Now that you know about some potentially undervalued gems within the Cosmos ecosystem, it's time for another group to take the stage.

Here's another list that could be worth 10x - 100x in the next cycle!

🐶🧵👇🏻

Here's another list that could be worth 10x - 100x in the next cycle!

🐶🧵👇🏻

If you missed part 1 of @cosmos ecosystem dapps, make sure to check it out below!

https://twitter.com/MeetWawa/status/1588160798039285760

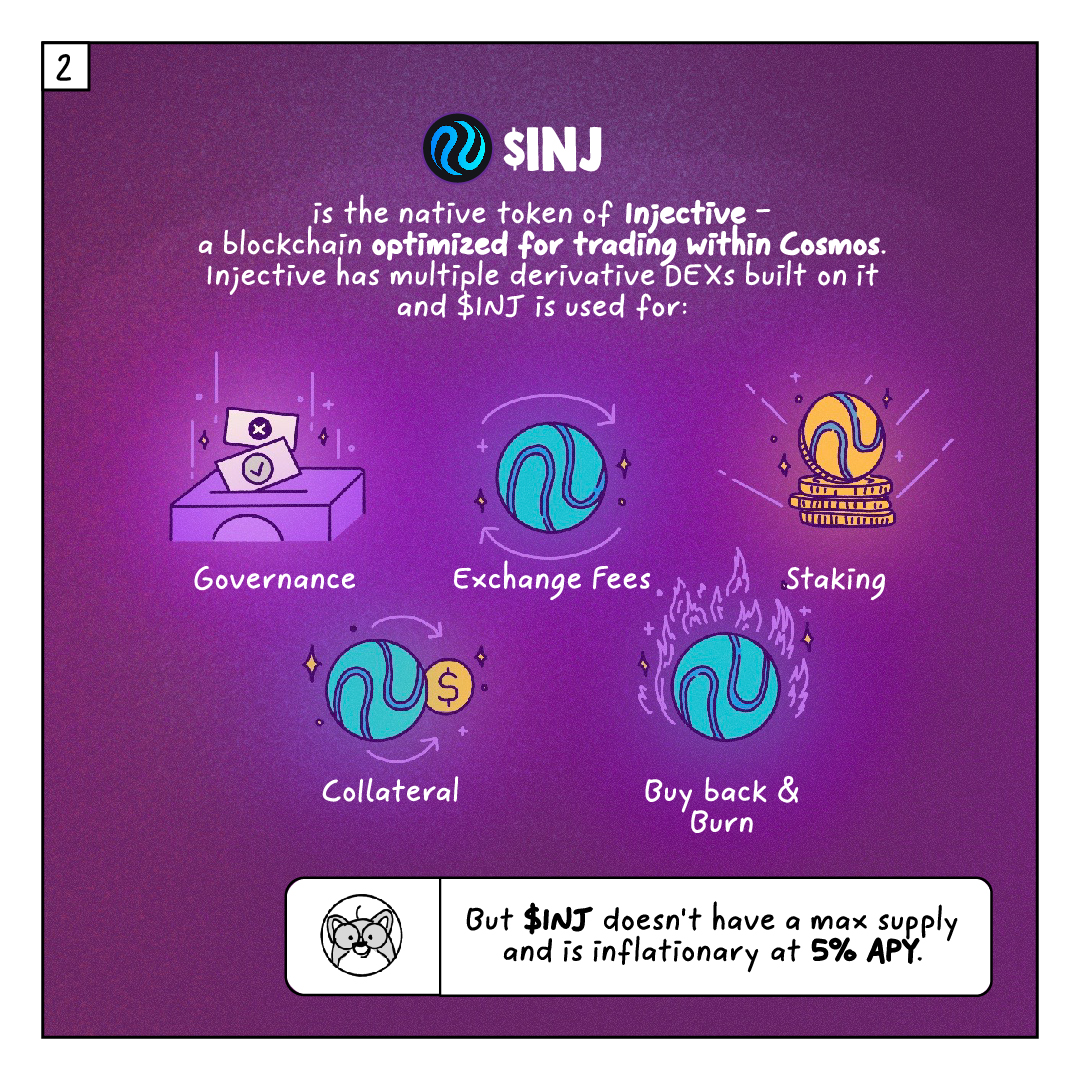

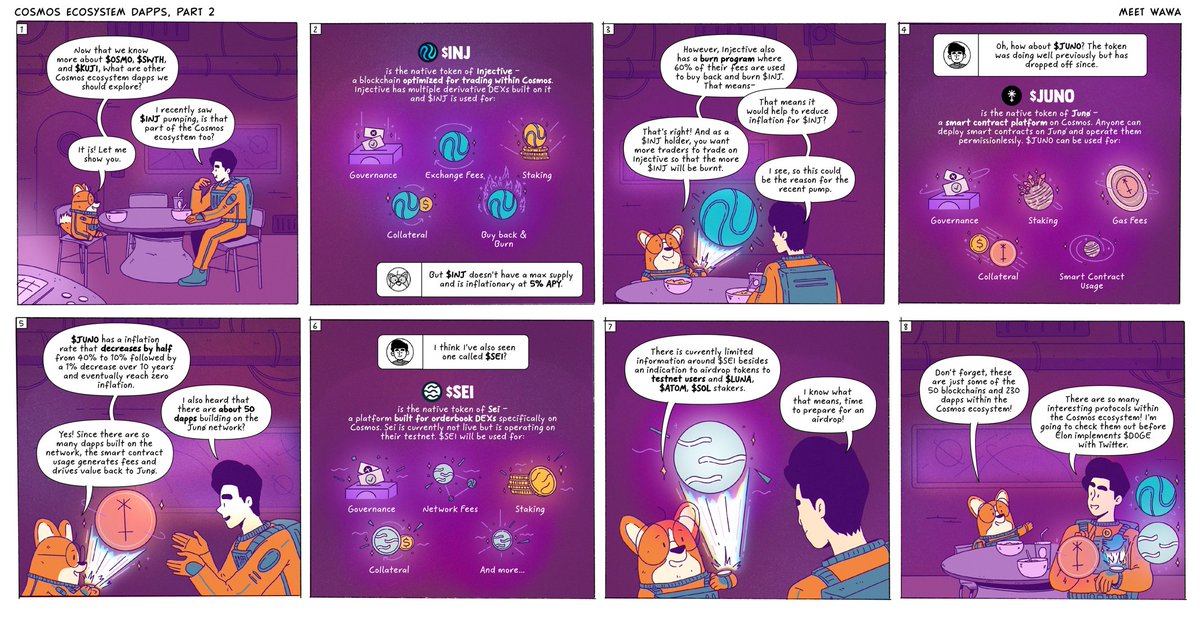

1. $INJ

$INJ is the native token of @Injective_, a blockchain optimized for trading within the @cosmos ecosystem.

$INJ can be used for:

• Governance

• Exchange fees

• Staking

• Collateral

• Buyback & burn

$INJ is the native token of @Injective_, a blockchain optimized for trading within the @cosmos ecosystem.

$INJ can be used for:

• Governance

• Exchange fees

• Staking

• Collateral

• Buyback & burn

They have a weekly burn program where 60% of fees from all exchanges on Injective are used to buy back and burn $INJ to reduce supply inflation.

That means the more users trading on Injective DEXs, the more $INJ will be burnt. This makes sense for traders to be $INJ holders!

That means the more users trading on Injective DEXs, the more $INJ will be burnt. This makes sense for traders to be $INJ holders!

2. $JUNO

$JUNO is the native token of @JunoNetwork, one of the biggest smart contract supported blockchains on @cosmos.

$JUNO can be for:

• Governance

• Staking

• Gas fees

• Collateral

• Smart contract usage

$JUNO is the native token of @JunoNetwork, one of the biggest smart contract supported blockchains on @cosmos.

$JUNO can be for:

• Governance

• Staking

• Gas fees

• Collateral

• Smart contract usage

$JUNO has an inflation rate that decreases by half from 40% to 10% followed by 1% over the next 10 years and eventually zero inflation.

There are 50 dapps building on @JunoNetwork which generates fees from smart contract usage to gas fees back to $JUNO holders.

There are 50 dapps building on @JunoNetwork which generates fees from smart contract usage to gas fees back to $JUNO holders.

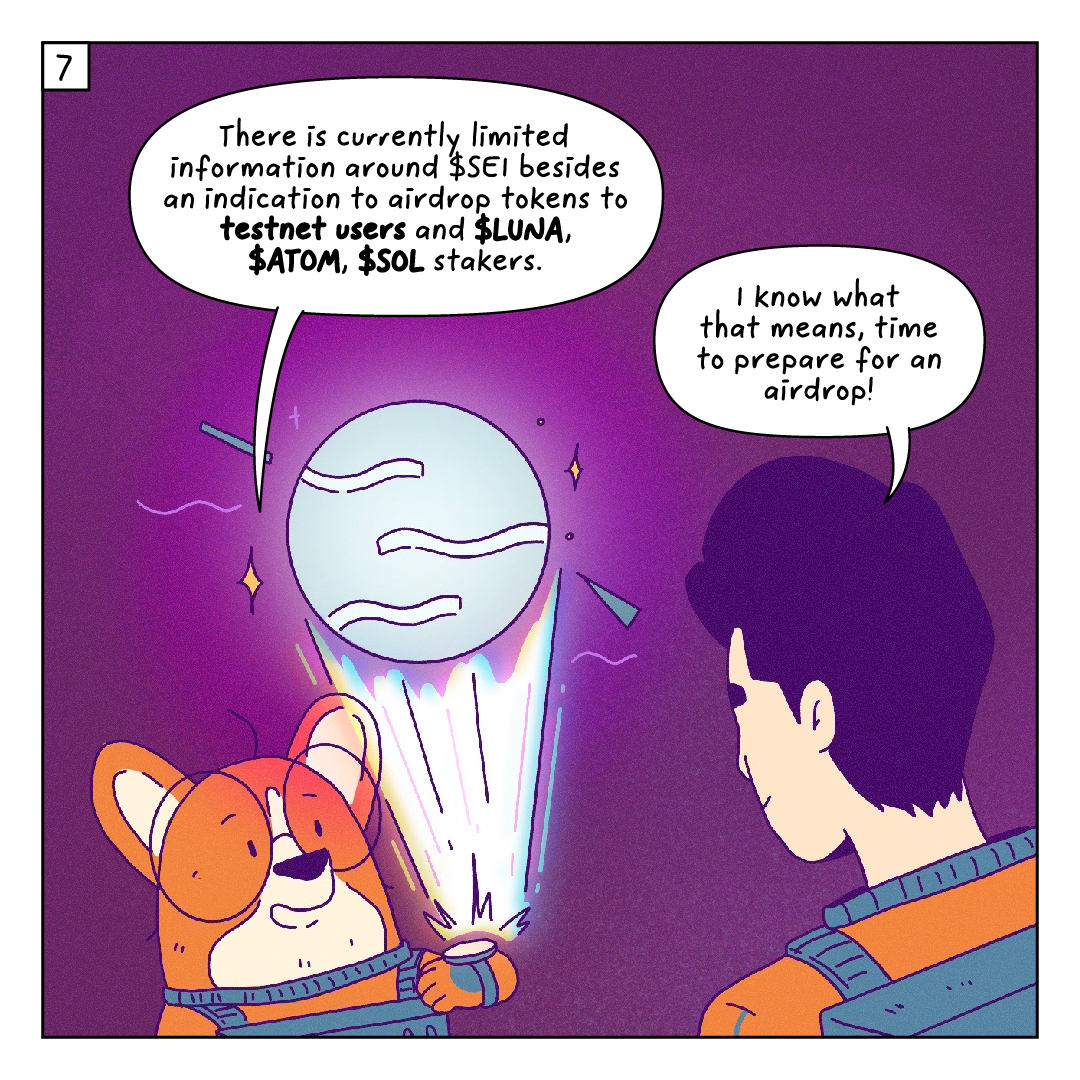

3. $SEI

$SEI is the native token of @SeiNetwork, a chain built specifically for orderbook DEXs on @cosmos. Sei is currently in testnet phase and will be preparing for its mainnet launch.

$SEI can be for:

• Governance

• Network fees

• Staking

• Collateral

$SEI is the native token of @SeiNetwork, a chain built specifically for orderbook DEXs on @cosmos. Sei is currently in testnet phase and will be preparing for its mainnet launch.

$SEI can be for:

• Governance

• Network fees

• Staking

• Collateral

There is limited information around $SEI tokenomics besides an indication from the team to airdrop tokens to testnet users along with $LUNA, $ATOM, and $SOL stakers.

But things can change especially in such a volatile market environment, so do keep a lookout for any updates!

But things can change especially in such a volatile market environment, so do keep a lookout for any updates!

There are so many tokens with good tokenomics in the Cosmos ecosystem!

If you want to learn more, stay tuned for our next comic and let us know which tokens you would like us to explore!

If you want to learn more, stay tuned for our next comic and let us know which tokens you would like us to explore!

If you enjoyed this comic, check out our other comics in the link below. 👇🏻

bit.ly/3fdOMID

As always, remember to do your own research #DYOR!

bit.ly/3fdOMID

As always, remember to do your own research #DYOR!

I want to make learning crypto fun with comics. If you enjoyed this comic thread, please consider:

❤️ Liking

🔁 Retweeting

🐶 Following me

☕ Buying us a coffee ko-fi.com/meetwawa

Check our previous comic on @comos!

What should I draw next?👇🏻

❤️ Liking

🔁 Retweeting

🐶 Following me

☕ Buying us a coffee ko-fi.com/meetwawa

Check our previous comic on @comos!

What should I draw next?👇🏻

Tagging fellow #cosmonauts 👋🏻🐶

@speicherx

@DaveCosmonaut

@johnniecosmos

@ZoltanAtom

@thedefiedge

@eli5_defi

@Thyborg_

@jackzampolin

@DocumentingATOM

@EncryptionDog

@L1am_Crypto

@Cryptocito

@Cosmos_Tic

@Cephii1

@speicherx

@DaveCosmonaut

@johnniecosmos

@ZoltanAtom

@thedefiedge

@eli5_defi

@Thyborg_

@jackzampolin

@DocumentingATOM

@EncryptionDog

@L1am_Crypto

@Cryptocito

@Cosmos_Tic

@Cephii1

If you found this thread helpful, consider helping us by retweeting our first tweet!

https://twitter.com/MeetWawa/status/1593601778641010688

• • •

Missing some Tweet in this thread? You can try to

force a refresh