1/Ω

🤔

"as least as informed as the press" level speculation on #Alameda / #FTX based on some numbers that imply some things

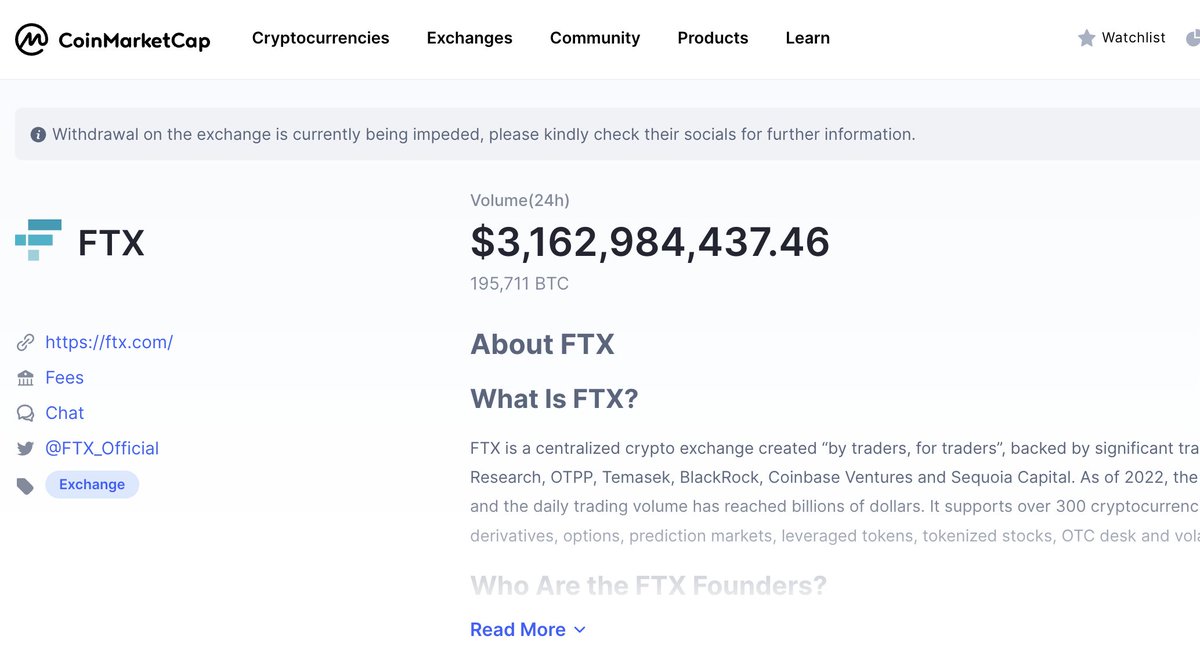

FTX folded quickly. could only process < $1B digit billions before running out of coins. Sure there are other wallets...

🤔

"as least as informed as the press" level speculation on #Alameda / #FTX based on some numbers that imply some things

FTX folded quickly. could only process < $1B digit billions before running out of coins. Sure there are other wallets...

2/Ω: FTX IS NOT SUPPOSED TO BE ABLE TO RUN OUT OF CASH (or tokens).

it's an EXCHANGE not a hedge fund. should have everyone's cash ready to be picked up at any given time in neat little separate piles.

THUS: AT A MINIMUM we know that #SBF commingled funds (maybe illegally)

it's an EXCHANGE not a hedge fund. should have everyone's cash ready to be picked up at any given time in neat little separate piles.

THUS: AT A MINIMUM we know that #SBF commingled funds (maybe illegally)

2.5/Ω: SBF IS SMART. ALSO WORKED AS A PRO TRADER AT ONE OF THE TRADING DESKS THOUGHT TO BE "really smart money" (#JaneStreet).

SBF: 2 MIT degrees (hard to get in a way most people cannot comprehend). SBF has taken exams for trading licenses. Fully 0% chance he doesn't know this

SBF: 2 MIT degrees (hard to get in a way most people cannot comprehend). SBF has taken exams for trading licenses. Fully 0% chance he doesn't know this

3/Ω He didn't just "forget" one day and say "let's mix all the wallets". Quite the opposite: he would have been ACUTELY aware of this gap between the regulations and the practice given that he went to Washington to get regulations adjusted!

4/Ω my chain research and @DataFinnovation's agree: more or less HALF - ~$40 BILLION - of the #Tether printed on #Tron went to #FTX where it was mysteriously kept on exchanges in the Asian market.

So where did the other half go? 👇

datafinnovation.medium.com/usdt-on-tron-f…

So where did the other half go? 👇

datafinnovation.medium.com/usdt-on-tron-f…

5/Ω yep, that guy. #LordCZ, CEO of the Binance Kingdom, Ruler of the Cryptoverse. (he recently added the title "SBFlayer" because he slayed #GodEmperorSBF yesterday)

BUT

CZ's #Tether was on #Ethereum chain exclusively and all in Europe/America.

BUT

CZ's #Tether was on #Ethereum chain exclusively and all in Europe/America.

6/Ω kind of... weird no? why is SBF in charge of the Chinese language market and CZ in charge of the English language market?

Also how is it possible that those two markets created demand for basically the exact same amount of casino chips (#Tether) at close to all times?

Also how is it possible that those two markets created demand for basically the exact same amount of casino chips (#Tether) at close to all times?

7/Ω If you had a conspiratorial bent you might see obvious cooperation between #FTX, #Tether, and #CZ. If you don't maybe you can see perfectly matched competitors vying for market share.

except that Binance was one of #FTX's first investors lol

except that Binance was one of #FTX's first investors lol

8/Ω CHART SAYS 87.1% OF VOLUME ON FTX IS $USD TXNS.

Interesting... Only 8.5% $USDT (#Tether)

(caveat: coingeck isn't reloading properly and can't find other data source)

Interesting... Only 8.5% $USDT (#Tether)

(caveat: coingeck isn't reloading properly and can't find other data source)

9/Ω And yet... Americans aren't allowed to use #FTX. That's why #FTXUS is a whole thing. Thus it should be the case that everyone gambling with $USD in #SBF's casino playing with USD chips is ... not from America.

10/Ω Not unreasonable, right? In fact it makes a lot of sense: $USD is the global reserve currency. So everyone must be changing their $JPY, $RMB, $AUD etc to $USD and playing in Sam's casino.

How much trading? Let's say v.rough :

$10B volume per day,

$5B when you take out 🛀

How much trading? Let's say v.rough :

$10B volume per day,

$5B when you take out 🛀

11/Ω What can trade volume tell us about #FTX?

> $5B/day trade volume

> 87% of that volume $USD (call it $450M USD/day)

> 9% USDT (Call it $40M USD /day)

>100% Non

So that means there's ~$410M of daily vol by non Americans using $USD and $40M using #Tether

> $5B/day trade volume

> 87% of that volume $USD (call it $450M USD/day)

> 9% USDT (Call it $40M USD /day)

>100% Non

So that means there's ~$410M of daily vol by non Americans using $USD and $40M using #Tether

11/Ω "Wait a minute... How much $USDT did you say customers bought from #Tether, Inc. through the #FTX platform over the years?"

"Did you just say FORTY BILLION DOLLARS?"

...

..

.

"srs?"

And we know the purchased $USDT was minted directly into FTX wallets. (#4 above for both)

"Did you just say FORTY BILLION DOLLARS?"

...

..

.

"srs?"

And we know the purchased $USDT was minted directly into FTX wallets. (#4 above for both)

12/Ω "So if #FTX's customers bought $40B worth of Tethers to get casino chips in the asian markets, why are so few of them actually using those chips at #FTX?"

Good question

"If people bought tethers and dollars in the same ratio, how many dollars would they have put into #FTX?

Good question

"If people bought tethers and dollars in the same ratio, how many dollars would they have put into #FTX?

13/Ω Ratio is roughly 10:1 so $UDS should be ~$400 billion. Which is... a big number

That we can check; I made a dashboard that #DuneAnalytics put at #3 is "most helpful queries" today (it's weird times when skeptics get a prime slot over the believers)

dune.com/crypto_oracle/…

That we can check; I made a dashboard that #DuneAnalytics put at #3 is "most helpful queries" today (it's weird times when skeptics get a prime slot over the believers)

dune.com/crypto_oracle/…

13/Ω It's hard to be *sure* w/out an expensive query but... the "inbound_usd" col could end up adding up to $400M I guess.

14/Ω Backing up a sec: #FTX halted withdrawals after $800M was withdrawn in past week from known wallets. hidden wallets are big deal but it's still surprising that a platform claiming $5-20 BILLION in volume/day has to give up after $800M withdrawn in a week

15/Ω I know wash trading and HFT are nuts but... not that nuts. If there's only $800M in there:

a. every singly $ has to be traded ~10-25 per day

b. there can be no one with a resting account - no one HODLING at all, or at least of any size.

a. every singly $ has to be traded ~10-25 per day

b. there can be no one with a resting account - no one HODLING at all, or at least of any size.

16/Ω That doesn't make a lot of sense, honestly. People HODL. On exchanges. All the time. There should be more cash - a lot more - unless of course most of FTX cash is on hidden wallets (def. possible)

protos.com/heres-why-sam-…

protos.com/heres-why-sam-…

17/Ω Now consider this 👆 summary of #GodEmperorSBF's "bailouts" over the summer by @Protos:

He didn't "bailout" #voyager in the normal sense bc FTX OWED VOYAGER $$. People assumed he was JP Morgancoin when really he put in no capital he didn't already owe! to Voyager!

He didn't "bailout" #voyager in the normal sense bc FTX OWED VOYAGER $$. People assumed he was JP Morgancoin when really he put in no capital he didn't already owe! to Voyager!

18/Ω #FTX also "bailed out" #BlockFI. We have no idea who owed who money bc it never hit the courts.

But we DO KNOW (w/slight uncertainty) that #FTX WAS ITSELF bailed out by Celsius for like billions less than 90 days pre Celsius implosion 👇

But we DO KNOW (w/slight uncertainty) that #FTX WAS ITSELF bailed out by Celsius for like billions less than 90 days pre Celsius implosion 👇

https://twitter.com/Cryptadamist/status/1587244487495110656

19/Ω Once again let's remember SBF worked at Jane st. and is a literal genius. He knows

A) a txion like that so close to bankruptcy will have to be returned ("fraudulent conveyance", see 🧵👆)

B) It's going to come out in bankruptcy court

Why would he even bother?

A) a txion like that so close to bankruptcy will have to be returned ("fraudulent conveyance", see 🧵👆)

B) It's going to come out in bankruptcy court

Why would he even bother?

20/Ω Well, there's one answer to "why do people take money even if they know they have to give it back and even if it hurts the counterparty who has to use the courts to get it back"

A: Prolly they need the money now, not later.

GUESS: SBF was already in a liquidity crunch

A: Prolly they need the money now, not later.

GUESS: SBF was already in a liquidity crunch

21/Ω He managed to bluff his way through the JP Morgancoin persona while not really bailing anyone out not just to steady markets, as I had assumed.

22/Ω #SBF did it because FTX accts were empty and he decided getting out in front w/PR team and bluffing had a better chance at making sure no one could see that FTX accounts were bare..

BC as soon as they know... game over, as #CZ proved

🧵 continues!👇

BC as soon as they know... game over, as #CZ proved

https://twitter.com/cz_binance/status/1589374530413215744

🧵 continues!👇

So what do we know:

1. CZ / SBF were buds, splitting up the world

2. someone bought $40B worth of #Tether from #FTX but took most of it to other casinos rather than play on #FTX

3. Big hole in #FTX books for a while confirmed by tone of CZ recent tweets

1. CZ / SBF were buds, splitting up the world

2. someone bought $40B worth of #Tether from #FTX but took most of it to other casinos rather than play on #FTX

3. Big hole in #FTX books for a while confirmed by tone of CZ recent tweets

https://twitter.com/cz_binance/status/1590103159506341888

25/Ω

4. #FTX should be making a TON of money (commissions). Should doubled their user deposits in fees every few years or less.

5. How did they fuck up so badly that not only is all that profit they should have gone, they also now have a multi billion dollar HOLE???

4. #FTX should be making a TON of money (commissions). Should doubled their user deposits in fees every few years or less.

5. How did they fuck up so badly that not only is all that profit they should have gone, they also now have a multi billion dollar HOLE???

26/Ω IMHO #SBF on his own is too savvy to fuck this up this bad. (i mean I could easily be wrong but, bear with me. this is a thought experiment more than an evidentiary hearing)

What if... someone less competent fucked something up BIG? Like a totally incompetent person.

What if... someone less competent fucked something up BIG? Like a totally incompetent person.

27/Ω What if... someone less competent fucked something up BIG? and what if somehow that person's fucked was somehow in an area that it could be contained by a more competent person - hidden, covered up, until the missing $ could be earned back?

28/Ω Someone like... oh I dunno, the kind of guy who thinks going on TV and promising audits that never come multiple years in a row will quell suspicions?

Paolo doesn't have 2 degrees from MIT and never will.

The tether guys are morons, full stop.

coindesk.com/markets/2022/0…

Paolo doesn't have 2 degrees from MIT and never will.

The tether guys are morons, full stop.

coindesk.com/markets/2022/0…

29/Ω CONSIDER:

Above we learned that ALL $USDT (#Tether) on Tron has to pass by #SBF on the way in and the way out.

If someone stole tethers or (more likely) won them trading against a moron, those tethers would re-enter Tether's books through #SBF.

Above we learned that ALL $USDT (#Tether) on Tron has to pass by #SBF on the way in and the way out.

If someone stole tethers or (more likely) won them trading against a moron, those tethers would re-enter Tether's books through #SBF.

31/Ω What if:

#Tether fucked something up so big that it's obvious to #SBF and everyone who knows about the loss that if word gets out, it's game over? What would you, a smart person like #SBF do?

#Tether fucked something up so big that it's obvious to #SBF and everyone who knows about the loss that if word gets out, it's game over? What would you, a smart person like #SBF do?

31/Ω What if:

I mean you don't have a choice. yr a smart person, you can see the outcomes. you are the only thing between the bomb and the end of the world so...

you jump on the bomb

Now it's YOUR problem but yr smarter than Paolo.

I mean you don't have a choice. yr a smart person, you can see the outcomes. you are the only thing between the bomb and the end of the world so...

you jump on the bomb

Now it's YOUR problem but yr smarter than Paolo.

32/Ω As long as there's no run on FTX you can strut around with confidence even with a VERY big hole, (or even an open bleeding wound!)

But if there IS ever a run... it's gonna be short one.

But if there IS ever a run... it's gonna be short one.

32/Ω Like, maybe ... this one.

tl;dr

1. tether makes bad trade

2. sbf jumps on bomb, blows hole in #ftx balance sheet

3. #sbf desperately trying to fill hole with increasingly risky strategies (traders call this "blowing up"

4. crypto winter❄️

5. bankrun

6. crypto ☢️❄️

7. 🪦

tl;dr

1. tether makes bad trade

2. sbf jumps on bomb, blows hole in #ftx balance sheet

3. #sbf desperately trying to fill hole with increasingly risky strategies (traders call this "blowing up"

4. crypto winter❄️

5. bankrun

6. crypto ☢️❄️

7. 🪦

Also did no one else notice that #CZ literally:

1. frogmarched SBF to the guillotine

2. did this right out in of the raging mob (us)

3. humiliated and mocked #SBF so we could see

4. stripped #SBF of his wealth

5. executed him (or at least his business)

1. frogmarched SBF to the guillotine

2. did this right out in of the raging mob (us)

3. humiliated and mocked #SBF so we could see

4. stripped #SBF of his wealth

5. executed him (or at least his business)

42/Ω

I thought I posted this somewhere but it should be here:

A medium length humor/history thing I put on substack about the bromance of #LordCZ and #GodEmperorSBF

less speculating and more fun than this thread: cryptadamus.substack.com/p/hail-to-the-…

I thought I posted this somewhere but it should be here:

A medium length humor/history thing I put on substack about the bromance of #LordCZ and #GodEmperorSBF

less speculating and more fun than this thread: cryptadamus.substack.com/p/hail-to-the-…

Tweet says $10Bhole ... ok.

front page page of WSJ says...

$8B hole...

AND THAT's JUST FTX!!

front page page of WSJ says...

$8B hole...

AND THAT's JUST FTX!!

https://twitter.com/ClarityToast/status/1590461310067933184

42/Ω Here's another plausible scenario

1. back in June it became obvious someone was propping up price of $BTC at $40k, $30k, $20k

2. @WSJ is saying he lost $10B (!) running a *highly* profitable biz.

3. Insane number! but 1 way to get it is if FTX has been propping up price

1. back in June it became obvious someone was propping up price of $BTC at $40k, $30k, $20k

2. @WSJ is saying he lost $10B (!) running a *highly* profitable biz.

3. Insane number! but 1 way to get it is if FTX has been propping up price

realizing this reads wrong

HALF of the #Tether TOTAL went to @SBF_FTX...

But ALL of the #Tether on #Tron wen to @SBF_FTX.

Basically:

> All USA/Eurozone $USDT went to #Ethereum chain and was purchased through @cz_binance

> All Asia zone $USDT went to #SBF on #Tron chain.

HALF of the #Tether TOTAL went to @SBF_FTX...

But ALL of the #Tether on #Tron wen to @SBF_FTX.

Basically:

> All USA/Eurozone $USDT went to #Ethereum chain and was purchased through @cz_binance

> All Asia zone $USDT went to #SBF on #Tron chain.

To put the $800M in withdrawal that killed FTX perspective, Binance has $20 BILLION in its wallets (that we know about!).

get wild and say its $4B w/hidden wallets. finance could handle that w/ease.

FTX should be same order of magnitude, no?

dune.com/allenhsu/binan…

get wild and say its $4B w/hidden wallets. finance could handle that w/ease.

FTX should be same order of magnitude, no?

dune.com/allenhsu/binan…

42.A/Ω (see #42)

1. back in June my first actual analysis joining twitter birth was to compute when one might go bankrupt if one now propping up the price of BTC as it oscillated semi randomly.

wasn't a sophisticated model and the error margins were huge but I'll say this:

1. back in June my first actual analysis joining twitter birth was to compute when one might go bankrupt if one now propping up the price of BTC as it oscillated semi randomly.

wasn't a sophisticated model and the error margins were huge but I'll say this:

42.B/Ω (see #42)

Right around 150 days would fall dead in the center of the result the model would spit out as I changed starting assumptions, assuming no panic. was never over ~1.

because one thing the model was sure about: exponential growth is a motherfucker.

Right around 150 days would fall dead in the center of the result the model would spit out as I changed starting assumptions, assuming no panic. was never over ~1.

because one thing the model was sure about: exponential growth is a motherfucker.

42.C/Ω (see #42)

Basically model said you could prop up price for maybe a year max and 1.5 years if you REALLY stretched it, but more centrally around 90-180 days.

BUT

As soon as even a 1% rate of exponential growth (as happens in mob mentality) it's game over.

Basically model said you could prop up price for maybe a year max and 1.5 years if you REALLY stretched it, but more centrally around 90-180 days.

BUT

As soon as even a 1% rate of exponential growth (as happens in mob mentality) it's game over.

Most people would think the the diff between a 1% rate of panic (1 + 1.01 + 1.0201+ ..) and 100% (meaning doubling 1 + 2 + 4...) Is HUGE.

instead it was more like at 100% rate of panic you have 3 hours. at 1% you get 3 days.

instead it was more like at 100% rate of panic you have 3 hours. at 1% you get 3 days.

no rate of panic? up to a year. NEVER 3 days let alone 3 hours

as I said before and say often because I think the less mathematically inclined could kind of benefit from trying to internalize this v. important lesson about numbers:

"exponential growth is a motherfucker"

as I said before and say often because I think the less mathematically inclined could kind of benefit from trying to internalize this v. important lesson about numbers:

"exponential growth is a motherfucker"

44/Ω

BTW at the time I thought my model was stupid because

a) huge error bands depending on starting assumptions

b) general crudenesss (we're talking like arithmetic, not scipy)

c) couldn't possibly take this long for crypto to die. at the time it was done for in weeks.

BTW at the time I thought my model was stupid because

a) huge error bands depending on starting assumptions

b) general crudenesss (we're talking like arithmetic, not scipy)

c) couldn't possibly take this long for crypto to die. at the time it was done for in weeks.

will be pretty hilarious if that janky piece of total open air guesswork ended up being the most accurate model and all the other harder stuff since then just led me astray

31/Ω Here's one thing - every single skeptic (including me!) has noted how they did not see FTX disintegrating literally over night coming. I for one thought SBF would come out on top (curious what @BennettTomlin @Frances_Coppola and @molly0xFFF say)

510/Ω but we should have! it was right there in the data this whole time

1. He never had the $ to do the bailouts he got the news to print

2. He had tether/celsius send him fraudulent conveyances

3. CZ (who knew) called him poor on twitter

1. He never had the $ to do the bailouts he got the news to print

2. He had tether/celsius send him fraudulent conveyances

3. CZ (who knew) called him poor on twitter

https://twitter.com/Cryptadamist/status/1590510088460328961

This is a good example of how hard it is to see information even when it's right there!

all of us were looking for EXACTLY this thing - a crypto exchange that was gonna blow up - and SBF totally bamboozled us with his effective altruism glitter ball

all of us were looking for EXACTLY this thing - a crypto exchange that was gonna blow up - and SBF totally bamboozled us with his effective altruism glitter ball

👆👆👆 this

no other big exchange revealed these kinds of weaknesses

@BennettTomlin @ahcastor @molly0xFFF @CasPiancey @MikeBurgersburg @DataFinnovation @Bitfinexed @FatManTerra @otteroooo @davidgerard @crasl7 @DesoGames @intel_jakal @ben_mckenzie

no other big exchange revealed these kinds of weaknesses

@BennettTomlin @ahcastor @molly0xFFF @CasPiancey @MikeBurgersburg @DataFinnovation @Bitfinexed @FatManTerra @otteroooo @davidgerard @crasl7 @DesoGames @intel_jakal @ben_mckenzie

maybe I can even summon @WallStCynic or @ClarityToast who have way more experience than us with spotting scams to weigh in on this question

tonight feels like a good night to watch The Smartest Guys In The Room (the Enron documentary; awesome) for the 30th time

vimeo.com/424073216

vimeo.com/424073216

@BennettTomlin @ahcastor @molly0xFFF @CasPiancey @MikeBurgersburg @DataFinnovation @Bitfinexed @FatManTerra @otteroooo @davidgerard @crasl7 @DesoGames @intel_jakal @ben_mckenzie guys he even came right out and said it

coincodecap.com/sbf-warns-seve…

coincodecap.com/sbf-warns-seve…

• • •

Missing some Tweet in this thread? You can try to

force a refresh