A sustainable finance taxonomy is a critical policy instrument for identifying if and to what extent economic activities contribute to international goals and national commitments aligned with the #ParisAgreement and/or the #SDGs. 🧵

Taxonomies can increase the #resilience of financial systems by enhancing the management of #sustainability risks and contribute to closing the funding gap for implementing #sustainableactivities.

There has been enormous momentum across the world to systematically integrate sustainability into financial decision making. However, channeling capital into sustainability-aligned investments requires a clear definition and common understanding of what qualifies as #sustainable

... to establish a level playing field, build trust and avoid #greenwashing.

Globally, taxonomies are emerging as powerful policy instruments to provide a granular #classification of #sustainable economic activities.

Globally, taxonomies are emerging as powerful policy instruments to provide a granular #classification of #sustainable economic activities.

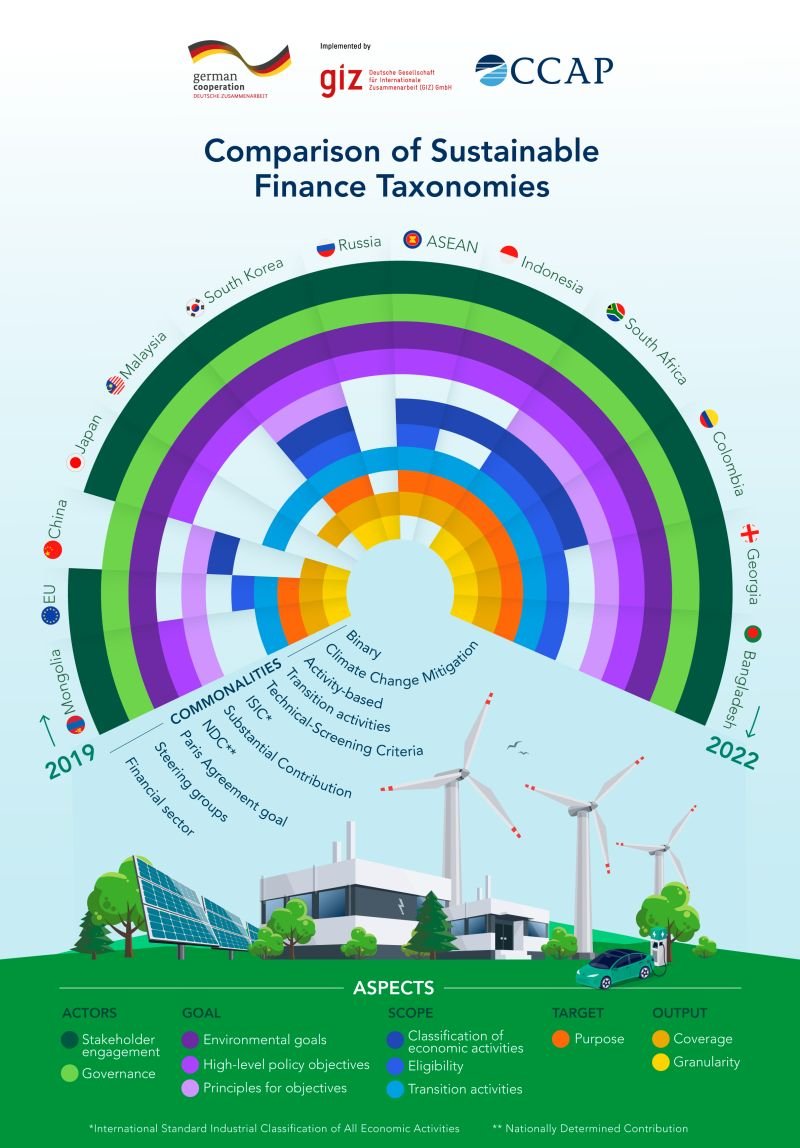

Many countries are developing taxonomies or have already developed taxonomies, which increases the risk of market fragmentation.

To enable #crosscountry learning and alignment, this policy brief sets out a detailed comparison of select taxonomies that have already been adopted,

To enable #crosscountry learning and alignment, this policy brief sets out a detailed comparison of select taxonomies that have already been adopted,

... many of which in emerging and developing countries. It systematically assesses core components of existing taxonomies and outlines key commonalities and divergences across taxonomies to provide guidance to those countries seeking to develop taxonomies.

As emphasized at #COP27, there is an urgency to align public and private financial flows with sustainability. This calls for a common definition of #sustainable economic activities in the form of taxonomies.

bit.ly/PBSFTCG

bit.ly/PBSFTCG

• • •

Missing some Tweet in this thread? You can try to

force a refresh