It all started with the worry about #Alameda's financial status after their balance sheet and liability are leaked👇.

Then the rumor is out that FTX is in a liquidity crisis.

But at this point, based on the scale of FTX, many still hold FTX is safe.

coindesk.com/business/2022/…

Then the rumor is out that FTX is in a liquidity crisis.

But at this point, based on the scale of FTX, many still hold FTX is safe.

coindesk.com/business/2022/…

Then 3 days later, a huge #FTT transaction (22,999,999 - $580M at that time) happens, then the man, @cz_binance steps in and announces #Binance gonna sell all #FTT they have due to #FTX existing risk, seems a war between @binance and @FTX_Official has just begun.

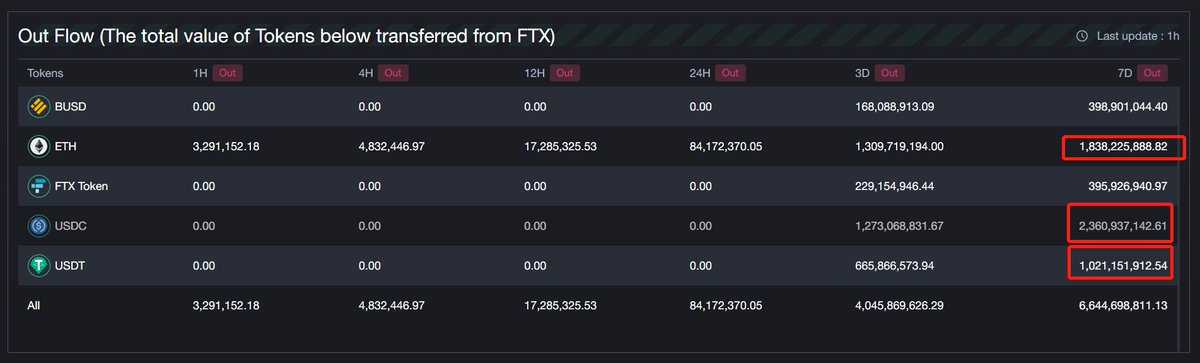

Affected by the above, In 7 days span, $6.6B worth of assets on Ethereum left #FTX, especially Stablecoins, users are hard to withdraw USDT/USDC from #FTX as they have a lower than 100M stablecoin balance.

As the speed of withdrawal from #FTX gets slow, @SBF claims to be the problem of banks.

https://twitter.com/SBF_FTX/status/1589399420487208960

To track the overall status including the FTX/FTT/Binance inflow/outflow, we created a sheet yesterday to track everything, thousands of people viewed this and discuss it with us.

https://twitter.com/ScopeProtocol/status/1589905088981905409

What's interesting is that #Binance is the one exchange that seems to attract these escaped capitals.

For the past 7 Days, $1.1B worth of money was transferred from #FTX to #Binance.

For the past 7 Days, $1.1B worth of money was transferred from #FTX to #Binance.

At the same time, we analyze the money flow into FTX exchanges on Nov 9 and Nov 8.

We found that all the assets are from other exchanges and other institutions, and NO COLD WALLET transfer or other direct resources.

A chance that FTX moved the user funds.

We found that all the assets are from other exchanges and other institutions, and NO COLD WALLET transfer or other direct resources.

A chance that FTX moved the user funds.

https://twitter.com/ScopeProtocol/status/1589945720098131968

Another incident that happens yesterday is the issue between @BitDAO_Official and @AlamedaResearch about whether the latter kept the promise of not selling the exchanged $BIT.

https://twitter.com/benbybit/status/1589849378394886145

Our research @BobieLiu did a detailed analysis of the $BIT transfer by #Alameda and find out indeed $BIT price it is highly possible #Alameda is just market making.

And later it proves to be true.

And later it proves to be true.

https://twitter.com/BobieLiu/status/1589977090782552064

Nov 8th, 12am UTC, 98.5M $BIT was sent back from #FTX to #Alameda, which they still hold for today.

https://twitter.com/ScopeProtocol/status/1589928070156537856

Then comes the craziest 6 hours in crypto history we may say:

👇

👇

🚨At 2022/11/08 12:00 UTC, the 0xScope team found that no assets have been out from #FTX, we wait for about 1.5 hours to confirm and post the following about the FTX withdraw suspend.

https://twitter.com/ScopeProtocol/status/1589979450204389377

But #FTXUS seems not affected, the operation runs normally, and their deposit and withdrawal were still working.

https://twitter.com/ScopeProtocol/status/1589997406216540160

As more people aware of this and the media spreads the message, the market finally realizes #FTX is in serious trouble.

No clarification from the #FTX side also boosted this fear.

No clarification from the #FTX side also boosted this fear.

But the message sent out by two main characters @cz_binance and @SBF_FTX changed everything.

😲Binance intended to fully acquire FTX.com.

😲Binance intended to fully acquire FTX.com.

https://twitter.com/cz_binance/status/1590013613586411520

This is something the market never expected, @cz_binance suddenly become the only main character of the crypto world.

The price of FTT & BNB rises up quickly.

The price of FTT & BNB rises up quickly.

When everybody thinks this unnecessary war is finally over, we can finally go to sleep.

Rumor is out, regulation could stop @cz_binance to finish the deal.

reuters.com/markets/curren…

Rumor is out, regulation could stop @cz_binance to finish the deal.

reuters.com/markets/curren…

And people are starting to realize that FTX being fully acquired is not a good sign.

The problem should be super big that @SBF_FTX had to give up his empire in such a short term.

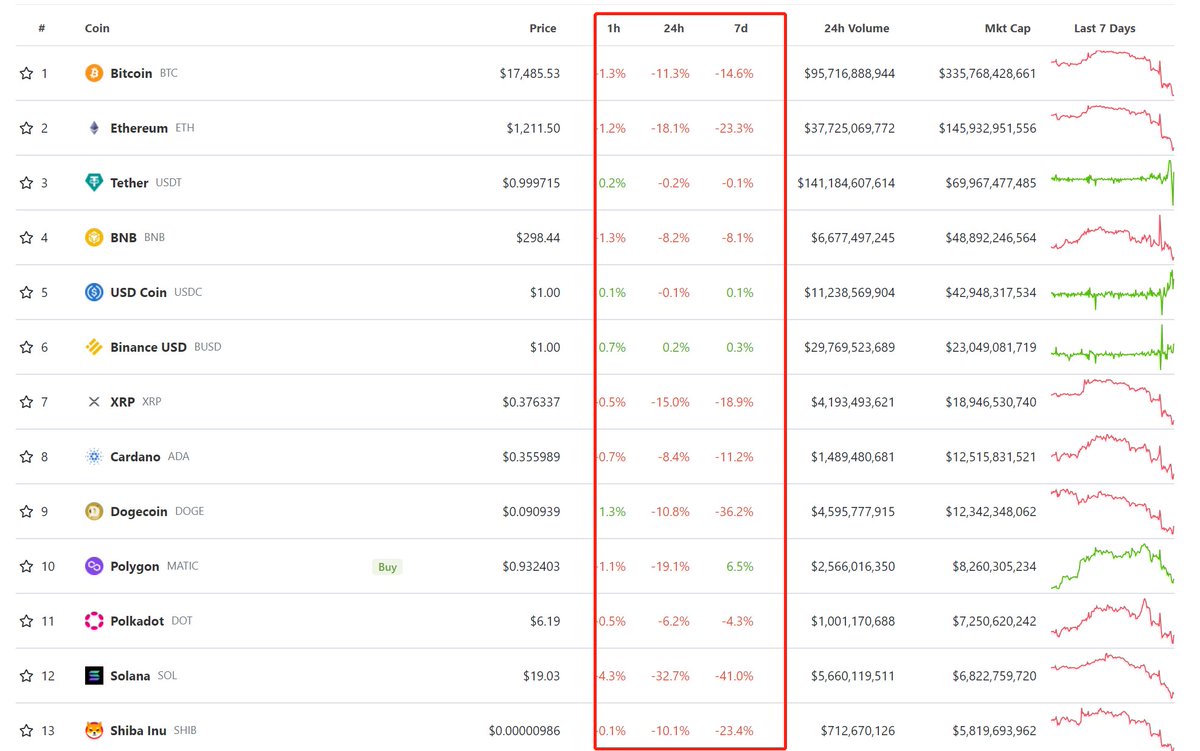

This drags the whole market down until this point.

The problem should be super big that @SBF_FTX had to give up his empire in such a short term.

This drags the whole market down until this point.

And parties could be affected by potential #Alameda and #FTX collapses like other exchanges, CeFi institutions, and FTX portfolios like #Kucoin #Amber #Solana are all surrendered by rumors.

#SOL and #FTT down badly in the past 20 hours

#SOL and #FTT down badly in the past 20 hours

Centralized exchanges are now on a driven mission to a fully reserved mode, and multiple parties have expressed their actions and willingness.

https://twitter.com/DujunX/status/1589990211005861888

In a short term, the worries and influence will not stop🚫.

Answers to the following questions still need to be found🤔:

Will @cz_binance be able to finish the deal?

Will #Alameda dump the whole market?

How big is the #FTX 's hole?

Answers to the following questions still need to be found🤔:

Will @cz_binance be able to finish the deal?

Will #Alameda dump the whole market?

How big is the #FTX 's hole?

That's why 0xScope will continue to track the data to evaluate the influence on the crypto market, we will launch our detailed FTX&Binance data dashboard on @0xWatchers soon, and we will stay with you to analyze everything out 💪.

Stay Tuned.

Stay Tuned.

@cz_binance Updates:

#Binance has decided to stop the acquisition process after Due Diligence on FTX.com.

#Binance has decided to stop the acquisition process after Due Diligence on FTX.com.

https://twitter.com/binance/status/1590449161069268992

• • •

Missing some Tweet in this thread? You can try to

force a refresh