A few thoughts on the FTX - Binance situation.

Many persons on the CT don’t realize the real effects such bankruptcy will cause and why it’s extremely concerning for the whole blockchain industry.

$FTT #FTX #Alameda #Binance

Many persons on the CT don’t realize the real effects such bankruptcy will cause and why it’s extremely concerning for the whole blockchain industry.

$FTT #FTX #Alameda #Binance

TL DR:

- Recap

- Market hit

- Regulation

- Binance god mode

- Alameda impact

- Warning

- Other options and further thinking

1/

- Recap

- Market hit

- Regulation

- Binance god mode

- Alameda impact

- Warning

- Other options and further thinking

1/

RECAP

If you just caught the news, you‘ll find here an awesome recap from @miledeutscher on what happened in the past days.

Later on, @SBF_FTX and @cz_binance posted a thread presenting a potential agreement

2/

If you just caught the news, you‘ll find here an awesome recap from @miledeutscher on what happened in the past days.

https://twitter.com/milesdeutscher/status/1589631447517655040

Later on, @SBF_FTX and @cz_binance posted a thread presenting a potential agreement

https://twitter.com/SBF_FTX/status/1590012124864348160?s=20&t=V1EOkmxiPq70BkFtCEl9bw

2/

Which was in the end abandoned by @binance

3/

https://twitter.com/binance/status/1590449161069268992?s=20&t=OlEnnfyINuPLwBycbmMGjw

3/

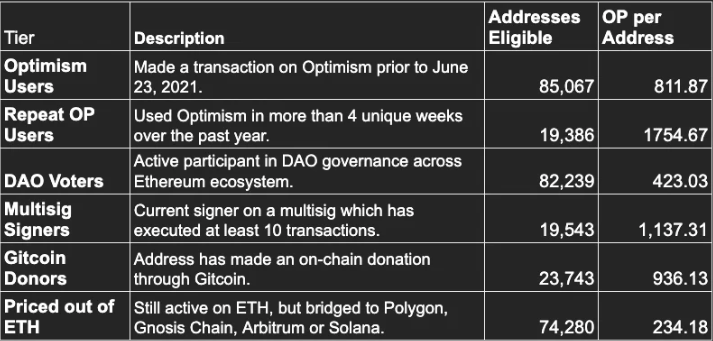

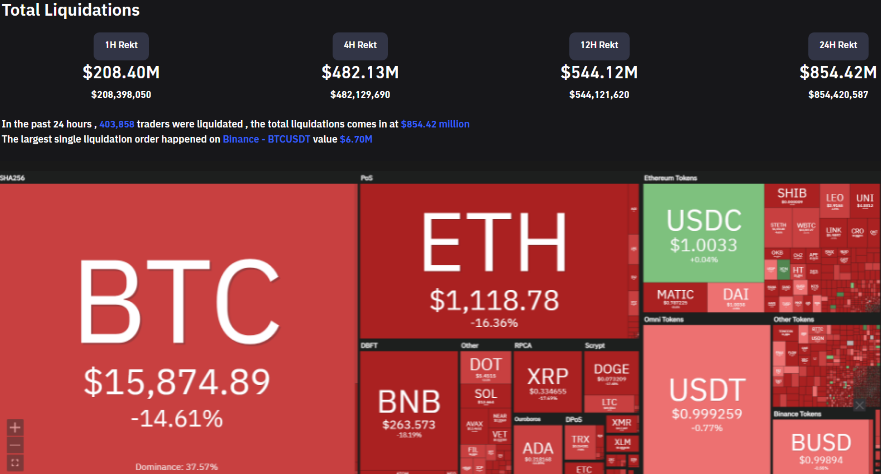

MARKET HIT

CZ and SBF mentioned that everything was made to “protect the funds” and “build the ecosystem”

However, now that the storm has calmed a bit (not finished) did the users funds get protected? For sure not as $260B of market cap got wiped out and almost a B$ got rekt

4/

CZ and SBF mentioned that everything was made to “protect the funds” and “build the ecosystem”

However, now that the storm has calmed a bit (not finished) did the users funds get protected? For sure not as $260B of market cap got wiped out and almost a B$ got rekt

4/

If we zoom towards the market confidence, this is a major hit for the community, as for most of us #FTX was the most secured CEX (far in front of binance with its regulation issues).

5/

https://twitter.com/cobie/status/1590188580483497985?s=20&t=PQdzy56PzP17QfE1rWZoKQ

5/

@cobie underlined quite well as for one time, this crash wasn’t caused by tech issues or rug, but by an insane greed, manipulation and lies.

6/

https://twitter.com/ledgerstatus/status/1590115753331937281

6/

FTX SITUATION

@FTX_Official could raise funds from multiple ways (debt, new fundraising,...).

Why did they chose their main competitor if they were solvent ?

7/

@FTX_Official could raise funds from multiple ways (debt, new fundraising,...).

Why did they chose their main competitor if they were solvent ?

7/

It shows that the exchange had a very large need in financing, that they were using their users funds (illegal) and only Binance could/would bail out a company in such deep trouble to fix it.

8/

https://twitter.com/adamscochran/status/1590460119086923776?s=20&t=OlEnnfyINuPLwBycbmMGjw

8/

#FTX recently did large funding rounds with tradfi heavyweights : @BlackRock , @sequoia , @paradigm , @Temasek ,...

We all know that tradfi investment and trust are extremely important to bring massive money inflows and adoption.

9/

We all know that tradfi investment and trust are extremely important to bring massive money inflows and adoption.

9/

A $32B series C crashing in a few days by tweets from the main competitor killed the total confidence they had in the industry.

In addition they understood they‘ve invested in a company that had large holes in its balance sheet, while still not being able to figure it out.

10/

In addition they understood they‘ve invested in a company that had large holes in its balance sheet, while still not being able to figure it out.

10/

Some of those VCs have been heavily committed towards crypto companies, and the recent crashes from #3AC, #Celsius, $LUNA etc might be financially extremely impactful and take them out of the market.

11/

11/

REGULATION

Binance not bailing out the whole FTX will result in opening up data and internal figures to authorities as most probably many class actions will be held against them.

12/

Binance not bailing out the whole FTX will result in opening up data and internal figures to authorities as most probably many class actions will be held against them.

12/

From what seems to be a total mess in #FTX balance sheet, regulators will use this event to restrain even more the regulations in order to "protect" investors.

13/

13/

BINANCE GOD MODE

The past weeks were kind of a downward spiral for SBF

From a business POV, it’s hard to imagine CZ was unaware that Binance public announcement to dump $2.1B of $FTT or equivalents would have an impact on whether FTX, FTT or both.

14/

The past weeks were kind of a downward spiral for SBF

From a business POV, it’s hard to imagine CZ was unaware that Binance public announcement to dump $2.1B of $FTT or equivalents would have an impact on whether FTX, FTT or both.

https://twitter.com/cz_binance/status/1589283421704290306?s=20&t=V1EOkmxiPq70BkFtCEl9bw

14/

So, why CZ did this ?

- For transparency ?

- Was Binance looking for closing an acquisition deal on their terms (thus going public)?

- To trigger panic and short $FTT?

- To vampirize FTX users and funds before FTX crash ($1B left FTX in a few days)?

15/

- For transparency ?

- Was Binance looking for closing an acquisition deal on their terms (thus going public)?

- To trigger panic and short $FTT?

- To vampirize FTX users and funds before FTX crash ($1B left FTX in a few days)?

https://twitter.com/DefiIgnas/status/1590178536161128448?s=20&t=XdWyFt9nMnbkSF5ub0Nqog

15/

There are multiple possibilities and rumours circulating, just remember the crypto industry is same or in some recent cases worst than the traditional finance and due to low regulations, actors seem to be more aggressive.

16/

16/

Binance is now the only heavyweight #CEX which makes it more powerful than ever.

Such power is unprecedented in the crypto space and will have to be monitored thoroughly.

17/

Such power is unprecedented in the crypto space and will have to be monitored thoroughly.

17/

Monopoly has never been good for a mkt as it can lead to various abuses over prices, spread, no new market entrants, low innovation…

It' especially worrying for the crypto sector which was made to redistribute wealth, power and governance due to 2008 financial insanities.

18/

It' especially worrying for the crypto sector which was made to redistribute wealth, power and governance due to 2008 financial insanities.

18/

ALAMEDA IMPACT

Binance offered to bail out #FTX but not #Alameda, which was in the initial insolvent company that got their balance sheet leaked.

19/

Binance offered to bail out #FTX but not #Alameda, which was in the initial insolvent company that got their balance sheet leaked.

19/

Alameda is one of the biggest trading firms in the crypto industry which borrowed assets with FTT collateral (FTT dropped by 90%+ in 2 days)

What will happen when the biggest trading firm and borrower ($8B of liabilities) start to get margin called ?

coindesk.com/business/2022/…

20/

What will happen when the biggest trading firm and borrower ($8B of liabilities) start to get margin called ?

coindesk.com/business/2022/…

20/

Most of Alameda holdings are illiquid tokens which have already devalued a lot due to the market crash.

If alameda fails repayments, the lenders will have to absorb the losses.

The problem ? Most of them got rekt by $Luna, #3AC, @CelsiusNetwork and the miners.

21/

If alameda fails repayments, the lenders will have to absorb the losses.

The problem ? Most of them got rekt by $Luna, #3AC, @CelsiusNetwork and the miners.

21/

It’s important to know that #FTX might be the main borrower/lender of Alameda, which means they will sell all their liquid holdings ( $FTT, $OL, $CRV, $UNI, $SUSHI) and potential investments. It’s thus smart to stay away from those tokens.

dune.com/21shares_resea…

22/

dune.com/21shares_resea…

22/

Now speculations go towards Alameda used a sort of hedge during this crash and market manipulation.

#FTX and Alameda has really close ties and it won’t be surprising if the trading desk took opportunities of “insider” deals such as a potential bailout 🤔

23/

#FTX and Alameda has really close ties and it won’t be surprising if the trading desk took opportunities of “insider” deals such as a potential bailout 🤔

23/

WARNING

As you have noticed, #FTX got bank runned.

However, they weren’t supposed to manage and use their users' funds for personal activities as mentioned by SBF 1 day before the end. (deleted now)

24/

As you have noticed, #FTX got bank runned.

However, they weren’t supposed to manage and use their users' funds for personal activities as mentioned by SBF 1 day before the end. (deleted now)

https://twitter.com/ledgerstatus/status/1590115753331937281

24/

But unfortunately, they lied, and they might not be the only ones to do so.

It leads to the common quote “Not your keys not your coins” which once again showed how CEXs and #CeFi are risky.

;)

25/

It leads to the common quote “Not your keys not your coins” which once again showed how CEXs and #CeFi are risky.

;)

https://twitter.com/lemiscate/status/1589364001401896962?s=20&t=SdzgQwtA8fDLJRBTZeExUQ

25/

Special mention to those who tried to raise awareness or took part of the event @EricNewcomer @fintechfrank @wassielawyer @Galois_Capital @AviFelman @DoveyWan @AltcoinPsycho @DefiIgnas @Route2FI @crypto_condom @Crypt0_Andrew @LadyofCrypto1 @rektdiomedes @DAdvisoor @bneiluj

26/

26/

WHAT’S NOW ?

Maybe most of you got their funds stuck in FTX, you can find here a thread from @Crypto_Joe10 on how to recover from it, hoping it will once become available.

27/

Maybe most of you got their funds stuck in FTX, you can find here a thread from @Crypto_Joe10 on how to recover from it, hoping it will once become available.

https://twitter.com/Crypto_Joe10/status/1590332100346929152?s=20&t=v42z3vJmD-vRwXDx577g4w

27/

Following this shock, #DeFi and especially perp trading #DEXs such as $GMX or $GNS could become the next narrative as users will be leaning towards decentralization and transparency.

28/

https://twitter.com/daotopiaVC/status/1583981295020912640?s=20&t=zYlRue72clTP4JvpHjMZhA

28/

The downward pressure is still not finished, FTX was the 1st degree of contagion but many other entities will suffer from it.

29/

https://twitter.com/hodlKRYPTONITE/status/1590277064602812416?t=KNbTBgrtDl24cH4lKrWBlQ&s=19

29/

Users are preparing for major future market movements and you can see it on-chain.

30/

https://twitter.com/lookonchain/status/1590327788904796165

30/

FURTHER THINKING

Here are a few more thoughts and left open questions on the situation:

- To which extent is CZ involved in this case ? Did he dusted off his Rockefeller strategy books ?

- Did #Binance have insider information about #FTX health ?

31/

Here are a few more thoughts and left open questions on the situation:

- To which extent is CZ involved in this case ? Did he dusted off his Rockefeller strategy books ?

- Did #Binance have insider information about #FTX health ?

31/

- Why did SBF, a finance genius, well experimented and with a large network choose to deal with Binance while he could have asked for a loan or external capital ?

Do they have more shady things to disclose ?

32/

Do they have more shady things to disclose ?

32/

- What if SBF´s involvement in politics and regulations worried some major actors who decided to shut him down by leaking Alameda’s balance sheet ?

- Why didn't SBF sacrifice Alameda to keep FTX ? (by lending funds, assets..)

33/

- Why didn't SBF sacrifice Alameda to keep FTX ? (by lending funds, assets..)

33/

- Why did @AlamedaTrabucco suddenly leave Alameda a few months ago? (in general politics, resigning is a synonym of big trouble)

Some major questions will for sure remain open and might stay forever.

34/

Some major questions will for sure remain open and might stay forever.

34/

However, what’s sure is that someone has to be held accountable for the funds unavailability, lies and manipulation that happened.

35/

35/

It might have been an inevitable situation for FTX and the market, and as Jeremy Irons said in Margin call, there are three ways to make a living in this business: be first; be smarter; or cheat.

Binance chose to be first.

36/

Binance chose to be first.

36/

To conclude with a bit of hope, it’s encouraging to see that the market and actors are still building after the year we’ve been through.

2022 isn’t yet finished but has for sure been one of the worst the crypto has seen with Luna, 3AC, Celsius, Voyager and now FTX.

37/

2022 isn’t yet finished but has for sure been one of the worst the crypto has seen with Luna, 3AC, Celsius, Voyager and now FTX.

37/

Not to mention the horrible macro environment, inflation, and crisis that haven’t been seen in decades as well.

38/

38/

Our hearts goes to all the persons that have funds on FTX, feel free to drop us a DM if you need any help !

Do not hesitate to share this post to spread awareness on the potential future situation 🤗

Do not hesitate to share this post to spread awareness on the potential future situation 🤗

https://twitter.com/daotopiaVC/status/1590484482293125121?s=20&t=LqpGYJf1S7N4gwIhoJArpw

• • •

Missing some Tweet in this thread? You can try to

force a refresh