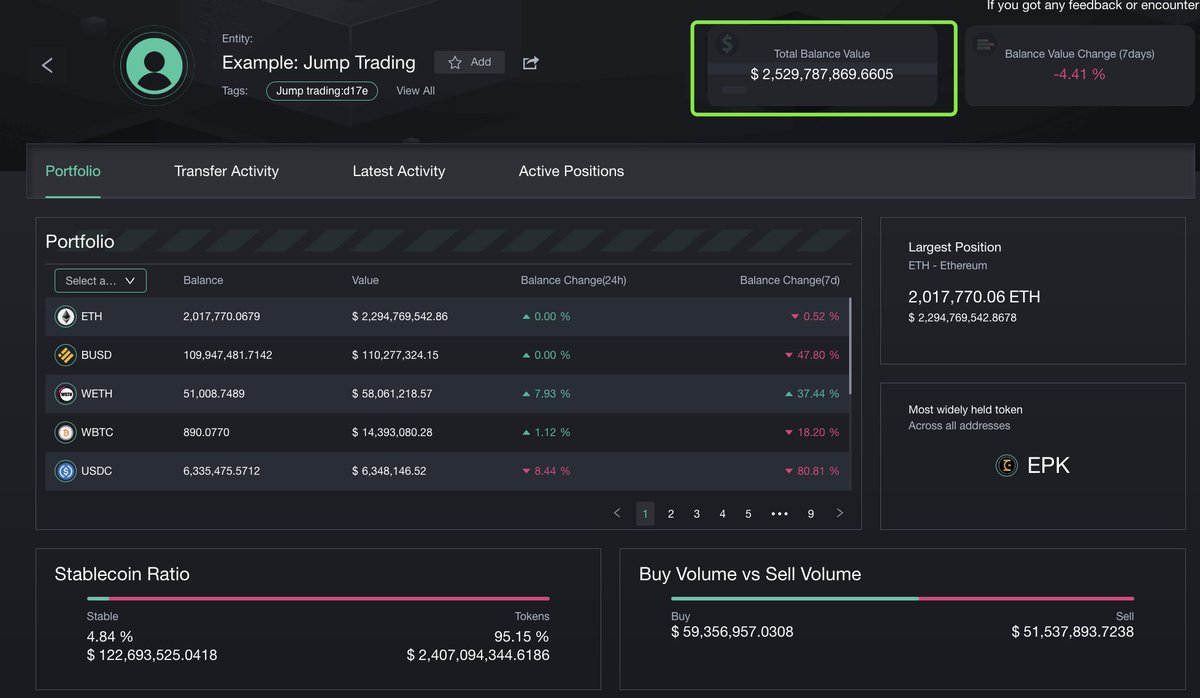

🕵️According to our #JumpCrypto entity, for now, they have over $2.5B worth of assets on Ethereum, and 90%+ of them are $ETH (2.07M/$2.28B).

This makes Jump the single largest EOA holder.

Every move Jump makes matters to ETH holders.

This makes Jump the single largest EOA holder.

Every move Jump makes matters to ETH holders.

Of all 56 addresses within Jump Entity, one address holds 2M ETH, let's see what does this address recently do:

0x0716a17fbaee714f1e6ab0f9d59edbc5f09815c0

This address total was sent out 60K $ETH after October, where did it go?

Time to use our money flow tool.

0x0716a17fbaee714f1e6ab0f9d59edbc5f09815c0

This address total was sent out 60K $ETH after October, where did it go?

Time to use our money flow tool.

Well, the finding is surprising and no-surprising at the same time, the ETH got out and was immediately moved to another address and seems deposited around $39M to exchanges like #Gemini.

🧐Dig deeper, we find one address and then transferred $42M to #coinbase.

We checked the other two addresses that receive ETH from Jump, and our address clustering graph shows there is a strong chance that is Jump's own addresses that transfer funds to other exchanges.

Thoughts?

We checked the other two addresses that receive ETH from Jump, and our address clustering graph shows there is a strong chance that is Jump's own addresses that transfer funds to other exchanges.

Thoughts?

To sum up, Jump seems moving their $ETH to different exchanges at a quite gentle speed, as the single biggest holder of ETH, this is something that is worth noticing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh