#MCFC do not provide details of their highest paid director, so we cannot say whether the remuneration is in the same ball park as Ed Woodward at #MUFC and Daniel Levy at #THFC, who trousered £2.9m and £2.7m respectively in 2020/21.

#MCFC other expenses shot up £34m (35%) from £100m to £134m, due to the impact of staging home games in front of a full capacity crowd and increased commercial activity. This is the highest in the Premier League, possibly driven by charges from City Football Group Ltd.

#MCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, fell £5m (3%) from £146m to £141m, due to player exits and contract extensions. Lower than #CFC £162m and #MUFC £149m. There was no repeat of prior year’s £19m player impairment.

#MCFC spent £149m on player purchases in 2021/22, down £45m compared to prior year. This was almost exactly the same outlay as #MUFC £152m. Mainly Jack Grealish from #AVFC, Julian Alvarez from River Plate and Kayky from Fluminense.

#MCFC have splashed out £938m on player recruitment in the last 5 years, even more than £659m in the preceding 5-year period. This summer they again spent big on Erling Haaland and Manuel Akanji (both from Borussia Dortmund), Kalvin Phillips (#LUFC) and Sergio Gomez (Anderlecht).

In fact, #MCFC have the highest transfer expenditure in the Premier League over the five years up to 2021 with nearly a billion, though their £992m outlay is pretty much the same as #CFC, followed by #MUFC £850m, #AFC £676m and #LFC £660m.

#MCFC squad cost increased from £975m to £1,077m, which is the first time that a Premier League club has broken through the billion pound barrier. The next highest in England are #CFC £959m (2021 figure) and #MUFC £779m.

#MCFC have £64m debt for leases on the Etihad stadium. This is one of the lowest in the Premier League, way below the likes of #CFC £1.5 bln (Abramovich funding), #THFC £854m (stadium) and #MUFC £636m (Glazers’ leveraged buy-out).

In July 2021 City Football Group Ltd, #MCFC parent company, took out a $650m loan, which is not included in the football club’s accounts. This is presumably to cover COVID losses, but also provides funding for investment in other clubs in the CFG stable.

#MCFC made no interest payment in 2021/22 (expect lease payments) in contrast to #MUFC £21m, #THFC £18m, #WHUFC £8m and #SaintsFC £7m. City’s funding via additional share capital (instead of debt) provides a competitive advantage here.

#MCFC transfer debt rose £33m from £100m to £136m, which is City’s second highest ever, though still a lot less than #MUFC £182m, #THFC £170m and #CFC £147m. Transfer receivables up £65m to £97m, so net payables fell £32m to £39m.

However, #MCFC also have massive contingent liabilities of £197m for transfer fees, signing-on fees and loyalty payments, dependent on the achievement of certain contractual clauses. Even though these fell £31m, these are by far the highest in England, well ahead of #MUFC £112m.

#MCFC cash increased from £45m to £78m, only surpassed by #THFC £148m (2021 balance) and #MUFC £121m. The football club does not publish a cash flow statement, though one is included in the parent company’s annual report.

#MCFC have become largely self-sufficient in recent years (excluding the impact of COVID), but the club did receive £23m additional share capital in 2020/21. To date, the owners have provided the football club with more than £1.3 bln of funding via new shares or loans.

#MCFC benefited from the highest owner funding in the Premier League in the 10 years up to until 2021 with £684m, followed by #CFC £516m. However, it’s a very different story for the 5 years up to 2021, when City’s £81m was much lower than #EFC £448m and #AVFC £400m.

#MCFC have had a few issues with FFP in the past, but were not among the clubs recently fined by UEFA. My model suggests that they were fine over the latest monitoring period even before allowable deductions for “good” expenditure and COVID impact.

For the second year in a row, #MCFC accounts acknowledged “an ongoing Premier League investigation linked to the speculation resulting from the illegal hacking and out of context publication of club emails”, but they have not made a provision for any financial loss.

Chairman Khaldoon Al Mubarak concluded that #MCFC had “emerged from the pandemic with strong finances and further on-pitch successes.” In ominous news for the rest of the league, he warned that City were “committed to accomplish so much more.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh